Bitcoin Fundamentals Report #293

Bitcoin too big to be ignored by politicians, adoption everywhere, macro headwinds, bitcoin price, mining industry update, and more

June 17, 2024 | Block 848,372

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Weak price, strong fundamentals |

| Media sentiment | Extremely Positive |

| Network traffic | Low |

| Mining industry | Stable |

| Price Section | |

| Weekly price* | $66,482 (-$3,558, -5.1%) |

| Market cap | $1.306 trillion |

| Satoshis/$1 USD | 1504 |

| 1 finney (1/10,000 btc) | $6.65 |

| Mining Sector | |

| Previous difficulty adjustment | -0.7879% |

| Next estimated adjustment | +0.5% in ~2 days |

| Mempool | 193MB |

| Fees for next block (sats/byte) | $1.40 (15 s/vb) |

| Low Priority fee | $1.30 |

| Lightning Network** | |

| Capacity | 4999.50 btc (+0.3%, +15) |

| Channels | 51,645 (-0.7%, -357) |

In Case You Missed It...

Bitcoin Magazine Pro

- Federal Reserve’s Terrible Projections, Macro Implications for Bitcoin

- Market Tracker breakdown: By The Numbers: Macro Headwinds Testing Bitcoin’s Fundamentals

- Mining Tracker breakdown: By the Numbers: Bitcoin Miners and Network Trends

Member

- BMPRO content a few days delayed

- Full Bitcoin Update, Charts and Emerging Fundamentals - Premium

- 💢 June price forecast competition

Community streams and Podcast

Blog

- Demographic Collapse: Effects of Urbanization

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

Headlines

“I will end Joe Biden’s war on crypto, and we will ensure that the future of crypto and the future of Bitcoin will be made in America; we’re going to keep it right here, and a lot of it is going to be done right here in Florida,” Trump said during a special address in West Palm Beach, Florida.

Immediate thought was, 'they are just thinking about this now?'

EXCLUSIVE: Key Biden Admin officials are set to attend a #Bitcoin roundtable hosted by Congressman Ro Khanna in DC, according to a leaked email seen by me.

— Nik 🇺🇸 (@nikcantmine) June 15, 2024

Topic of the meeting: how to keep Bitcoin innovation in the country.

More:https://t.co/LiYtjMS1QU

Deutsche Telekom, Europe's largest telecommunications provider, is set to venture into Bitcoin mining. This announcement was made by Dirk Röder, head of Web3 infrastructure and solutions at T-Systems MMS, a Deutsche Telekom-owned subsidiary, during the BTC Prague conference on Friday.

"Since 2023 we [have been] running a Bitcoin node and we are running Bitcoin Lightning nodes as well," he stated. Röder then hinted at an upcoming venture, saying, "And with a heart full of [...] pride, I would like to let you in on a little secret: we will engage in 'digital monetary photosynthesis' soon."

This week, one of the perennial topics in bitcoin reemerged, whether or not central banks will, or have already been, buying bitcoin. David Bailey of BTC Media claimed that they already are. When pressed, the countries he named were already known. Bhutan, we've known they've been mining and buying for several years, no surprise. Iran mining and buying bitcoin have been rumored for years due to the need to get around sanctions and roughly 4% of global hash rate being there. Venezuela is another country speculated for a long time to by buying and using bitcoin.

Other commenters like Mike Alfred claim to be having talks with countries like Burkina Faso and French Guyana.

My take is that the adoption of bitcoin by these smaller countries and central banks do not have much if any impact on the thinking of the larger central banks. The Federal Reserve does not care if Bhutan is mining bitcoin, in fact, it could be a negative, because of those countries are not seen as particularly sophisticated or well run. It is my opinion that larger central banks will not start buying bitcoin until ordered by their associated governments. That might be close to happening in the US and perhaps Japan.

MicroStrategy first announced plans on Thursday to raise $500 million by selling convertible senior notes to qualified institutional buyers. The proceeds would primarily go toward acquiring more Bitcoin for its corporate treasury, which already contains over 214,400 BTC worth $15 billion.

The software analytics firm then boosted the offering to $700 million on Friday. The company said the offering is expected to close on June 17th.

Macro

- FOMC keeps rates the same, but their projections have backed them into a corner

I wrote about this last week, originally on Bitcoin Magazine Pro and then on this site.

The FOMC released an updated Summary of Economic Projections (SEP) with notable adjustments. Their average projection for the fed funds rate by year-end increased from 4.6% (three 25 bps cuts) to 5.1% (one 25 bps cut), suggesting they don't foresee a severe economic downturn. This is dangerous group-think, as worsening economic data contradicts their forecasts. For instance, they don't expect the unemployment rate to rise above 4.5%, despite the household survey showing massive job losses in May, diverging drastically from the Non-farm Payrolls data. Including the drop in labor force participation, over 600,000 jobs were lost in May, pushing the unemployment rate to 4.0%, creating a significant job gap.

They backed themselves into a corner though. If they have to cut more than once, it will cause more loss of confidence. Specifically, their unemployment projections seem separated from reality. If I'm seeing this, it is guaranteed that large capital allocators see this as well. They will get defensive and bring on the recession.

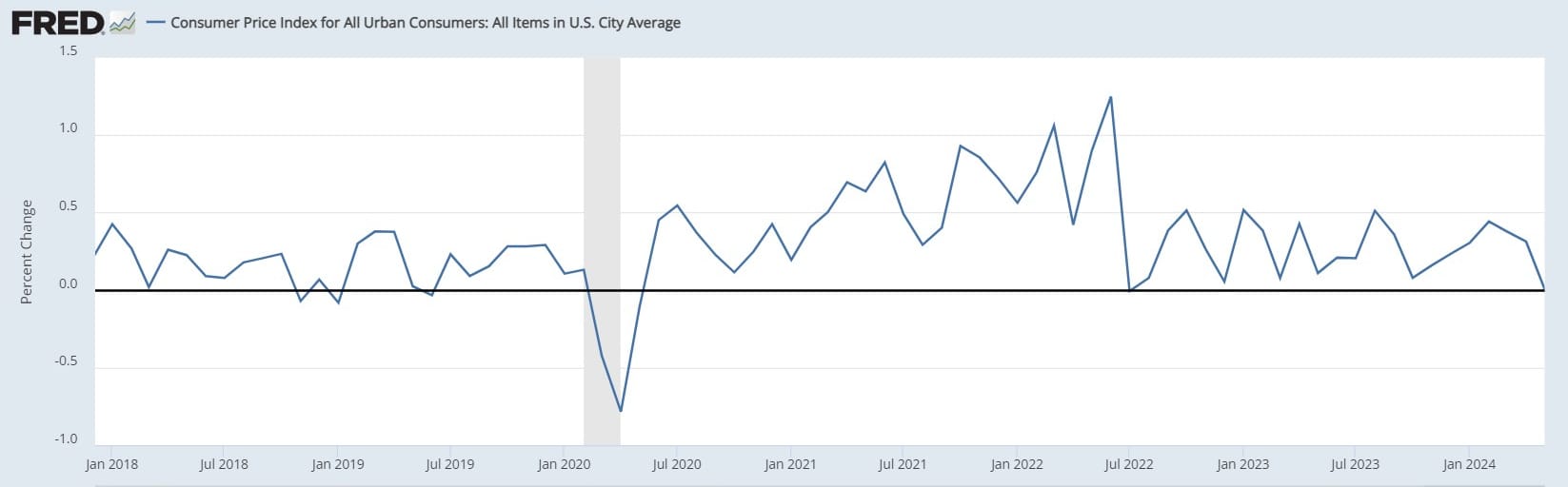

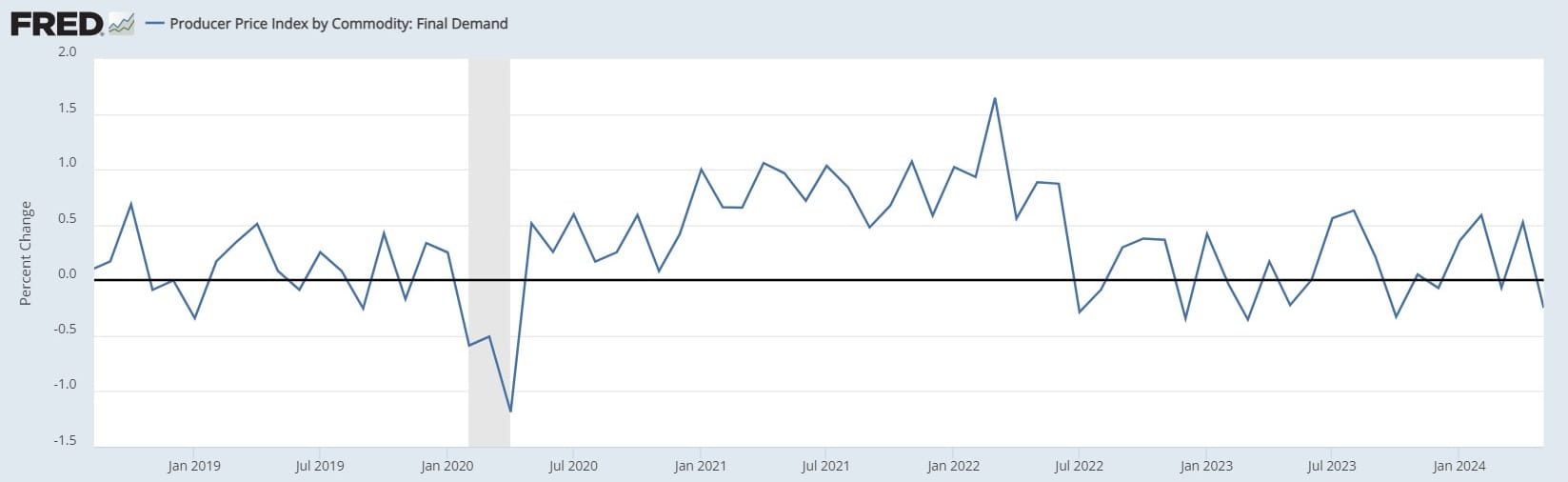

- May CPI and PPI signal recession

CPI came in last week at 0.0%. For years, I've saying we will return to a "post-GFC" normal for CPI and GDP and other things. If we look at the two charts below, we can obviously see the acceleration really start at the end of 2020, and ending abruptly in July 2022.

The CPI is particularly concerning to me. Not that I think we should have price increases or anything, but CPI is direction connected to economic strength. The CPI will fall in a recession. In our modern (and dying) model, credit expands at roughly the rate of growth. Contraction in prices will mean contraction in the economy, and as a direct result people will lose their jobs, their homes, even their lives. It's a horrible mess we've created, and the only way out with minimal pain is adoption of bitcoin.

- Oil "glut" is starting to get spoken about

Again, years ago I wrote about the oil glut we were in and called our situation over the next 20 years or so as Peak Oil Demand. Now, that idea is starting to make its way into the professional commentary on the space.

From Oilprice.com:

Oil demand growth is set to slow in the coming years and global demand will peak in 2029, while rising production will lead to a major glut this decade, the International Energy Agency (IEA) said in its new medium-term oil outlook on Wednesday.

While the IEA relies heavily on ESG renewable nonsense, it isn't wrong about demand falling. I think we likely much closer to a peak than 2029. Gasoline demand in the US has already been falling for years, and the demographic decline will simply not demand as much oil.

We also have Citibank talking about supply surpluses, aka glut:

Citibank is turning bearish as well on crude oil in its latest price forecast predicting Brent crude oil prices will drop down to $60 per barrel in 2025. Yahoo Finance's Morning Brief team reviews Citibank's call, which cites supply surpluses and the transition into renewable energies.

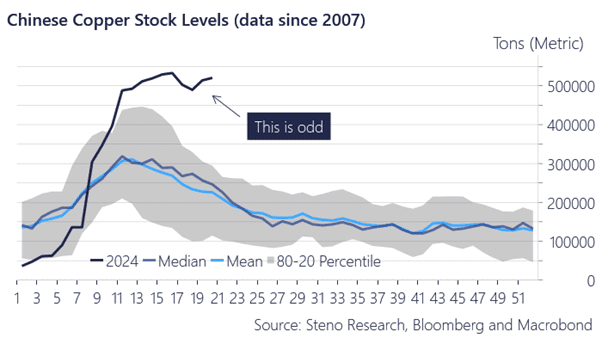

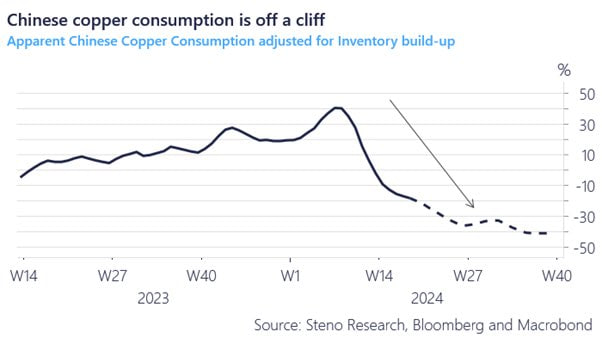

- Chinese copper mystery solved?

I've been talking about this chart for a while, copper stockpiles in China were booming. Some implied it was China preparing for war, but I questioned it immediately as likely their economy being garbage.

What do their imports/production of copper look like? This could simply be a sign they are importing normal amounts, but their economy is so garbage they aren't using it.

— Ansel Lindner (@AnselLindner) April 11, 2024

We got our answer right here, it was the consumption and not the imports that caused this rise in copper stockpiles. However, the rise in stockpiles is what drove the speculative demand pricing up copper and much of the conversation around a commodity super cycle. Now, that we see it was actually a lack of economic activity driving the stockpiles.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

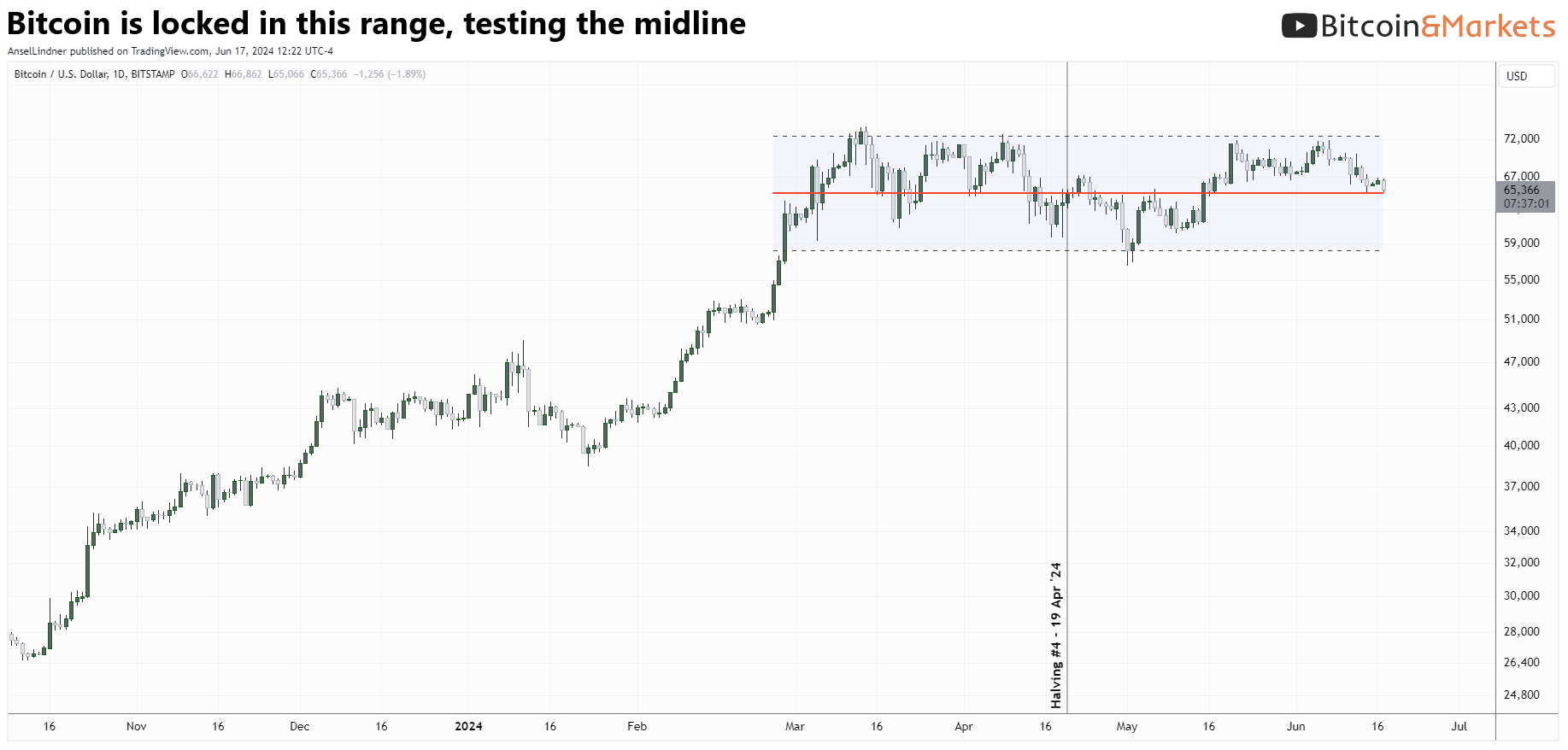

Price has been painful this week. With all the massively bullish fundamentals, price still has not cooperated. At the time of writing, the price is at $65,800 right in the middle of the range we've been in since early March.

On Friday's LIVE stream, I spoke about holding being hard and that this period is going to be very difficult because price is not acting as we expect. Therefore, it requires the ability to hold a dissonance in your mind, that of the immensely bullish fundamentals and the languishing price.

There must be something we are missing that is causing price to remain so range bound. I believe the main driving force to be people losing confidence in their interpretation of bitcoin due to that dissonance mentioned above. The longer price does not go up in accordance to fundamentals, the more they doubt themselves. This causes marginal selling, and the price refuses to rise. This is why the holders of last resort are always the floor, they will never sell, because of their ultra-low time preference and pure belief in bitcoin.

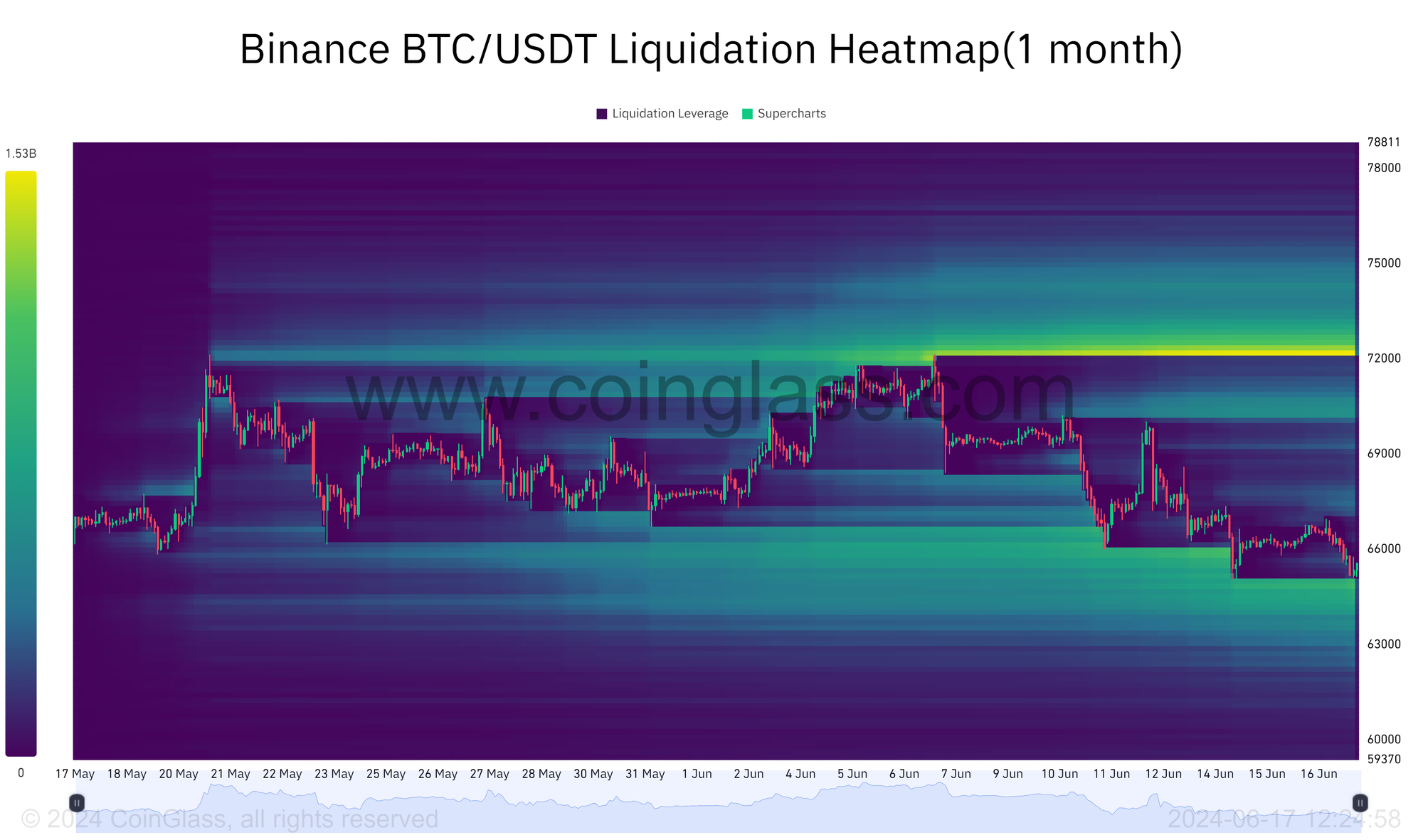

Moving on to some other aspects of this market, the heat map is still showing very juicy liquidations up at the $72.3k level, but there are still a generous amount below the price as well, down to roughly $63k.

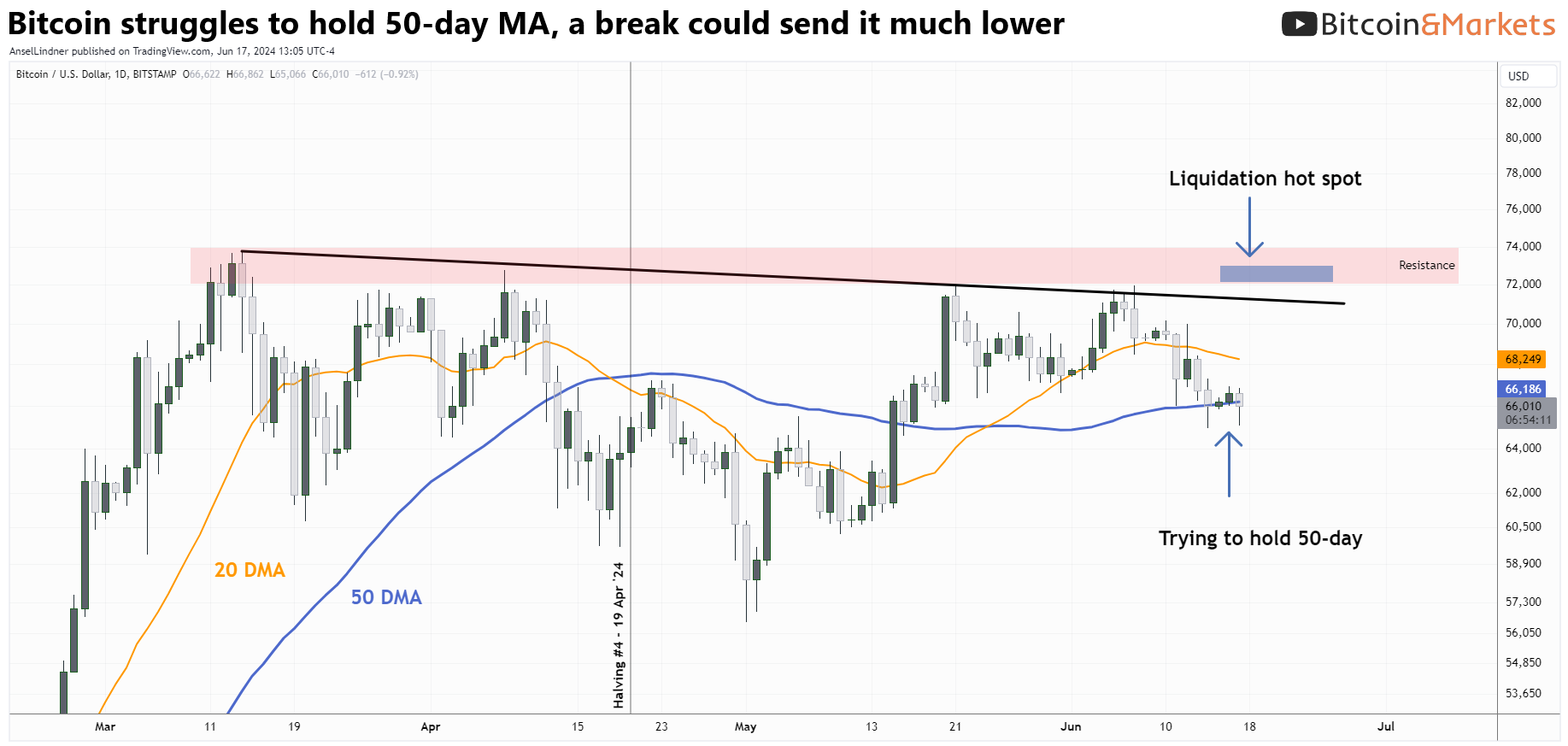

I will be watching price behavior over the next few days. If it can hold the 50-day MA,

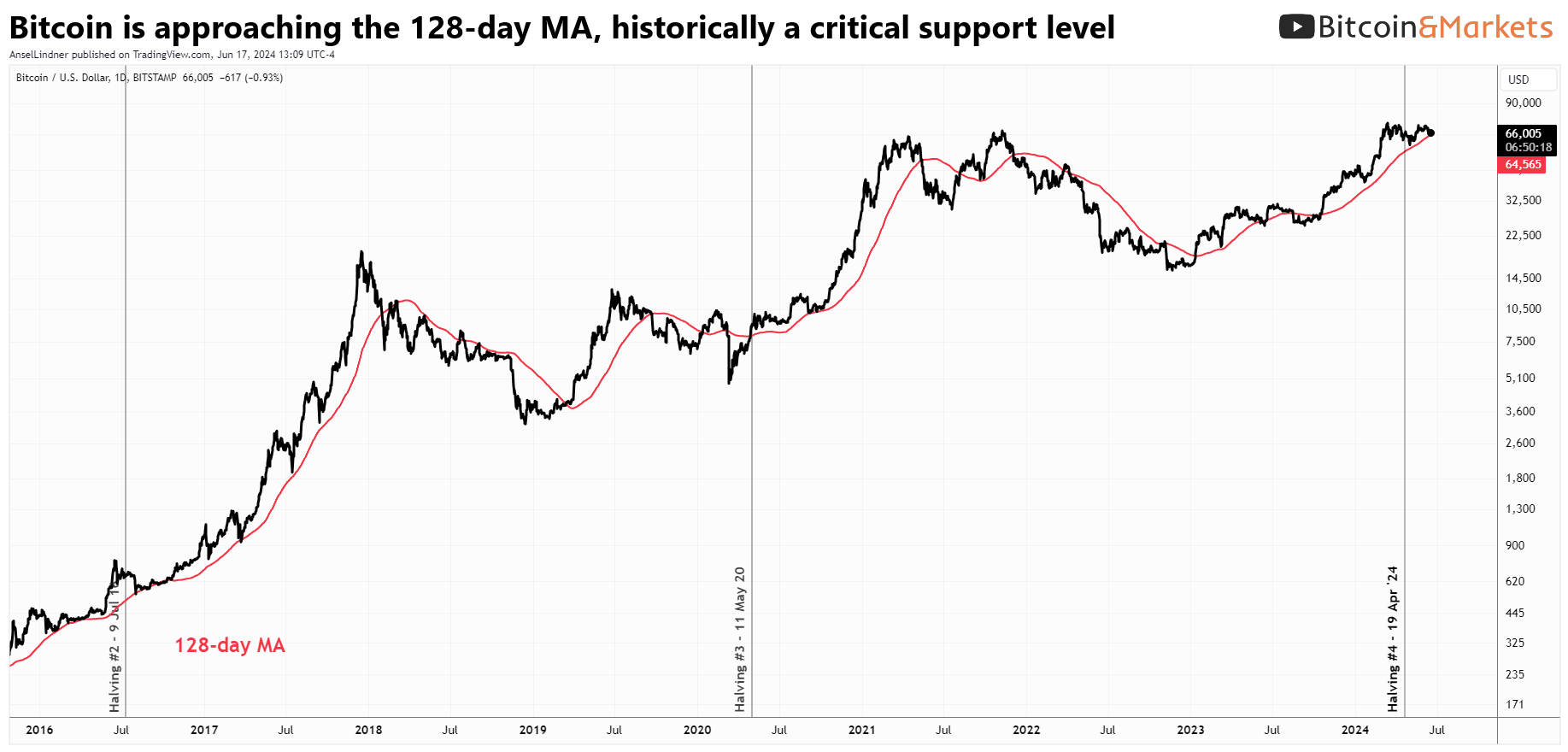

Price is also approaching critical historical level in bitcoin, the 128-day MA. This particular moving average was identified several years ago by Willy Woo, and then followed by Tone Vays. It's hard to argue with its accuracy. Currently, the 128-day MA is providing support at $64,500.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Presidential contender Donald Trump has been in the headlines for his newfound interest and inclination towards cryptocurrency. More recently, he strengthened his stance by highlighting the importance of Bitcoin [BTC] mining. The former President promised to advocate for Bitcoin mining in the White House during a meeting with several Bitcoin miners at Mar-a-Lago, Trump’s Palm Beach resort.

Alongside this development, Trump made a point of emphasizing on Truth Social that he wants the USA to produce all the remaining Bitcoin. This appears to be the reason behind his abrupt support for miners.

Hash rate and Difficulty

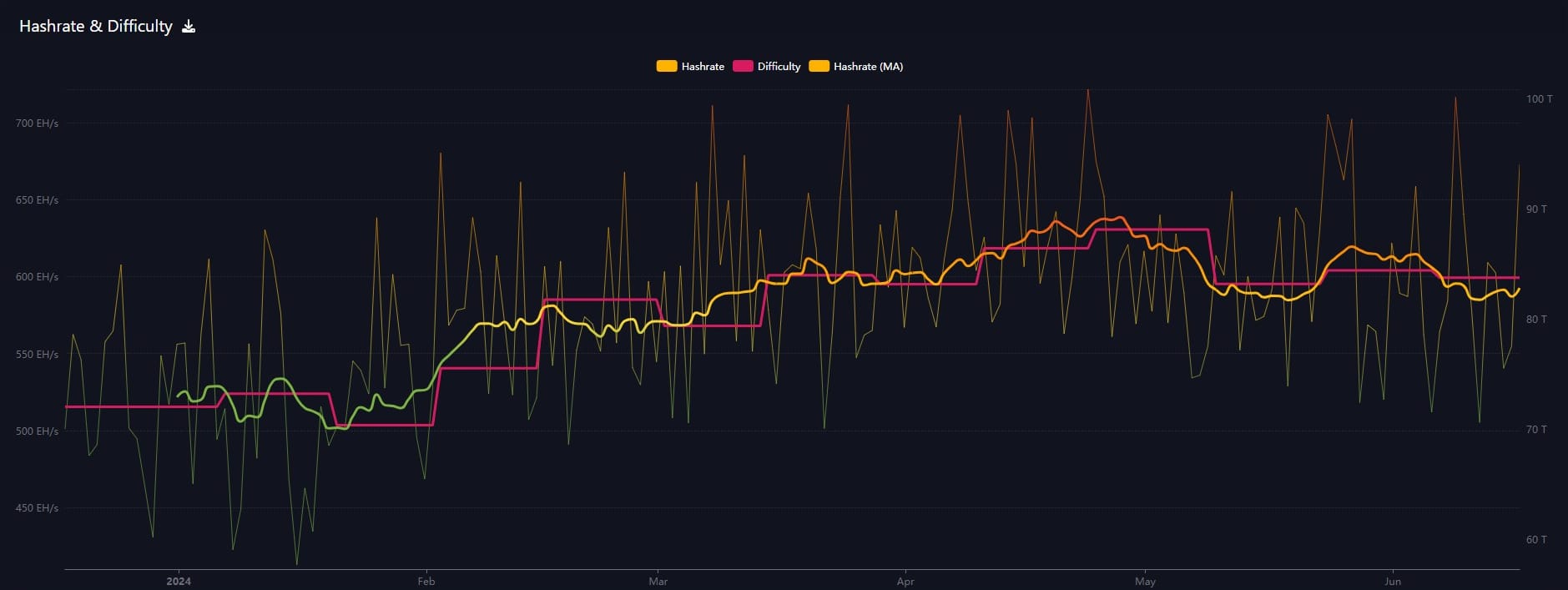

Hash rate has stabilized this week, and might be ready to move higher once price also puts in a bottom.

Mempool

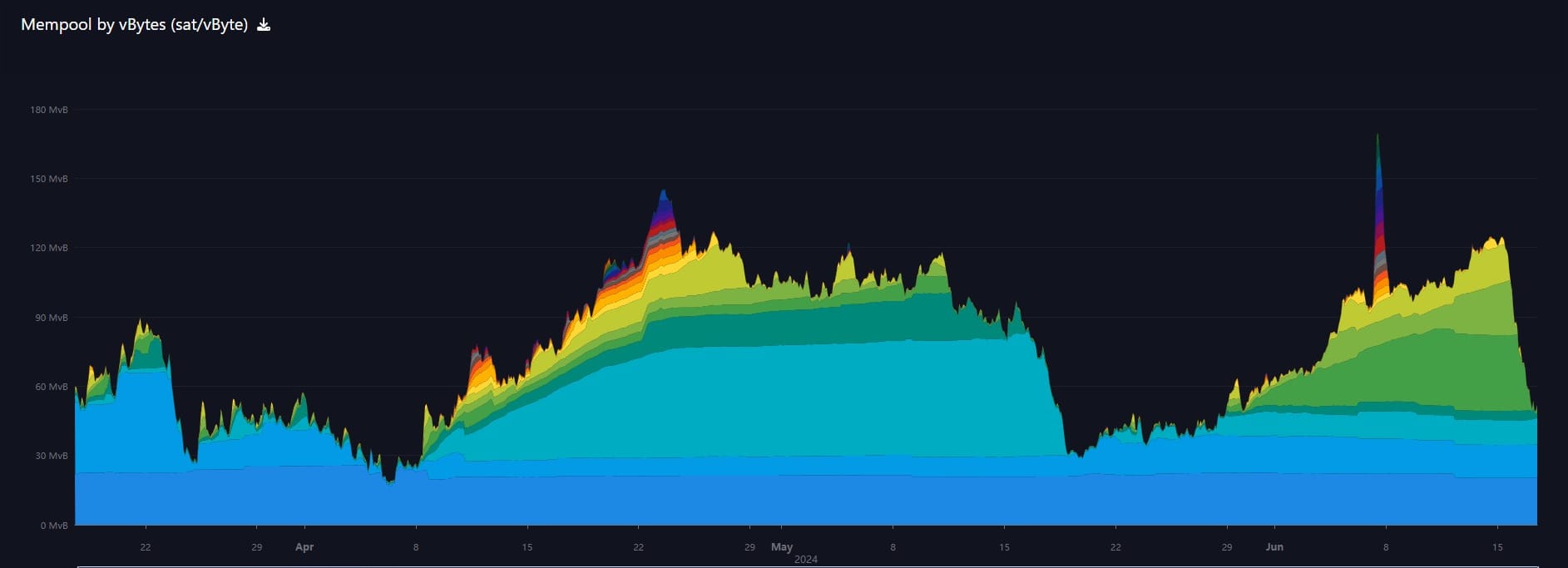

The mempool continues to be quite volatile, this week dropping from 266MB down to 193MB. This can be interpreted as part of my holistic view of the space as a strong data point supporting the idea that risk of a sell-off is very low. Sell-offs tend to be preceded by a gradual rise in the mempool as people are trying to get coins to exchanges.

Layer 2 including Token Protocols

I've been saying that these layer 2 tokens, whether you agree with them or not, are where the innovation is happening for the time being, and as time and money are spent around the bitcoin protocol, perhaps something with long term practicality will be discovered. IOW a layer 2 that works well.

Stacks, a layer-2 scaling network for Bitcoin, experienced a significant disruption Friday as block production stalled for nearly nine hours.

The incident, attributed to a Bitcoin reorganization (reorg) and “unexpected miner behavior”, sent shockwaves through the Stacks ecosystem and triggered a 12% drop in the STX token price over the past 24 hours.

Stacks was built to enable functionality like smart contracts to power decentralized applications (dapps) and NFTs on the Bitcoin network, since the blockchain itself wasn’t designed for such features that have flourished on rival networks over the years.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com