Bitcoin Fundamentals Report #269

Recap of the last week, ETF news, macro, price action, why the dip, mining news, ethereum being censored, liquid sidechain action.

December 11, 2023 | Block 820,748

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Stalled, correction |

| Media sentiment | Neutral |

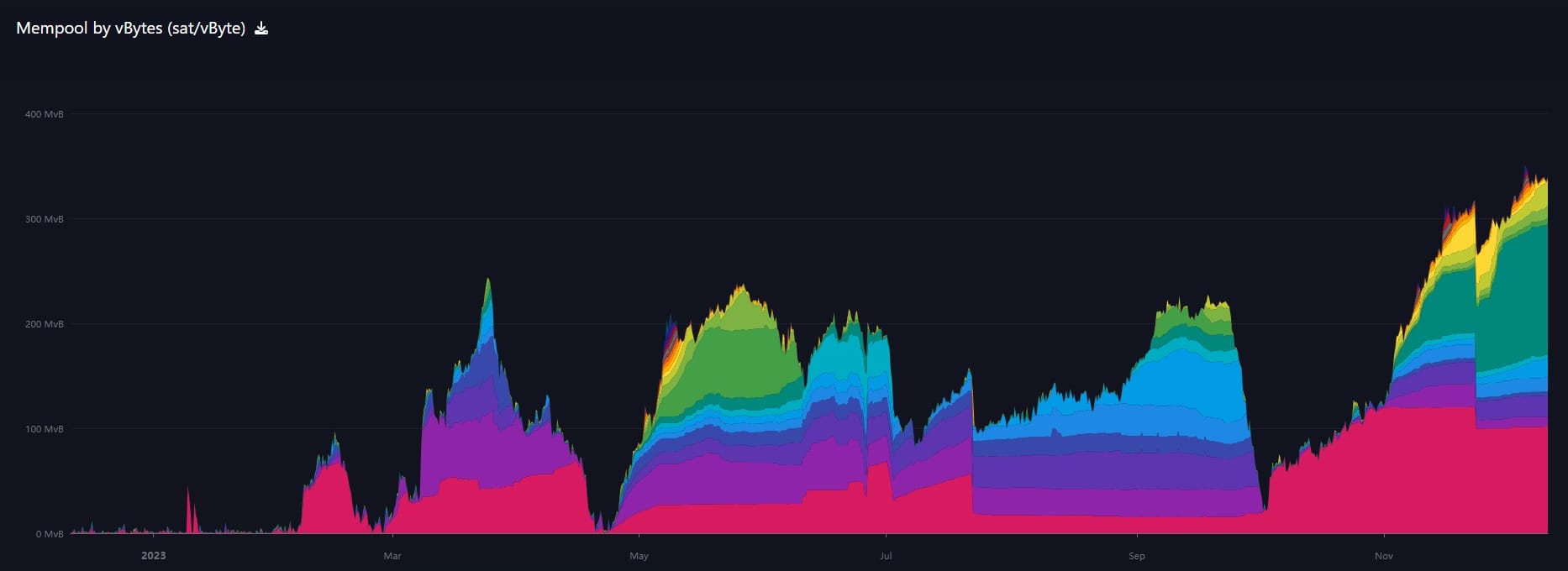

| Network traffic | Very High |

| Mining industry | Growing rapidly |

| Days until Halving | 128 |

| Price Section | |

| Weekly price* | $41,195 (-$769, -1.8%) |

| Market cap | $0.802 trillion |

| Satoshis/$1 USD | 2,439 |

| 1 finney (1/10,000 btc) | $4.10 |

| Mining Sector | |

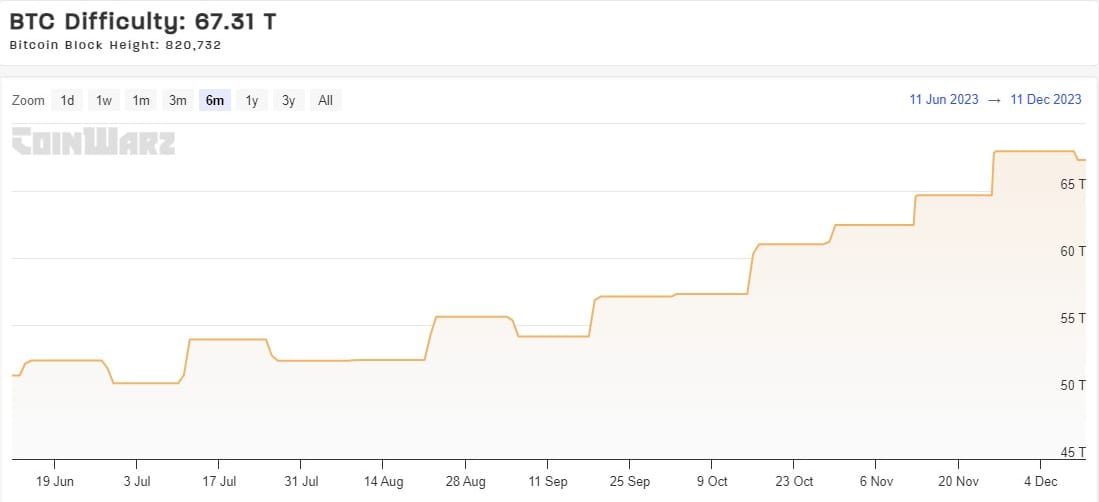

| Previous difficulty adjustment | -0.9592% |

| Next estimated adjustment | -0.25% in ~12 days |

| Mempool | 348 MB |

| Fees for next block (sats/byte) | $4.76 (83 s/vb) |

| Low Priority fee | $4.76 |

| Lightning Network** | |

| Capacity | 5079.55 btc (-0.2%, -10) |

| Channels | 59,720 (-0.6%, -361) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

Headlines

- ETF News continues to march forward

This week we got news that applicants continue to meet steadily with the SEC working through many minor paperwork issues. SEC is reportedly working late to get these things buttoned up as tight as possible. In-kind vs cash creates is still a sticking point, but not one that will hold up launching. Blackrock and others will have either or options. While they prefer in-kind creates, they will likely settle for cash creates at least for the time being.

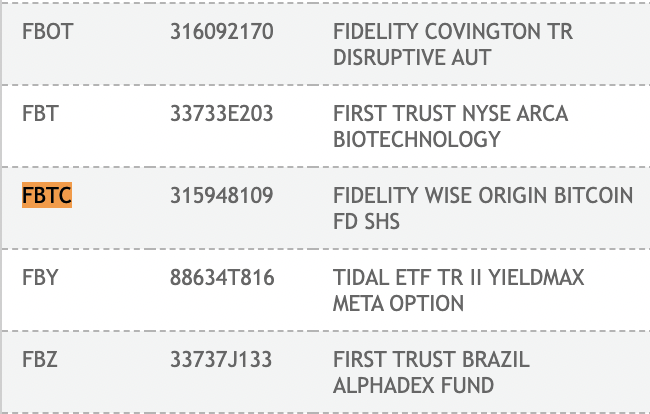

Tickers are being assigned by the DTCC, the back-end of stock market. Blackrock is IBTC to go along with their I-shares brand, Fidelity is FBTC, and Vaneck has filed for HODL.

Probabilities remain high for approval, but I did walk through what the real battle is, several times on live streams now. The globalists represented by Senator Warren and the administration want to deny and regulate hard, then launch a CBDC. Wall Street capitalists represented by Blackrock and the Fed, want to push ahead with bitcoin against the globalist plans to march us into a Marxist death cult. Gensler as a person is part of the latter, but his role at the SEC is part of the former.

- Jamie Dimon and Elizabeth Warren Team Up To FUD Bitcoin

There was nothing new in their FUD. Senator Warren used the false claim that bitcoin is used to terrorist financing, and Jamie Dimon, CEO of JP Morgan, claimed it was only used for crime. We've heard those lines for years when bitcoin was much smaller and less entrenched. It didn't work then, it won't work now. There is no way Blackrock is going to be filing for an ETF and these goons will get some draconian regulation passed through Congress.

The best they can hope for is to get a globalist stooge as Fed Chairman and recalibrate the domestic banking rules against bitcoin. Wall Street (unofficially) picks the Chair for the President, who is then confirmed by the Senate. I think there is little chance Wall Street will give up that power. Short of that, they can try to bend the existing laws and statutes to include bitcoin is a nefarious way, but that is also a long shot IMO.

Elizabeth Warren is trying it right now, she just introduced another bill targeting self-custody yesterday. All timed to try and squeeze as ounce of attention for it.

Jamie Dimon walks into a bar.

— Swan.com (@Swan) December 6, 2023

He sees that the bar accepts Bitcoin so he says,

“Do you want to hear my opinion on Bitcoin?”

“Sure,” says the bartender.

“It’s worthless,” Jamie says.

“I know, but let’s hear it anyway.”#bitcoin

pic.twitter.com/RwAfcEtdW2

JUST IN: 🇺🇸 US Senator Elizabeth Warren claims North Korea is using #Bitcoin and crypto to fund "half" of its nuclear weapons program.

— Bitcoin Magazine (@BitcoinMagazine) December 7, 2023

pic.twitter.com/ZNSA3JKpHh

JUST IN: 🇺🇸 US Senator Elizabeth Warren introduces bill to crack down on crypto. pic.twitter.com/T5J1i8B86G

— Watcher.Guru (@WatcherGuru) December 11, 2023

Macro

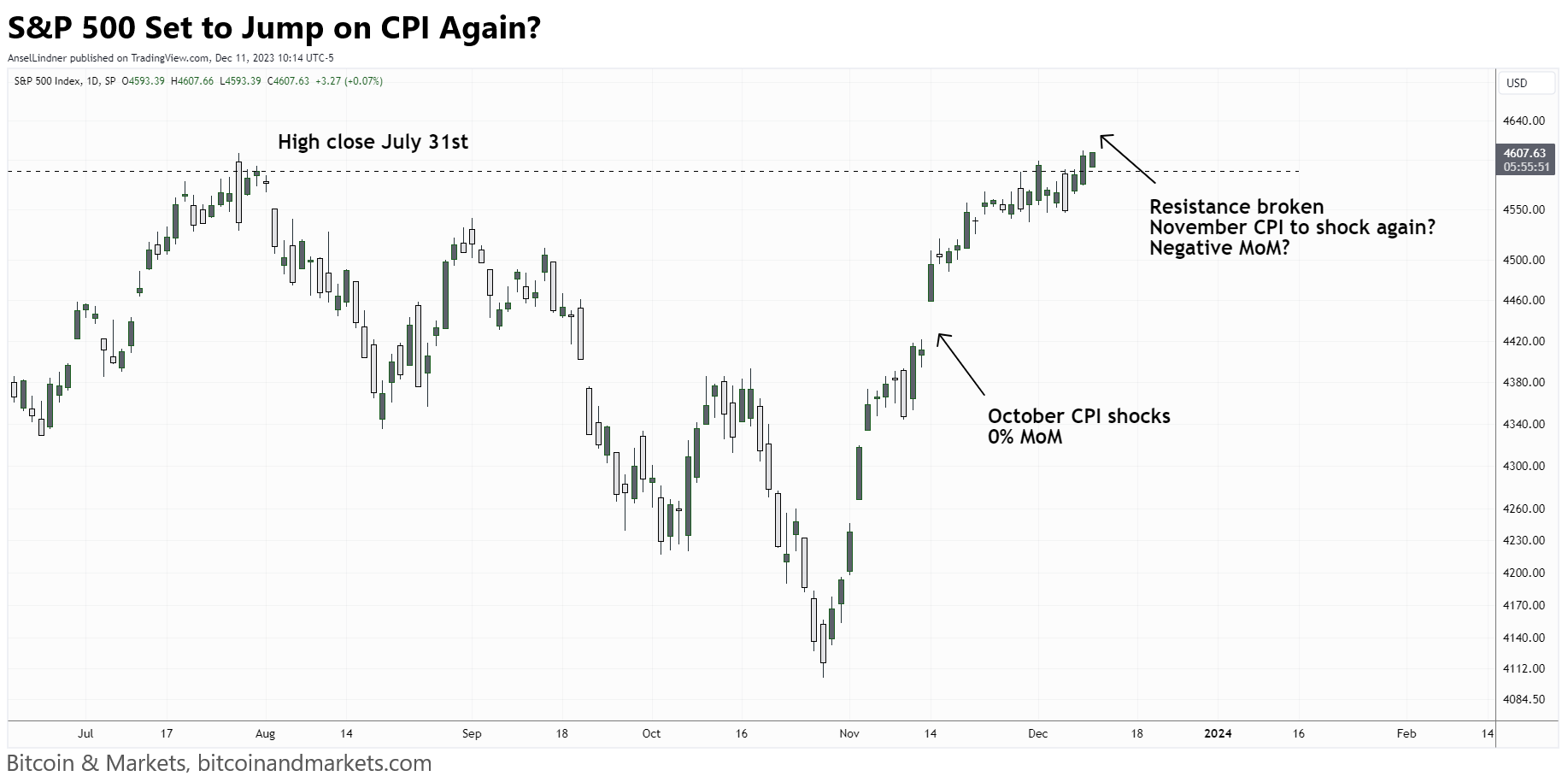

The release of October's CPI allowed markets to move in the underlying trend. This month is shaping up to be another interesting release.

The Red Sea is heating up. Houthi's claim they will stop all ships going to Israel.

BREAKING:

— Visegrád 24 (@visegrad24) December 9, 2023

The screaming spokesman of the Houthi rebels in Yemen announces that from now on, they will attack all ships heading for or departing Israeli ports

The Bab Al-Mandeb straight near Yemen is only 30 km wide and is the only way to the Suez Canal pic.twitter.com/aJRFV5aU7N

Yemen’s Houthi movement said on Saturday they would target all ships heading to Israel, regardless of their nationality, and warned all international shipping companies against dealing with Israeli ports.

A French warship operating in the Red Sea has shot down two drones that were launched at it from the Yemen coast, the defence ministry said on Sunday.

This is a big escalation because most of the traffic going through the Red Sea to the Suez canal are headed to Europe. This shows that other countries are going start bearing more cost for securing global sea lanes. If they are increasing their involvement, they need the US less as policeman, allowing the US to continue withdrawing from that role. That is a big part of my geopolitical forecast over the next 10 years.

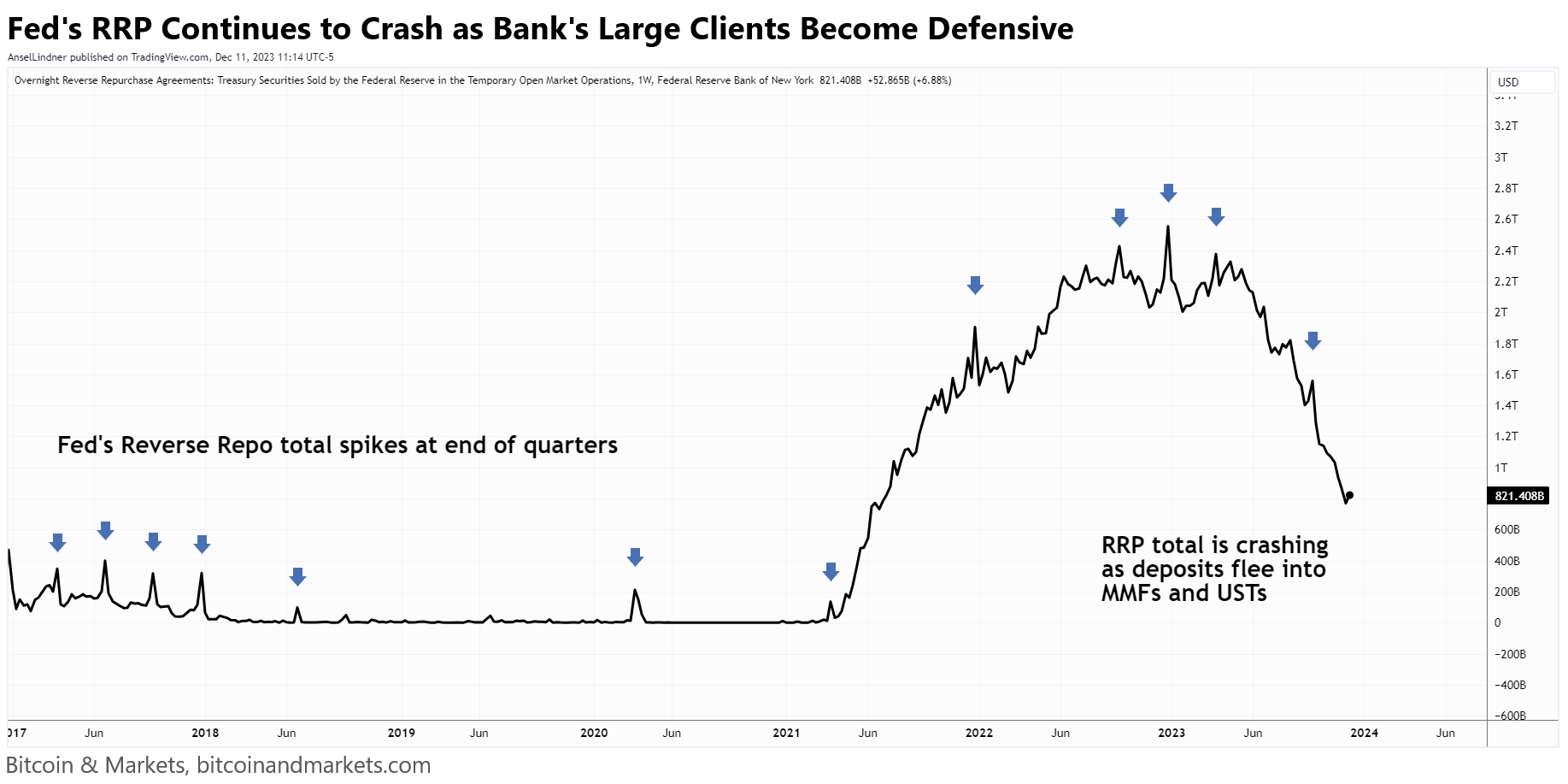

- Fed's RRP total is crashing

Most people don't understand what's going on here. What RRP represented was bank's deposits not being lent out into the economy but squirreled away into RRP. However, now those depositors, high net-worth individuals and pools of capital are getting defensive themselves. They want to use those deposits to buy Treasuries.

I read a take that once this runs out, there will be no one left to buy Treasuries, implying that yields will go back up to new highs. That is exactly the opposite. As these "excess" deposits disappear, it will put increasing pressure on banks' balance sheets, causing more and more money to flee to the safety of Treasuries. This level is not "available money" it should be viewed as market sentiment. As it drains the market is getting increasingly worried and paranoid about crisis. What happens then? Freezing up of bank plumbing and financial crisis.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

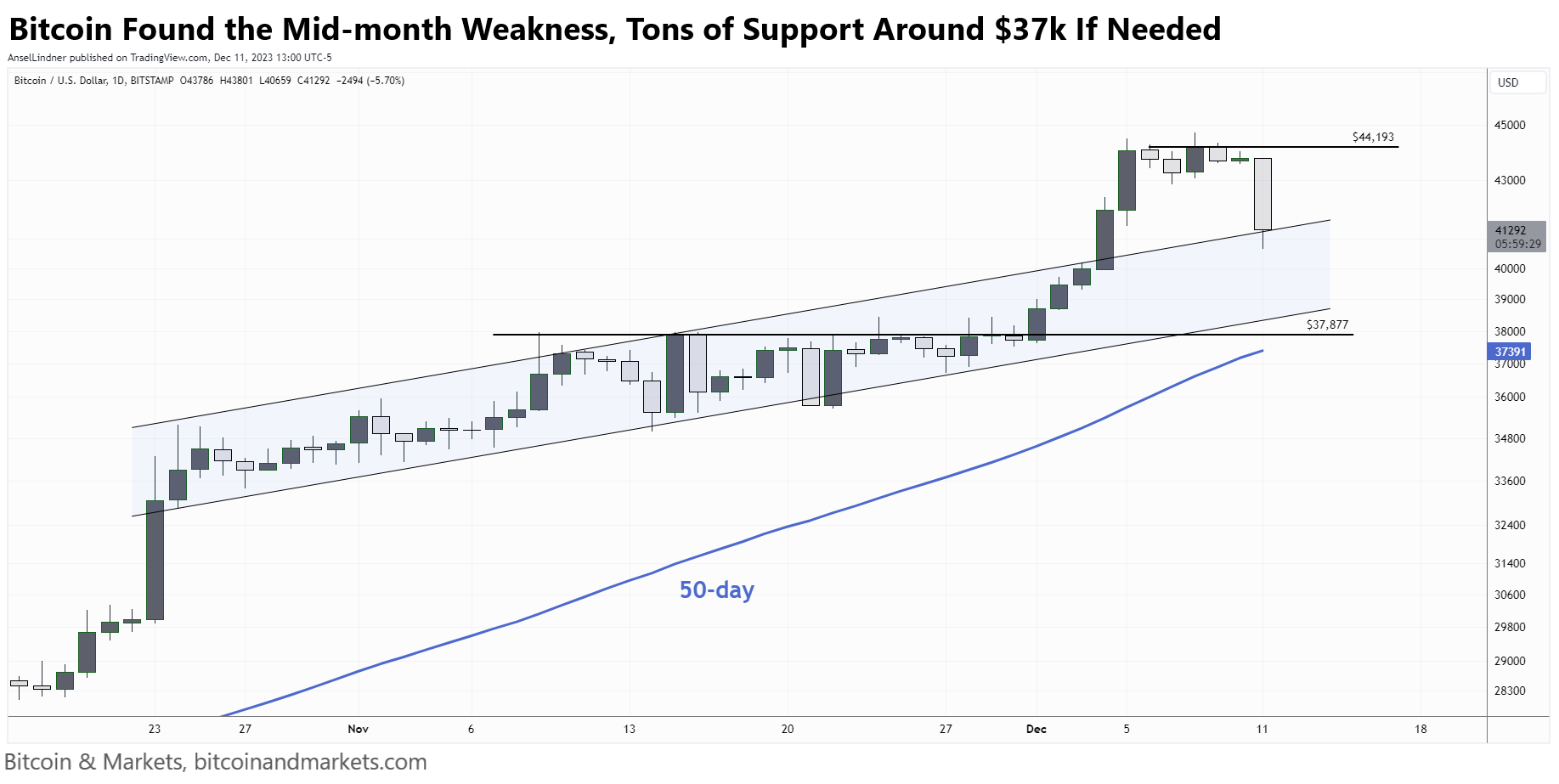

All that said, the probabilities favor price continuing higher over the next week and then softening around the middle of the month.

Price did continue slightly higher last week from the $41,200 at time of writing last week. It hovered around $44,000 for much of the week, selling off 5% this morning, right back to $41,200.

I'm a bit surprised that price didn't stretch for $48k before the mid-month weakness, but that could result in a sooner bounce, perhaps even by the end of the week.

Price is now being supported a little by the top of the channel and the round number of $40k. Below that is the prior resistance at $37,800 and the rapidly rising 50-day moving average. I did make my prediction for the mid-month weakness on last Friday's Proton for Professional tier members.

I am expecting some volatility around the CPI release tomorrow. Last month, stocks jumped but bitcoin didn't react too much. If the same thing happens this month, it will add support to bitcoin wherever it happens to be at 830 am ET tomorrow.

Forecasters must take into account two big events making it hard to predict price right now, the ETF approval window of January 8-10 and the Halving on approximately April 17. This current dip is tiny in the grand scheme of those two events. What I'm focused on is watching the price react to support over the next few days while in this mild correction.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

We are starting to see some halving FUD.

Darwinism could soon pummel some bitcoin (BTC) miners as the halving, a once-every-four-year event that cuts the reward for creating new BTC gets cut by 50%, unleashes a "survival of the fittest" battle in April.

The fact is, there are many more miners today after several halvings than in the past. The halving will hurt some miners, but very minimally. Price will increase offsetting the reduction in reward.

The article does go into that aspect, but glosses over the real Darwinian period is the depth of the bear market. Prior to each halving the price more than doubles off the bottom.

Lastly, the article talks about cash heavy bitcoin miners right now. They are sitting on hundreds of millions of dollars, looking to acquire struggling miners around the halving. If I'm correct and the price will more than compensate for the lower reward, the cash miners are sitting on can be used to hold more of what they mine, kicking the deflationary feedback loop into effect even more.

This isn't a bitcoin mining story, but it does highlight the differences between Proof-of-work mining and Proof-of-stake centralization.

A turning point came last year when the U.S. government sanctioned Tornado Cash – a "privacy mixing" program on Ethereum that helped people transact without leaving a trace. The Treasury Department's Office of Foreign Assets Control (OFAC) said the program was used by terrorists and other U.S.-sanctioned entities, so it added Tornado's Ethereum-based computer code to the same blacklist as Iran, North Korea and Hamas. In response, some blockchain advocates were defiant; they balked at OFAC's attempt at "censorship" and gloated that Ethereum would be immune to it as a result of its decentralized construction.

It hasn't really worked out that way. About 72% of data blocks posted to MEV-Boost, middleware that powers almost all of the validators that write blocks to Ethereum, are now considered "censored," up from about 25% in November 2022, based on research from Toni Wahrstätter, a researcher at the Ethereum Foundation. - emphasis added

This can't happen with bitcoin because it stems from the complicated structure of Ethereum. Validators (block producers in PoS) learned to front-run the trades on defi and other attached activity to Ethereum through Maximum Extractable Value (MEV) block construction. 90% of validators on Ethereum outsource their block production to MEV builders. MEV insights were then shared with everyone via flashbots, and data transmission became very centralized to MEV players, creating a very centralized chokepoint for regulators to force censorship.

Difficulty

Very slight decrease in difficulty this week. After 6 upward adjustments, some quite large, this was a minor decline. There is not much to information to draw from this other than perhaps some evidence that the price rally is losing a little momentum.

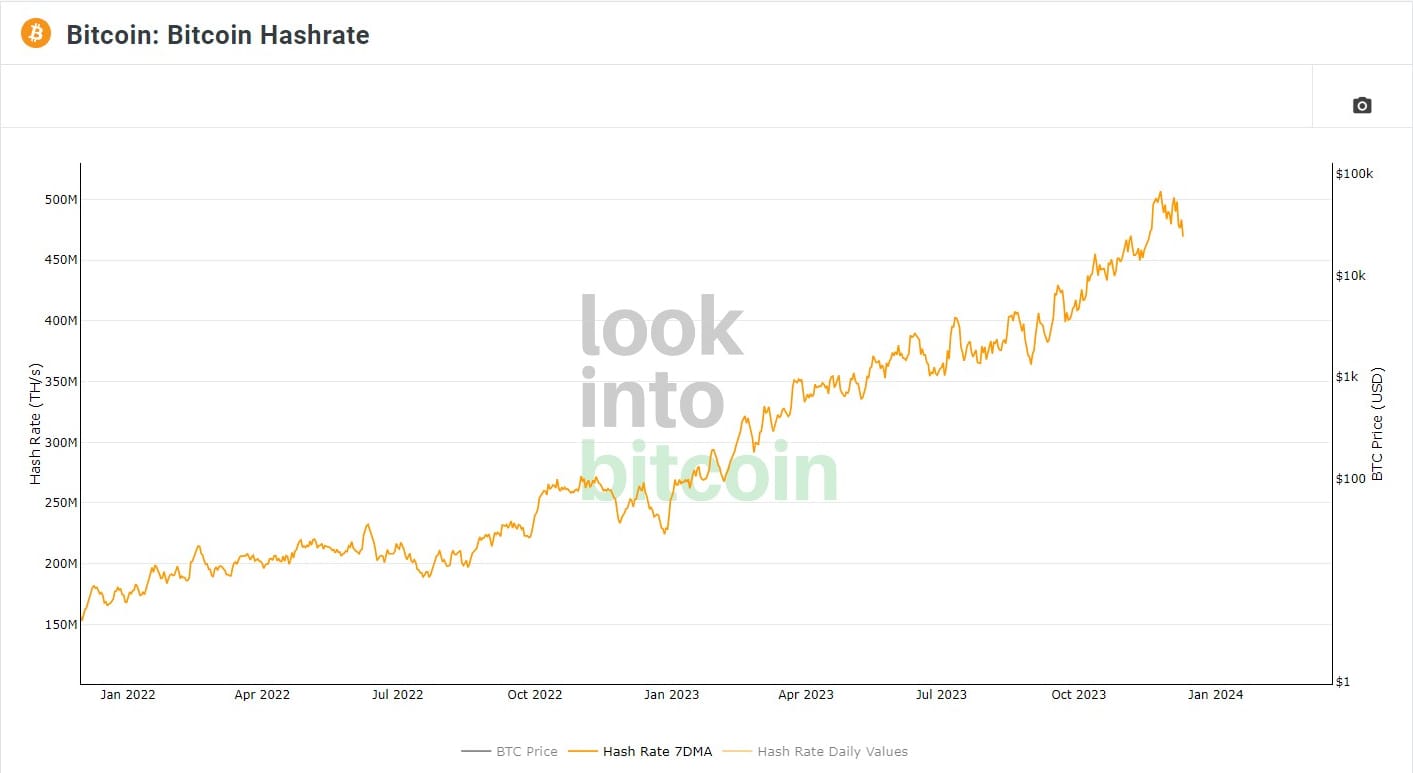

Hash Rate

Bitcoin hash rate peaked at or around November 25th. Since then it has been only slightly lower in a typical heartbeat pattern.

Mempool

Mempool rose again this week to another high. However, the network is able to confirm most of high fee transactions. Fees did rise slightly, but not by much considering the state of the mempool. With price cooling down here a little, the mempool might also

Layer Two

- Could Ordinals and Inscription trading be a use case for Liquid?

Liquid has found it difficult to attract transaction activity, usually only averaging about 1 transaction other than coinbase transactions every few minutes. However, just recently, it seems some people are starting to try it out as a way to trade ordinals.

Ordinals saved Liquid.

— ₿ Isaiah⚡️ (@BitcoinIsaiah) December 11, 2023

This is the most activity I’ve seen in 5 years and it’s likely just beginning. pic.twitter.com/c1rsSciaUG

I'm not super clear on how this would work, but I am assuming the sats associated with the Ordinal will be pegged into the Liquid sidechain and the Liquid BTC version of the sat will trade. It is an interesting concept, and we will have to watch how this develops.

Long term, I think Elements side chains, which Liquid is the premier example, will likely be quite popular. The future might be a web of interconnected sidechains and lightning network all based on Bitcoin.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space