Bitcoin Fundamentals Report #294

Billionaires falling in love with bitcoin, Bitcoin in politics, EU-China trade war, bitcoin price and mining news.

June 24, 2024 | Block 849,343

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Max bearishness |

| Media sentiment | Indifferent |

| Network traffic | Low |

| Mining industry | Struggling and shifting |

| Price Section | |

| Weekly price* | $60,283 (-$6,199, -9.2%) |

| Market cap | $1.188 trillion |

| Satoshis/$1 USD | 1658 |

| 1 finney (1/10,000 btc) | $6.03 |

| Mining Sector | |

| Previous difficulty adjustment | -0.0494% |

| Next estimated adjustment | -3% in ~9 days |

| Mempool | 187MB |

| Fees for next block (sats/byte) | $0.93 (11 s/vb) |

| Low Priority fee | $0.76 |

| Lightning Network** | |

| Capacity | 5068.95 btc (+1.3%, +69) |

| Channels | 51,503 (-0.3%, -142) |

In Case You Missed It...

Bitcoin Magazine Pro

- Four Bitcoin Indicators, One Comprehensive Conclusion

- Market Tracker breakdown: By the Numbers: Bitcoin Gets Bumpy

- Mining Tracker breakdown: By the Numbers: Signals of Stability in Bitcoin Mining Sector

Member

- BMPRO content a few days delayed

- Full Bitcoin Update, Charts and Emerging Fundamentals - Premium

- 💢 June price forecast competition

Community streams and Podcast

Blog

- Demographic Collapse: Effects of Urbanization

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

Headlines

On June 21, Dell tweeted, "Scarcity creates value," a phrase often associated with Bitcoin due to its supply cap of 21 million tokens against rising demand. His tweet quickly drew the attention of Michael Saylor, a prominent advocate for Bitcoin as a corporate treasury asset.

Michael Dell's net worth is approximately $120 billion to Michael Saylor's ~$5 billion. Completely different class of billionaire.

So far, in 2024, Dell has cashed out $2.1 billion while retaining 58% of the company's ownership. In other words, he has excess capital available to deploy into the Bitcoin market, particularly against the backdrop of rising U.S. debt, which may negatively impact the U.S. dollar's value in the future.

Also, Dell as a company has $5 billion in cash on their balance sheet. It is possible that Michael Dell either buyer bitcoin personally, or will put some on his company's balance sheet, or both.

Dell has a history with bitcoin since they began accepting it for computer purchases in late 2014.

If you didn't think that bitcoin was an actual big deal this election, check this out. The people want bitcoin, the monied interests want bitcoin, the banks even want bitcoin. The only players in the entire world that don't want bitcoin are the authoritarians losing ground everywhere.

The crypto industry super PAC "Fairshake" has raised more money than any other super PAC.

— Jameson Lopp (@lopp) June 24, 2024

Probably nothing... 🙃 pic.twitter.com/EHYROtBO9G

JUST IN: 🇺🇸 SEC permanently suspends its investigation into Ethereum.

— Watcher.Guru (@WatcherGuru) June 19, 2024

This story is slightly odd, even if you don't understand why ETH is such a scam. Just before this news dropped, it was announced that the SEC's Crypto Enforcement Chief was leaving the agency.

I'm the first one to say that the SEC fails at consumer protection, but this is going to have horrible consequences. This is the worst of both worlds. Not only does the SEC still exist, but it is basically giving all the scams a green light.

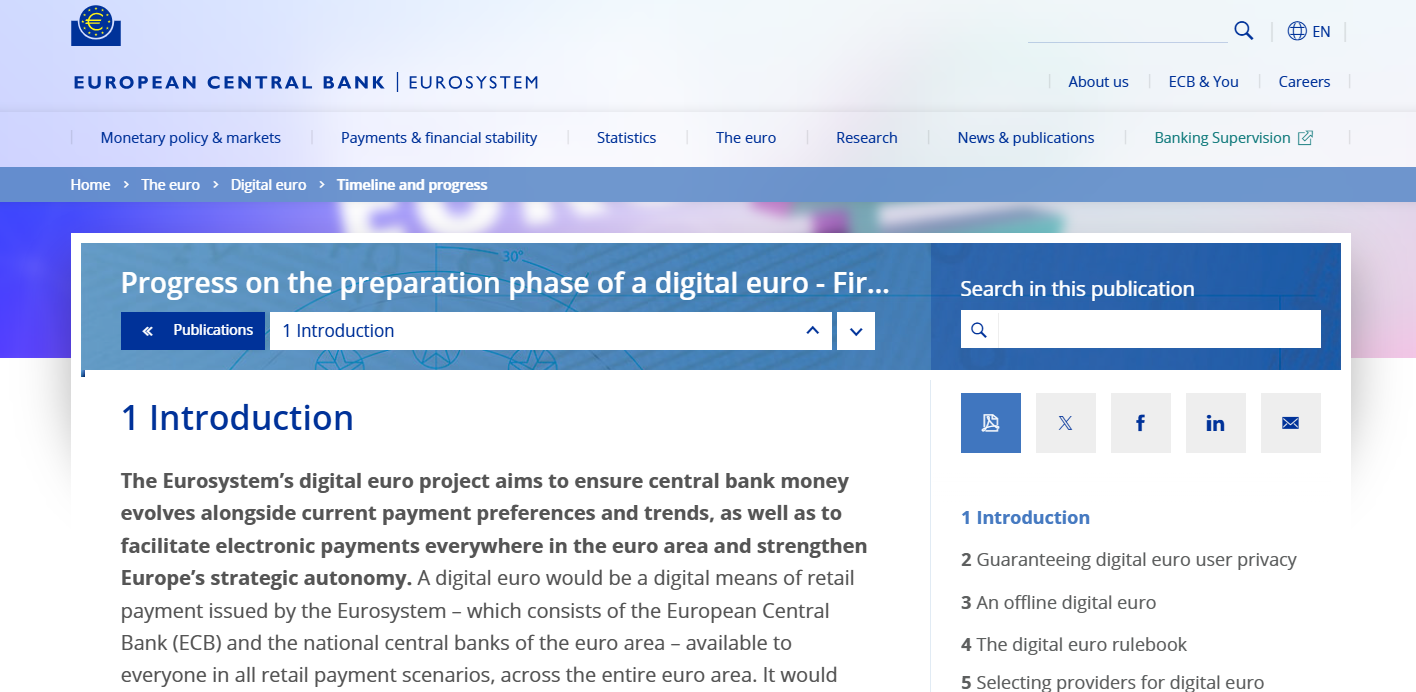

Macro

Following the completion of the digital euro investigation phase launched by the Eurosystem in 2021, on 18 October 2023 the Governing Council of the ECB approved the launch of a two-year preparation phase. The aim of the preparation phase, which will last until 31 October 2025, is to build on the findings of the previous phase and lay the foundations for the potential issuance of a digital euro. It involves finalising the digital euro rulebook (by defining a single set of rules to be applied to payments in digital euro) and selecting providers that could potentially develop a digital euro platform and infrastructure. As part of this phase, the Eurosystem is also carrying out further testing and experimentation and a deeper dive into technical aspects of the digital euro, such as its offline functionality and a testing and rollout plan.

In CBDC lingo there are two different types. 1) A wholesale CBDC used for bank-to-bank transfers and settlement, basically a overly complex version of Fed Wire. 2) A retail CBDC which is the full-blown dystopian version of control and inflation. It is telling that the ECB is going for the latter here.

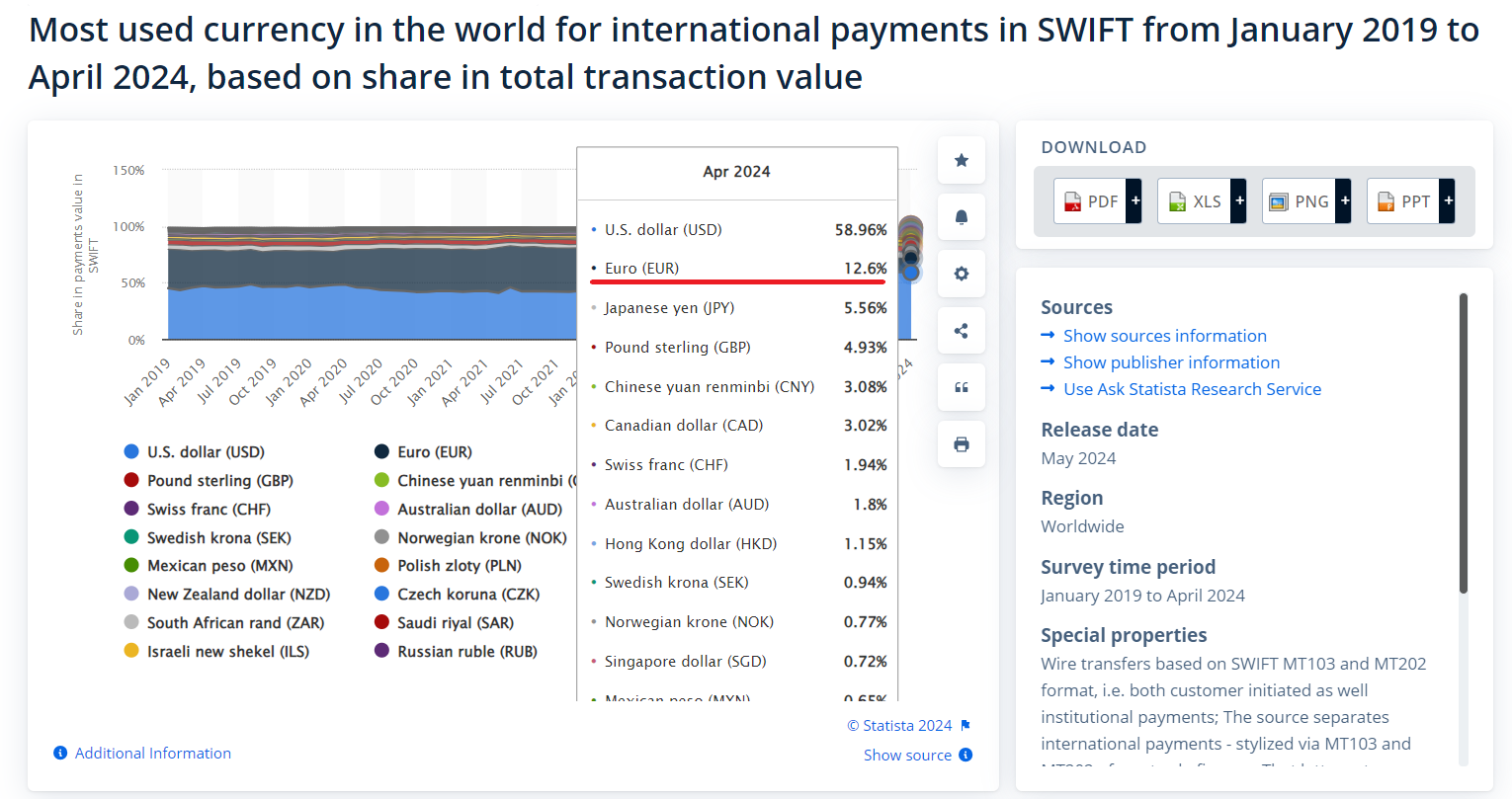

Also interesting, the ECB is likely shaking in their boots about the existential decline in the use of the Euro in international payments and receipts to approximately 12% from the latest SWIFT transaction numbers.

Bottom line from this report is that they are still working and will come to their next decision point in Oct 2025. A long way off. a lot can happen by then.

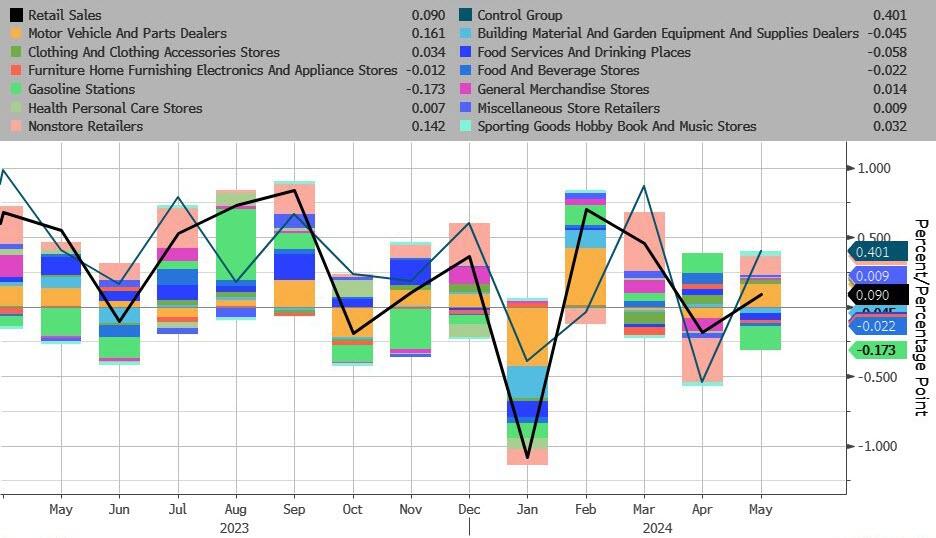

- The US consumer, the world's last hope for avoiding a global recession, is slowing

Last week, US retail sales came out and were a huge miss of expectations. 0.1% MoM vs 0.3% expected. April revised lower from 0.0% to -0.2%.

Adjusting for "inflation" and considering the revision to April, retail sales for May were actually -0.4%.

This is on top of price cuts from most major US retailers like Walmart, Target, Kohls and Amazon.

Deglobalization is read guys. I've been telling you for years that this process will only continue. Now it is China vs EU. Just imagine what will happen when Trump gets reelected.

Beijing warned on Friday that escalating frictions with the European Union over electric vehicle imports could trigger a trade war, as Germany's economy minister arrived in the Chinese capital with the proposed tariffs high on his agenda.

Robert Habeck's three-day trip to China is the first by a senior European official since Brussels proposed hefty duties on imports of Chinese-made electric vehicles to combat excessive subsidies. That has unleashed countermeasures by China and harsh criticism from Chinese leaders.

This week alone, Chinese automakers urged Beijing to hike tariffs on imported European gasoline-powered cars and the government launched a dumping probe into EU pork imports in retaliation for the EU Commission's move.

I talked about this topic on a live stream last week using this article: EU Tariffs Of Up To 38.1% On China-Made EVs Are About To Take Hold.

This move cannot be taken in isolation, it's like a snowball rolling downhill. As quoted above, China is already looking to retaliate. Now, imagine you are a CEO of a large company with vulnerable supply chains to this kind of trade war, will you continue as if this isn't happening? Which side would you choose to be on?

China is a low income country with a collapsing economic model, communist regime and closed capital account. China does not have customers for your products, they've been trying to boost domestic consumption for a decade with no progress. Of course, the large company that wants to sell things will side with the US consumer.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

These are the hard times that make great hodlers.

One of the things that is making this period particularly difficult psychologically is that our expectations were very elevated. The fundamentals are still extremely strong, the US might very well pivot on the bitcoin issue, and institutional demand is here. The $14 billion of inflows to the ETF were record breaking, but only the tip of the iceberg.

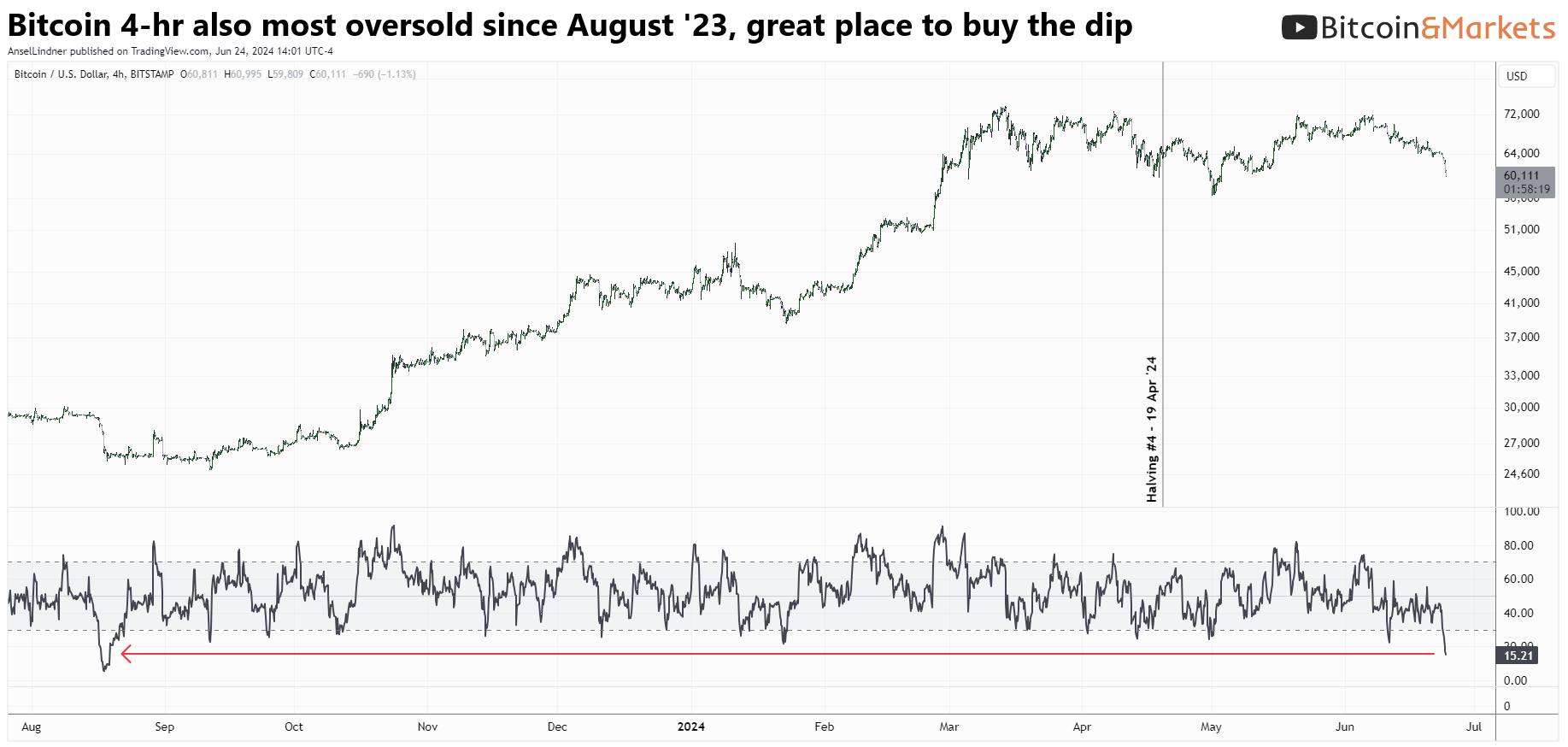

Bitcoin has painfully grinded lower, but when viewed in perspective of our consolidation range the entire bull market move so far, this is peanuts. RSI also tapped oversold for the first time since August last year. That leads to a couple likely scenarios. 1) Price closes oversold and bounces hard back to the mid-line of the consolidation. 2) There is a weak bounce and later this week, price puts in a lower low price, but a higher low on the RSI forming a bearish divergence. I do not see price dipping below the 200-day.

Bitcoin 4-hr RSI is also extremely oversold. Lowest level since Aug '23, also.

These oversold conditions will get corrected. This is a major milestone for price, being this oversold. How does it look on the weekly?

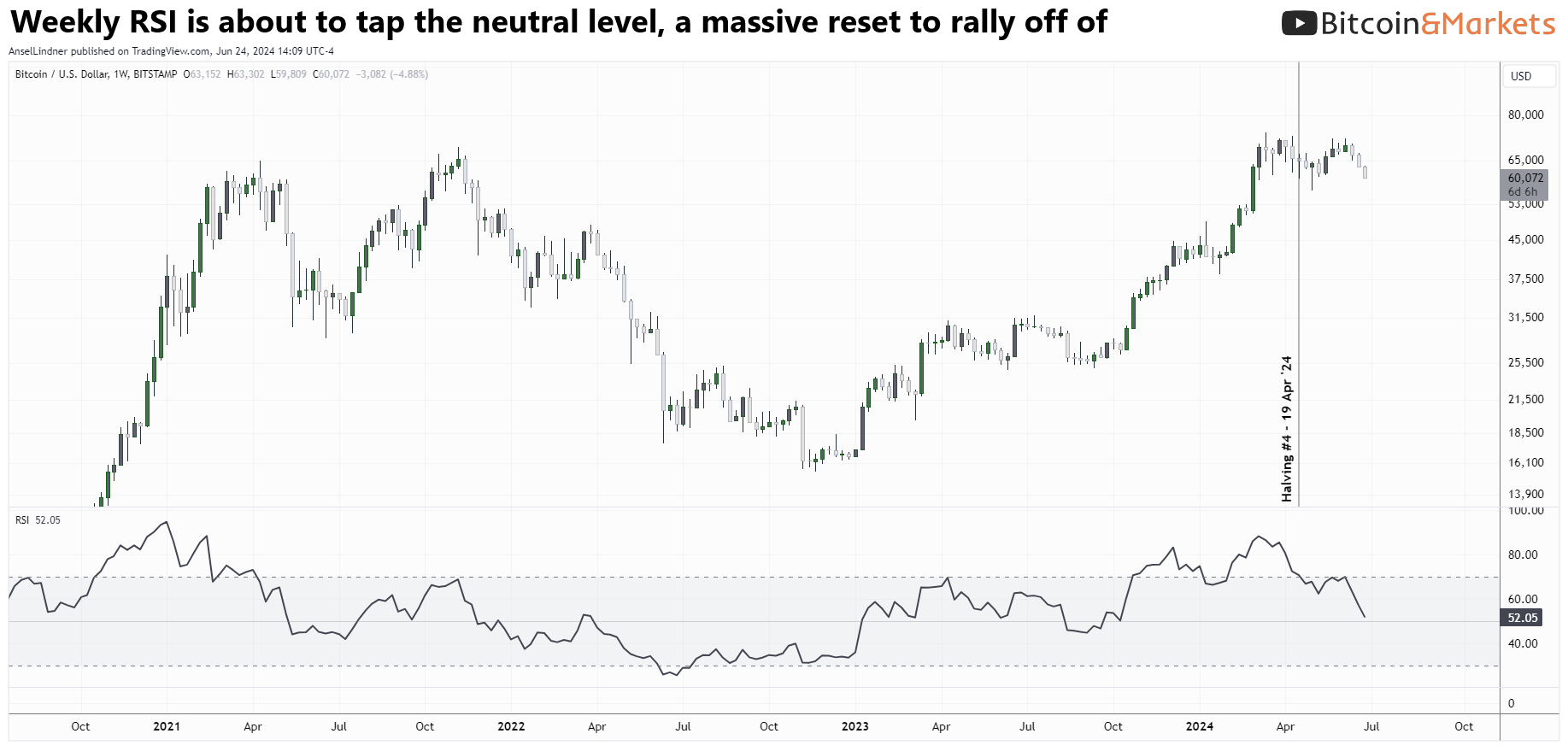

The weekly RSI is beautifully reset to the neutral mid-line. Last time it was there, price was $27k, therefore, we are resetting from a much higher level.

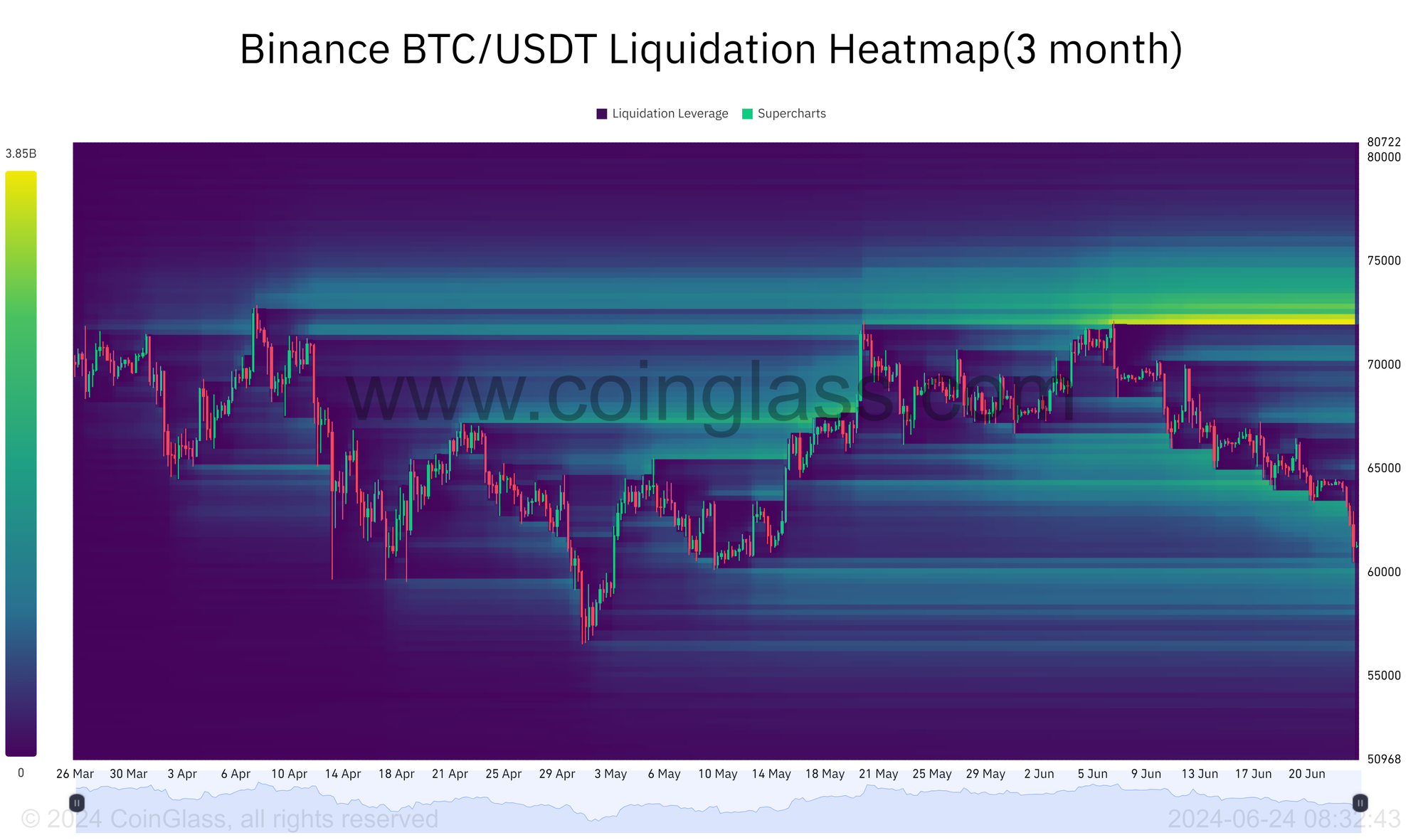

Liquidation heat map shows >$3 billion in very juicy liquidations up at $72k. There is not a lot of liquidity immediately above price though, since we have been almost straight down over the last couple of weeks, giving no time for those shorts to come in. If we check back tomorrow, there will likely be more liquidity above the price to help set it on its way to $72k.

Overall, price is not fun right now. I don't know what exact level the bounce will come, but it will come. Perhaps at the 200-day MA at $57,500, which also happens to be the bottom of the Ichimoku cloud. The round number of $60k also might provide more support that we are expecting right now being near the bottom of the range.

This is a great opportunity to buy a dip if you are interested. I expect a bounce to come later this week or next, and for the price to rally throughout July.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

The tech-focused investment manager Coatue Management will make a $150-million investment into the Bitcoin (BTC) miner Hut 8 Corp as investors continue to capitalize on the artificial intelligence (AI) boom.

On June 24, Hut 8 Corp revealed the multimillion-dollar investment from Coatue Management, owned by billionaire Philippe Laffont, which will take place through a convertible note.

In the crypto industry, Hut 8 was one of the earliest to get involved in the high-performance computing business, which is now being sought after to power generative AI models and applications.

Other cryptocurrency miners, including Core Scientific and TeraWulf, have also become involved with hosting data centers or striking deals with AI companies. Both of the aforementioned companies saw upticks in their stock prices after making AI-focused deals.

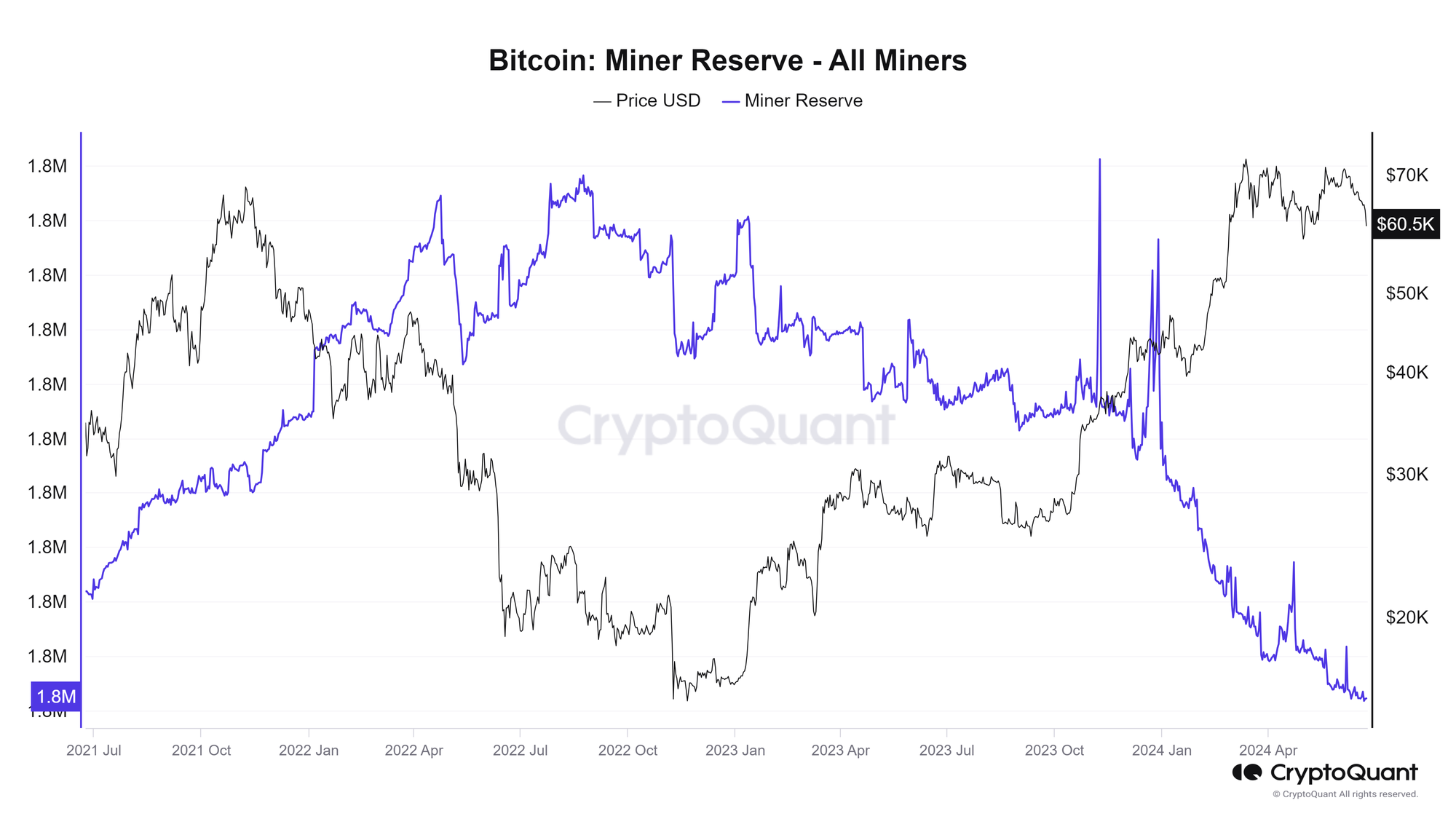

In June, bitcoin miners have sold off 30,000 BTC so far, the most this year.

The image above is not very clear from IntotheBlock, but below from CryptoQuant, we can see this is not an new trend at all.

Notice the miners' bitcoin balance has been falling consistently since July 2022, long before the eventual bottom with FTX. Since then, miners' bitcoin balance has gone from 1.864 M to 1.816 M. That measure does not match the IntotheBlock number above however, so these stats are not hard facts, but estimates.

It's very safe to say that miners are selling a lot of bitcoin at the moment, but the total number is less clear. For instance, they could be using bitcoin for collateral on a loan to make it through this dip in price. That would would look like a sale to these blockchain derived measures.

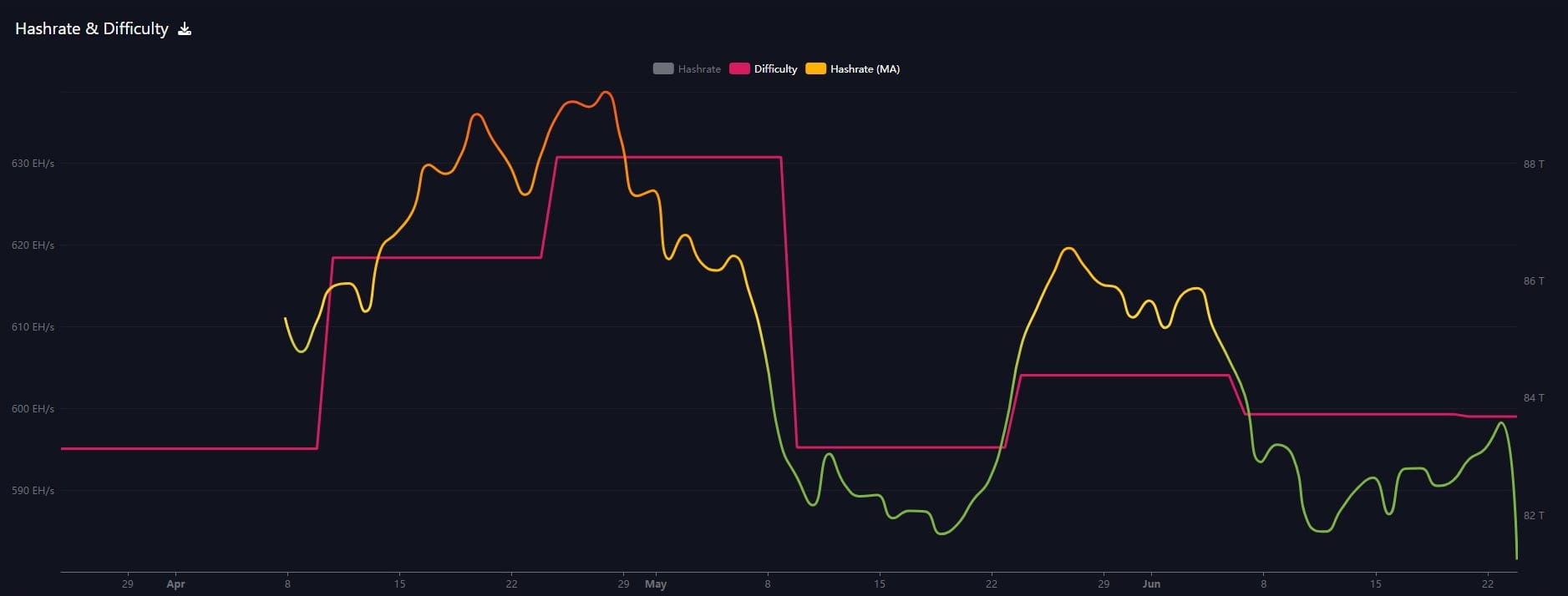

Hash rate and Difficulty

Hash rate has collapsed with this recent price dip. Difficulty did adjust downward very slightly, but the price dip over the last week has taken a heavy toll. This has also been met with significant selling by bitcoin miners that has put more pressure on the price. This is turning into a very important capitulation event.

This is a temporary issue. This equipment did not blow up and stop working, the rigs were simply taken off-line because they were not profitable. Once the price begins to trend upward, they will be brought back online.

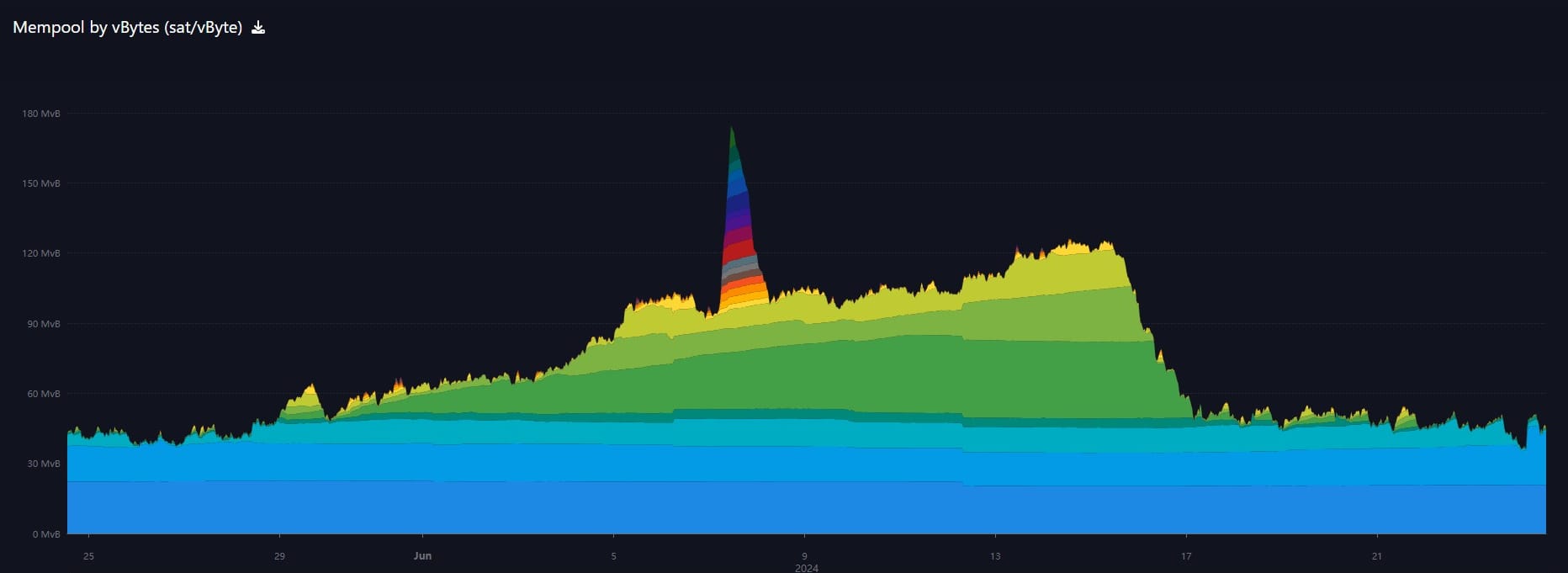

Mempool

Fees are extremely cheap, coming in under $1 for the next block. The mempool is slowly getting chewed through, despite block times being almost 5% slower right now.

Layer 2 including Token Protocols

Introducing Brollups: a Bitcoin-native rollup design that works with a native Bitcoin peg and requires no changes to the Bitcoin protocol.https://t.co/OW2y0xJrg0

— Burak (@brqgoo) June 21, 2024

Bitcoin developer “Burak” — who also created a Lightning Network competitor called Ark Protocol last year — has introduced “Brollups.”

Brollup is a layer 2 that offers a Bitcoin-native rollup design, bundling up transactions without needing to hard fork Bitcoin or issue a non-Bitcoin token, explained Burak.

Brollups will aim to support more than 90% of use cases in DeFi when it eventually launches, Burak said.

“Whether it’s listing an NFT for sale in exchange for Bitcoin where the buyer pays with Bitcoin upon execution, or placing a token sell order on a decentralized exchange, [all of this is] atomically executed, verifiable, scalable, and enforceable on Bitcoin.”

Brollups will be managed by “operators,” who will provide liquidity to the protocol and advance the rollup state by chaining Bitcoin transactions at “regular intervals.”

Transactions will be executed on the Bitcoin Virtual Machine.

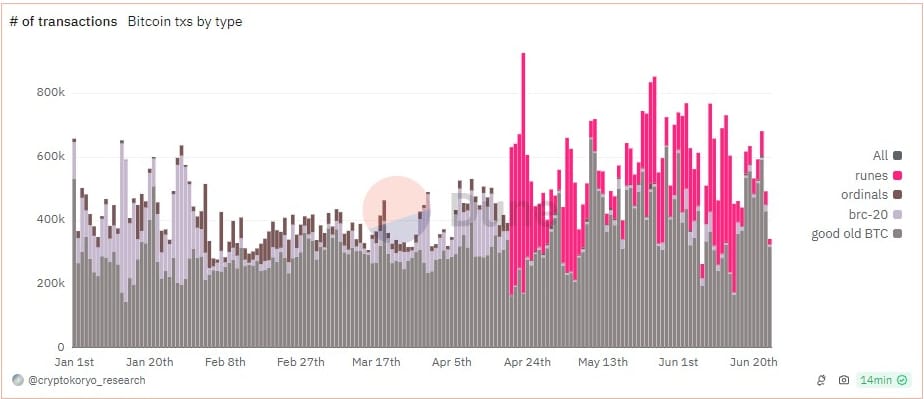

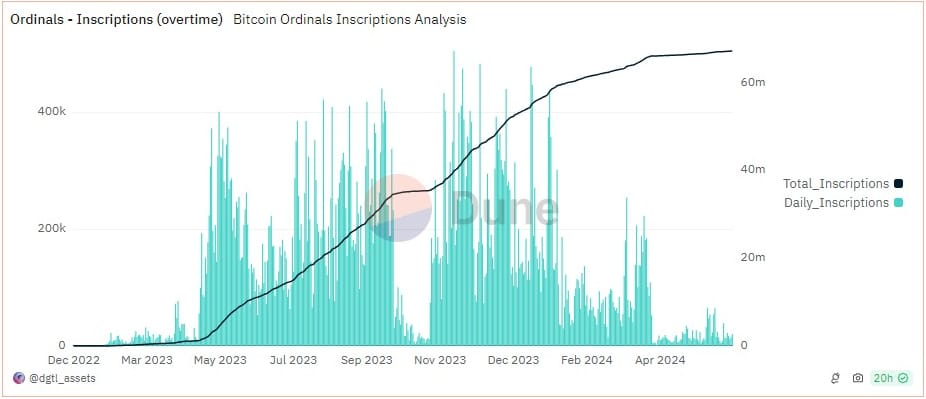

Runes and tokens

The number of Runes transactions has falling once again. Yesterday, only had 41,000. Our proxy for speculative interest in bitcoin is telling no one is interested.

As for the inferior inscriptions, they have managed to maintain a low level of transactions, despite interest being taken over massively by Runes. Yesterday, there were 11,000 inscriptions.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com