Bitcoin Fundamentals Report #285

HK Bitcoin ETFs, Iran FUD, China crash, bitcoin price analysis, miners bracing for halving and MORE!

April 15, 2024 | Block 839,370

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Pre-halving |

| Media sentiment | Neutral |

| Network traffic | Elevated |

| Mining industry | Growing |

| Days until Halving | 4 |

| Price Section | |

| Weekly price* | $64,195 (-$7,708, -10.7%) |

| Market cap | $1.262 trillion |

| Satoshis/$1 USD | 1557 |

| 1 finney (1/10,000 btc) | $6.42 |

| Mining Sector | |

| Previous difficulty adjustment | +3.9236% |

| Next estimated adjustment | +1.5% in ~8 days |

| Mempool | 214 MB |

| Fees for next block (sats/byte) | $10.51 (117 s/vb) |

| Low Priority fee | $9.08 |

| Lightning Network** | |

| Capacity | 4572.23 btc (+0.5%, +24) |

| Channels | 52,225 (-0.4%, -203) |

In Case You Missed It...

Bitcoin Magazine Pro

- This Time is Different: Unprecedented Halving Forces

- Market Tracker breakdown: Bitcoin's Pre-Halving Inflection Point

- Mining Tracker breakdown: Bitcoin Mining Industry’s Pre-Halving Dynamics

Member

- Gold and Yields Tell Us Everything About the Upcoming Recession

- What to expect heading into the halving?

- 💢 April Price Forecast Competition

Community streams and Podcast

Blog

Headlines

- Hong Kong, China Spot Bitcoin ETF

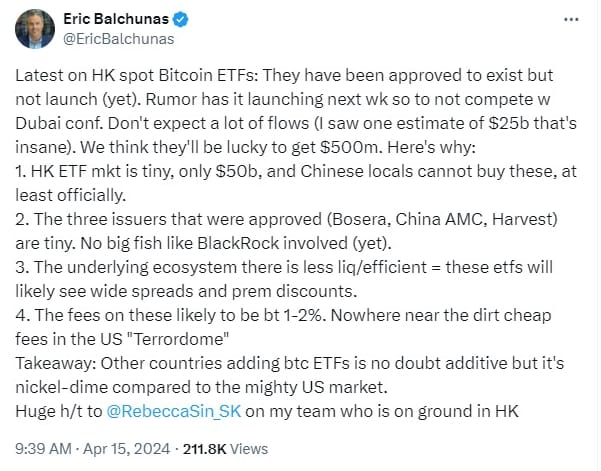

Mirroring the US stumble around the Bitcoin ETF announcement, Hong Kong Authorities did the same thing today. Rumor flashed that the ETFs were approved, only to be contradicted shortly after that they hadn't made the announcement yet. These ETFs will be approved, as to not let China fall behind the US in this important area.

Differences with the HK ETFs: China has gone slightly further than the US by approving not only a Bitcoin ETF, but also an Ethereum ETF. I think that is a big mistake, because it will confuse their investors and dilute their investment away from Bitcoin proper into a scam token. These ETFs are also "in-kind" as opposed to "cash creations" in the US. In-kind allows for the ability to create and redeem shares in bitcoin versus having to convert into cash. This makes the US ETFs less efficient but allows for some more oversight (overreach) of the market.

Update while writing:

I agree with his points here about being tiny in comparison, but I think people from mainland China can invest $50,000/yr into HK. That limits the wholesale flood of flows, but this market might also appeal to South Korean, Taiwanese or Japanese investors, as well. The spreads and fees are a great point, but Chinese investors are a captured audience.

I'll also mention that there's been a swarm into gold related companies and exchange-traded products recently, resulting in a premium of 30%. Last month, we also saw similar premiums in Chinese listed US-related stocks, like their S&P 500 tracking ETF. Bitcoin would be a similar hot commodity.

The flows should be significantly higher than Eric's estimate of $500M. He also estimated $10B in the first year for the US ETFs, we are already over $12B in the first 4 months. I think the HK ETFs will see $2-5B in their first year.

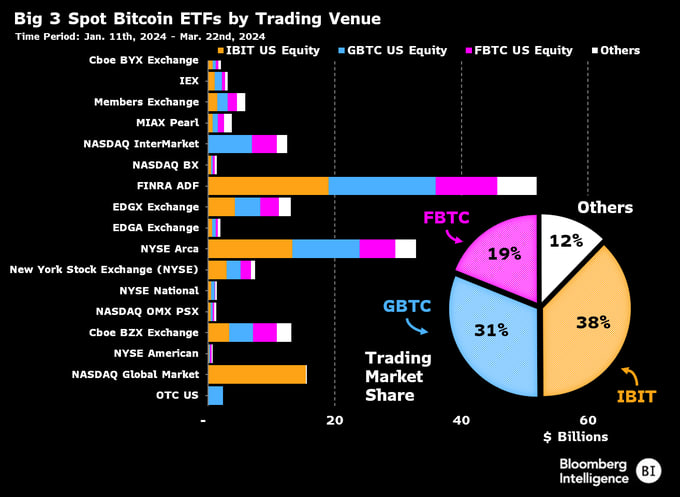

- Off-exchange trading is huge for the Bitcoin ETFs

FINRA ADF is "other than exchange" trades. "A facility that provides members of FINRA the capability to post quotes, report trades, and compare trades in NMS (National Market System) stocks outside of traditional exchange environments."

Metaplanet, a publicly traded company listed on the Tokyo Stock Exchange, a diversified enterprise, revealed the Bitcoin buying initiative on X. The company cited hedging risks from currency devaluation and inflation as motivations.

The announcement said the purchase is an "initial commitment" and part of a broader embrace of Bitcoin's potential. Partners like legendary hedge fund manager Mark Yusko, UTXO Management, and Sora Ventures support it.

By adopting a Bitcoin treasury reserve similar to MicroStrategy, Metaplanet aims to benefit from Bitcoin's upside while mitigating risks. MicroStrategy has pioneered the corporate Bitcoin treasury strategy, buying over $6 billion worth of BTC since 2020.

Metaplanet's stock price spiked 89.47% on Tuesday following the Bitcoin announcement.

The move also provides Japanese investors indirect Bitcoin exposure without high unrealized gains taxes, which can reach 55% in Japan. Metaplanet's Bitcoin funds will be held in a tax-advantaged structure only accessible by the company.

Macro

- Iran Fear-Mongering

I just have to get this off my chest, if your macro guy spent the weekend talking up the WW3 threat, you need to seriously think about finding someone else to listen to. I was busy this weekend, only checking the headlines a couple times a day, but when I saw the back-and-forth I immediately disregarded all the fear mongering for a couple reasons.

1) The price of oil is weak. In the two previous military conflicts, Russia and Gaza, the price of oil rose strongly to $95/bbl. The Pre-Russia rise was the strongest, and actually presented a global threat, resulting in a price spike. The Israel-Gaza situation saw a strong but less rapid rise in the oil price in anticipation (the market knows better than anyone), but no follow-through let us know it did not pose a significant immediate geopolitical threat. Now, we have Iran, with a very weak rise and barely making it to $85.

This tells me that the threat of this situation is less, and the risk of recession is greater, due to the market unable to mount a rally to $95 this time.

- China's Economy Is Much Worse Than It Appears, Dragging the Whole World Down With It

This was a great summary video about the current situation in China. I highly recommend watching it. It's not just a trade war problem, or a real estate bubble popping, it is a total systemic breakdown of their economic model. It includes things such as massive debt, demographic collapse, communist authoritarianism, and deglobalization.

Can't see video? Link here

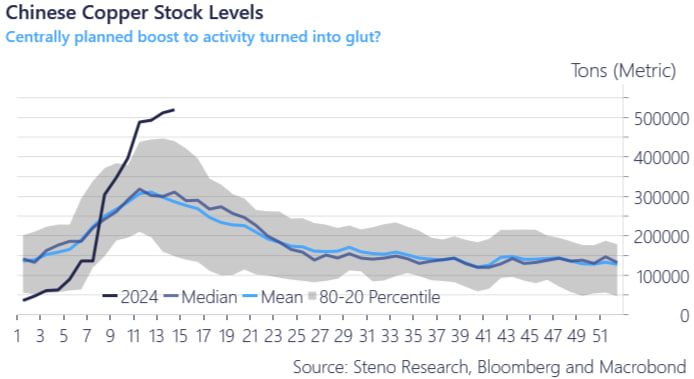

China's copper stock piles are also building rapidly. This chart is from Steno Research, with Andreas saying that this is a sign of more economic activity. However, I see just the opposite. It is likely that they are importing relatively the same amount of copper, but their economy is in such bad shape that they are putting it in stockpiles instead of using it.

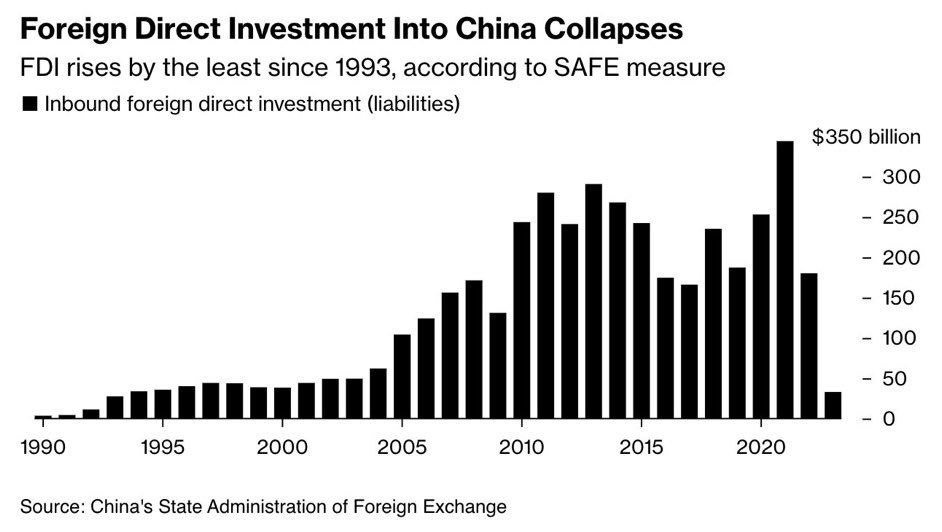

Lastly for China this week, their FDI collapses to 1993 level.

In 2023, the total FDI flowing into the country was just $33 billion – that’s 82% less than the previous year and the least since 1993, according to China’s State Administration of Foreign Exchange. And companies from Japan, Taiwan, and South Korea shrank their direct investments in China the most.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

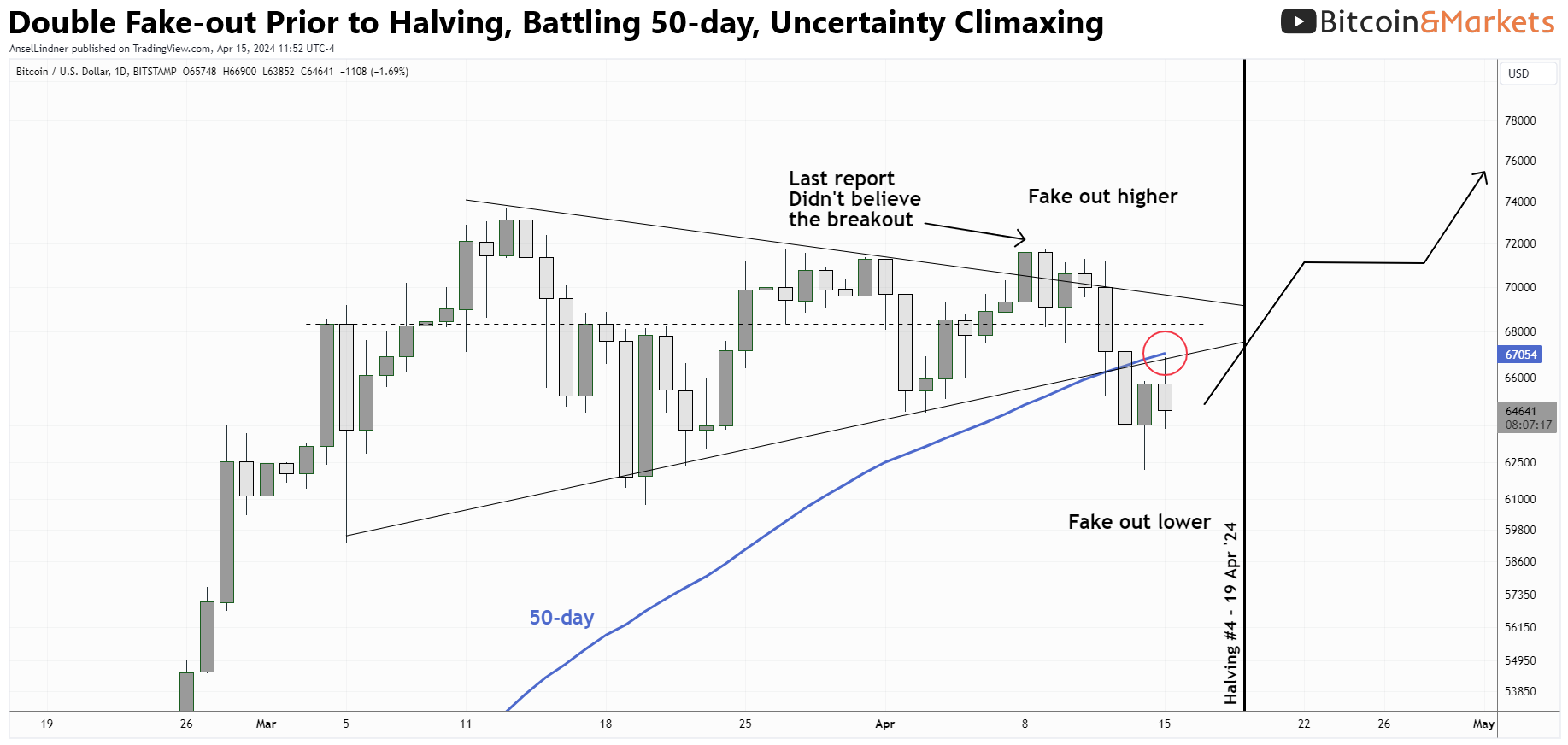

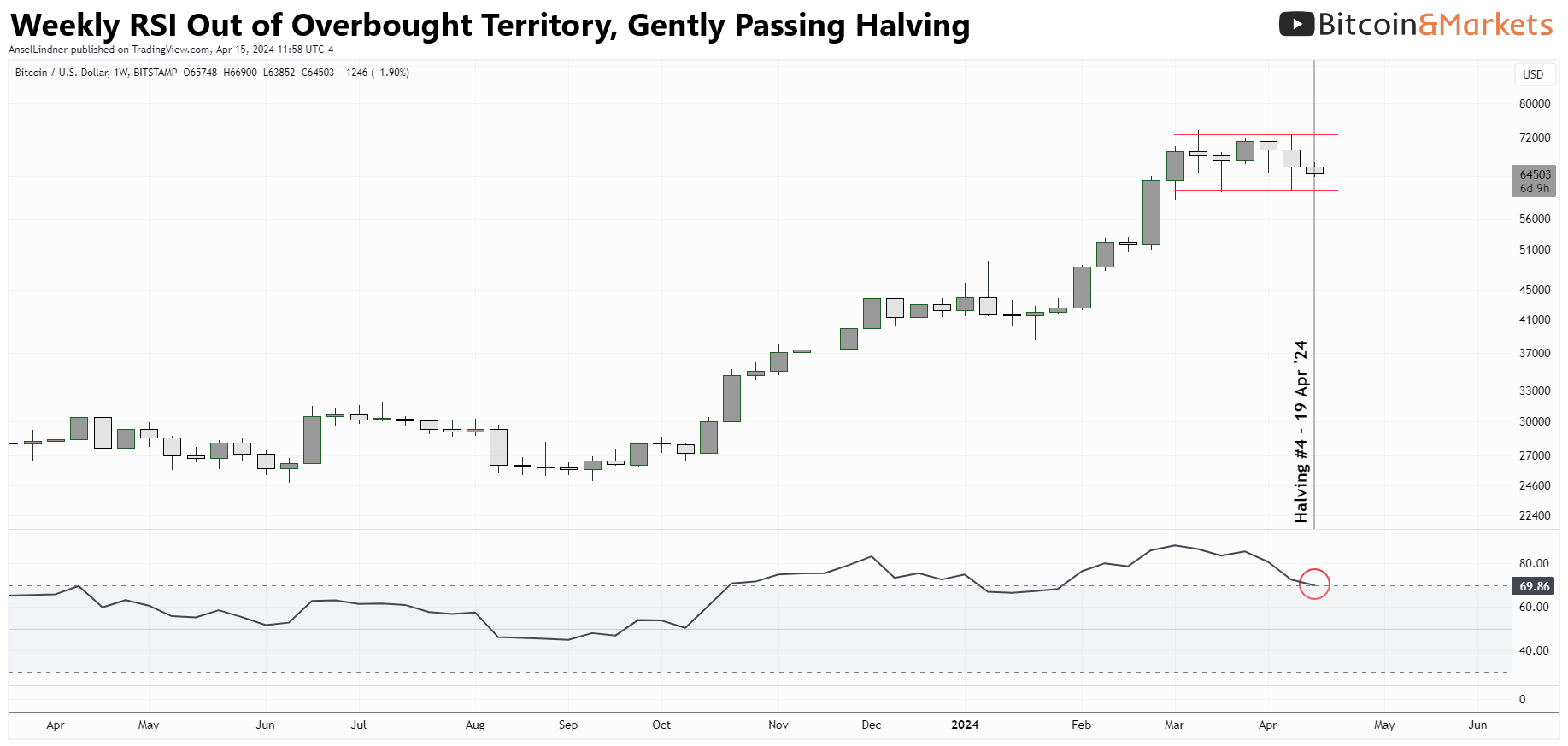

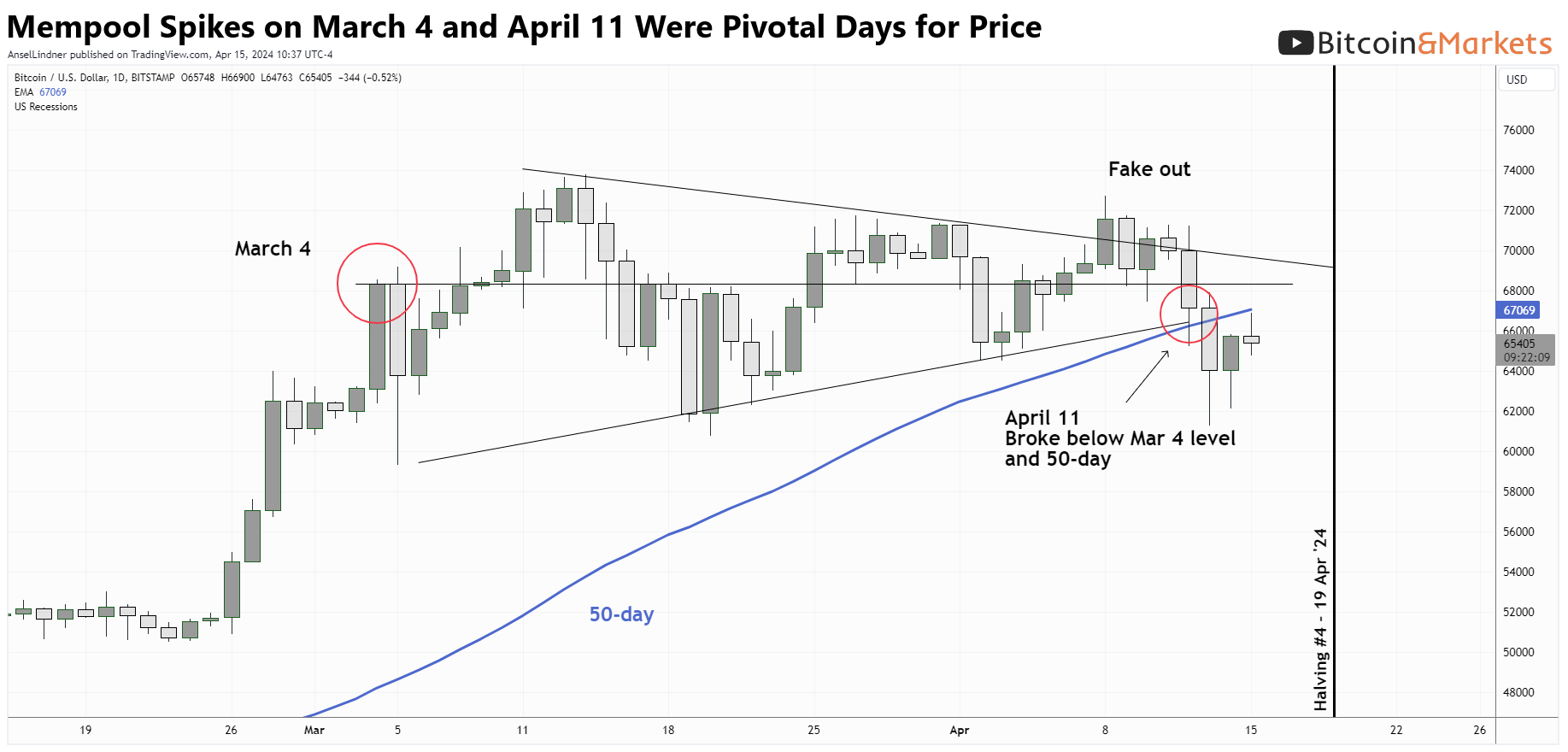

Throughout the entire month of March and so far in April, I've be a voice of caution about the price. I've been expecting price to cool on the weekly time, as it was still significantly overbought. Last week, at the time of writing the report, we were breaking above the pennant pattern I said the following:

I think price is setting up for a big move, just not quite yet. The halving a significant event and while it is possible to pump into next week's halving, I think it is highly unlikely.

I did not think that the move higher was likely to come to anything that weak and that close to the halving. The rest of the week proved that out. Price settled back into the pattern and then dropped below on geopolitical concerns over Iran and Israel. Whenever I see bitcoin price movements driven on speculative geopolitical events, I question the knee-jerk reaction to the news. Nothing fundamentally has changed for bitcoin, the Iran-Israel conflict was not foreshadowed in the markets, therefore, it is hard for me to believe they are very serious.

The move higher was weak and a fake out, I believe this move lower is weak and will ultimately be a fake out as well, driven by misplaced speculation about WW3. We will most likely hit the halving between $65-70k and then start moving higher from there.

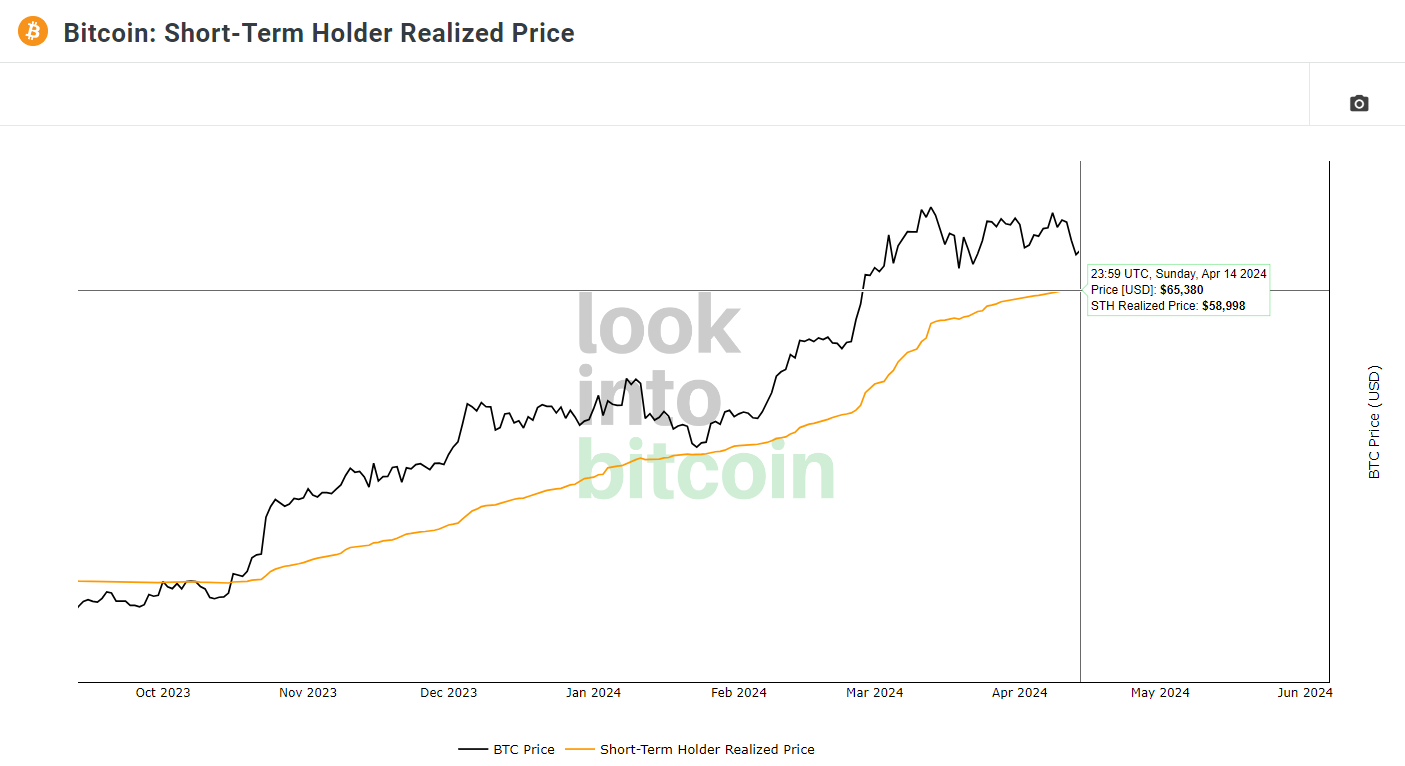

I am closely watching my favorite indicator for weak-hands, that is the STH Realized Price. Sitting at $59,000 this means that breaking that level will likely trigger STHs to sell. While this would be typical market maliciousness, causing the most pain and making obvious gains hard to come by, I still think it is unlikely to happen. I won't discount touching that level, but with the demand from the Hong Kong ETFs added to the US ETFs, banks and Bitcoin "development companies" like Microstrategy and now Metaplanet in Japan, any dip will be aggressively bought.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Specifically, the US Energy Information Administration (EIA — a statistical agency within the US Department of Energy, responsible for collecting, analyzing, and disseminating energy information — sought what it deemed to be an “emergency survey” of the cryptocurrency mining industry’s energy consumption. While the EIA’s initial justification for the survey was debunked and the emergency data collection process halted due to a lawsuit, the agency is moving forward with plans for a slower, more deliberate survey of the industry. The survey’s process, however, is still biased in that it is focused only on the costs of crypto mining, out of context of any benefits the sector provides or the costs imposed by other sectors’ electricity use. Thus, it is another weapon in the anti-crypto arsenal of the Biden administration. - emphasis added

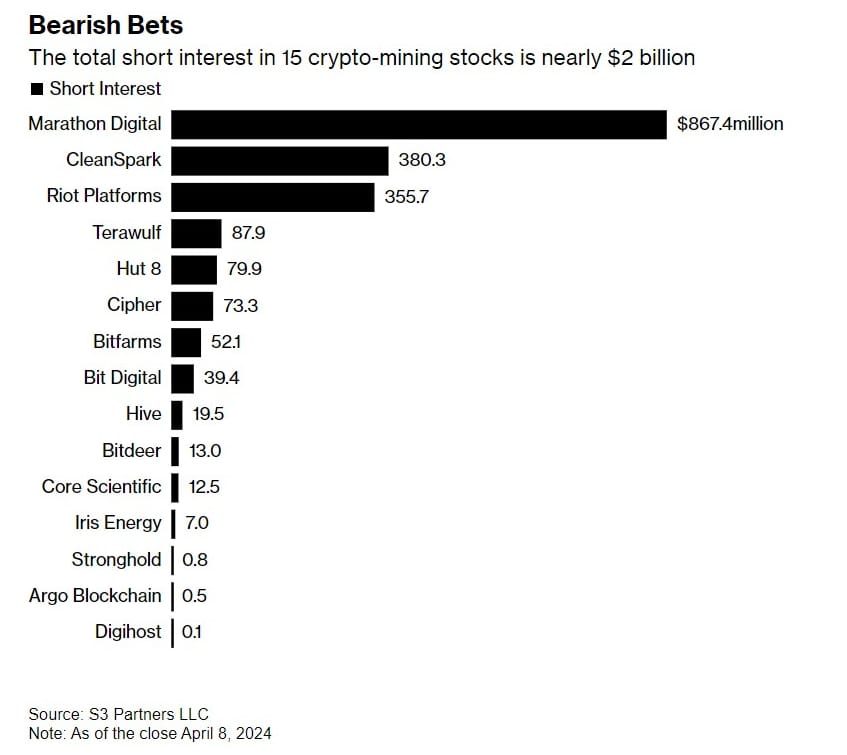

As the hoopla has revved up around the event, some traders are betting that mining stocks will fall. Total short interest, the dollar value of the shares borrowed and sold by bearish traders, stood at about $2 billion as of April 11, according to an estimate from S3 Partners LLC. That short interest accounted for almost 15% of the group’s outstanding shares — three times more than the US average of 4.75%, said Ihor Dusaniwsky, managing director of predictive analytics at S3.

These shorts can get squeezed after the halving. Recent standout performers Terawulf, Hut 8, and Cipher are less shorted than the big three. Marathon has a mountain of bitcoin and the most shorting activity. It could be set for a massive post-halving rally.

- The Post-halving Supply and Demand

Some traders are expecting a bearish result from the halving as remarked on above. They believe if miner revenue falls due to a reduced block reward, they will be forced to liquidate some bitcoin reserves in order to meet their costs. This bitcoin will flood the market pushing prices and revenue down even more.

Of course, miners are well aware that their revenue is sensitive to their selling, so will do whatever they can to either not have to sell (raise money through debt or equity) or at most sell off-exchange. Just two weeks ago, there was a pretty big story about the banks themselves wanting to buy bitcoin directly from the miners.

What these short sellers underappreciate is the slashing of new supply not only affects miner revenue, but the number of flow available to meet new demand. They see the downward feedback loop clearly, but don't see that if miners can remain solvent through the first period after the halving, perhaps by borrowing against their bitcoin instead of selling it, their theory blows up rapidly in their face.

Hash rate and Difficulty

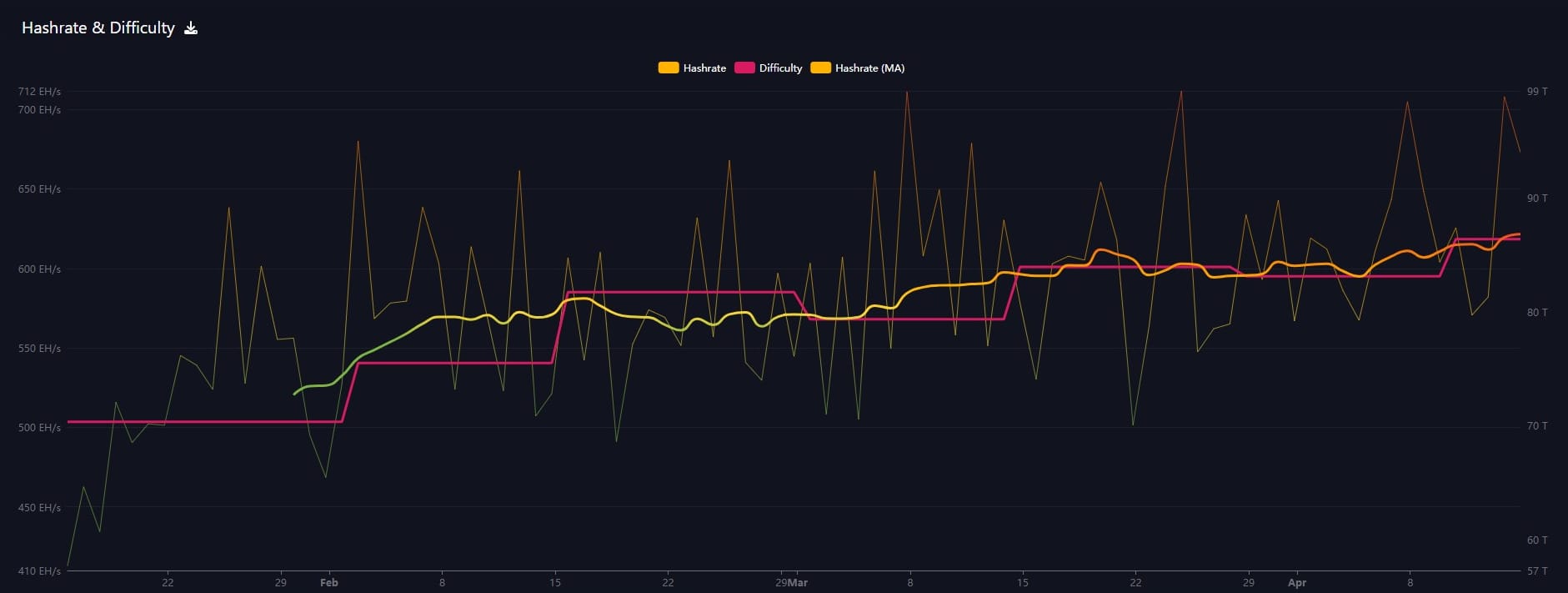

Hash rate continues to around the ATH, with difficulty adjusting up 3.9% last week. It will be interesting to watch the hash rate after Friday's halving, but I expect less fireworks than seems to be the consensus out there. Miners are extremely professional and have a grasp on very deep fundamentals in the bitcoin space. From demand from different sources, to their long term strategy and runway, they see more than the average investor.

Mempool

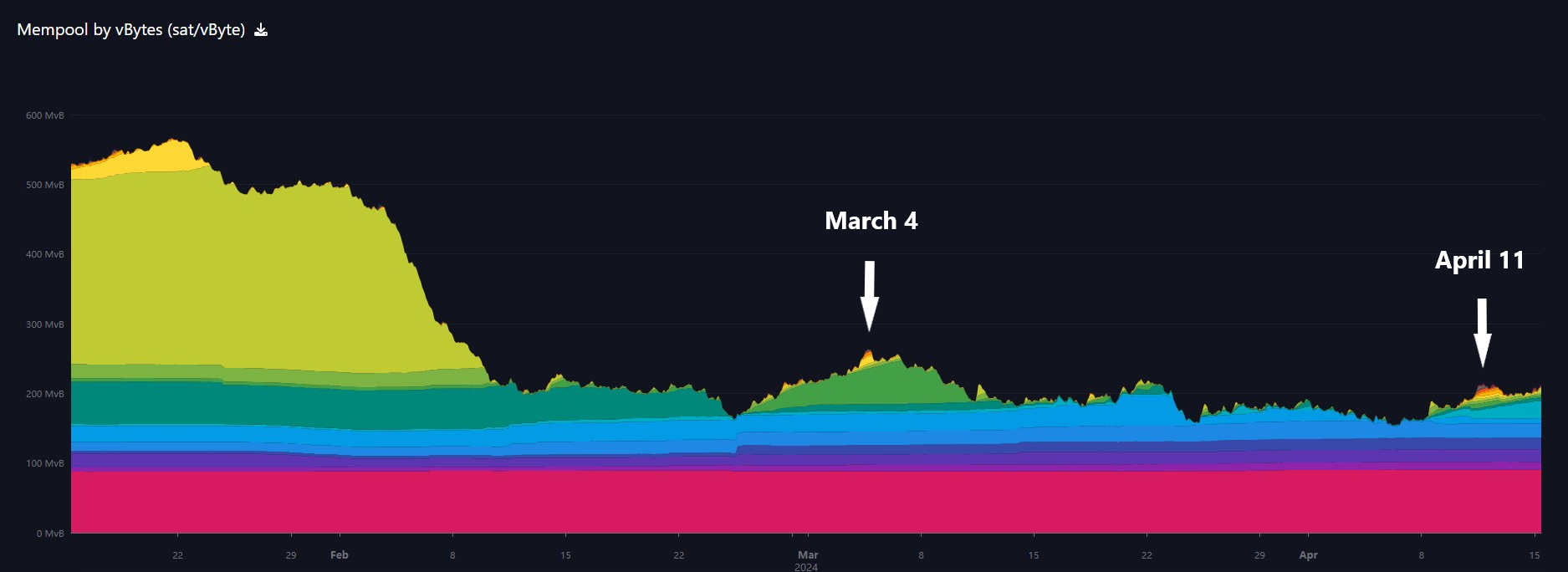

The mempool spiked on the 11th to very high fee levels, breaking $20 per transaction and 200 sats/vb. While the absolute size of the mempool has not increased, the urgency and fee insensitivity of the transactions have pushed up fees. We can confidently say this is not due to inscriptions, but due to uncertainty around the upcoming halving.

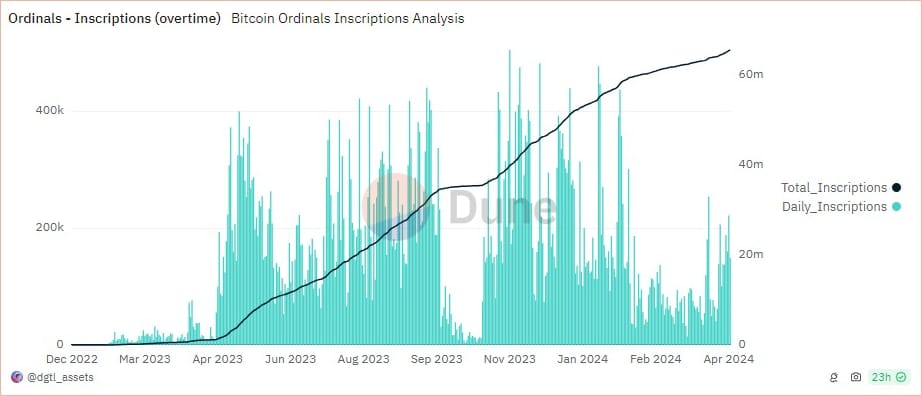

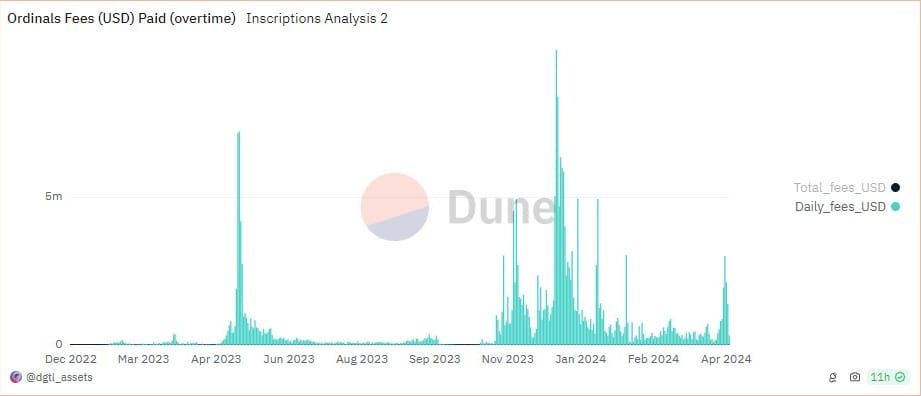

Inscriptions

Inscriptions have become the speculative barometer for the bitcoin space. As you can see in April inscriptions have picked from over the two prior months, but are still well below their peak. This could be a sign that basic retail demand is beginning to get excited again about bitcoin.

There are also some rumors that Roger Ver and associates are actively attacking bitcoin again with spam, like he did in 2016-2017 Block Size Debate. There has been a little up-tick in big blocker activity lately. If that is the case, it is a huge waste of money and once again Roger will be on the wrong side of history.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com