Bitcoin Fundamentals Report #209

This week we cover the White House and the SEC, price analysis including macro, and mining news.

Jump to: White House Framework / SEC's Gensler drops bombs on Ethereum / What this means for bitcoin / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! Members can find the link to all past live stream recordings here.

- (Fed Watch) CPI, China Crisis Deepens, and Globalists are Losing - Fedwatch 112

- (Bitcoin & Markets) Interview with Q - Deep dive into my philosophy - Second hour segment

- (Blog) Quick Explanation of Eth Merge, Sharding, and Proof-of-stake

- (Fed Watch Clips) New clips coming soon!

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Brushing off CPI dip |

| Media sentiment | Very negative |

| Network traffic | Low |

| Mining industry | Surging |

| Market cycle timing | Looking for rally |

White House Framework for Bitcoin

Earlier this year, the White House put out an executive order calling for agencies throughout the US government to look into "crypto" and make recommendations for regulation. Many people were worried about this process, because they fear the US government can squash innovation and impose costs on the use of bitcoin, not killing but slowing down bitcoin adoption.

This week, the wait was over. The White House published their "crypto" regulatory framework. The link below is a good introductory write up by Bitcoin Magazine.

Here are a few of my takeaways:

- Horrible conflation of Bitcoin with "crypto".

- All the recommendations on consumer protection, scams and illicit uses do not concern bitcoin. 90% of what is in here doesn't concern bitcoin.

- Most of the recommendations are to leverage existing rules and agencies, or form cross-agency working groups, etc. Not much new.

- The hubris was overwhelming in parts. The free market creates something fought by the government, then the government turns around and claims they made it all possible. The gov also claims to protect consumers multiple times in this release, however, they have not stopped a single scam ever in the space.

- The White House thinks a CBDC has many benefits, but didn't mention a single drawback, of which there are many. They will use the Treasury to push the Fed forward, even though the Fed doesn't want a CBDC.

- Mining was barely mentioned.

Overall, this was yet another benign framework recommendation. It's more of the same talking points, e.g. they will use different agencies to work with the industry, and others to police the industry. The Terra scam was mentioned twice as a rationale for why these policies are needed, which does not concern bitcoin in the slightest.

Expanding Economic Integration Boosts Demand

Archived (read full article)

Chairman Gensler comes out firing. Last week, I wrote about Gensler's comments regarding the Commodities Futures Trading Commission (CFTC) to take responsibility for regulating Bitcoin but not Ethereum, showing he has divergent views on the classification between the two.

This week, after the big Ethereum upgrade, Gensler is back at it, claiming that Proof-of-stake networks, which Ethereum now is, could make it a security.

Securities and Exchange Commission Chairman Gary Gensler said Thursday that cryptocurrencies and intermediaries that allow holders to “stake” their coins might pass a key test used by courts to determine whether an asset is a security. Known as the Howey test, it examines whether investors expect to earn a return from the work of third parties.

“From the coin’s perspective…that’s another indicia that under the Howey test, the investing public is anticipating profits based on the efforts of others,” Mr. Gensler told reporters after a congressional hearing.

Gensler's concerns seem to be around the pooling of staking on exchanges, which also happens to be bitcoiners' most vocal point of the transition to PoS, albeit for different reasons. Gensler says it is akin to lending by a different name. Users deposit coins in the exchange to be staked with the group, and receive a return on their deposit. Bitcoiners' point is that a handful of these large staking-pools already have a controlling super-majority, meaning the network is centralized to regulated entities, destroying any claimed "decentralization" Ethereum had.

If an intermediary such as a crypto exchange offers staking services to its customers, Mr. Gensler said, it “looks very similar—with some changes of labeling—to lending.”

What this means for Bitcoin

You'd be forgiven if you were caught up in the Ethereum debate about being a security or not (I think it is), and forgetting about bitcoin this week. Again, like the White House Framework above, none of this really applies to Bitcoin! Bitcoin is unequivocally a commodity, with very few if any related scams or illicit uses. All of the nefarious activity is concentrated on the altcoins and the "crypto" market, not bitcoin.

The only criticisms that apply to bitcoin are the energy debate and the threat it poses to monetary sovereignty of national currencies. I'll go through these quickly.

The energy debate in bitcoin has taken on a new dimension recently. It was already making headway in educating about how bitcoin mining can strengthen the power grid by making excess capacity generation profitable. Miners are able to ramp down their energy use at a moment's notice to protect the grid. This was demonstrated brilliantly in Texas this summer, where miners voluntarily turned off their machines protecting the grid during a crisis. The miners also received financial incentives to do so, making it a win-win scenario.

The new dimension in bitcoin's energy story that has flown under the radar for the most part is big energy companies getting into bitcoin mining. Exxon Mobile and ConocoPhillips are mining bitcoin with stranded energy and flare gas.

Previously, energy companies burned the natural gas that came out of wells that didn't have facilities to capture and transport. Tons of methane and other gases escaped directly into the atmosphere. Now, these energy companies can move a container to the site, one with a generator and bitcoin mining equipment inside. They can turn pure waste and pollution into a more thoroughly burnt gas and bitcoin. Another win-win.

If these large companies are getting involved at a fast pace, there is little the politicians can do about it. For decades, people have questioned the power the oil companies had in Washington, do you think they will get shutdown?

The other legitimate criticism of bitcoin right now is the threat it poses to monetary sovereignty of nation states. That concern is front and center in the European Central Bank's push for a CBDC, but we need to be able to read between the lines to notice it.

Typically, this concern for monetary sovereignty is communicated as a general risk to the stability of the market. Central bankers (specifically the ECB) think stability depends on their expert captaincy of the economy. Without them, the economy would surely collapse. So, any innovation that cuts their power and relevance is a risk for stability.

They cannot come straight out and say that bitcoin is a competitive threat to their currencies, because that would be a de facto promotion of bitcoin! They have to play up the risks, and of course as the "risks" become greater in their eyes, it really means the more they are scared of bitcoin's competition.

Quick Price Analysis

| Weekly price* | $19,975 (-$732, -3.5%) |

| Market cap | $0.382 trillion |

| Satoshis/$1 USD | 5,007 |

| 1 finney (1/10,000 btc) | $2.00 |

Last week, price was looking bullish, but was smacked down by the first resistance on the chart. Huge sign of weakness.

The red dashed line is a significant level at $22,500. It served as resistance on July 8th, support on August 4th, and now is providing a little resistance. [...]

Price has approached the first level of resistance, if it breaks, I expect the rally to continue much higher.

This resistance level was quite weak, but received an added boost with the CPI print. More on the CPI below.

Daily chart

Quite the rapid decline over the last week. Very little sign of life from the bulls. One development just this morning is the long bottom wick on the daily candle. If it can turn green, it is a hammer which is a bullish reversal candle.

The other interpretation of the long wick on this candle is there were quite a few bids at the black dash-line. Price action dipped in there soaking up that pool of defensive bids. Next time it's tested, fewer buys will be there to protect that level.

Behavior around FOMC meetings

Of course, this year has been down down down for bitcoin, so it's not surprising that the FOMC policy decisions have correlated to the bitcoin price dipping. However, since the Fed changed to 75 bps at the June meeting, bitcoin has actually been SIDEWAYS!

Each hike is a step closer to a pause and an eventual pivot. The Fed will not risk a meltdown of the entire global financial system. It's just a matter of when Powell thinks the economy has had enough, and CPI has completed its transitory journey.

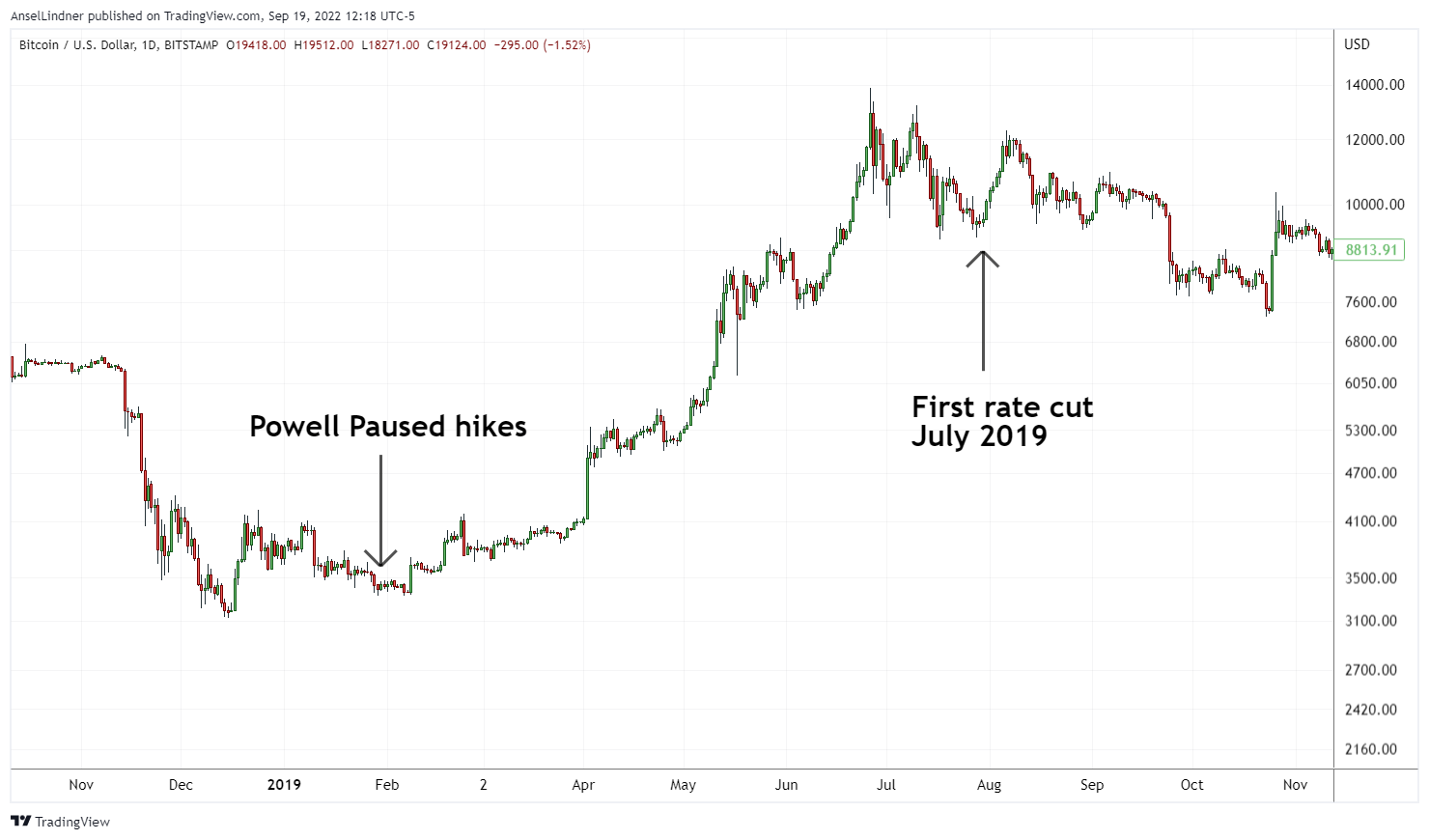

When the Fed does pause rate hikes, that is going to be explosively bullish for bitcoin. The last time Powell did it, in January 2019, bitcoin immediately began rising. It only took until 6 months for the price to 3x, from $3500 to over $12,000.

An interest aspect of this pattern is that the price in 2019 was generally flat for months leading up to the pause, and today, the price has again been close to flat since mid-June.

If bitcoin were to 3x today, like back in 2019, it would rally from $20k up to $60k and challenge the ATH.

Headwinds and Tailwinds

Ethereum's merge happened with little issue, as predicted the last couple of weeks. However, I did not think it would be as much of a bearish sell-the-news event has it turned out to be.

My reasoning was there wasn't all that much buy-the-rumor pump to reverse into selling the news. Remeasuring though, the Eth price did rally 130% from its bottom in June, a pretty big buy-the-rumor move. I did not realize the size of this move.

I also expected the Merge to reduce uncertainty in the market generally for bitcoin. This might have happened, but so far hasn't been a major factor.

Eth could easily fall all the way back to June lows, which would drag sentiment lower in bitcoin as well. If the Ethereum sentiment is extremely low, and new pump-amentals and/or marketing strategy is not found soon (I see this as doubtful), ethereum will resort to attacking bitcoin directly. That too, can cause sentiment in bitcoin to wane.

Stock Market

If you've been reading my newsletter for the last few months, you'll know I've been calling stocks a headwind for bitcoin, mainly because all the bearishness around the economy in general, and the stock market dips.

However last week, I switched to calling this a tailwind, because both bitcoin and stocks (S&P 500) were rallying in the move I had been waiting for.

Over the past week, stocks did sell off rapidly after the CPI release for no fundamental reason IMO. It broke down to new swing lows.

The market is OVERWHELMINGLY bearish on stocks. It is truly something to behold. The market surveys I've seen like the AAII, is not showing this massive mismatch on sentiment, it is only anecdotal at this point. It is hard to find a mid-term bull (6-12 months) on FinTwit or BitcoinTwitter. Instead, I've seen a few perma-bulls actually convert to bears over the last couple of weeks.

Zooming in a little...

My confidence in stocks is not a near-term call. I think the long-term fundamentals for the US are extremely strong, especially relative to other large economies like the EU and China. Therefore, any downward movement in stocks is going to eventually break higher once again. Very similar to my bitcoin thesis here.

The FOMC rate hike decision has only tangential significance in the form of market sentiment. The market is expecting 75 bps, so I believe that is what they will go with. One step closer to the pause, stocks can smell that.

CPI

What a wild ride with CPI this week. For starters, it was 0.1% (1.4% annualized) in August, even though we heard crazy terms like "acceleration" and "big beat". For once the market dove into the nuance to find specific data they could interpret as bearish. Usually, people don't do that. They look at the headline number and react. Most of the time it is me diving into the nuanced numbers.

Some parts of the CPI are showing signs of being sticky to the high side. Food for example, on a year-over-year (Y/Y) basis, prices are very high, however, August was the slowest CPI for food this year! Shelter is another one, and just this month we are starting to see cracks in these price rises as well. Shelter is very sticky, but it shouldn't be basis for your inflation analysis.

The main problem is people interpreting August CPI as changing the fundamentals. It did not. It is old data by definition, from last month (and in the case of shelter prices, it's very old data), it does not change the fundamentals of the market. Nothing in CPI says we are not returning to slow anemic growth, and low inflation.

The stock market and bitcoin love that environment, because there's no good place to put your money, so it ends up in stocks and taking a chance on bitcoin.

A return to low growth from a nearly 8% nominal rate in Q2, is going to feel like slamming on the breaks. But that is not bearish for the stock market. In a counterintuitive way, a slowing economy is bullish stocks and bitcoin! Falling CPI (and it is falling, 0% in July, 0.1% in August), confirms the slowing economy fundamental.

Price Conclusion

This was a long price section, I'll try to sum it up as briefly as I can.

Bitcoin has very little bull market energy. It is, however, holding the June lows so far. Bitcoin has not reacted to the last two 75 bps hikes from the Fed, and I don't expect it will react all that much to this one.

During the last Powell Pause back in Jan 2019, bitcoin responded aggressively, popping from $3500 to over $12000 in 6 months. If we are one step closer to a Fed rate hike pause, bitcoin is one step closer to a big rally.

Ethereum is a headwind and is selling off. The Ethereum ecosystem is dependent on inflation, and they have now killed that Golden Goose. They also are under attack from SEC's Gensler in raising the chance that Ethereum is now much more fit to the definition of a security.

Stocks do not look as weak as the bears will have you believe. If we are in a general market slowdown, in GDP there is little where else to put your money but into stocks, especially if Japan, China and Europe are selling Treasuries to get the dollars.

CPI this week helped the bears take temporary control of the markets, but no fundamentals changed. If we are going back to post-GFC normal, which I strongly believe, it means stocks should perform well and CPI should come down rapidly. This behavior will feel like we are sliding into a major recession, when in fact it is a rapid move from big nominal GDP gains, to low nominal GDP gains.

Overall, the risk of a dramatic sell off is elevated this week with the FOMC decision on deck. I expect the bitcoin price to continue sideways to slightly lower this week, but to find its footing again very soon. By the end of the month, I think bitcoin has it's reversal.

Mining

| Previous difficulty adjustment | +3.4487% |

| Next estimated adjustment | -1.0% in ~8 days |

| Mempool | 5.5 MB |

| Fees for next block (sats/byte) | $0.35 (13 s/vb) |

| Median fee (finneys) | $0.27 (0.180) |

Mining News

Just hours after Ethereum shot themselves in the foot by switching to Proof-of-stake, Greenpeace jump on the bandwagon to diss on bitcoin's elegant and successful Proof-of-work mining.

Greenpeace and the Environmental Working Group have intensified their attack against Bitcoin’s proof-of-work (PoW) with a $1 million ad campaign, per a press release.

The climate groups are pushing for institutions such as Fidelity, BlackRock, Block and PayPal to influence the Bitcoin protocol. The group's intentions are to have these institutions somehow help change the consensus mechanism from PoW to proof-of-stake (PoS).

The radical Greenpeace attack on bitcoin mining shows an deep lack of knowing who controls bitcoin and why PoS doesn't fix anything. They claim:

"Ethereum has shown it's possible to switch to an energy-efficient protocol with far less climate, air and water pollution," said Michael Brune, director of the Change the Code, Not the Climate campaign.

Ethereum has shown no such thing, Michael. Its distributed consensus (what makes the system secure) was destroyed with this move. Now the truth and the rules on the Ethereum network comes from a handful of regulated companies. Innovation on Ethereum is dead.

In the end, this is a $1 million waste of money for bitcoin's enemies. Go for it!

Archived (had trouble with this archive, link might not work)

With Ethereum changing from proof-of-work (PoW) to proof-of-stake (PoS), only 12% of the top 50 coins now leverage PoW. Six crypto asset networks use PoW consensus mechanisms like SHA256 or Scrypt to verify transactions and mint new coins.

Distributed consensus is a hard thing, it's very expensive and only viable for actually useful networks. Proof-of-work mining is the secret sauce that makes a truly independent consensus, absent central control, possible. It comes with massive trade-offs though.

The problem with Ethereum and other altcoins is they do not respect the trade-offs. They think they can have the cake and eat it, too. The reality is Proof-of-stake is inherently flawed. The benefit to energy use is traded off with decentralized control and fair distribution.

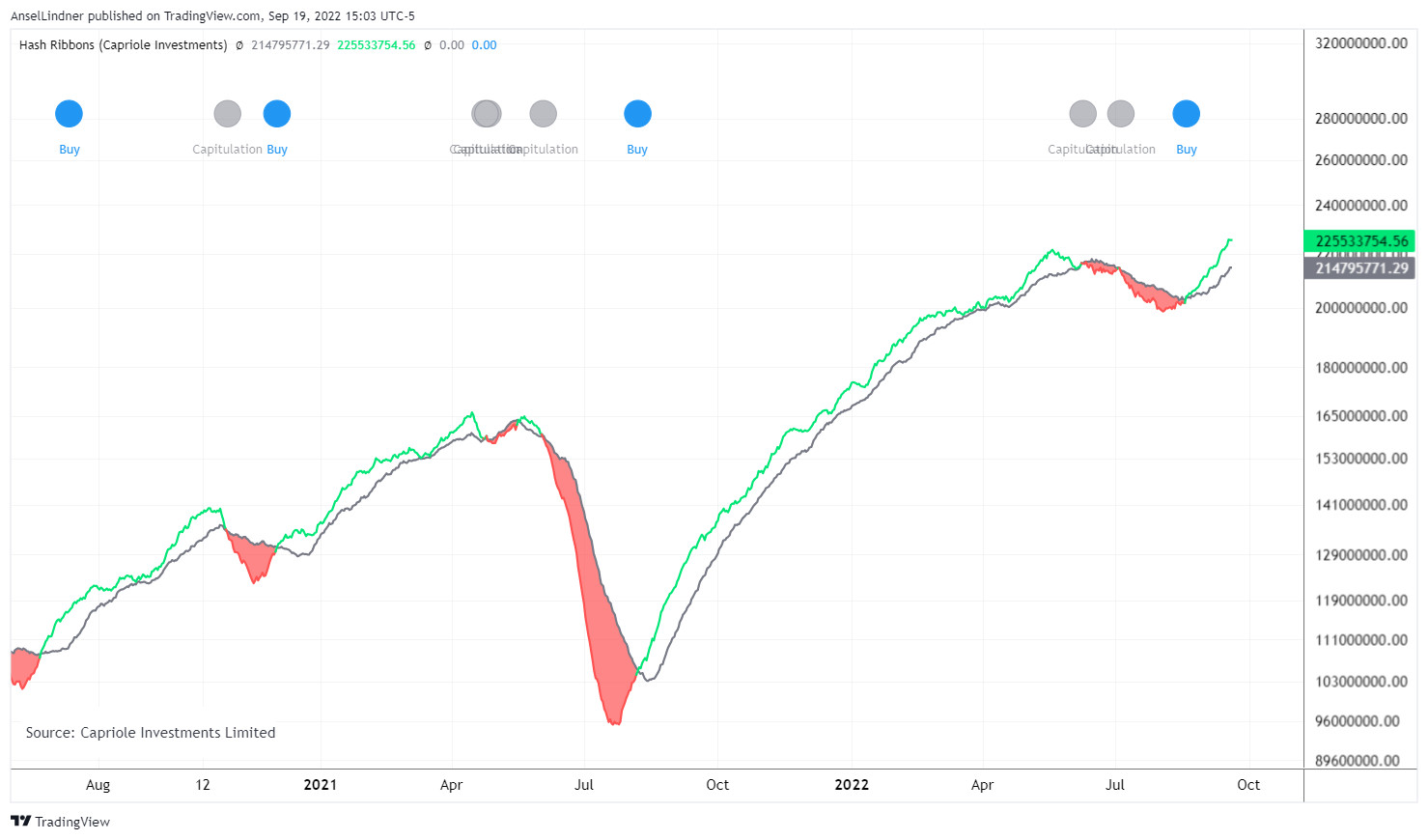

Hash Ribbons

The hash ribbons continue to extend into the buy zone. The actual signal was triggered on Aug 19th at roughly $20,800. We'll see if this is once again on the money. For now, it is looking very strong for mining.

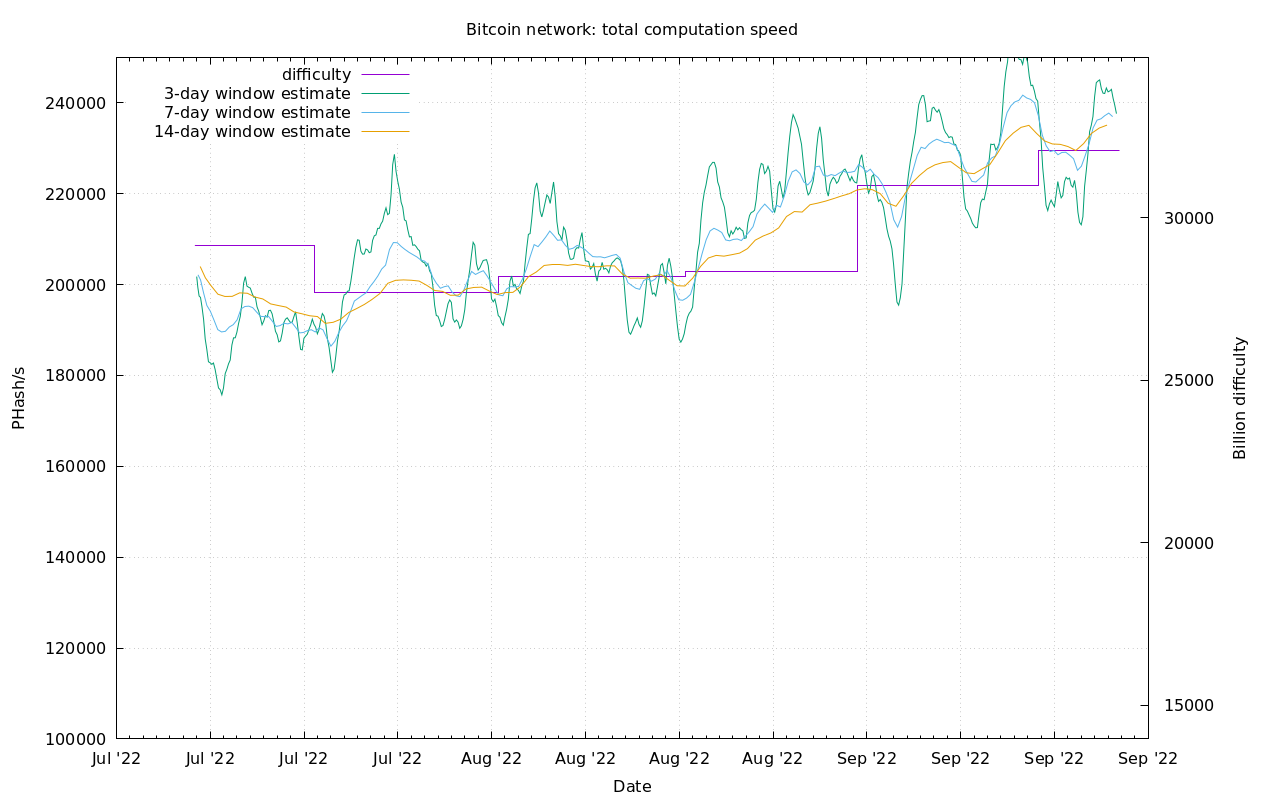

Difficulty and Hash Rate

Bitcoin hash rate continues to surge this week. Last Tuesday, the difficulty jumped 3.4% to an All-time-high despite price being in the dumps. This is a massive signal that the bitcoin mining industry is becoming more professional and interconnected into the energy infrastructure and financial system.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

September 19, 2022 | Issue #209 | Block 754,845 | Disclaimer

* Price change since last week's report