Bitcoin Fundamentals Report #160

In this issue we discuss Twitter adding lightning network tipping and news out of China, along with price action, mining, government news, and stablecoins.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

In Case You Missed It...

- (Podcast) Evergrande: The Deteriorating Situation in China - E233 HOT !!

- (Op-Ed) The Fiat Dollar System is No Privilege: The Burden and Why the US Will Adopt Bitcoin MUST READ!!

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $42,200 (-$5,535, -11.6%) |

| Market cap | $796 billion |

| Satoshis/$1 USD | 2,363 |

| 1 finney (1/10,000 btc) | $4.23 |

| Median fee confirmed (finneys) | $0.57 (0.13) |

| Market cycle timing | Second half of bull market |

| Weekly trend | Brief sell-off |

| Media sentiment | Very negative |

| Network traffic | Low |

| Mining | Stable |

Market Commentary

Twitter Adds Lightning Tipping

Twitter has rolled out new ways to pay people through Twitter. The feature called "Tips" can integrate with many different payment processors like CashApp (of course), Venmo, and Patreon. Most importantly, however, is the integration with Strike, a bitcoin lightning wallet. This gives people the ability to send lightning payments through Twitter. Free, permissionless, and final payments anywhere in the world via one of the largest social media networks.

Invoicing, sending a request for payment, was one of the biggest pain-points for bitcoin's lightning network. Developers have been working hard and with this integration, the complexity of bitcoin has been completely abstracted away. The experience now is seamless - on par with any payment app but without the limitations.

When I saw the news I went immediately to my profile to link my Strike wallet, but didn't see the option anywhere. For the time being it is only available on iOS. Android and web clients have to wait a bit longer.

Strike is making huge waves in the payments world. They have their own wallet, but also are responsible for the Chivo wallet from El Salvador, and now their API is behind this capability for lightning tips on Twitter. I remember when Jack Mallers first hit the bitcoin scene, you immediately knew big things were coming from him. Now, he's challenging giants like Coinbase's Brian Armstrong to match their disruptive tech, and calling out the most entrenched money-hustlers in the world, Western Union.

"Pawn to E4. Your move."

I just published Announcing the Strike API

— Jack Mallers (@jackmallers) September 23, 2021

Today, @Twitter enables free, instant, global payments for their users with their integration of the Strike API.

What the internet did for communication, #Bitcoin + the Lightning Network is doing for money.https://t.co/jHkY6knXkP pic.twitter.com/FXujknG7sM

China Bans Bitcoin Again?

It's almost as if China is having a hard time banning #Bitcoin ...

— Alistair Milne (@alistairmilne) September 24, 2021

Today, a two week old memo from the People's Bank of China (PBOC) was reposted to their website and taken as fresh news. A small amount of selling resulted.

It has become a joke at this point, "China bans bitcoin again". Every 6 months for the last 5 years, we've had to put up with this exact story. But it's different this time. With the crackdown earlier this year, bitcoin activity in the country is almost completely dead. There are still holders there, but no trading or transacting in the open is allowed.

The bitcoin community responded by saying, "HFSP China". (Have Fun Staying Poor)

SHARE our content with friends and family!

Quick Price Analysis

China news has been the center of price action for the last week in bitcoin. First, the Evergrande situation caused a liquidation event on Monday, and second, the fake-news about the bitcoin ban this morning.

Despite the China bitcoin ban being in effect for several months, many Chinese still hold coins. With Evergrande causing liquidity issues throughout the Chinese market, people will turn to selling bitcoin to meet other obligations. Whatever happens to Evergrande and the Chinese economy (not looking good), the effect on bitcoin will be of almost no consequence, because the CCP has damned their country to insignificance.

Sufficing for a quick update, currently price is clinging to the support range from $38k-42k. This area is very strong, and minus any further major news it should hold solid. The dip this week pushed the 4hr RSI (relative strength index) to its most oversold since Sept 2020 (second chart below), after which price began the steady climb to ATHs.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Bitcoin Chart

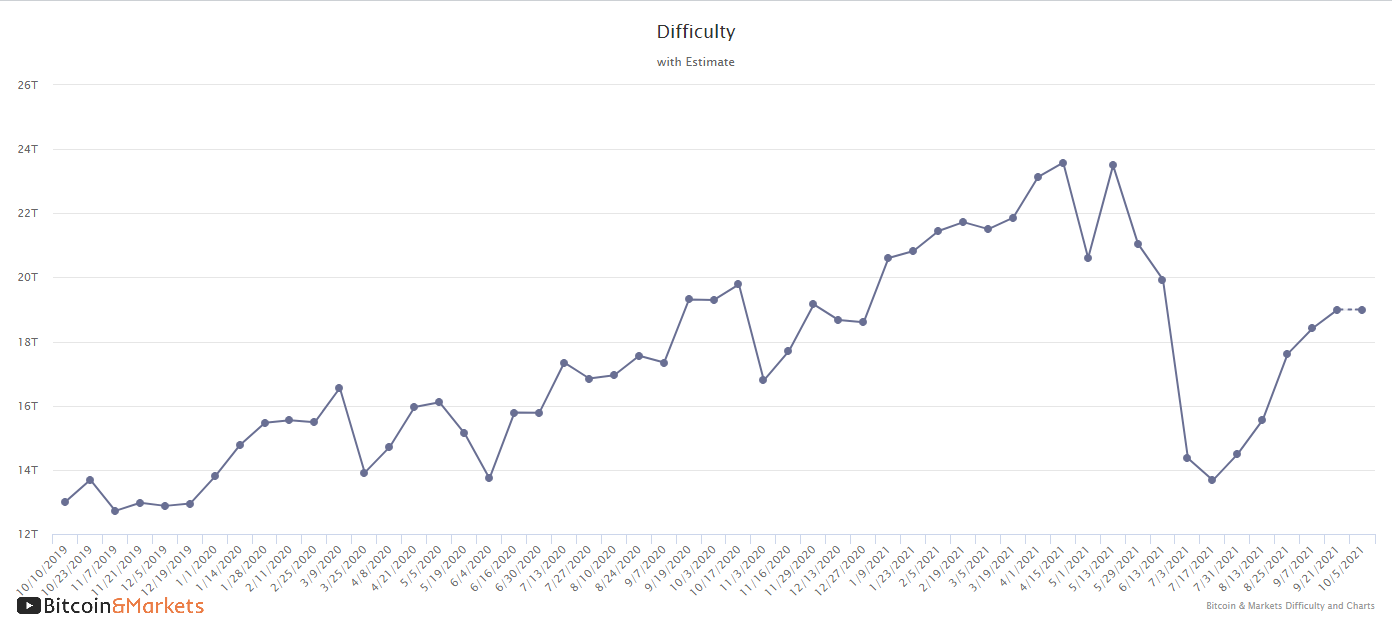

Mining and Development

| Previous difficulty adjustment | +3.16% |

| Next estimated adjustment | 0% in ~11 days |

| Mempool | 1 MB |

| Fees | 1 sat/byte for next block |

Bitcoin mining is the tedious side of the bitcoin industry, however, the truth of bitcoin adoption cannot be understood without it. Mining statistics and headlines cut through the BS we hear on a day-to-day basis bitcoin. If bitcoin truly faced substantive insurmountable resistance from "the powers that be", mining would not be expanding to all corners of the globe as it is.

Just this week a second major announcement has come out of the US State of Ohio, where BIT, a publicly-listed company, has contracted to create a 85 MW facility in the State by Feb '22. This comes just weeks after nuclear power company Energy Harbor Corp in Ohio announced they are working with another company to build a bitcoin mining facility to run off nuclear by the end of 2021.

I understand there are conflicting feelings around Belarus, but their infamous President Lukashenko has called on the government to mine bitcoin in a move that signifies bitcoin's legality is unlikely to be challenged there anytime soon.

Earlier this month, bitcoin miners and oil execs gathered in Houston for an informal meet and greet. Don't let the casual beers fool you, this meeting has enormous geopolitical significance.

And lastly, China's loss is Kazakhstan's gain. "On June 25, Kazakhstani President Kassym-Zhomart Tokaev signed legislation officially legalizing crypto-mining in Kazakhstan."

Watch this sector of the industry over the next 12 months. It is going to explode, and finally be talked about as a matter of national security for many countries.

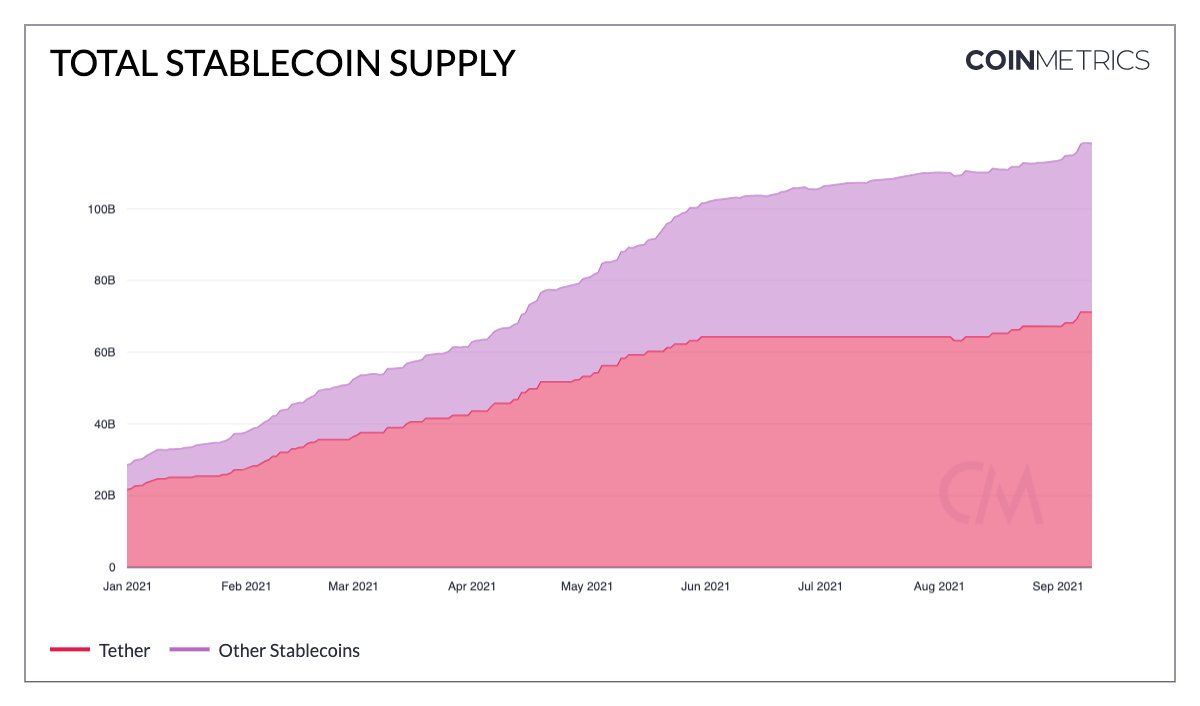

CBDC / Stablecoin / Altcoin

US Congress Pushes New Bitcoin Bill

The US government is not a monolithic thing. For years we've been confronted with the Federal Reserve and the Securities and Exchange Commission (SEC) making proclamations about bitcoin, but now a new entrant has arrived - Congress. Just weeks after the Infrastructure Bill introduced troublesome language, Rep Breyer has now introduced a bill that tries to corral the industry with faulty definitions, attempting to shoehorn things into easily regulatable buckets.

The bill outlines two categories, digital assets and digital asset securities. Bitcoin would be a digital asset and regulated like a commodity, while altcoins (nearly all, perhaps excluding Ether and stablecoins) would be digital asset securities and fall under the SEC purview. The bottom line is with new definitions comes new court battles and pockets for corruption. These new names are not needed. It feels like an attempt by the Congress to directly undermine the SEC and Fed.

This new bill also exposes what I'm interpreting as a internal jockeying for position. The SEC under Chairman Gensler has a clear vision and clear definitions. He wants all altcoins to be securities and to go after founders who've launched these unregistered securities. His constraint however is it's a new area of law and technology. It takes manpower and time to fight it in the courts. And that is where he intends to set the precedence, just like the Howey test from decades ago. It's a very slow process.

As for the Fed, they don't much care about bitcoin and two Chairmen, Yellen and Powell, have said as much. They aren't concerned about stablecoins either, to the annoyance of other central banks and Congress. There is likely no regulations for bitcoin, altcoins or stablecoins coming anytime soon from the Fed. If it does, it will be in the form of stablecoin reserve requirements.

That leaves Congress, a swamp of socialists and authoritarians, dependent on control of the currency to fund their political objectives. They desperately don't want to lose their central position in the dollar, which gives them cheap financing for State actions. If the world was to start using a currency like bitcoin, they'd be forced to live within their means. A private currency, like a Facebook Diem, adds the uncomfortable aspect of the Congress being beholden to a private company's whims.

What I'm trying to set up in your mind is a 3-way stalemate. The Fed v SEC (and Treasury) v Congress. This is a great atmosphere for gridlock, allowing bitcoin to grow yet further. It is already estimated that 46 million Americans own bitcoin or altcoins, one more bull market it could be 100-150 million. It already can't be stopped, but wait a few years and it will be even more apparent.

Stablecoin Supply

The circulating supply of stablecoins, tokens pegged to $1, is once again surging. According to Cryptoslate's stablecoin page, there is $127B in supply as of today.

If our thesis is correct, that the surge in digital dollars makes the ECB and other central banks worried, we should see some scary sounding statements from Lagarde and other in the coming weeks. As a reminder, nothing stops the private sector from issuing digital Euros, it's just that no one wants them.

Miscellaneous

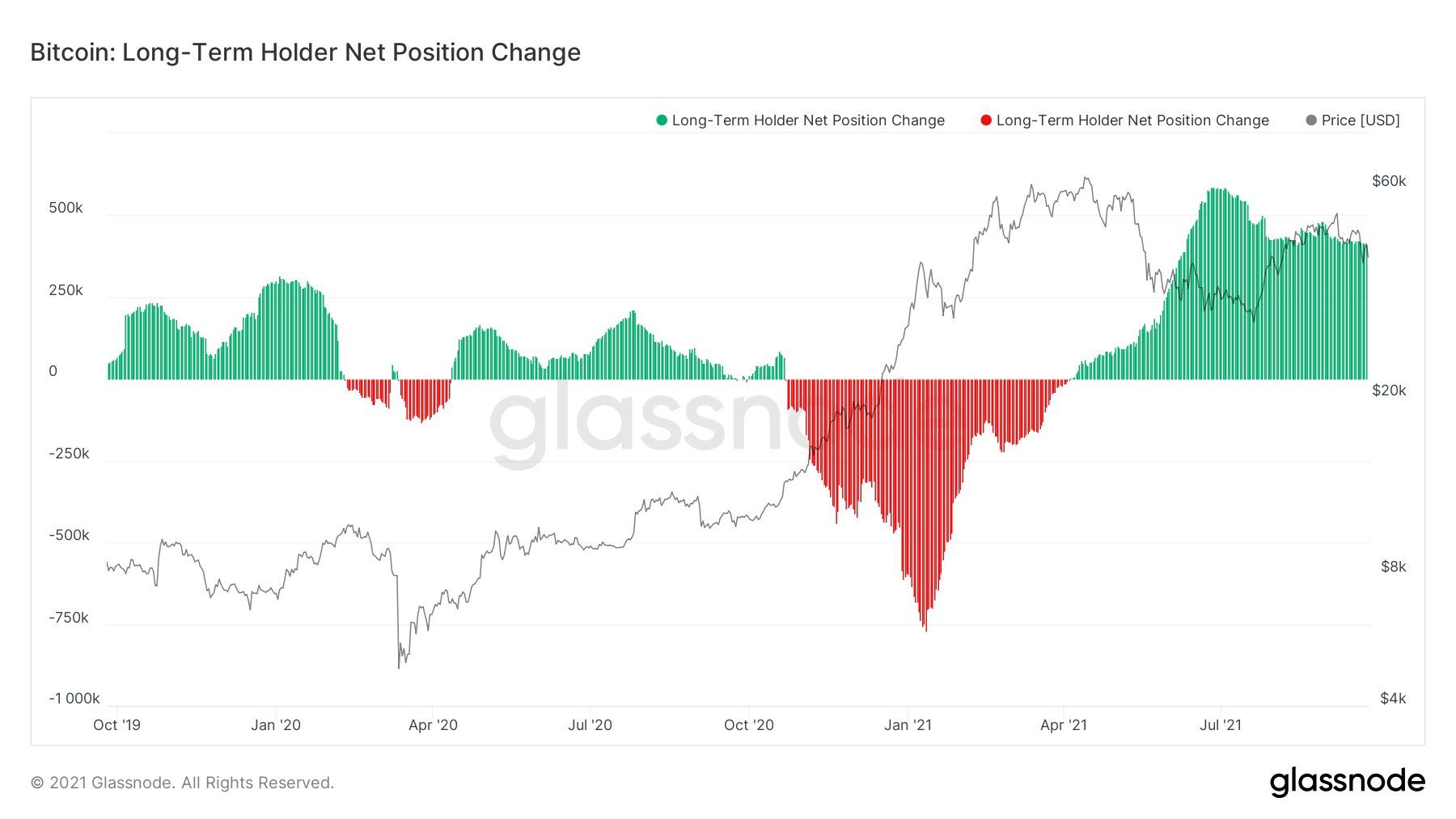

Just wanted to post an update to the halving cycle chart. We are in the region where a snap upward could result in a rally all the way to the ultimate cycle high. I'm still predicting $200k or higher, which would put the price somewhere between the highs of the red and blue previous cycles.

Finally, this is chart demonstrates the change in long term holdings. As you can see, the amount of bitcoin entering long term holdings today dwarfs the amount seen last year before the huge rally from $9k to $64k.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

September 24, 2021 | Issue #160 | Block 702,033 | Disclaimer

Meme by: @geekboyireland