Bitcoin Fundamentals Report #284

Tectonic plate movements in bitcoin, major macro pivots, bitcoin price analysis and mining industry news.

April 8, 2024 | Block 838,343

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Pre-halving |

| Media sentiment | Neutral |

| Network traffic | Slightly elevated |

| Mining industry | Growing |

| Days until Halving | 11 |

| Price Section | |

| Weekly price* | $71,903 (+$2,484, +3.6%) |

| Market cap | $1.416 trillion |

| Satoshis/$1 USD | 1390 |

| 1 finney (1/10,000 btc) | $7.19 |

| Mining Sector | |

| Previous difficulty adjustment | -0.9779% |

| Next estimated adjustment | +3.9% in ~2 days |

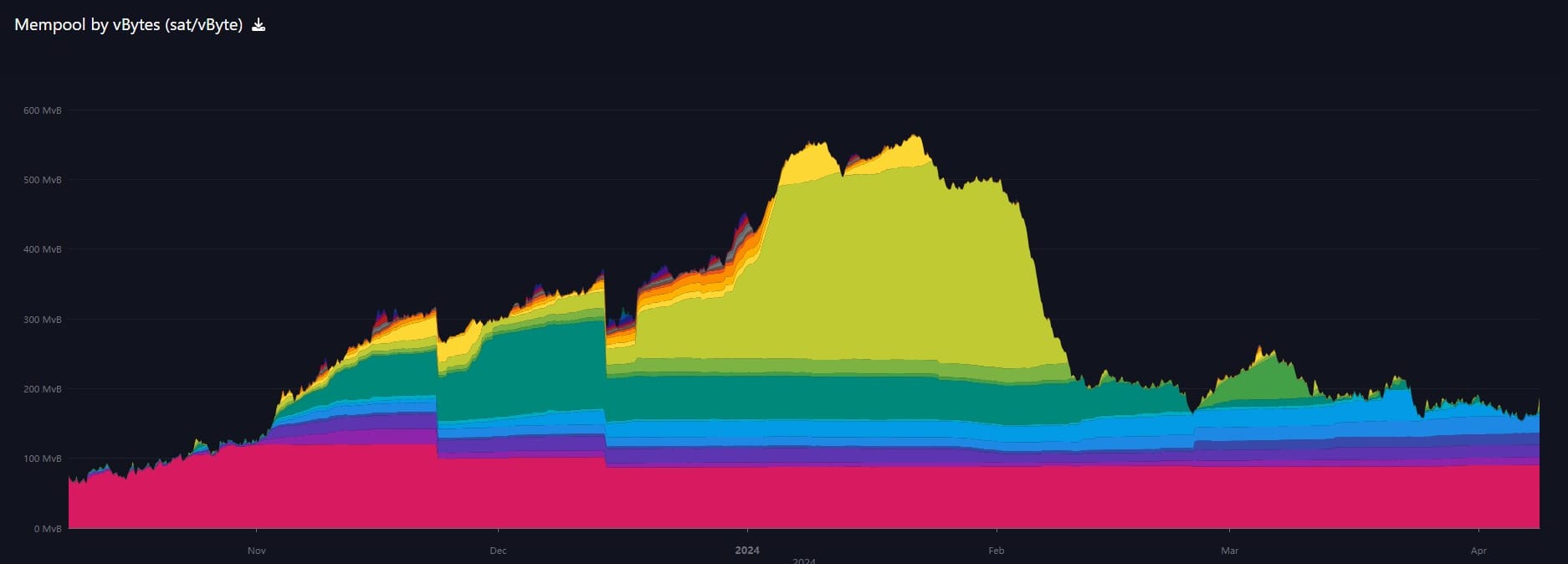

| Mempool | 189 MB |

| Fees for next block (sats/byte) | $4.23 (42 s/vb) |

| Low Priority fee | $3.73 |

| Lightning Network** | |

| Capacity | 4547.94 btc (-0.8%, -39) |

| Channels | 52,428 (-0.8%, -440) |

In Case You Missed It...

Bitcoin Magazine Pro

- Government Sales Meet Insatiable Demand for Bitcoin

- Market Tracker breakdown: Bitcoin's Tipping Point: Gauging Market Direction with STH Behavior and Macro Forces

- Mining Tracker breakdown: How is the Bitcoin Network Preparing for the Halving?

Member

- Gold and Yields Tell Us Everything About the Upcoming Recession

- What to expect heading into the halving?

- 💢 April Price Forecast Competition

Community streams and Podcast

Blog

Headlines

Morgan Stanley is reportedly vying to outpace UBS to become the first wirehouse to offer spot Bitcoin exchange-traded funds (ETFs) in the US. Andrew, @AP_Abacus on X, citing internal Morgan Stanley notes, suggested that the bank might soon announce its entry into Bitcoin ETFs. This development is part of a broader "race" among global banks to incorporate Bitcoin ETFs into their offerings.

UPDATE: several notes from @MorganStanley execs this AM; salty about @UBS post yesterday. They want to be the first wirehouse to fully approve the #Bitcoin ETF's.

— Andrew (@AP_Abacus) April 3, 2024

- @MorganStanley may announce a few days before @UBS.

- interesting that global banks are talking about $BTC ETF's…

The success of Bitcoin spot ETFs has led to a notable shortage in Bitcoin supply, prompting prominent Wall Street banks to directly approach Bitcoin miners for purchases. Hut 8 Mining Corp, a leading Bitcoin mining company in the US, revealed in an interview that it has been approached by major banks seeking to buy Bitcoin to mitigate the shortages experienced on centralized exchanges.

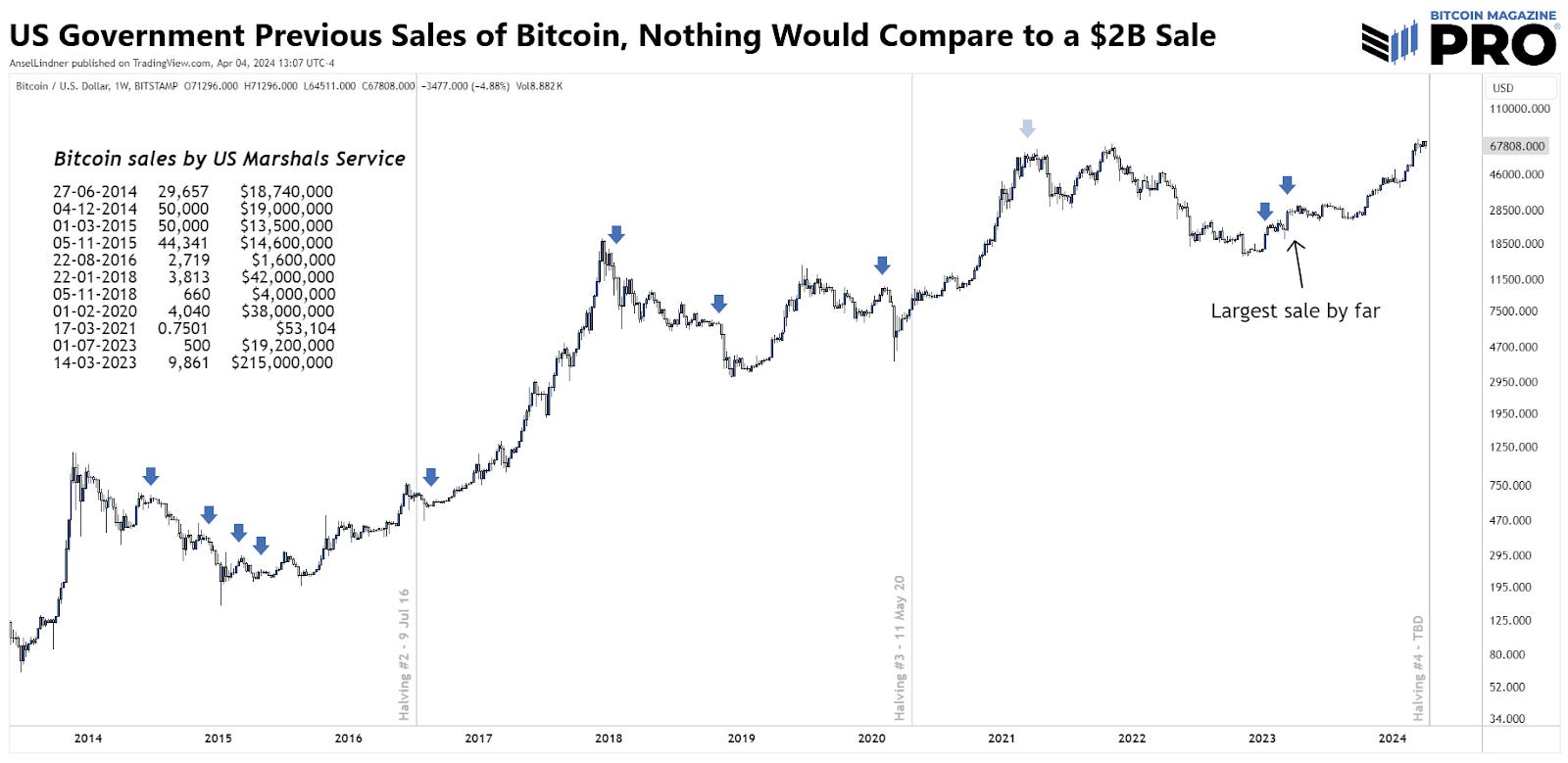

- US Government Set to Liquidate $2 Billion in Bitcoin Seized from Silk Road

The U.S. government appears poised to sell a significant amount of Bitcoin, approximately 30,174 BTC, which it had previously seized from the Silk Road online marketplace.

A test transaction of 0.001 BTC was observed moving to Coinbase, hinting at imminent liquidation, similar to a previous incident where the government sold about 9,861 BTC. This pattern of preliminary on-chain transactions aligns with past practices observed before official sales disclosures.

- Solana "glitch" still on-going

I discussed this article on the live stream Friday, 75% of Solana Transactions Are Failing as Bots Dominate Swap Count.

We then got some another update from the Solana team themselves:

In an X post, Solana co-founder Anatoly Yakovenko stated that dealing with bugs was more complex than keeping a network active and operational for users.

“Dealing with congestion bugs sucks so much more than total liveness failure. The latter is one and done, bug is identified and patched and chain continues,” the post read. “The former has to go through the full release and test pipeline. Shipping fast is impossible.”

Yakovenko’s announcement follows co-founder Raj Gokal’s post on X earlier this month, which addressed the overall concerns of the Solana chain and the deployment of world-class personnel to tackle the issues.

On Friday, I made a big point about the 400-800 millisecond block times, which is just insane to anyone who understands this technology. That is the obvious red flag Solana is completely centralized and a scam.

According to data from blockchain expert Dagnum-PI, Solana is currently congested with an average ping time (APT) of 20-40 seconds, signaling delays in node communication.

According to data from CryptoManiaks, Solana has witnessed nine blockchain network outages since 2021, with over 150 hours of downtime.

And that is for memecoins, jokes, spam, and outright fraud. Imagine if there were actual systemically important transactions on Solana. What a disaster.

Macro

The Swiss National Bank cut its main interest rate by 25 basis points to 1.50% on Thursday, a surprise move which made it the first major central bank to dial back tighter monetary policy aimed at tackling inflation.

"SNB is the first central bank to declare victory over inflation," said Karsten Junius, chief economist at J.Safra Sarasin, who had expected a rate cut.

The step follows a drop in Swiss inflation to 1.2% in February, the ninth month in succession that price rises have been within the SNB's 0-2% target range.

"The easing of monetary policy has been made possible because the fight against inflation over the past two and a half years has been effective," Jordan told reporters, noting how Swiss inflation has held below 2% for several months.

The European Central Bank is expected to make its first reduction in borrowing costs in June after it kept its interest rates on hold earlier this month.

The U.S. Federal Reserve on Wednesday left its benchmark interest rate unchanged but retained its outlook for three cuts this year.

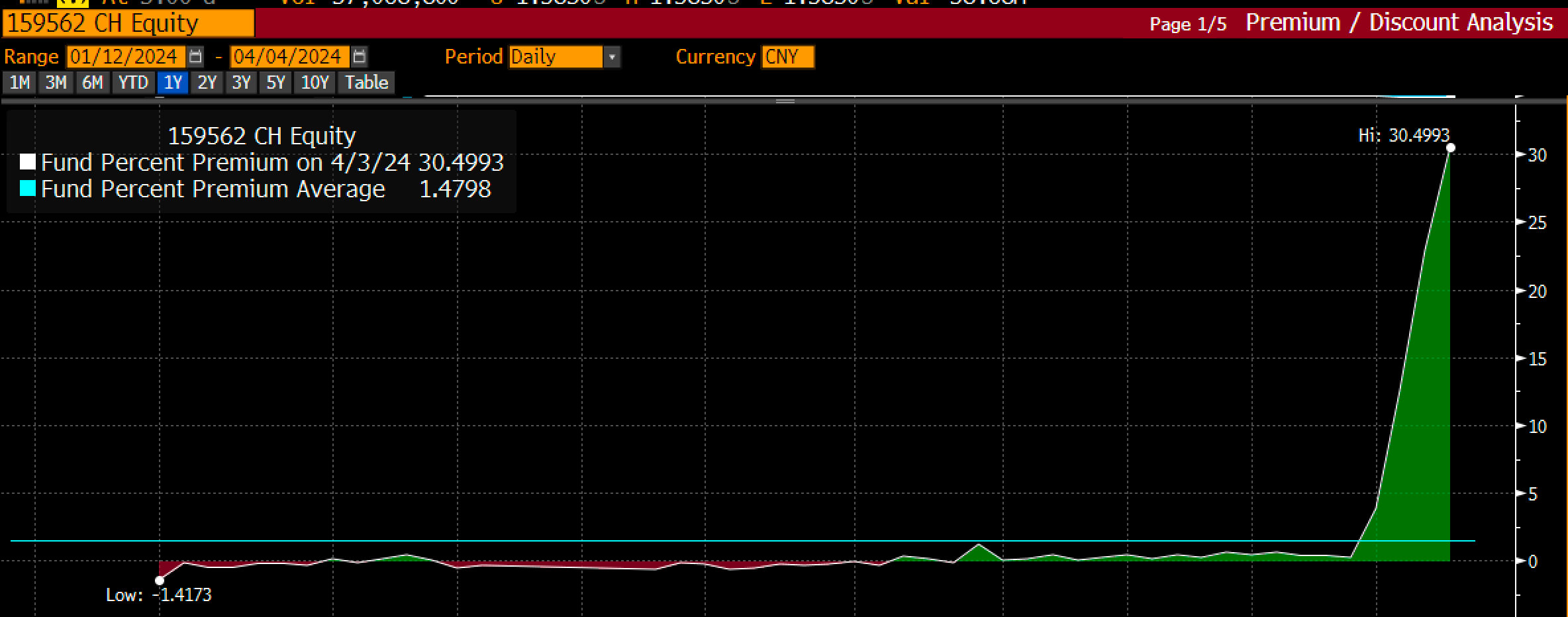

Trading for the ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF was halted until 10:30 a.m Monday local time, in order to protect investors’ interests, China Asset Management Co. said in a statement Monday. It was the second trading suspension for the product since last Tuesday.

The decision came after the fund’s premium over its underlying assets increased to more than 30% as of April 3, the highest on record, Bloomberg-compiled data shows. The ETF’s price had gained over 40% in the past four sessions before falling 10% after trading resumed Monday.

They don't have access to a Bitcoin ETF yet. There are futures ETFs in HK, and spot ETFs in HK just around the corner, but mainland Chinese nationals can only send $50,000/year to HK for investment.

This follows the mania from a couple months ago, where S&P products on the Chinese stock markets were trading at a similar premium. The Chinese are desperate to get their money out of China. That doesn't happen to a truly booming economy.

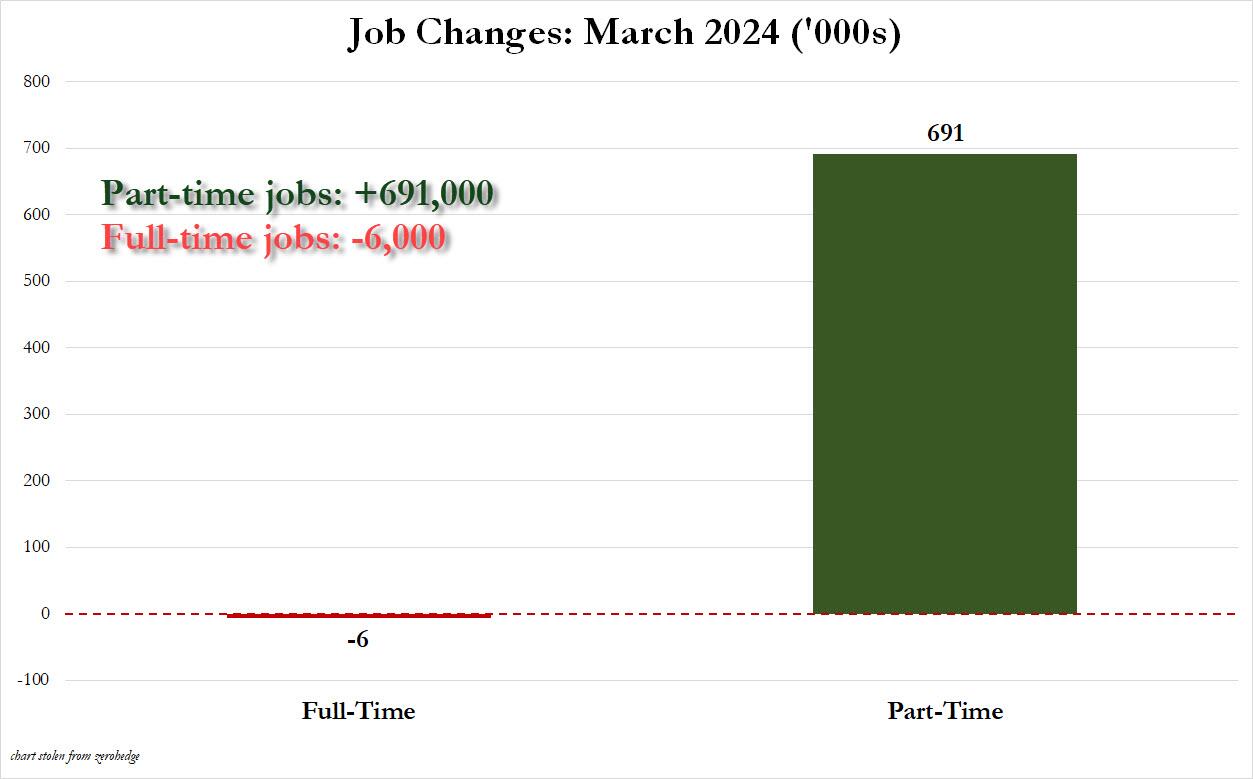

All jobs added for March were part-time jobs. You don't get a second or third job if the economy is doing great, and you are secure in the main job.

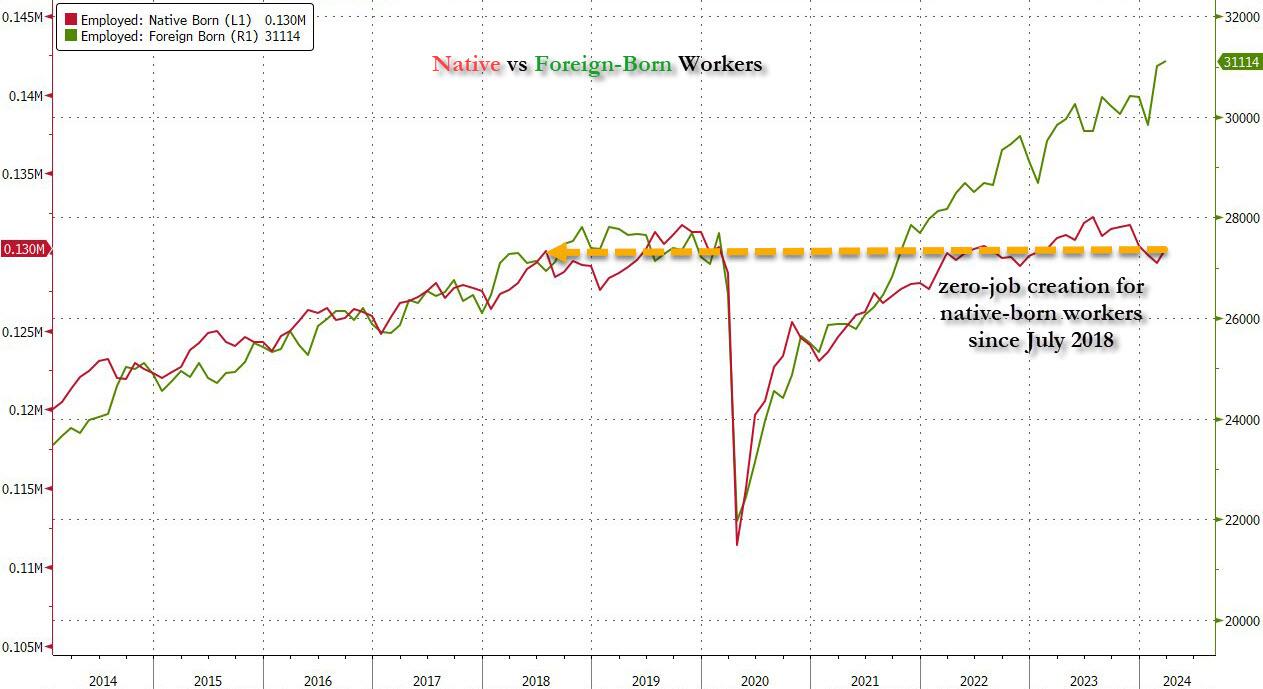

Not only that, but native born works have had zero job gains since 2018, while foreigners are booming with job creation.

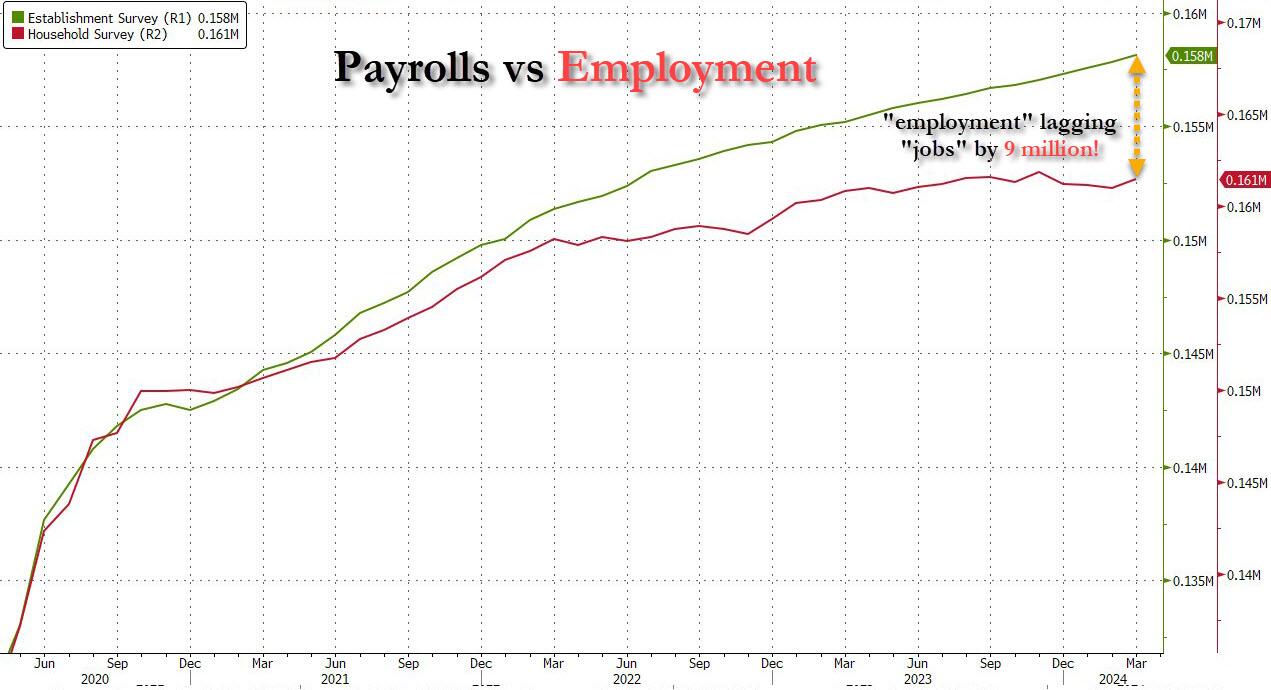

And the big one IMO is simply the difference between two of the government's own jobs reports. There is still a 9 million gap in employed people and payrolls. Meaning, many people have multiple jobs and there is no way currently in the methodology to deal with that.

Bottom line: things are much worse in the US economy than the jobs number state. People are holding on for dear life here. The turn into recession is pretty scary. Time to buy bitcoin.

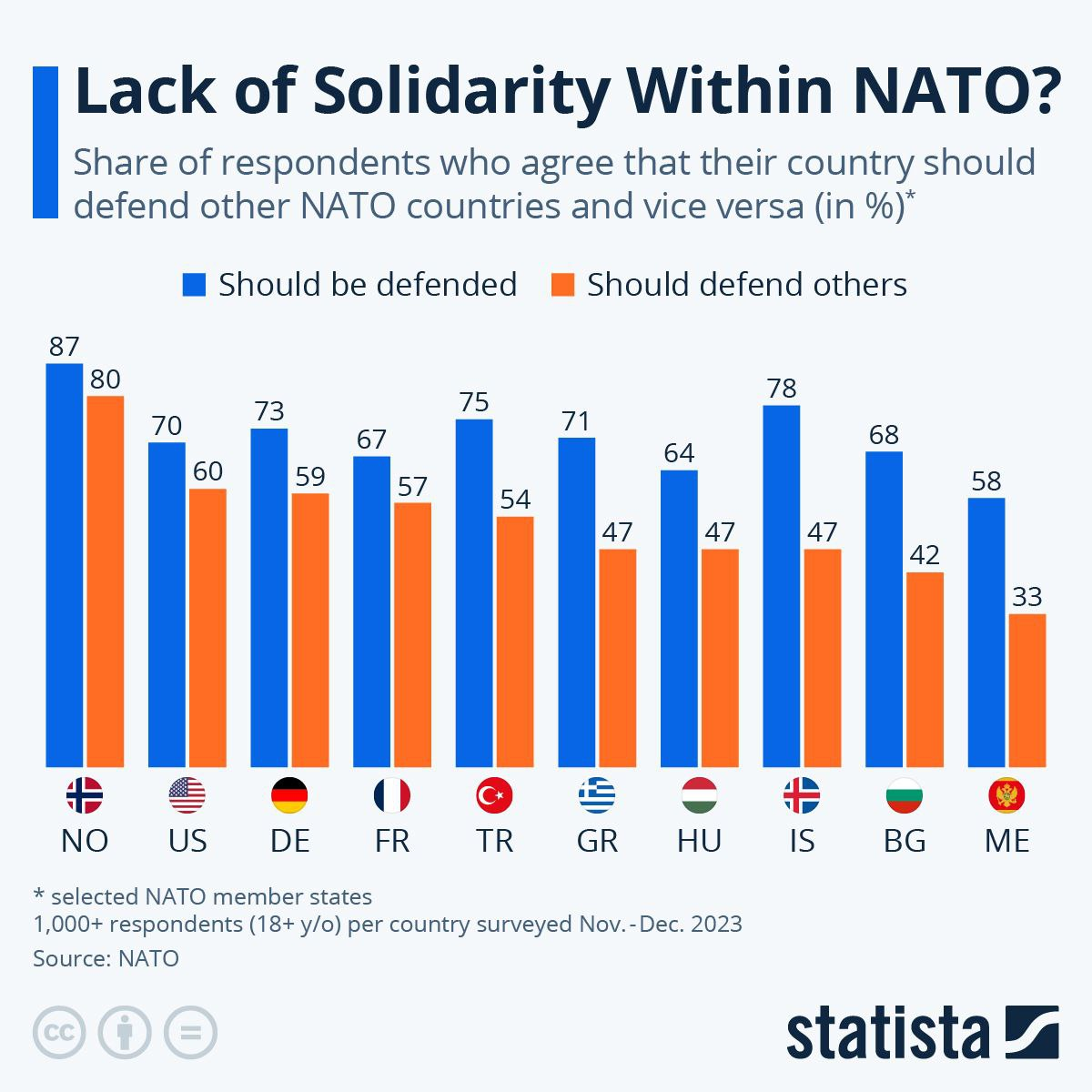

- Lack of solidarity is spreading

I've been saying it for a long time that NATO is a dead man walking. Global trust is breaking down, and our interests do not align anymore. Here is just another example, a poll showing that even in the core NATO members, nearly 40% of the population doesn't want to get involved to protect treaty members. Add to this, losing in Ukraine and you have something that could simply disintegrate. If I were countries like Turkey, Hungry and Poland, I'd be planning for what comes after NATO.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

This consolidation has been expected and predicted. Here are the main takeaways from my price forecasting over the last three weeks.

Three weeks ago:

Most likely we continue a consolidation for at least the next week, and it could stretch into the halving.

Two weeks ago:

A 44% move over 3 weeks until the halving is possible, though I still think unlikely. [...] It would be healthy to revisit those lows again before continuing higher, but it is so hard to move down against the ETFs.

Last week:

I've been talking about cooling off and consolidation for, pretty much, the whole month of March. Despite going sideways, there is not a lot of progress on cooling off the weekly. This leads me to believe that we will not have a significant pre-halving pump. But it also means we won't have a significant post-halving dump either. In fact, this could a huge catalyst for a great post-halving pump.

For many reasons detailed on today's Proton, I think price is setting up for a big move, just not quite yet. The halving a significant event and while it is possible to pump into next week's halving, I think it is highly unlikely. Gold is rallying off a safe haven bid, which will roll over to bitcoin, but technical analysis and behavior of the bitcoin price under similar circumstances leads me to believe we will be continue sideways through the halving.

Risk to Short-Term Holders is declining - STH Realized Price is $58,400, while the 50-day is $65,000, would need to fall 20% from current price and 10% from the 50-day to risk STH holders' weak hands. There is also no strong sign for a major bullish move from CME futures premium, MSTR or miner stocks. Not yet that is, they are all setting up for a big move, everything looks to be waiting for now, for the halving.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

There has been lots of hype about mining in the South American country of Paraguay, however, it seems their leaders have a different idea. This is part of the risk you take with geographic diversification.

A new bill in Paraguay is looking to temporarily rein in the country’s nascent crypto mining industry, citing the fact that crypto miners in the landlocked South American country are engaging in power theft and interrupting electricity in a country with abundant hydropower and renewable energy resources.

On April 4, a new bill was unveiled in the country to ban “crypto mining farms” for approximately six months. "The creation, preservation, storage, and commercialization of virtual assets or crypto-assets, cryptocurrencies, and the installation of crypto-mining farms in Paraguayan territory are temporarily prohibited,” a translated draft of the bill read.

If passed, the 180-day ban would effectively stop crypto miners from crippling the nation’s electricity grid. However, the bill promised to end the prohibition on crypto mining activities earlier if the country’s electric grid operator, the National Electricity Administration, ensured that miners operated “without affecting other users of Paraguay’s electrical system.”

Idiots. Estimates are that this ban will cost Paraguay $200M.

Bitcoin (BTC) miner Hut 8 (HUT) is a much more diversified company with multiple revenue streams following the completion of its merger with US Bitcoin Corp. (USBTC) at the end of last year, broker Canaccord Genuity said in a research report on Thursday.

“New Hut 8 has ~7 exahashes per second (EH/s) of self-mining capacity and revenue from self-mining accounts for ~68% of revenue today with the remaining coming from managed services, hosting and high-performance computing (HPC),” analysts led by Joseph Vafi wrote.

Hut 8 holds more than 9000 bitcoins on their balance sheet as well.

Bhutan’s investment arm and Bitdeer Technologies Group are planning to ramp up their Bitcoin mining operation to help offset the revenue impact of an upcoming event known as the halving.

The partnership between Druk Holding & Investments and Nasdaq-listed crypto mining firm Bitdeer aims to invest in boosting Bhutan’s mining capacity sixfold through the introduction of cutting-edge hardware.

The planned upgrades will increase the Himalayan kingdom’s mining capacity by 500 megawatts by the first half of 2025, Matt Linghui Kong, chief business officer at Bitdeer, said in an interview. That would bring Bhutan’s total capacity to 600 megawatts.

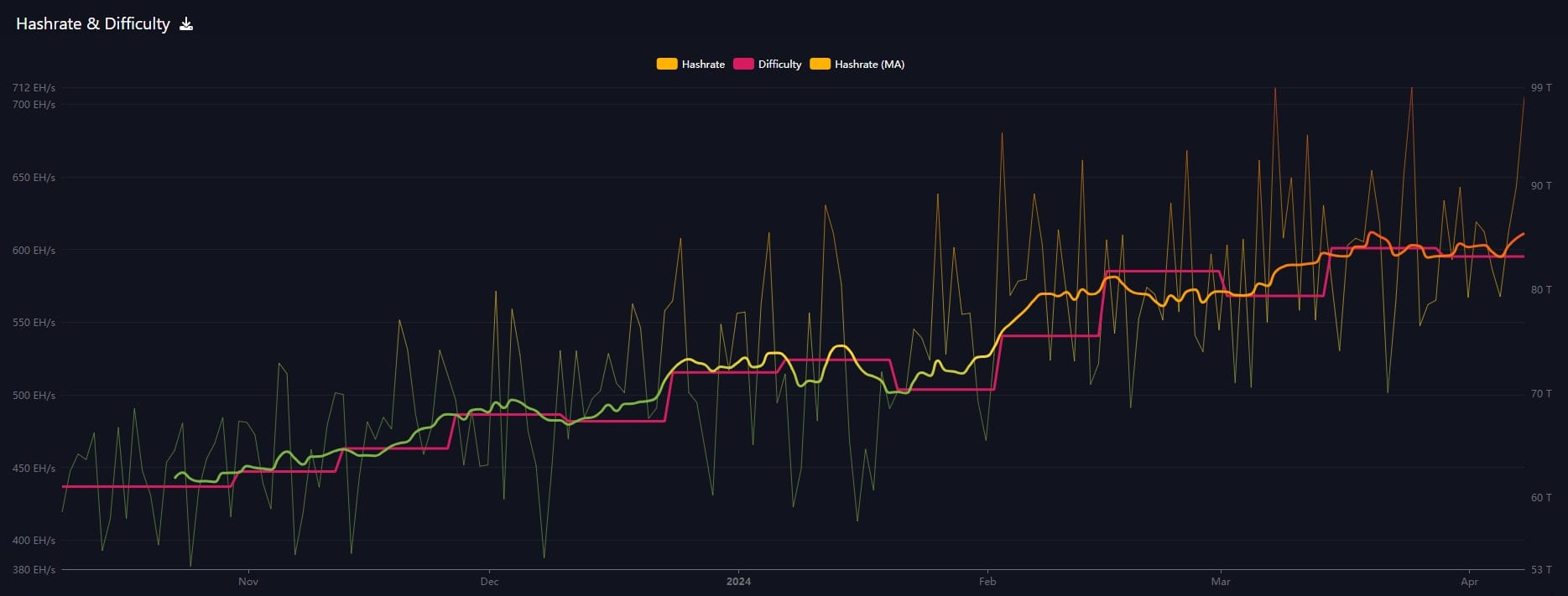

Hash rate and Difficulty

Hash rate has spiked over the last couple of days, pulling up the estimate for the next difficulty adjustment to almost 4% two days from now, from 1% last week. If hash rate continues higher like this for the next week, that is confirming evidence of less downside risk for price, and the growing likelihood of a price spike.

Mempool

The mempool was flat for most of the last week, but had a little spike today with the price bump. I use the mempool as an indicator of volatility. During periods of higher volatility, either up or down in price, the mempool should spike as urgent, fee-insensitive transactions are made. If this current price bump was going to be a big breakout, we would expect the mempool to anticipate it slightly and spike more than it has.

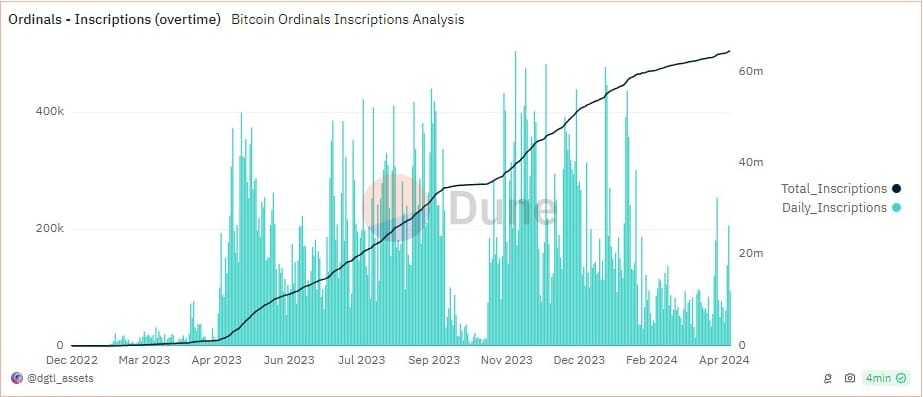

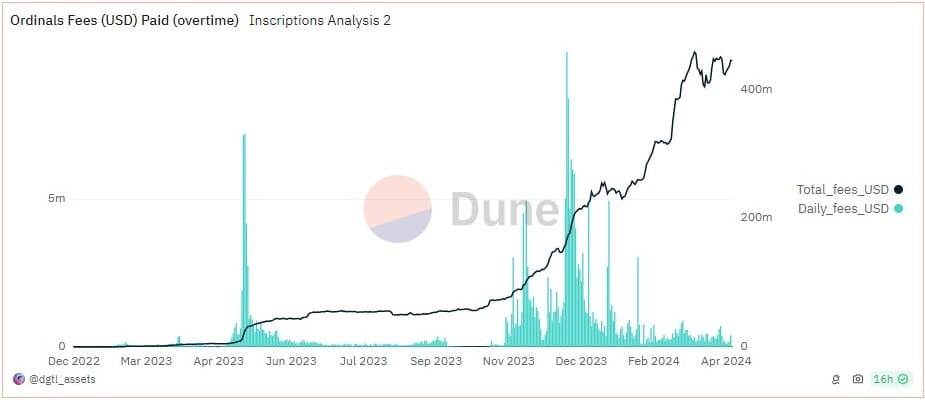

Inscriptions

I am using inscriptions as a measure of speculative interest in the bitcoin market. Much of the altcoin shitcoinery will be happening with inscriptions this time. However, it should be more tame, because fees impose a real economic cost.

The numbers have started to spike again after a nearly 2 month decline, over 200,000 inscriptions yesterday. This could be a sign that a speculative cycle is starting back up. We would expect this spike to also show up in the mempool above, but we don't have that confirmation yet.

No effect is seen on fees paid by inscriptions.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com