Bitcoin Fundamentals Report #265

Bitcoin news of the week, ETF approval rumors, CPI preview, freight recession, bitcoin price analysis, mining news, ordinals update.

November 13, 2023 | Block 816,629

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidating at highs |

| Media sentiment | Neutral |

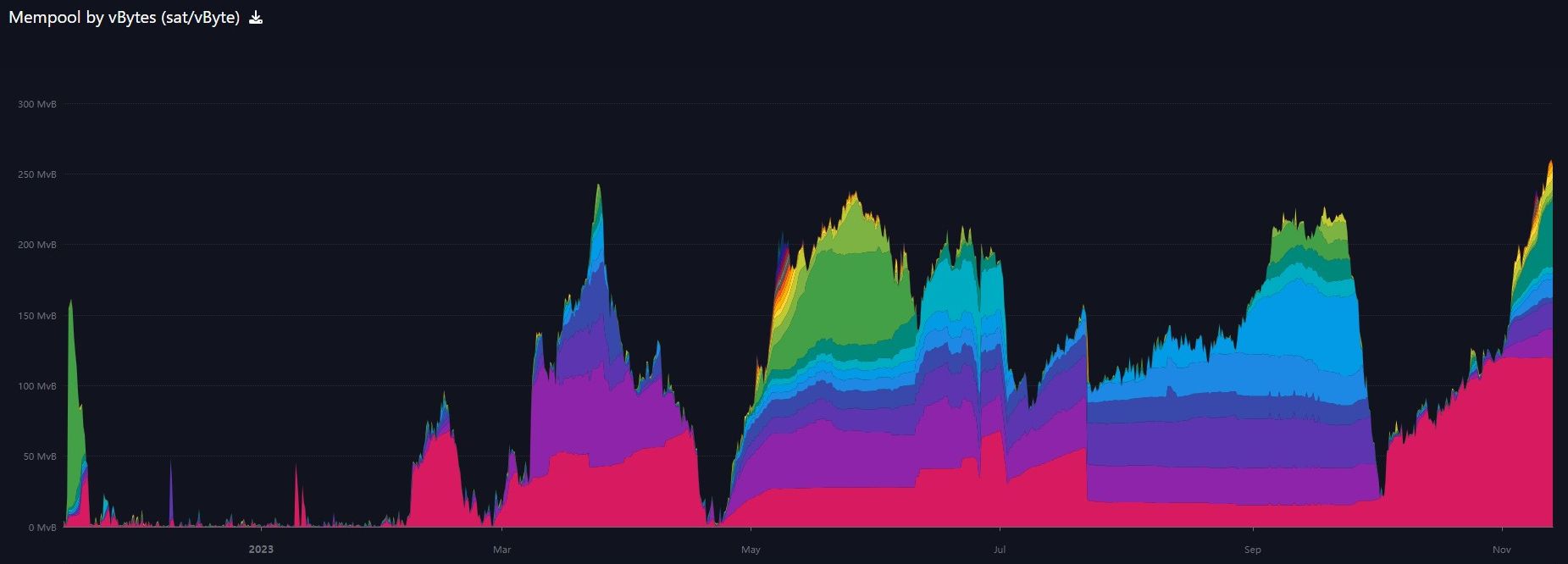

| Network traffic | Very High |

| Mining industry | Profitable |

| Days until Halving | 156 |

| Price Section | |

| Weekly price* | $36,749 (+$1,786, +5.1%) |

| Market cap | $0.718 trillion |

| Satoshis/$1 USD | 2,720 |

| 1 finney (1/10,000 btc) | $3.68 |

| Mining Sector | |

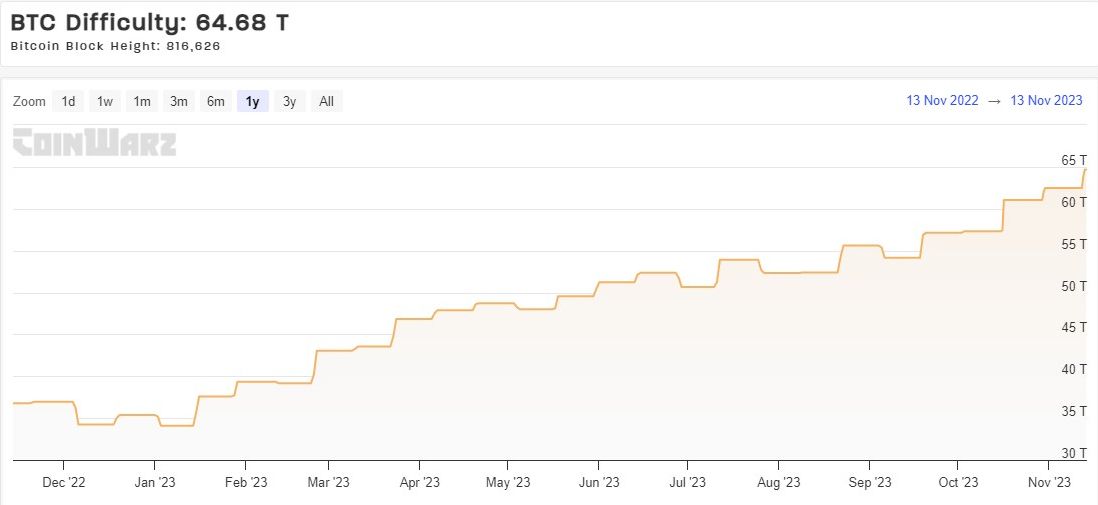

| Previous difficulty adjustment | +3.5463% |

| Next estimated adjustment | -4% in ~13 days |

| Mempool | 263 MB |

| Fees for next block (sats/byte) | $3.70 (72 s/vb) |

| Low Priority fee | $3.34 |

| Lightning Network** | |

| Capacity | 5346.52 btc (-0.4%, -24) |

| Channels | 62,153 (-0.2%, -111) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

- The Coming Multipolar World

- Demographic Collapse: Why Should We Care?

- Bitcoin is a Hedge Against Geopolitical Risk (continued...)

Bitcoin Magazine Pro

Headlines

A slow week in bitcoin but could get very exciting very quickly.

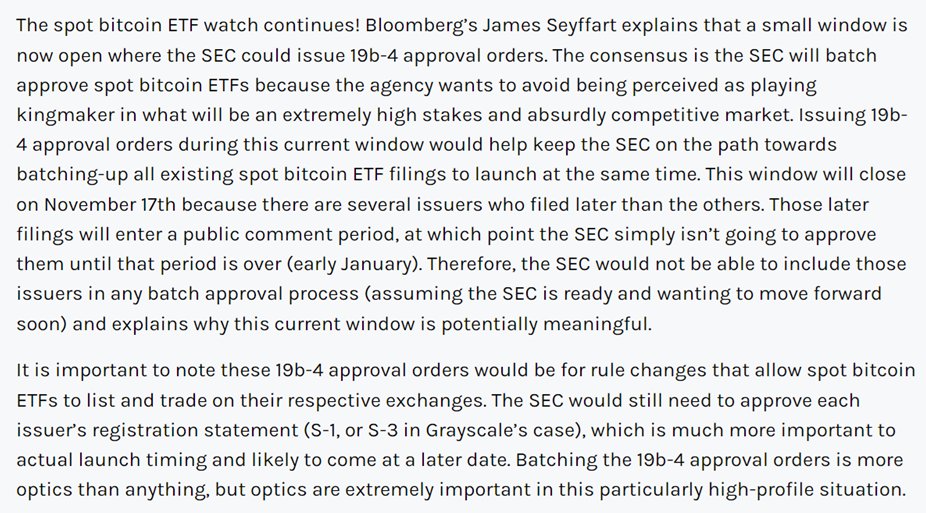

A brief window for Bitcoin spot ETF approval opened up this week. It seems if they aren't approved this week, the formal process gets in the way of the batch-approval approach.

Geraci also introduces the a two phase process, where the SEC approves the rule change to list the ETFs, but doesn't give actual approval until a later date.

Another very important factor is the looming government shutdown that comes again as early as this Friday. It was the last shutdown the fast-tracked the approval of the ETH futures ETFs in a batch process. Bitcoin ETFs are a much bigger decision and product this time around, but this particular parallel could affect the process. Remember, all the ETFs have come into compliance with the unprecedented SEC clarification request, Blackrock's filing said they are already actively constructing shares for launch, and very connected individuals think the approval is coming before the end of the year.

- Peter Schiff losing his mind

Peter Schiff, the bitcoin contraindicator extraordinaire, marked the recent Bitcoin pump with a tweet calling for a crash. Peter does not understand that higher prices beget higher demand.

#Bitcoin is approaching $38K as speculators continue to front run a new #BitcoinETF. However, once that ETF is launched all of the speculators will have already bought. So when those buyers sell to take profits, there won't be many left to buy the ETF. Get ready for a crash.

— Peter Schiff (@PeterSchiff) November 9, 2023

Zeihan's appearance on Joe Rogan back at the bottom of the bitcoin price included a brief discussion of bitcoin, where he claimed at $16k it was $17k overvalued. The main argument he made was the environmental impact. His other arguments were almost incomprehensible. He claimed that the fixed supply would make it go up in value for ever, hence why it will go to zero. Also, that since it is not widely used today in transactions, it never will be, even though bitcoin volume is among the top currencies in the world, is growing exponentially, and is owned by up to 200 million people globally.

I listened to the interview made into a song, memeing him hard on Friday's Live Stream. It's a real banger. Anyway, he has now responded via Twitter saying: "However little you believe I care about bitcoin, I assure you I care far less." Of course, the argument isn't that he doesn't care about bitcoin, but that he doesn't get it or has ulterior motives.

However little you believe I care about bitcoin, I assure you I care far less.

— Peter Zeihan (@PeterZeihan) November 10, 2023

Bitcoiners simply looked up all the times Zeihan had tweeted about bitcoin over the years, showing he cares a lot about it. All those years and he knows the same tiny amount.

Macro

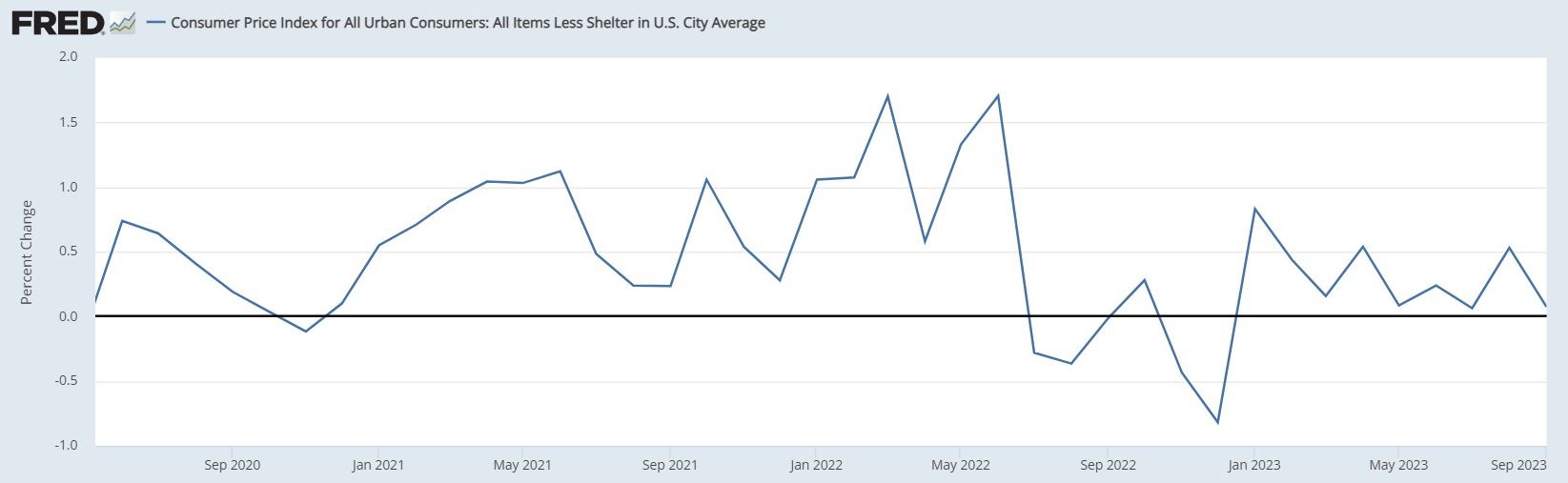

CPI is on a path to "normalization". August CPI came in a bit hotter than expected at 0.6%, September a little cooler at 0.4%, and October is being forecast to cool back down to <0.1%. To be precise the whole basket of prices is still rising, but it speaks to the normalization of CPI back to the post-GFC normal I've been talking about for years of around 1-2%.

Gasoline futures fell 8% in October and oil prices were down 10%. All items less Shelter should come in below zero. As I've commented on many times, shelter is a lagging indicator calculated differently that other jurisdictions, like the EU.

This does not mean that there is no pain from high prices, exactly the opposite. Consumers are cutting back. High prices have caused so much pain, caused demand to drop so much, that prices have to fall. The pain would not be as intense if money printing were keeping up with CPI.

With recession on the horizon, we should expect CPI and interest rates to continue to fall. Negative MoM readings are likely in the next few months, pulling YoY under 2%. Zero YoY is possible by mid-2024.

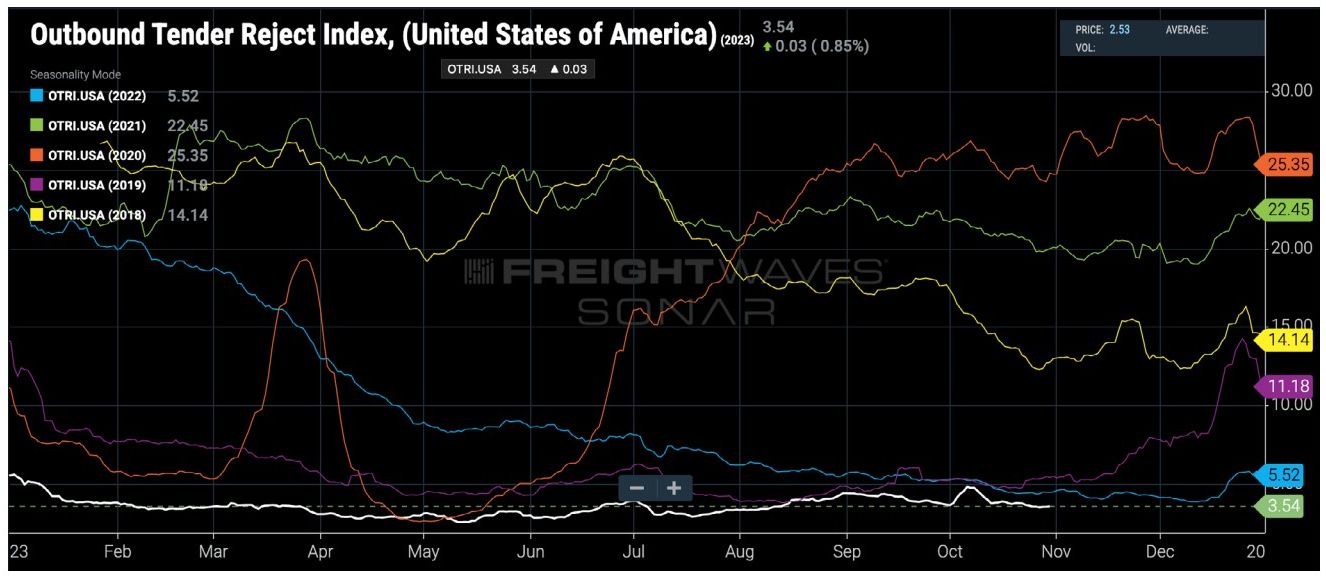

- Freight Recession hitting hard

Reject rates "measure the number of truckload tenders rejected and is an indication of relative-tightness or looseness-of trucking capacity." As you can see, they are at historically low levels, meaning there is tons of slack in the trucking industry, which will drive prices down.

In addition to slowing trucking volume, shipping giant Maersk cuts 10,000 jobs and is forecasting an extended period of slow economic growth.

"The new normal we are now headed into is one of more subdued macroeconomic outlook, and thus soft volume demands for the coming years, prices back in line with historical levels, inflationary pressures on our cost base, especially from energy cost, and also increased geopolitical uncertainty," CEO Vincent Clerc said on an investor call.

Transportation is a major part of all goods and is a major indicator of future economic growth. The common thread in the entire industry from mega container ships to start-up trucking companies is the COVID lockdown disruption. We've heard for a year now that the supply chain backlog is fixed, but that's not the end of this story.

In 2020-2022, a massive amount of new capacity was brought to market to deal with the supply chain backlog. Now, the industry is going to deal with lower demand in a global recession, but with much more capacity, and probably debt to service.

From The Bitcoin Layer, they have a great chart showing the employment change in transportation as gone negative. When that happens, it generally means we are currently in a recession. This might portend a very deep one when it happens.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

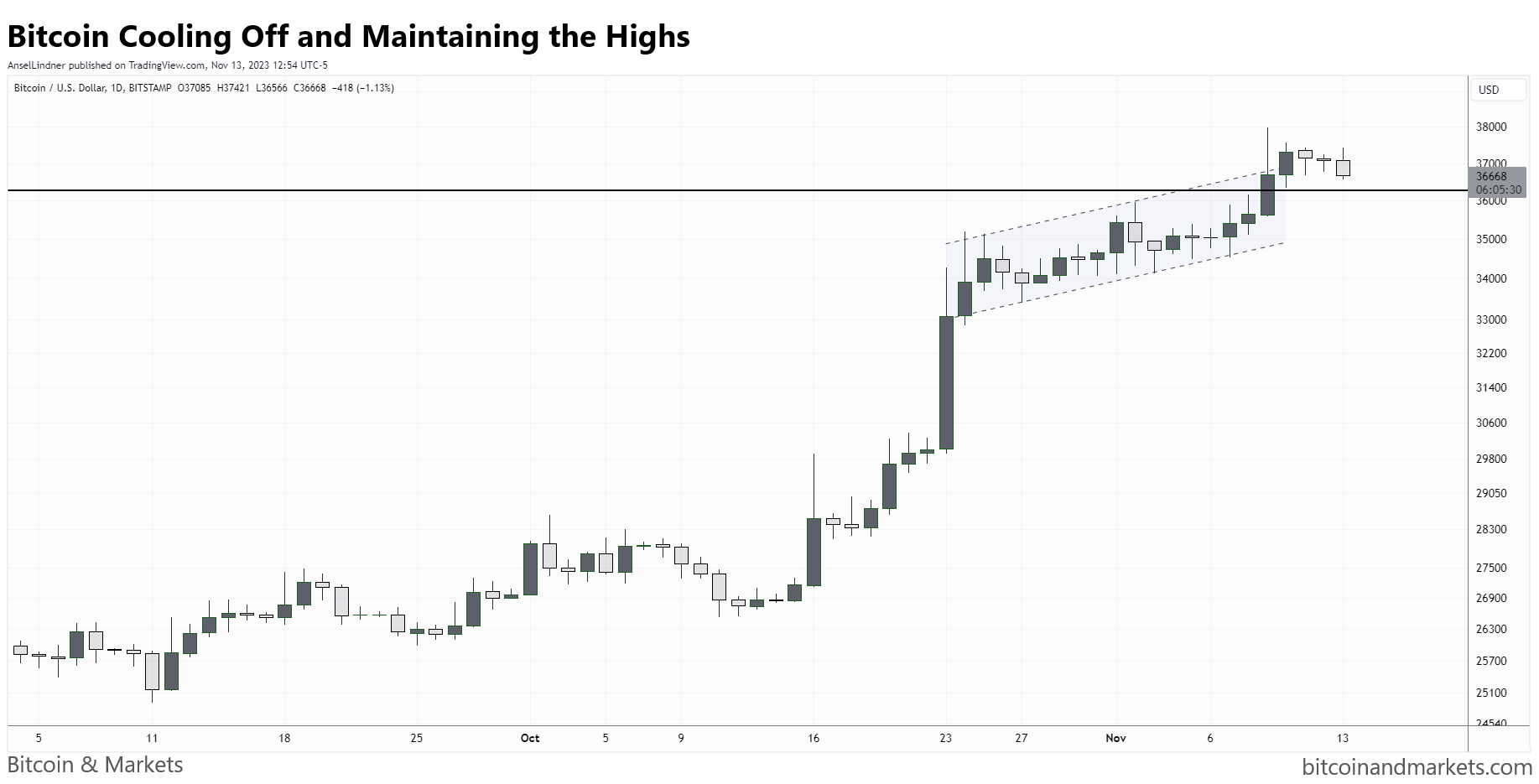

Last week, I was watching the ascending channel very closely. I argued that price would likely move to the top of the channel, and if we could close a daily candle above $36,500, a rise to $42k could be quick. The second half of that might have to wait.

Price did breakout above the channel, but is now trying to find support at the important $36,500 level, $36,600 at time of writing.

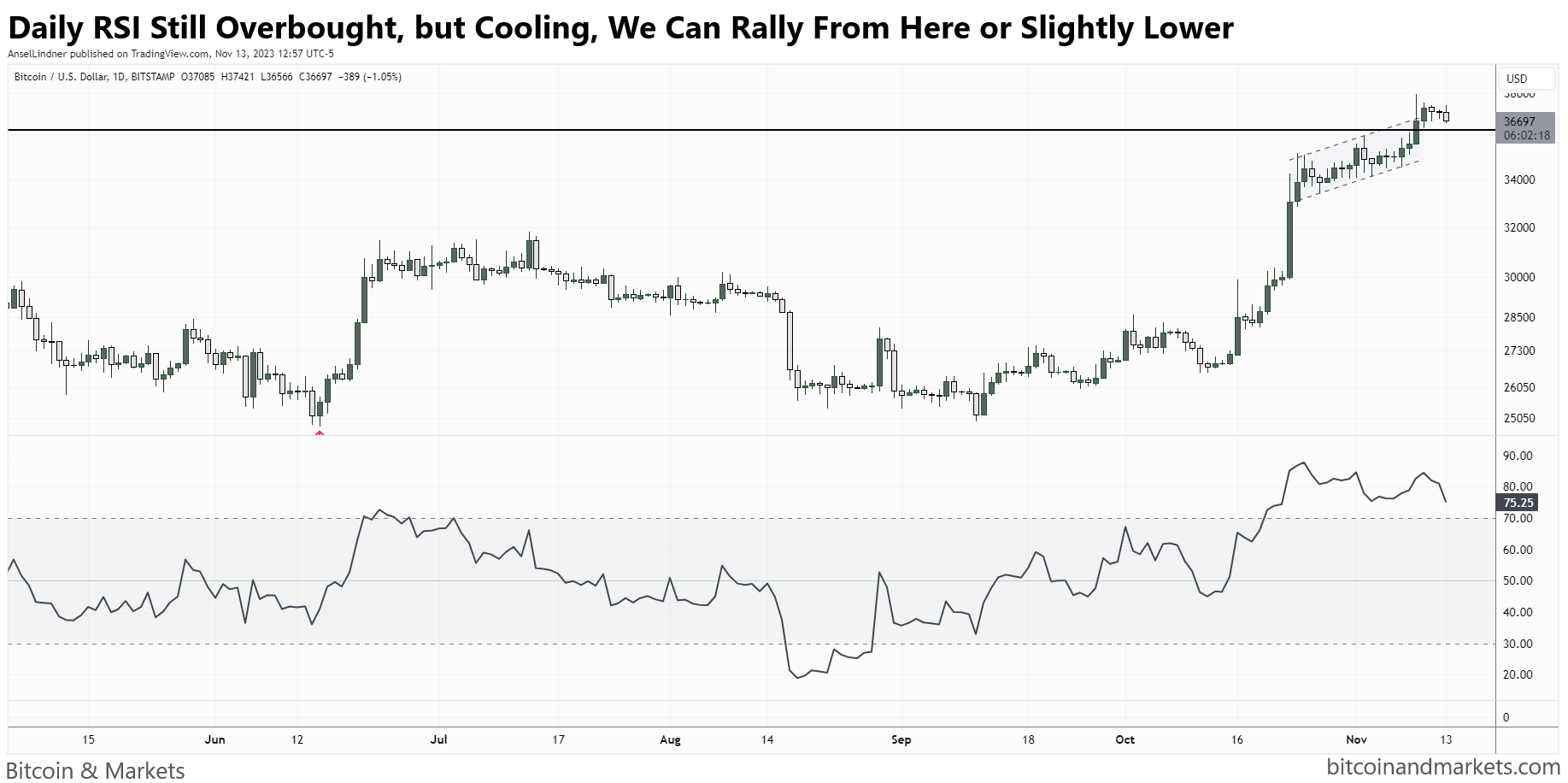

The overheated nature of this move tells us the bull momentum is real, but that a temporary cool off is still likely. Technically overbought, the risk of a downward consolidation is possible, but bitcoin did continue the rally from a very similar level back in January.

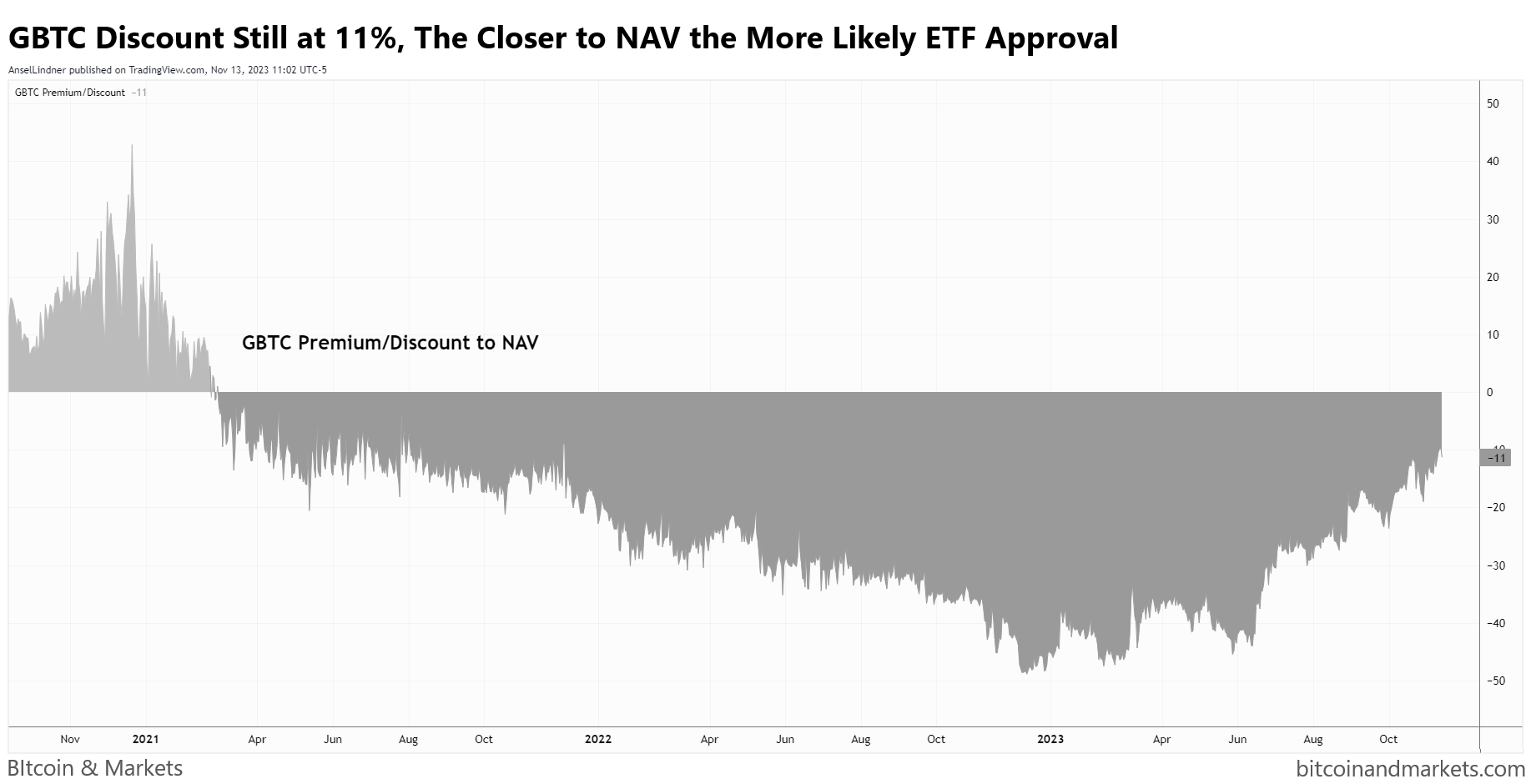

The GBTC discount continues to weaken, down to 11% at the time of writing. This is a barometer for ETF approval likelihood IMO. Does this look like it will be neutral this week, to meet this temporary ETF window? I don't think it does, to be honest.

There is room for one more push higher this week, however, if there's another ETF delay this Friday, the price could continue sideways to down over the next few weeks. That would reset all indicators to be ready for the next big move.

On a weekly timeframe, we are all systems go. Any daily volatility has a long way to go to break the weekly bullish structure. That is why everything is leaning toward minor consolidation or another push higher. The eventual likelihood of spot ETF approval remains very high, and fundamentals are extremely bullish. The path for the price is clear with little downside risk ATM. Resetting indicators (consolidation) can happen through price or time. The the cooling that is coming will be not be via a crash, therefore IMO it will come through time.

Much more detailed price analysis, including short, medium and long term forecasts on Market Protons!

Bitcoin Mining

Headlines

This story has popped up again, this time on Zerohedge and syndicated widely. It is about Chinese miners locating bitcoin mining facilities new other sensitive locations like military bases. Of course, military bases are also located at communication hubs, being the backbone which the internet grew up on. So, there could be a very innocent explanation.

I think it is somewhere in the middle, but more toward the innocent side of things. China is crumbling, money and people are desperate to get out, but there are also some nefarious people who could spy on the side, while mining bitcoin.

The deeper significance is the international importance of bitcoin mining. It is breaking into mainstream discussions in many ways. It is no longer something to be dismissed, it is a real thing, here to stay with geopolitical importance.

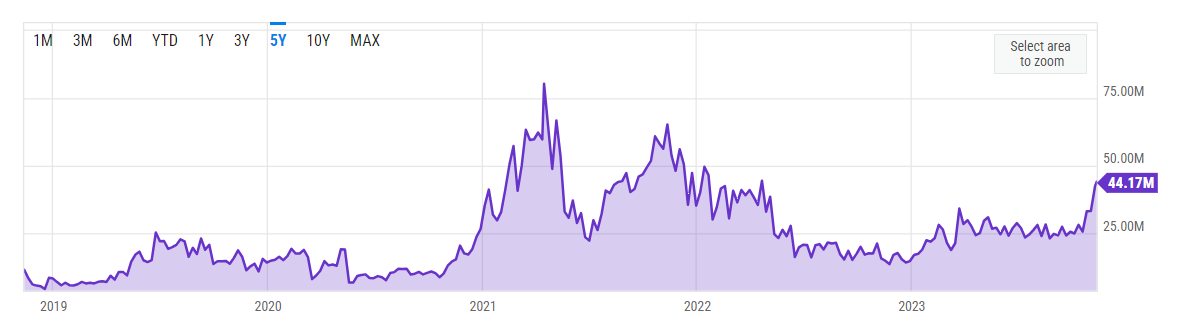

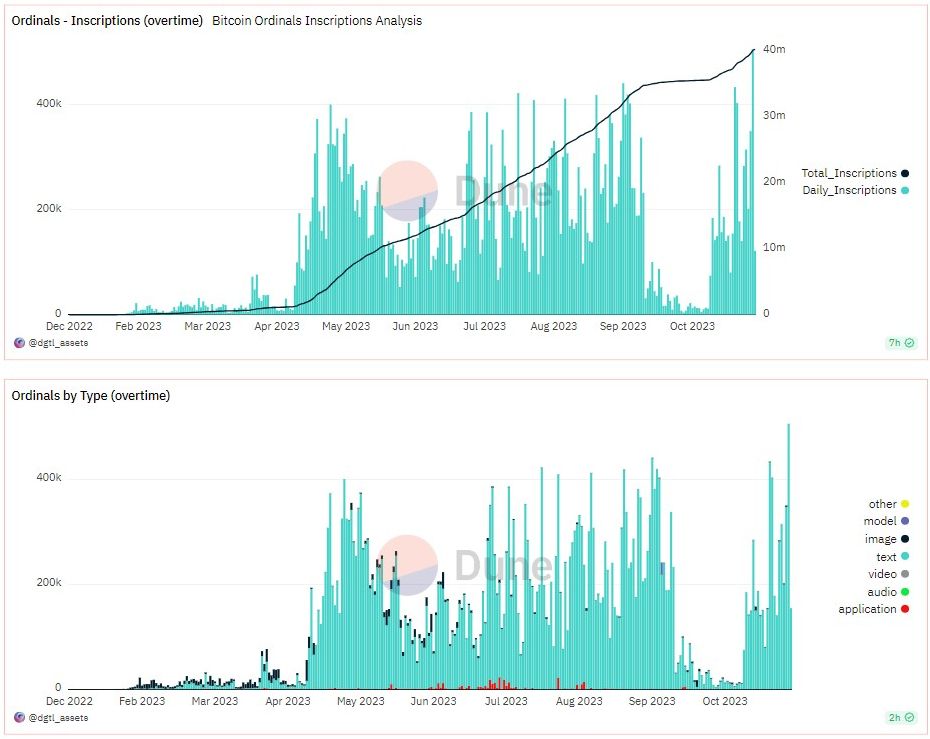

BTC mining revenue hit $42,386,514.038 on November 9, topping its previous yearly high of $41,744,197.067 set on May 8, 2023. For context: That's even higher than mining revenue was during the Ordinals craze in May.

It is now up to $44 million/day. This is huge, because it will allow miners to sell less of their bitcoin, at stack in anticipation of the halving. This is a very important dynamic NgU (Number go Up) feedback loop running into the halving.

Difficulty

Bitcoin's difficulty adjusted up yesterday by 3.5%. In the first 24 hours of the new difficulty period, the next adjustment is estimated to be around -3% in 13 days. Lots can change in that time, and I expect it to be a positive adjust if price can remain stable to go up.

Mempool

The mempool has continued higher this week to a yearly high. The return of Ordinals has boosted the fees and traffic. Fees are elevated but still quite cheap, except for the large Ordinal transactions. Apparently, some large JPEG transactions are costing the issuer $2000 in fees.

Ordinals Update

Ordinals traffic has shot right back up to a new daily high yesterday. Most of them are "text" only, with very few being JPEGs. This is definitely the culprit behind the mempool and fee increases. Of course, Ordinals have not become popular or more valuable, so this surge will likely play itself out soon.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space