Bitcoin Fundamentals Report #264

A few influential push backs on bitcoin, DCG problems, HK mulls spot ETF, SLOOS data, market shift, price analysis, mining and layer 2 news.

November 6, 2023 | Block 815,605

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidating at highs |

| Media sentiment | Neutral |

| Network traffic | High |

| Mining industry | ATHs |

| Days until Halving | 163 |

| Price Section | |

| Weekly price* | $34,963 (+$623, +1.8%) |

| Market cap | $0.683 trillion |

| Satoshis/$1 USD | 2,859 |

| 1 finney (1/10,000 btc) | $3.50 |

| Mining Sector | |

| Previous difficulty adjustment | +6.4708% |

| Next estimated adjustment | +3.5% in ~5 days |

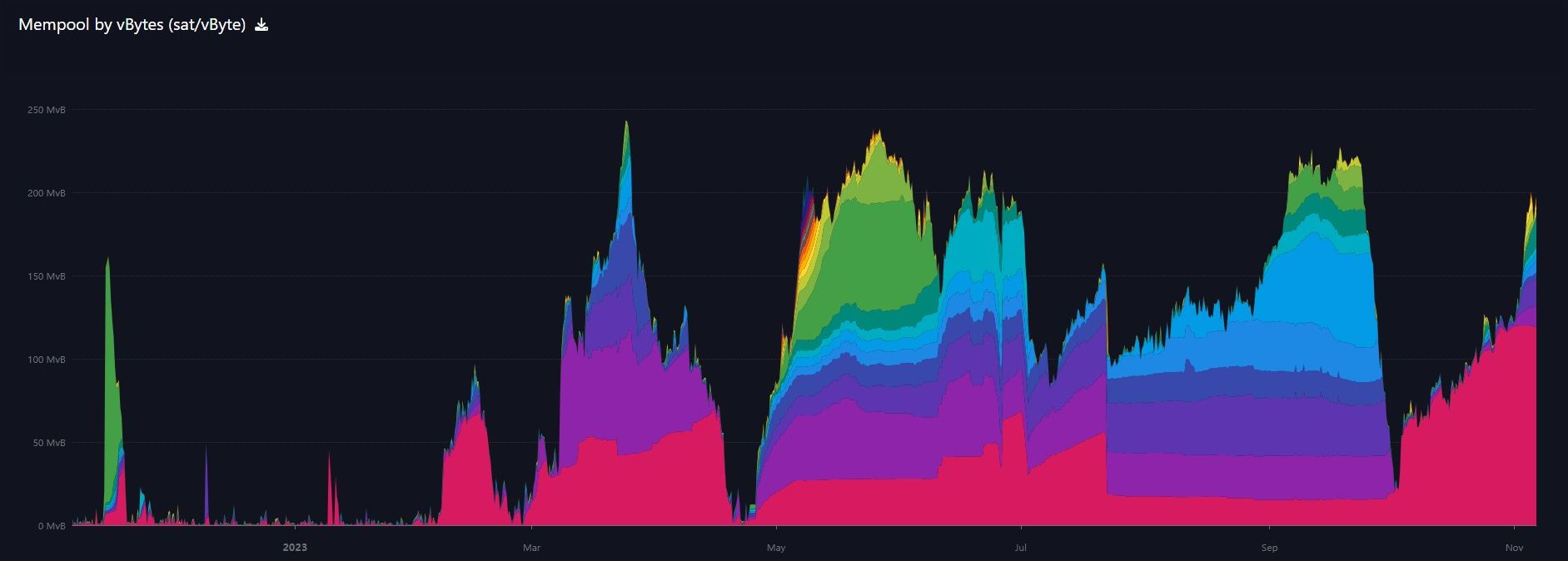

| Mempool | 208 MB |

| Fees for next block (sats/byte) | $4011 (84 s/vb) |

| Low Priority fee | $3.62 |

| Lightning Network** | |

| Capacity | 5370.28 btc (+0.8%, +42) |

| Channels | 62,264 (-0.0%, -9) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

- The Coming Multipolar World

- Demographic Collapse: Why Should We Care?

- Bitcoin is a Hedge Against Geopolitical Risk (continued...)

Bitcoin Magazine Pro

Headlines

- Charlie Munger and Vanguard CEO Trash Bitcoin

After weeks of bullish mega-CEOs and investment legends spelling out a deflationary safe haven investment thesis for bitcoin, over the weekend, Charlie Munger was quoted saying, "Bitcoin is like throwing a stink ball into a recipe that's been around for a long time, that's worked very well for a lot of people."

NEW: "#Bitcoin is like throwing a stink ball into a recipe that's been around for a long time, that's worked very well for a lot of people", per Berkshire Hathaway's vice chairman Charlie Munger 👀 pic.twitter.com/ALu5ekqg0X

— Bitcoin News (@BitcoinNewsCom) November 5, 2023

On top of that, the CEO of Vanguard, so and so, said bitcoin doesn't have any intrinsic value. The intrinsic value fallacy strikes again.

JUST IN: Chairman and CEO of Vanguard Group Tim Buckley says the firm won't join the #Bitcoin ETF race, as Vanguard claims to be focused on asset classes with an intrinsic value and capable to generate cash flows, like equities and bonds 🤔 pic.twitter.com/Q3kwDoS61G

— Bitcoin News (@BitcoinNewsCom) November 5, 2023

This was a great thread by Vijay Boyapati summarizing the precarious spot that DCG finds itself. I'll try to summarize here.

First, the premium on GBTC over the years created a arbitrage harvesting scheme that took over the industry. From Three Arrows Capital to BlockFi. That was then used to pump NFTs and altcoins. Along came Genesis subsidiary of DCG to facilitate this trade. When 3AC went bankrupt, Genesis was in a $2 billion hole. They secured a fraudulent loan from DCG which helped them avoid bankruptcy themselves for several months. They finally went up, and threatened DCG, who was also dealing in the GBTC trade.

How many times to I have to say it, what shitcoiners claim is innovation in financing is really just fraud.

1/ There was a much more important fraud than SBF's embezzlement that took place in 2022. It was a fraud (allegedly) perpetrated by one of the oldest companies in the space, @DCGco and its CEO, @BarrySilbert.

— Vijay Boyapati (@real_vijay) November 6, 2023

Time for a thread 👇

The city is weighing retail-investor access to such spot ETFs providing regulatory concerns are met, Securities and Futures Commission Chief Executive Officer Julia Leung said.

It appears that China is using Hong Kong to keep up with the US. HK recently did a U-turn, opening up its financial industry to investing in bitcoin related products. Now, not to be left behind as it looks more likely that the US will approve a spot ETF, HK is once again following suit.

Macro

- Fed kept rates steady. Likely to not raise in December.

No surprise, the Fed maintained rates at last week's meeting. They didn't and won't disappoint the market, especially when it is this apparently fragile.

All their dot plots and summary of expectation documents said the FOMC board had expected to raise one more time this year. That leaves only their December meeting. The market doesn't believe them, pricing in a 90% chance of no hike so far. I expect that to increase.

This is the most underappreciated data the Fed releases, their Senior Loan Officer Opinion Survey (SLOOS). The last couple of quarters has shown banks tightening their lending standards AND loan demand falling. That is confirmed by Commercial Bank Credit being negative. Since money in the traditional system is credit, that means there is outright deflation happening (net credit creation is negative).

Q3's SLOOS just dropped prior to publication of this letter. A SLOOS report consists of several components. Bank lending standards and customer demand for Commercial & Industrial loans (C&I), Commercial Real Estate (CRE), Residential Real Estate (RRE), and Home Equity Lines of Credit (HELOC), and other loans including personal, auto, and credit cards.

All segments reported tighter standards and less demand. It was a slower rate of deterioration but still deteriorating.

- Ukraine: The Forgotten War

The total pivot from Ukraine to Israel has been awe-inspiring to see. How the MSM could completely shift in the matter of a week is amazing. This is my quick update on Ukraine.

The reason I write about Ukraine in this newsletter, and talk about it in my content, is because the sanctions war attached and the outcome have dramatic affect on the market.

If the West loses this war, what reason is there for NATO? The EU member could be forced to foot the bill for their own defense, and EU members will be torn away. Here's a great thread reminder.

This is arguably a bigger news than what's going on in Gaza (as horrifying as it is). In fact there's no understating how significant this is.

— Arnaud Bertrand (@RnaudBertrand) November 5, 2023

For the past 2 years we've had NATO countries send hundreds of billions of dollars to Ukraine, a quantity of weapons so enormous it… https://t.co/R6LXjYW1Uf

As it turns out, the Ukrainians are surrounded in a couple key cities, just like we saw in Bakmut last year. With frozen ground favoring the Russians, more losses are coming soon for Ukraine and the West. It's so bad, there are calls from the West now, to offer peace terms. Of course, they built the monster Zelenskyy, who will not be offering terms.

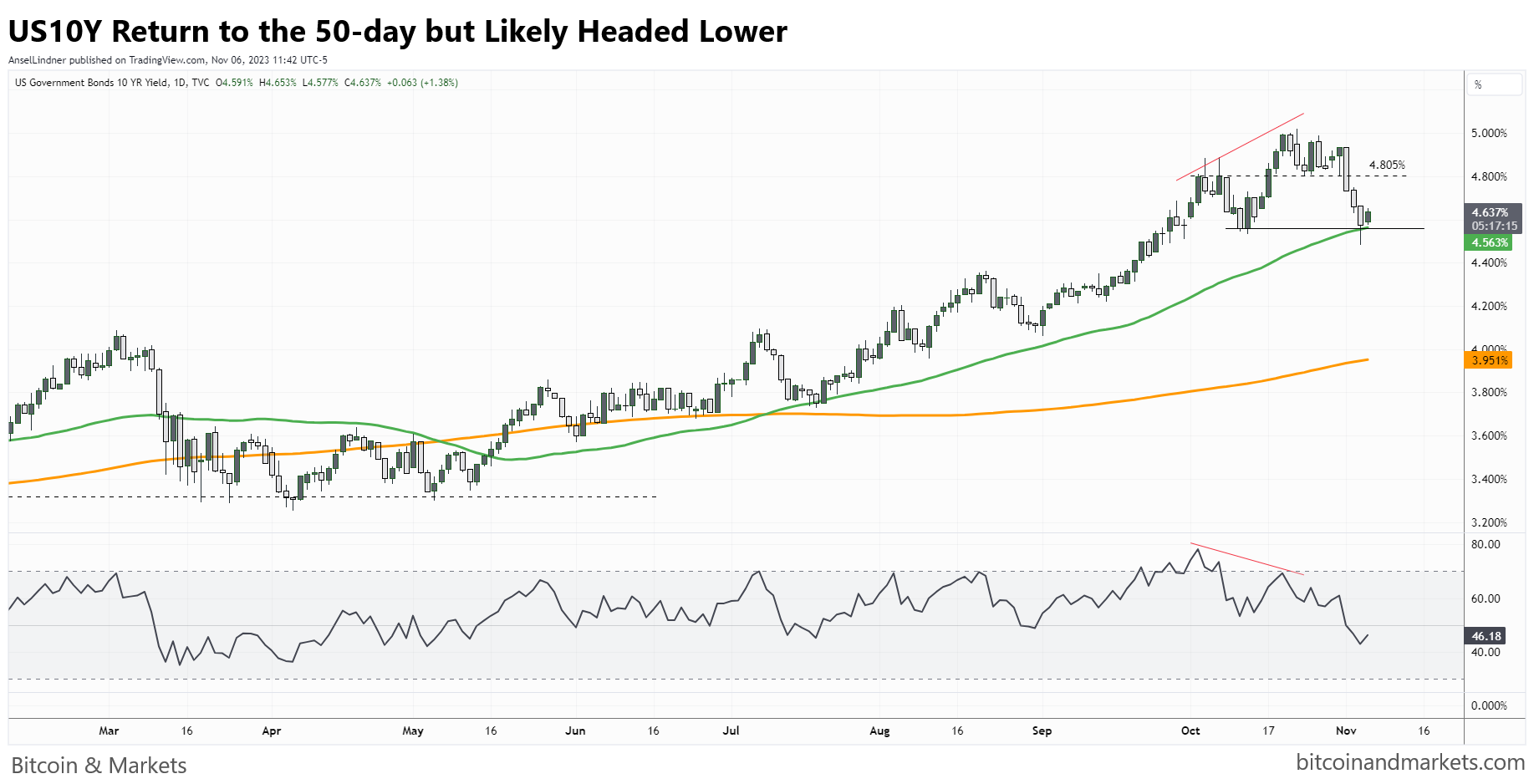

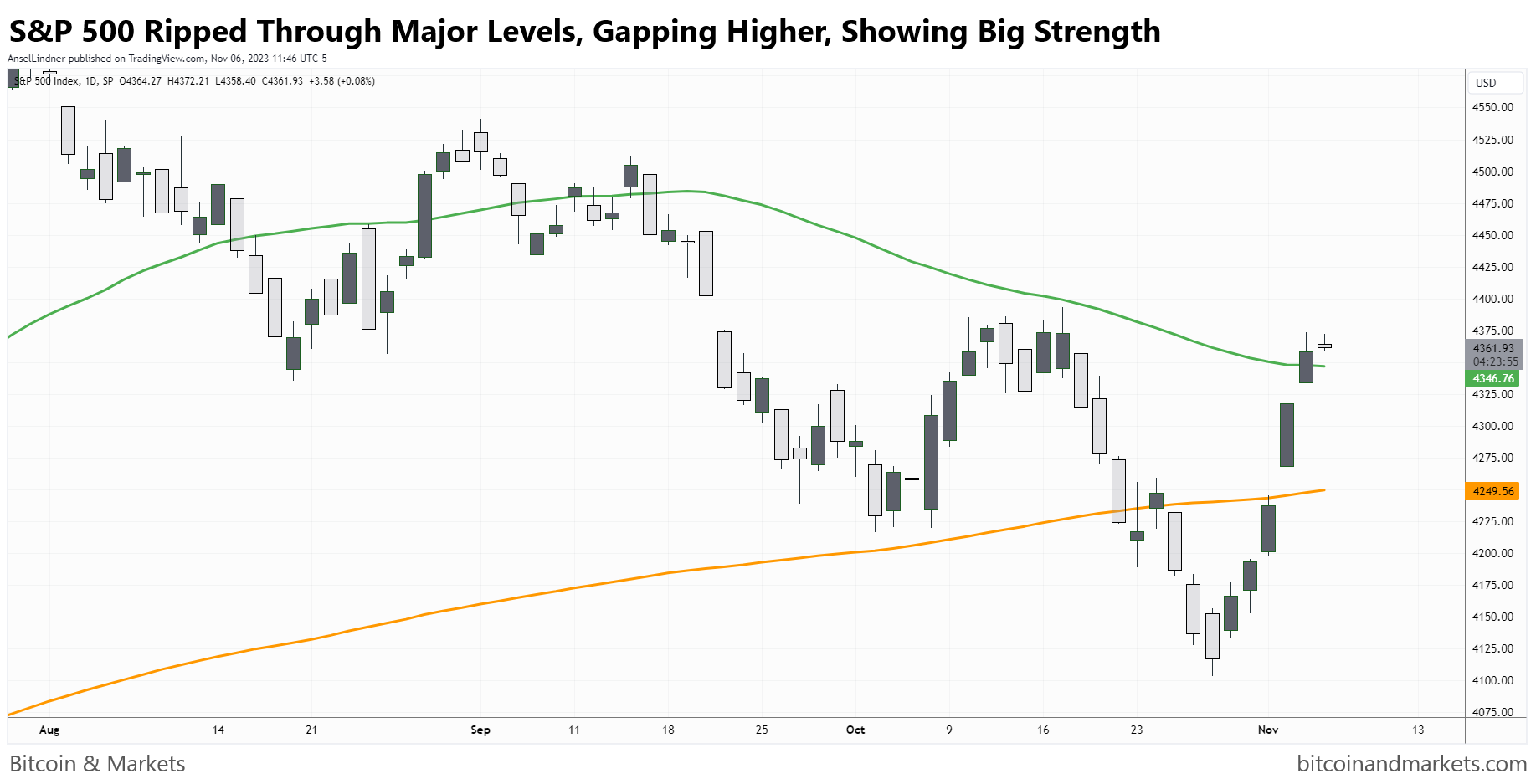

- MARKET CLIMAX as expected

Back on September 28th, I first wrote about the coming climax in markets (Professional tier post since made public). Therefore, I've been waiting for what we saw this last week. Bonds yields dumped and stocks jumped. The force of which was caught a lot of people off-sides.

I think we've seen the highs for bond yields and lows for stocks. Oil is still showing meager demand, while the dollar is weakening a bit. All these things point toward a climax has occurred and the global economy is heading into recession next year. A reminder: when the economy becomes more uncertain, people tend to put money into stocks and bonds and not risk expanding their business. Bitcoin is perfectly positioned, thanks to Larry Fink and others, for making bitcoin seen as a safe haven.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

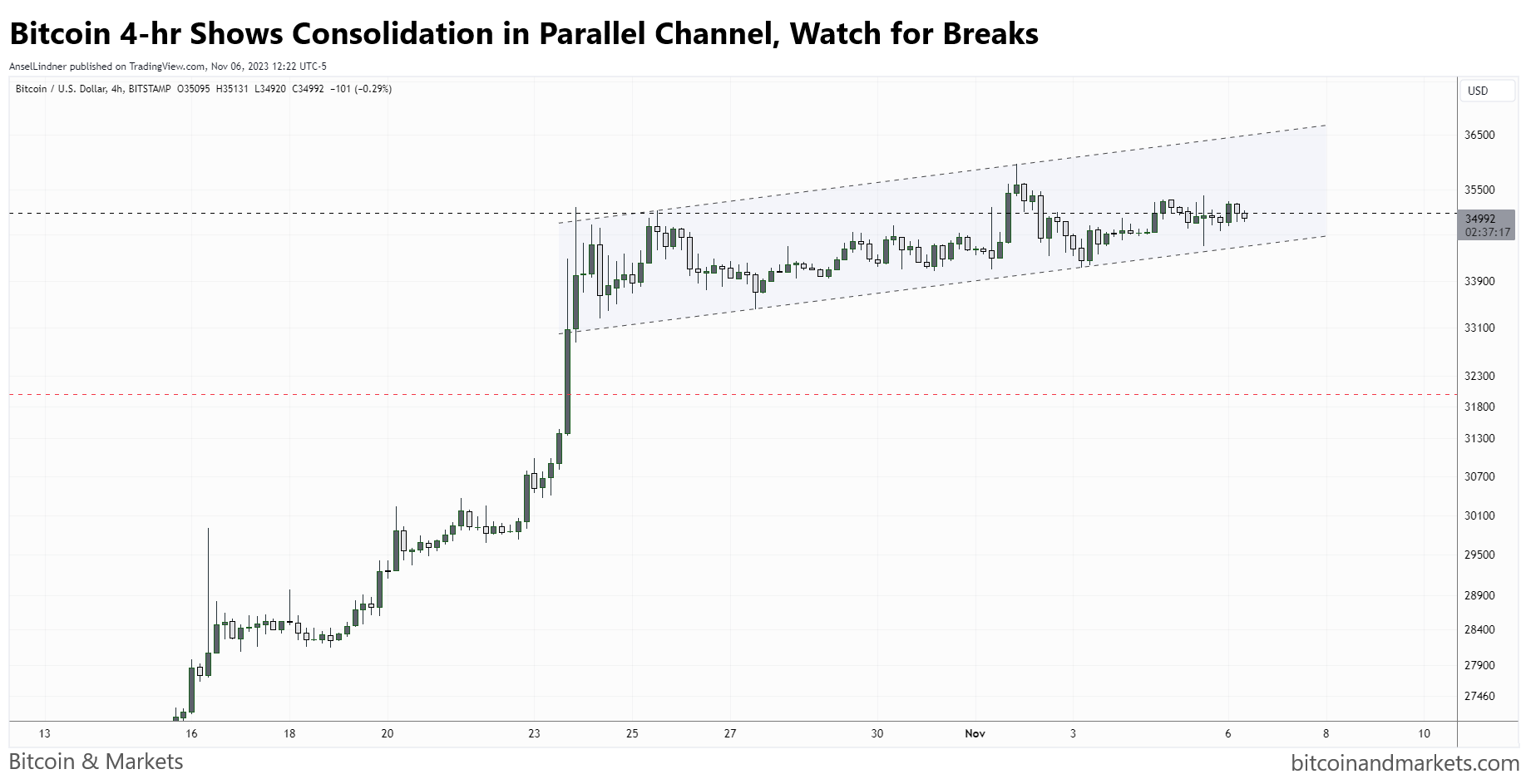

Bitcoin Charts

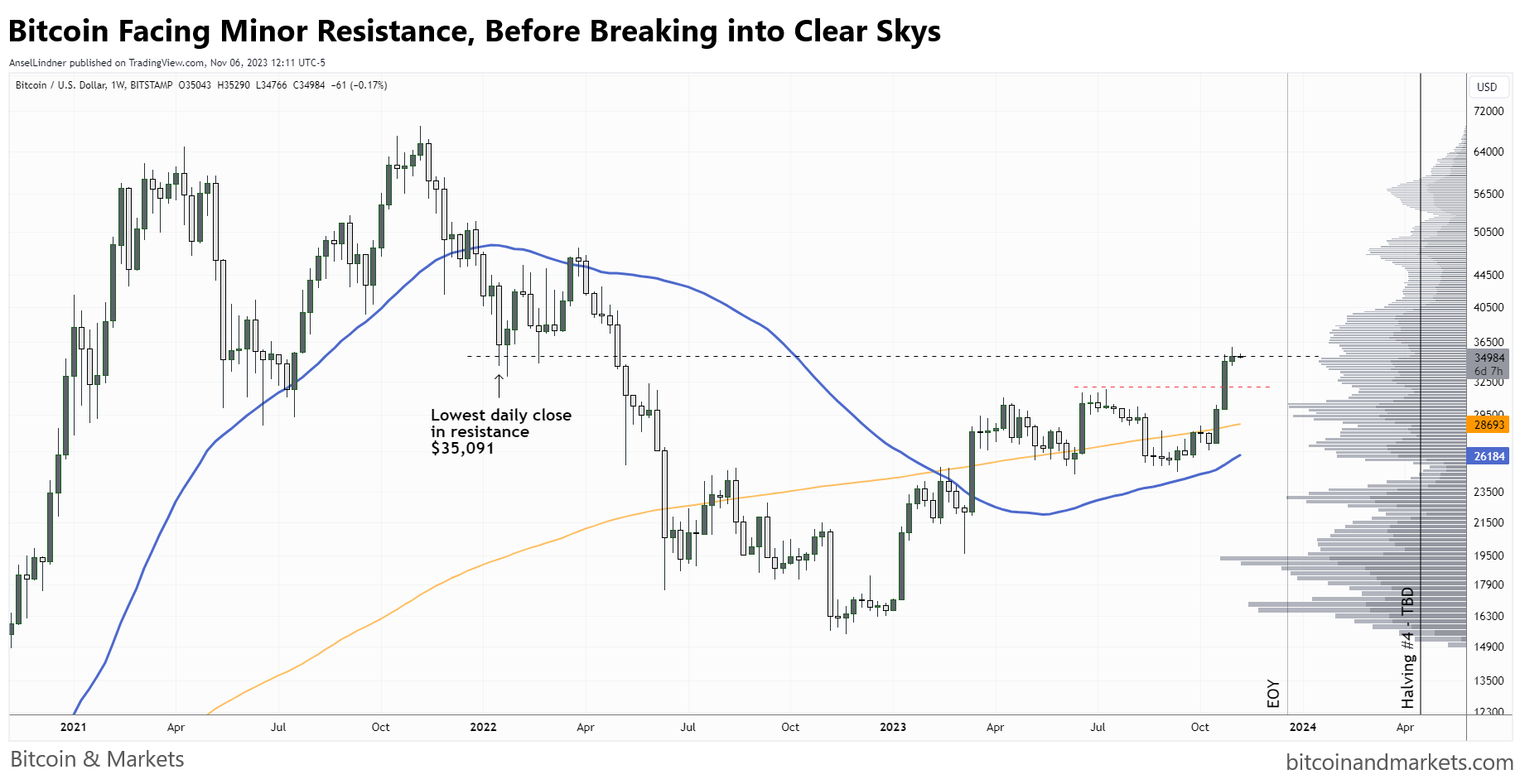

Bitcoin has consolidated this week in an ascending channel. Watch for breaks of this channel either way. A break downward remains less likely but possible. A trade around $32k would have a low risk reward if you include a stop-loss just below $31k. A break upward, will send bitcoin to the next level of resistance.

On the daily chart, we can see that Relative Strength Indicator is down to 75, which is cool enough to enable the next leg higher. It would be nice if it cooled to 70, but that is not necessary (see January second leg).

Zooming out to the weekly. Price looks to be dealing with the last bit of resistance before making a major move. Volume resistance peaks at $36,500 and is then down until the next higher resistance at around $47,000. It would be less surprising to see that move than a drop below $32k at this point.

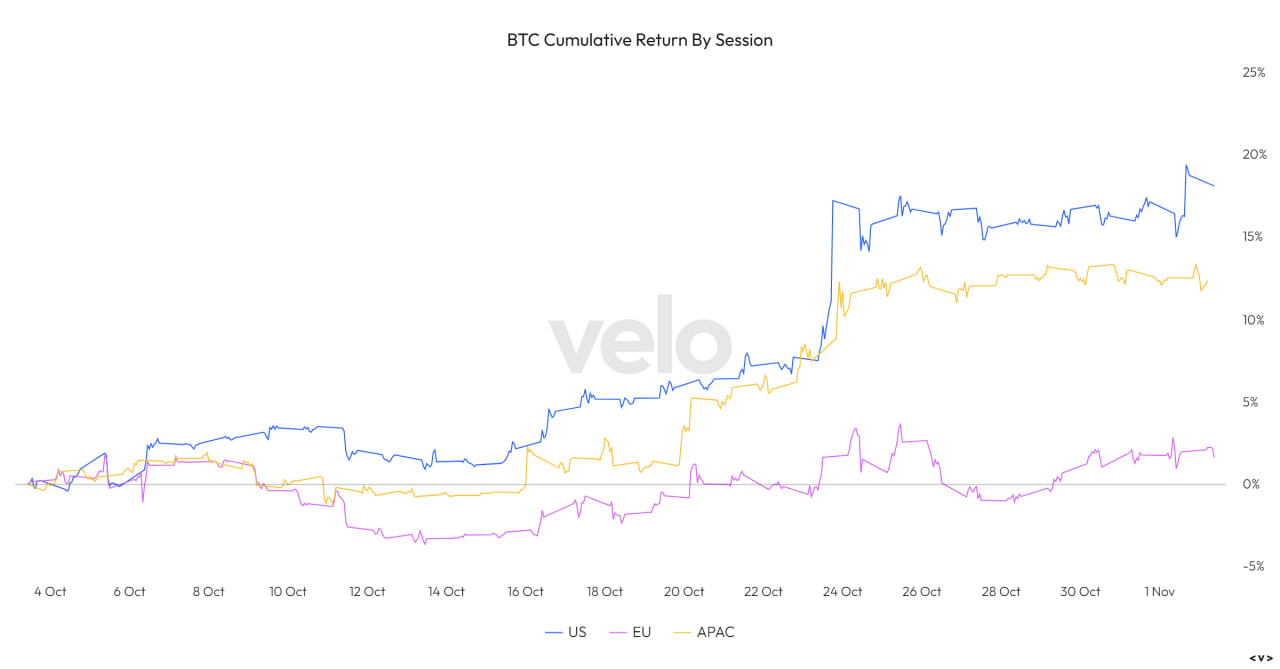

This was a fascinating chart from @WClementeIII this week. It shows bitcoin return by trading session. IOW business hours in these different global locations, EU, APAC and US. Obviously this shows that the US is the most bullish on bitcoin. It could also mean that these other areas are experiencing a squeeze on disposable/investable income, relative to the US.

Much more detailed price analysis, including short, medium and long term forecasts on Market Protons!

Bitcoin Mining

Headlines

Northern Data AG has secured a 575-million-euro ($610 million) debt financing facility from Tether to drive further investments across its businesses, according to an announcement on Nov. 2.

The debt capital specifically aims to enable Northern Data Group to invest in its three business lines, including its artificial intelligence cloud service provider Taiga Cloud, Ardent Data Centers and Peak Mining, the company’s mining business.

The debt financing comes after Tether acquired a stake in Northern Data. In September 2023, the USDT issuer invested an undisclosed amount in Northern Data in a move aimed at backing AI initiatives. Tether claimed the investment was separate from its reserves and would not impact customer funds. Tether has been actively moving into Bitcoin mining operations in 2023, launching its own mining operations and introducing proprietary mining software.

Dozens of mining firms came to Washington to steer the policy narrative away from negative environmental claims and make a case for mining as an economic and security boon.

...representatives of that sector flooded offices on Capitol Hill this week to argue their businesses can help stabilize the power grid, tie into renewable resources and foster domestic technology.

Difficulty

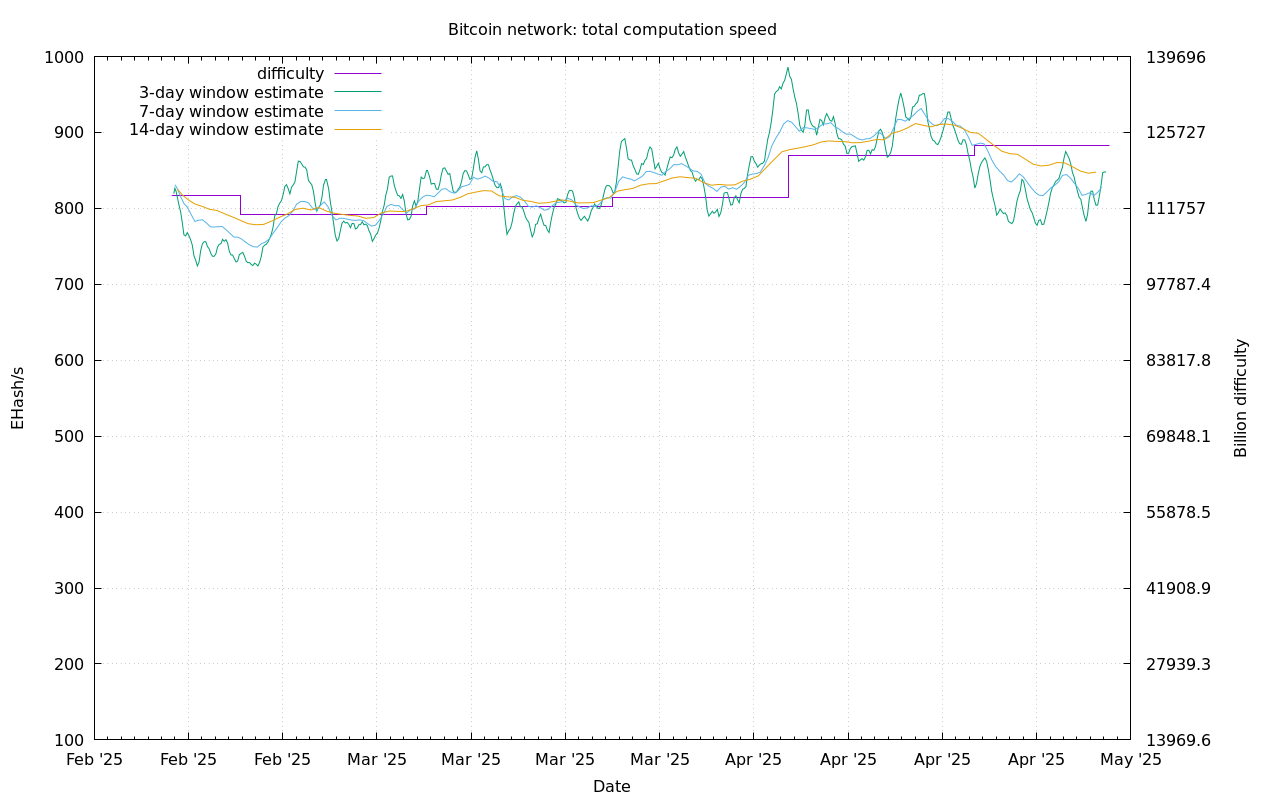

Bitcoin is on track for another positive difficulty adjustment in 5 days of roughly +3.5%. New ATH hash rate and continued investment in the industry give major weight to the bull thesis.

Mempool

The mempool has rocketed higher this week, with fees finally following. We often see these spikes in the mempool prior to or during market moves. The spikes in March this year, initially started with the rally, but the peak in mempool marked the general end of the move higher. The next jump in the mempool was in May. May was boring and slightly negative for price. Then came the September spike, happening over a period where the price bottomed.

Layer Two

Lightning is getting increasing flack in recent months. It has been around a long time now and I think people's expectations have been let down. It's not growing nearly as fast as many hoped. Add to this the recent exploit we discussed last week, frustration is bubbling over. This week, Fiatjaf, creator of Nostr called LN a scam. It is not a scam, but it is disappointing so far.

I'm personally more bullish on Elements sidechains (not Drivechains) over the next decade than Lightning Network. I always like to see it getting discussed in the bitcoin press. In this article, author Randy Naar shares some ways Liquid is using and helping development of Covenants and their discussion in Bitcoin.

Many applications have already taken advantage of covenant opcodes on Liquid. Steven Roose, a covenant proponent who recently defined a specification for the previously ideated OP_TXHASH, has developed an application for fidelity bonds on Liquid. This covenant is placed on funds that would be burned if evidence of a double spend is presented in the witness.

As the Bitcoin ecosystem continues to have a healthy debate regarding covenant opcodes, Liquid offers its own set of tools, catering to similar objectives but with distinct implementations. As the dialogue evolves, it'll be intriguing to witness the interplay between Bitcoin's native proposals and Liquid's already concrete and live covenant-related features and emulation of Bitcoin covenant proposals implemented using Elements Script.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space