Bitcoin Fundamentals Report #295

Bitcoin may have bottomed, Sony to launch bitcoin exchange, political upheaval, price analysis, and mining news.

July 1, 2024 | Block 850,276

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Hope |

| Media sentiment | Indifferent |

| Network traffic | Low |

| Mining industry | Struggling and shifting |

| Price Section | |

| Weekly price* | $63,782 (+$3,499, +5.8%) |

| Market cap | $1.253 trillion |

| Satoshis/$1 USD | 1570 |

| 1 finney (1/10,000 btc) | $6.37 |

| Mining Sector | |

| Previous difficulty adjustment | -0.0494% |

| Next estimated adjustment | -6% in ~3 days |

| Mempool | 194MB |

| Fees for next block (sats/byte) | $0.98 (11 s/vb) |

| Low Priority fee | $0.80 |

| Lightning Network** | |

| Capacity | 5117.69 btc (+1.0%, +49) |

| Channels | 51,360 (-0.3%, -143) |

In Case You Missed It...

Bitcoin Magazine Pro

- Overblown Market Fears: Bitcoin Well Within Range and Now Oversold

- Market Tracker breakdown: Bitcoin at a Crossroads: Price Metrics vs. Derivatives Insights

- Mining Tracker breakdown: Miners More Stable Than They Appear During Price Dip

Member

- BMPRO content a few days delayed

- Short, Medium and Long Term Forecast Update - Premium

- 💢 July price forecast competition

Community streams and Podcast

Blog

- Demographic Collapse: Effects of Urbanization

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

Headlines

Sony Group is preparing to launch a Bitcoin and crypto exchange in Japan after acquiring Amber Group's local subsidiary, Amber Japan. The revamped exchange will be called S.BLOX and aim to boost Sony's presence in the Bitcoin and crypto space.

The move reflects Sony's growing push into Bitcoin and crypto. By leveraging the Amber Japan exchange, Sony can capitalize on its brand recognition and global reach to boost the adoption of its future Bitcoin and crypto offerings.

Japan has emerged as a leading Bitcoin market due to proactive regulation and high consumer awareness. This makes it an ideal place for Sony to debut and expand services.

I think this move signals more than is being interpreted at first glance. This is the Japanese government's way to get in Bitcoin. While Japan is a market economy, but it is unique in the kind of managerial involvement from the government. From Britannica:

Japan’s system of economic management is probably without parallel in the world. Though the extent of direct state participation in economic activities is limited, the government’s control and influence over business is stronger and more pervasive than in most other countries with market economies. This control is exercised primarily through the government’s constant consultation with business and through the authorities’ deep indirect involvement in banking. Consultation is mainly done by means of joint committees and groups that monitor the performance of, and set targets for, nearly every branch and sector of the economy. Japanese bureaucrats utilize broad discretionary power rather than written directives to offer “administrative guidance” in their interaction with the private sector in order to implement official policies.

Last week, the news hit that the US and German governments were selling bitcoin. I wrote about why this would have less impact that worried by many people. That total was $250M. Then today, it is being reported that Germany has sent another $94 million worth of bitcoin to exchanges.

My view of this is similar to my view of dedollarization fears. People think that countries are dedollarizing their reserves because they hate the evil US dollar, when in fact, it is because their economy is struggling to get access to dollars. They are in a dollar shortage. A similar thing is happening with bitcoin sales, particularly in Germany. They are not selling bitcoin because bitcoin is evil and they want to crash it, they need money. Their economy is crashing, the globalist EU leadership is waning, and they need access to some more funds.

Uncertainty over what will happen with the MtGox coins continues. Some analysts believe there will be a significant sell pressure, while others like myself, think the sell pressure has been overestimated and price will adjust upward as these effects are weaker than anticipated.

I point you to Alex Thorns good thread on the topic. He points out there should be much less selling than anticipated. Claims funds have bought lots of individual creditor claims over the years, and individuals left are likely diamond-handed because they refused the claims funds aggressive tactics to buy their bitcoin for years.

Metaplanet, a publicly traded company listed on the Tokyo Stock Exchange and often compared to MicroStrategy, has acquired an additional 20.2 Bitcoin (BTC), valued at approximately 200 million Japanese Yen (around $1.2 million), the company shared in a Monday post.

This brings their total to 161 BTC, small compared to Microstrategy, but big in its psychological effect on investors and other companies. Every time a large company's stock crashes, people speculate whether they should buy bitcoin for their cash reserves to boost their price back up. This is go from meme to reality soon enough.

Macro

- Biden seals fate with debate performance

I don't want to get too deep into politics on this letter, but the Presidential debate last week was momentous. Biden appeared to not be all there on the largest debate ever with 51 million watching, and likely double that if you include all the rebroadcasts. This has created a rift in the Democrat party, with Biden refusing to step aside, this could turn into a major win for Trump with some major macro implications.

With Biden, or a replacement, trying to come from behind, will likely lead the the opening up of the SPR once again and dropping gas prices. There might even be outright stimmy check again as a bribe to vote for Biden. They unilaterally forgave some student loan debt, which will act as a stimulus, and are now running a $1T deficit every 3 months. All this is simulative in the short run. Of course, on the back side that will saddle Trump with the fallout recession in 2025.

If all this crazy Democrat drama leads to low voter turn out for them, you could see a massive win for Republicans in the Congress as well, flipping everything Trumps way for how he will deal with that recession. He's already said he will drill baby drill, which has massive geopolitical effects as well, but he is likely to tackle a recession with tax cuts. If he doesn't want runaway inflation, he'll have to pair those tax cuts with slashing the bureaucracy and he'll have the support of people shown by a landslide victory.

All that said, I'll have to update my recession odds soon with this new information.

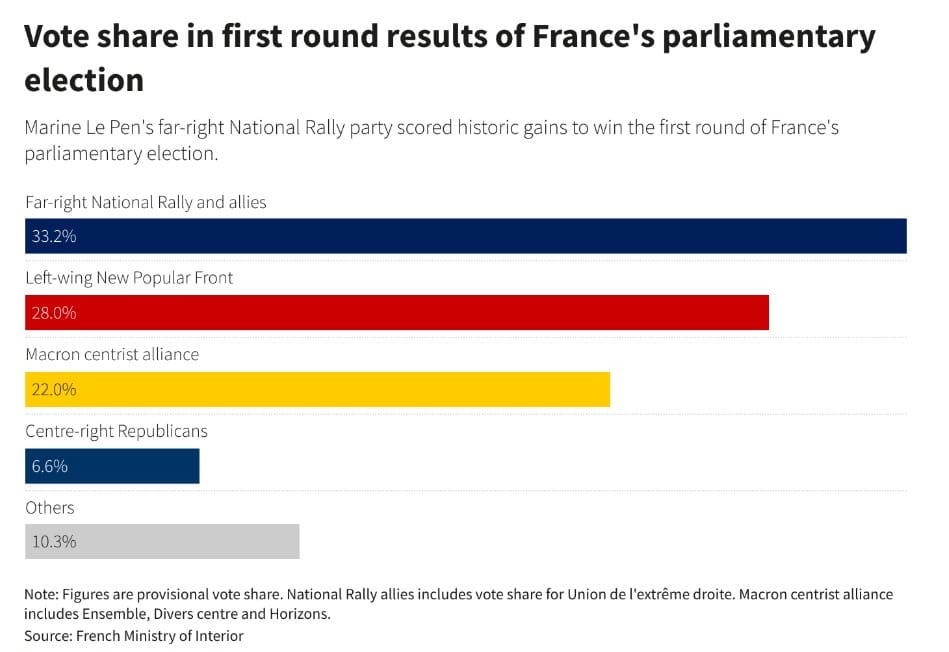

- French Elections

Everywhere we look around the West, my prediction of the rise of populism and the multi-generational pendulum is turning out to be correct. It is not a typical ebb and flow of political allegiances I'm talking about. I'm talking about a wholesale realignment in politics that will parallel a realignment in the monetary system.

This was the first round of voting, and response has been quite violent from the left. Always the left with their violence and not accepting democratic results. There were fiery riots in the streets. This might push some of those others into the hands of the NR and even from the Macron coalition.

Elections in the UK are coming up on July 4th, too, which are also expected to see a surge from the new right in the Reform party.

- US Supreme Court With Huge Case After Huge Case, in Big Hit to Bloated Government

Many people believe that the US experiment and the Constitution have failed. What those people do not realize is the system was not built to be a rigid and fragile system. It has flexibility and ebbs and flows throughout history, but always swings back toward the original intent. There are decades were it moves in a certain direction that might look like failure, but public sentiment changes and a new crop of Justices and politicians rise and take the country back in another direction. The Constitution is there to bend but not break. If the Constitution were dead, why would the Marxists be so furious to destroying it?

The Recent Supreme Court cases that have come down in the last 2 years, and particularly in the last couple of weeks, are a massive win for sanity and civilization. They should serve as a major white pill to doomers who constantly claim Western civilization and the US is dead.

Presidential immunity was upheld. This maintains the rule of law where the President is liable to Congress for a broad umbrella of official duties. They must first impeach and convict him as is clearly written in the Constitution.

Unconstitutional SEC courts were abolished, preserving our right to trial by jury.

Chevron deference was overturned, stripping bureaucrats of a lot of power and curtailing the administrative state.

Second Amendment preserved in several cases.

The only case that was suboptimal was the Facebook case, where the SC dismissed it on standing, keeping them from having to rule on the merits of the government colluding with social media to censor speech. This will come up again very soon.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

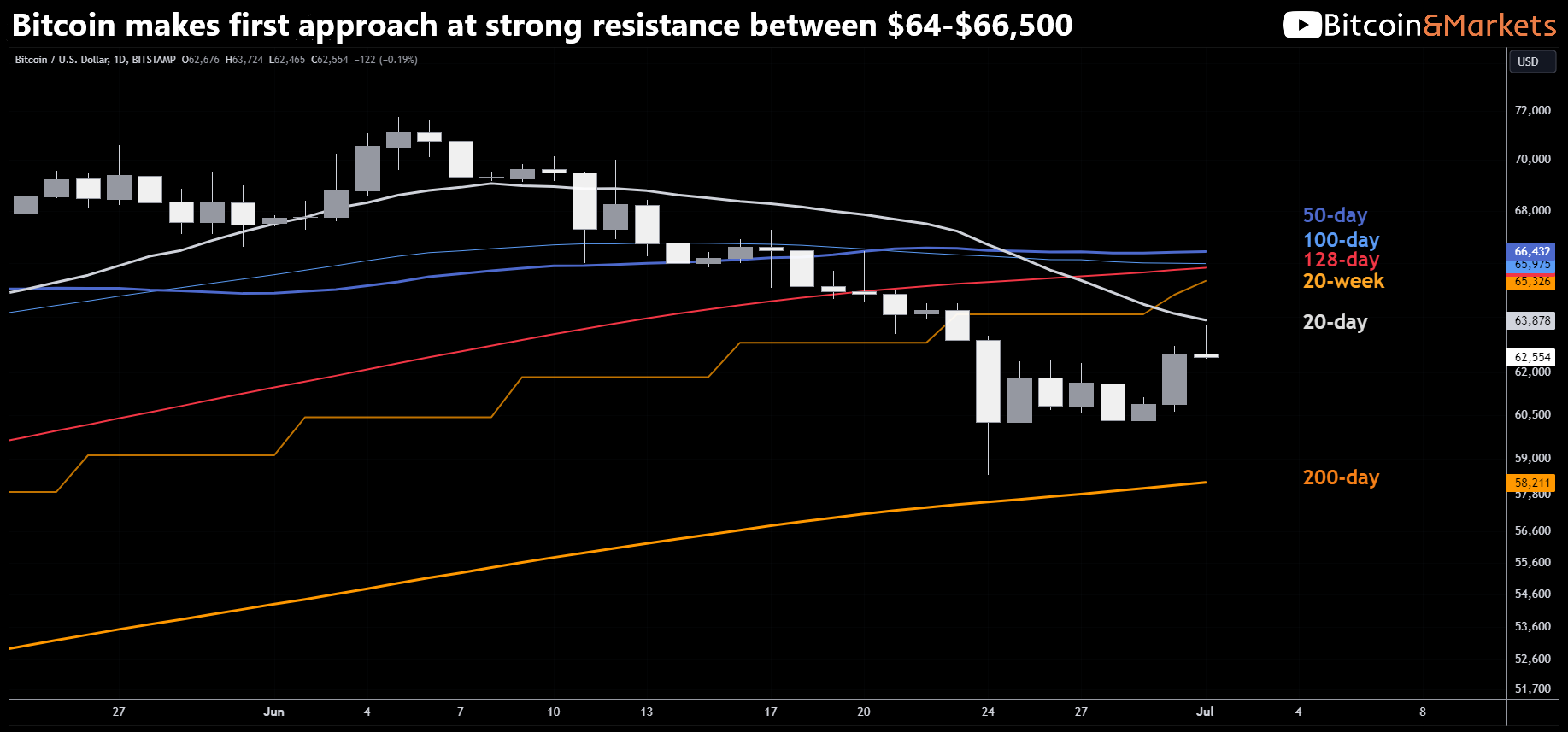

Bitcoin Charts

Last week:

These oversold conditions will get corrected. This is a major milestone for price, being this oversold. [...] This is a great opportunity to buy a dip if you are interested. I expect a bounce to come later this week or next.

So far, we have a weak bounce into the 20-day MA. There is still a lot of resistance above the price, and this bounce is not nearly strong enough break through it. We are not out of the woods yet.

This consolidation range has proven to be a monster. We were able to get to oversold without breaking out of the bottom, with a higher low even.

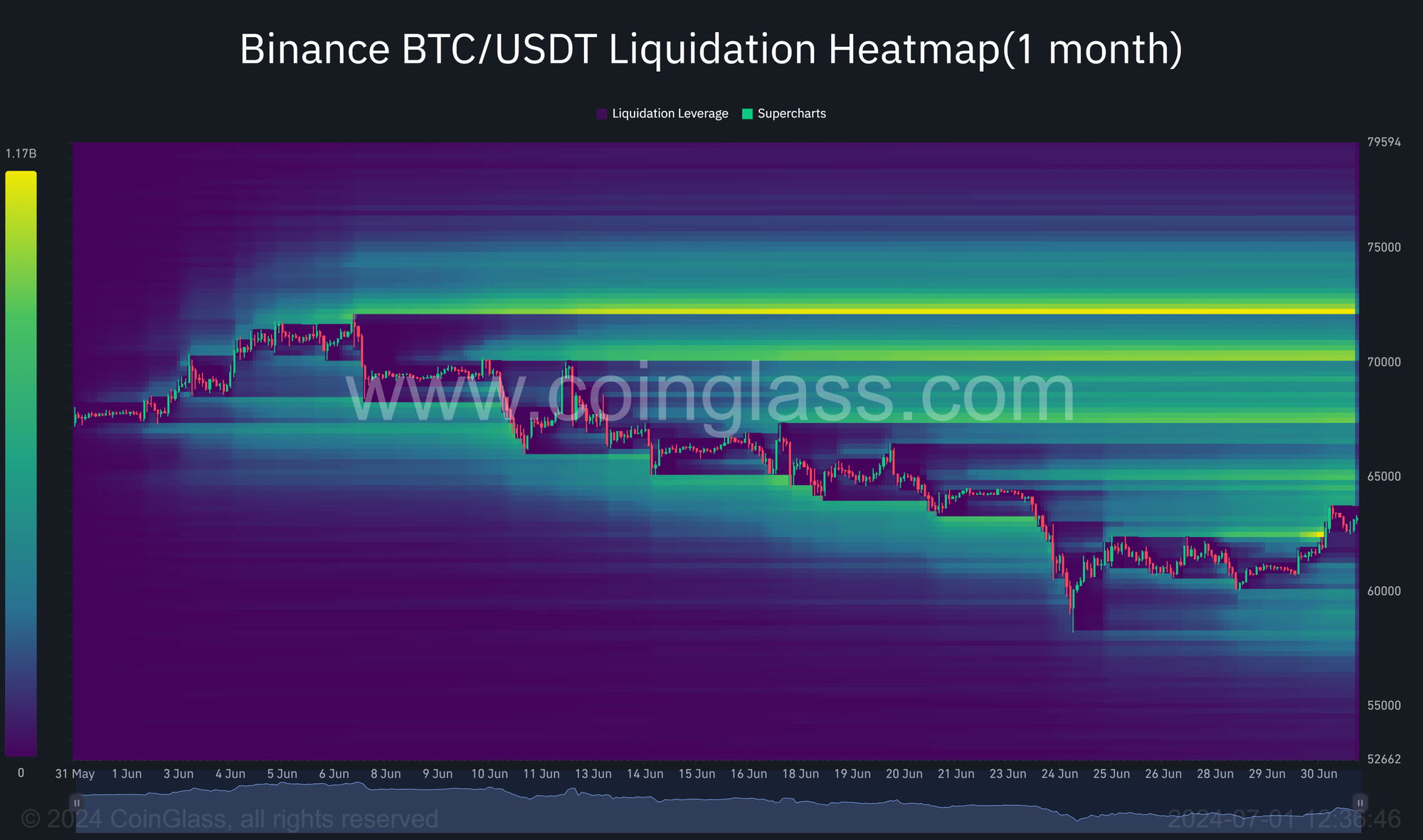

Below on the 1-month Heatmap, the upward cascade becomes more clear. Each level moving higher in price is going to reveal buying pressure from short liquidation, This is going to dwarf any selling from governments or MtGox creditors. Each level unlocks moving to the next level higher.

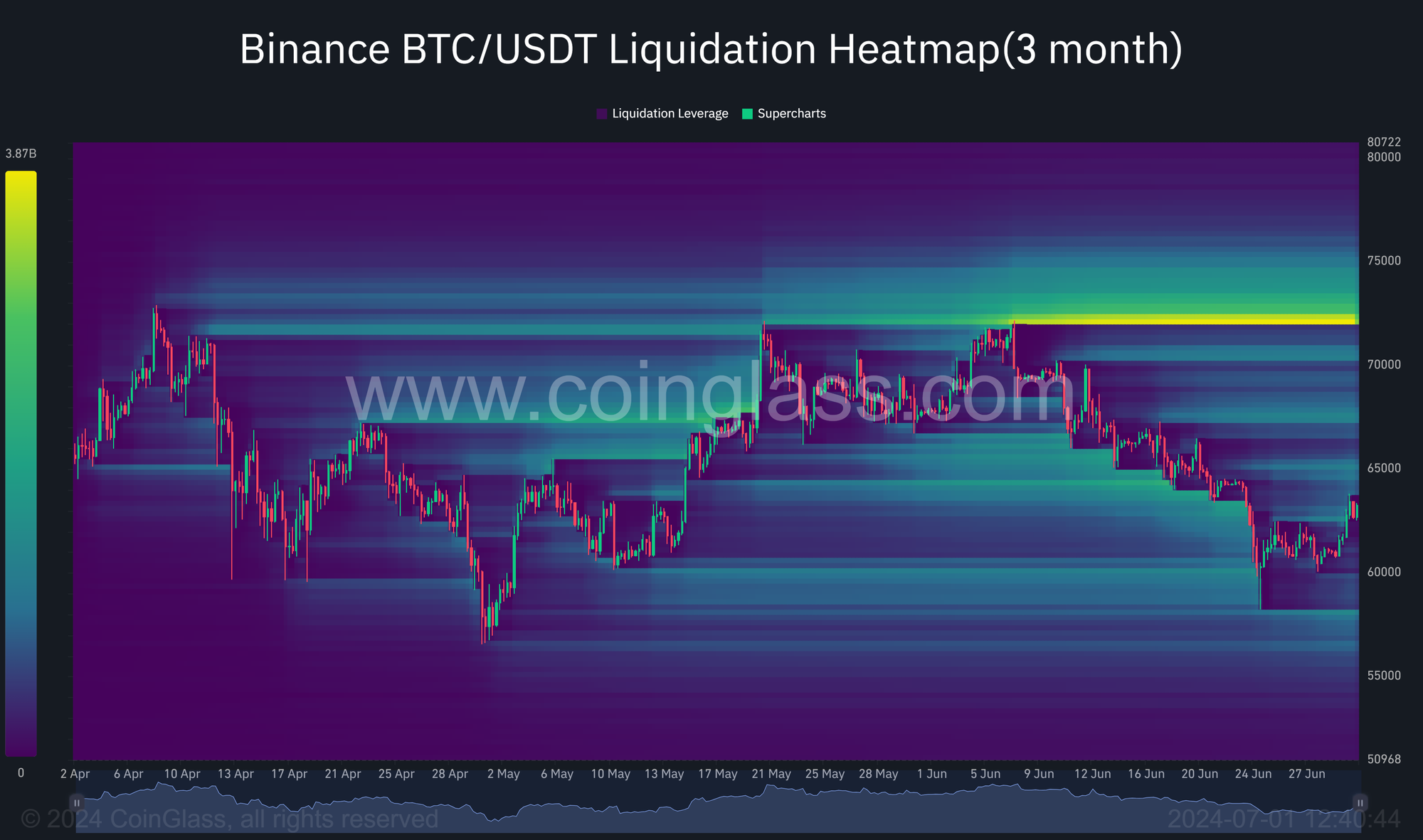

Examining the 3-month liquidation heatmap, we can add all the liquidations for this one trading pair on one exchange up to $12.75B in liquidations to be had between $72-$73,000.

My important levels to watch are the top of the flag at $61,800. If we close below that number, we will likely see a lower low close and bullish divergence. To the upside, the level to watch is the 50-day MA at $66,500. That would also be breaking all the other resistance I showed above. Uncertain if we can get there this week, but I still think July is going to be a big month, because the bearish selling has been overestimated.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

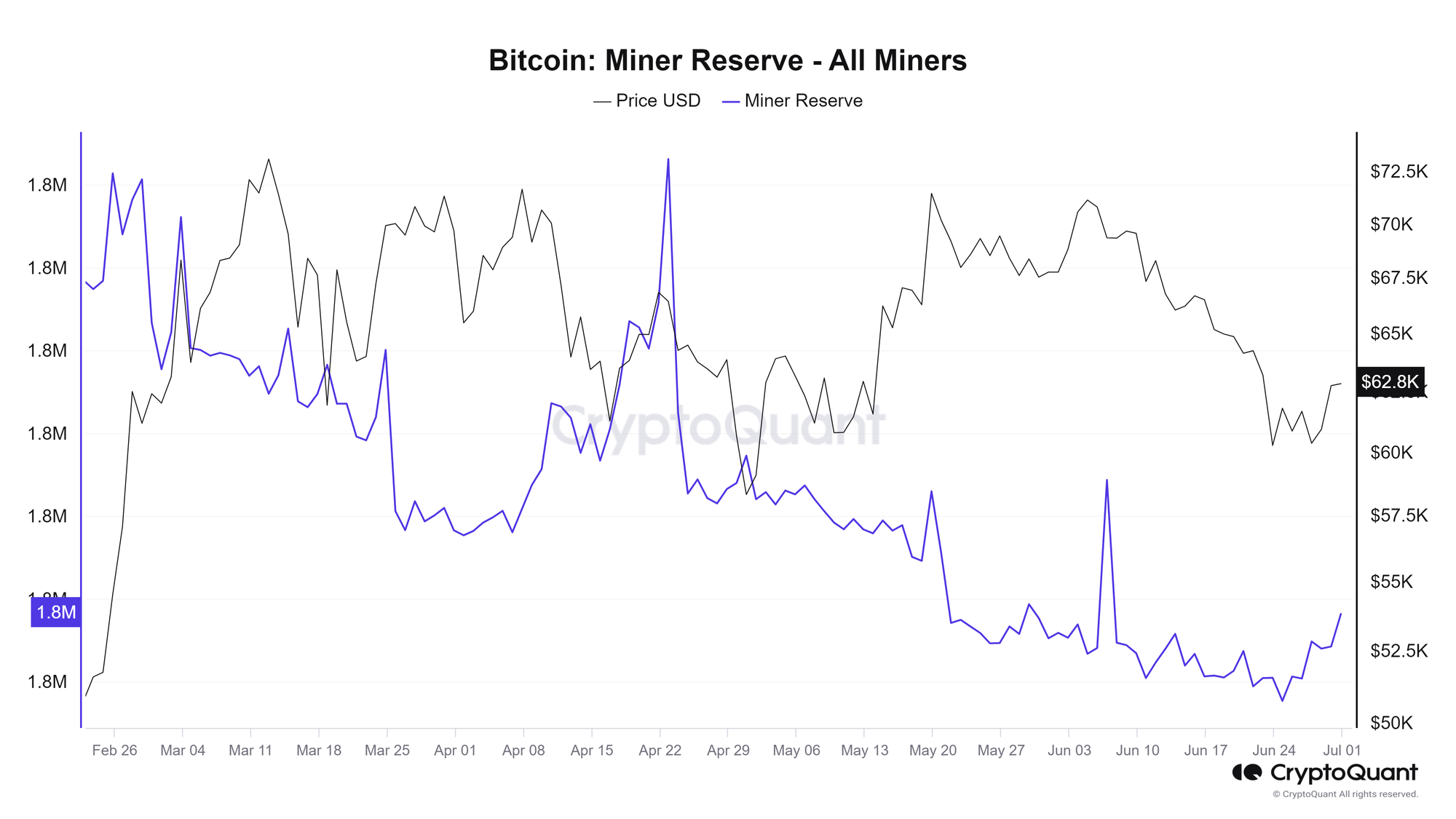

- Miner Reserves are leveling out and increasing slightly

This is a positive development, the miners have stopped selling for the time being.

Several bitcoin miners have become increasingly vocal about their diversification strategies post-Bitcoin halving, with many venturing further into AI.

Hut 8 is among them, recently revealing it would look to build out its high-performance computing (HPC) vertical to support AI applications.

The company said Monday it had secured $150 million in funding through a convertible note from tech-focused investment firm Coatue Management. The investor deems the miner “well-positioned to accelerate new compute capacity” and advance the AI segment.

Disclaimer: I went long HUT several months ago and am holding a small position.

This highlights an interesting diversification for Bitcoin miners. However, it will lead to some increased risk. When these companies were diversified into Ethereum mining, where the price of ethereum is highly correlated to Bitcoin, the risk of the non-Bitcoin operation negatively affecting their Bitcoin operation was less. With AI, it could get themselves into a situation where they have to sell more bitcoin to make up for losses from the AI operation. I'll be watching this dynamic closely.

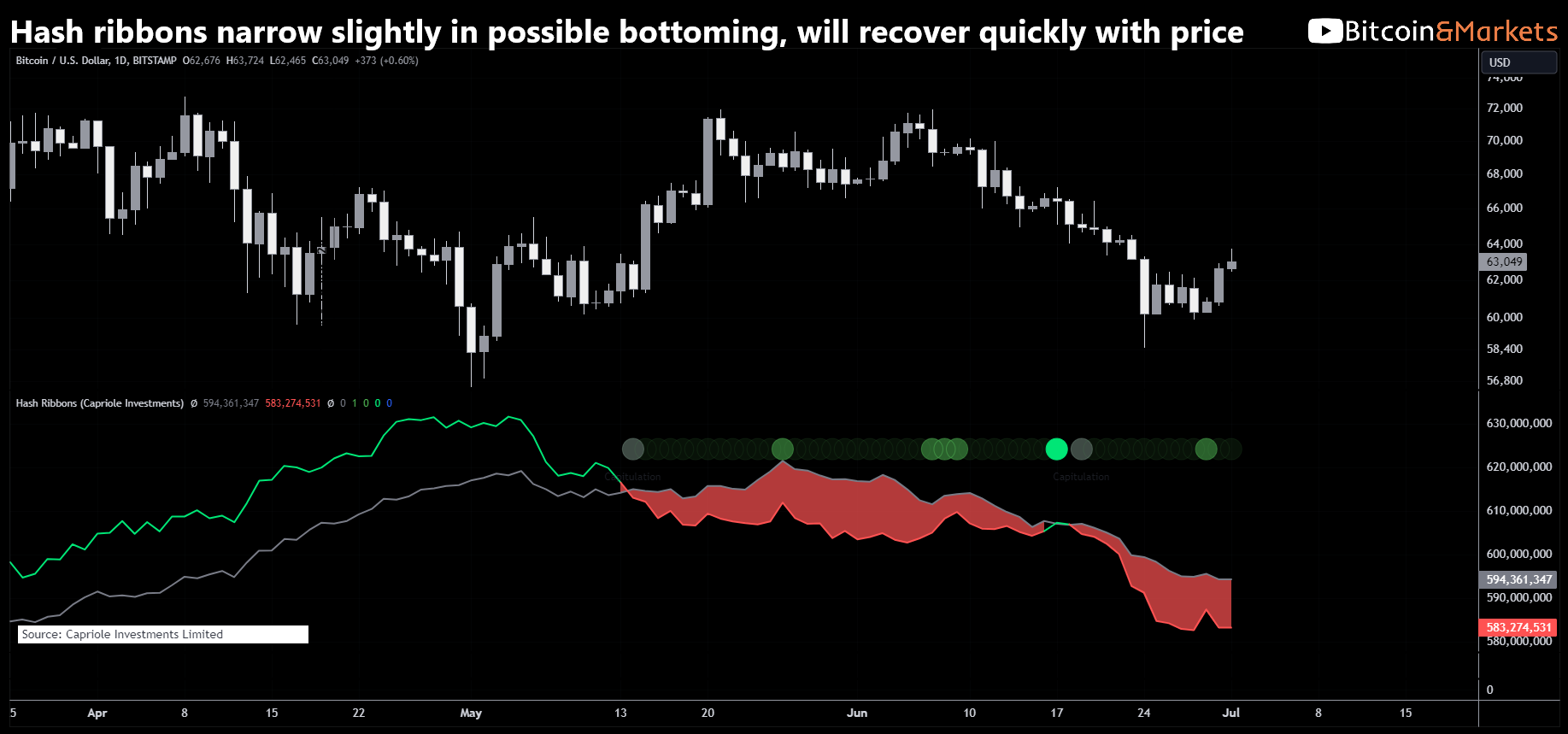

Hash rate and Difficulty

Hash rate hit a major consolidation post-halving. Larger than I had expected, since I was not expecting it to take this long for price to respond positively. The next adjustment in 3 days is expected to be -6%, which should give miners a little more breathing room on profitability.

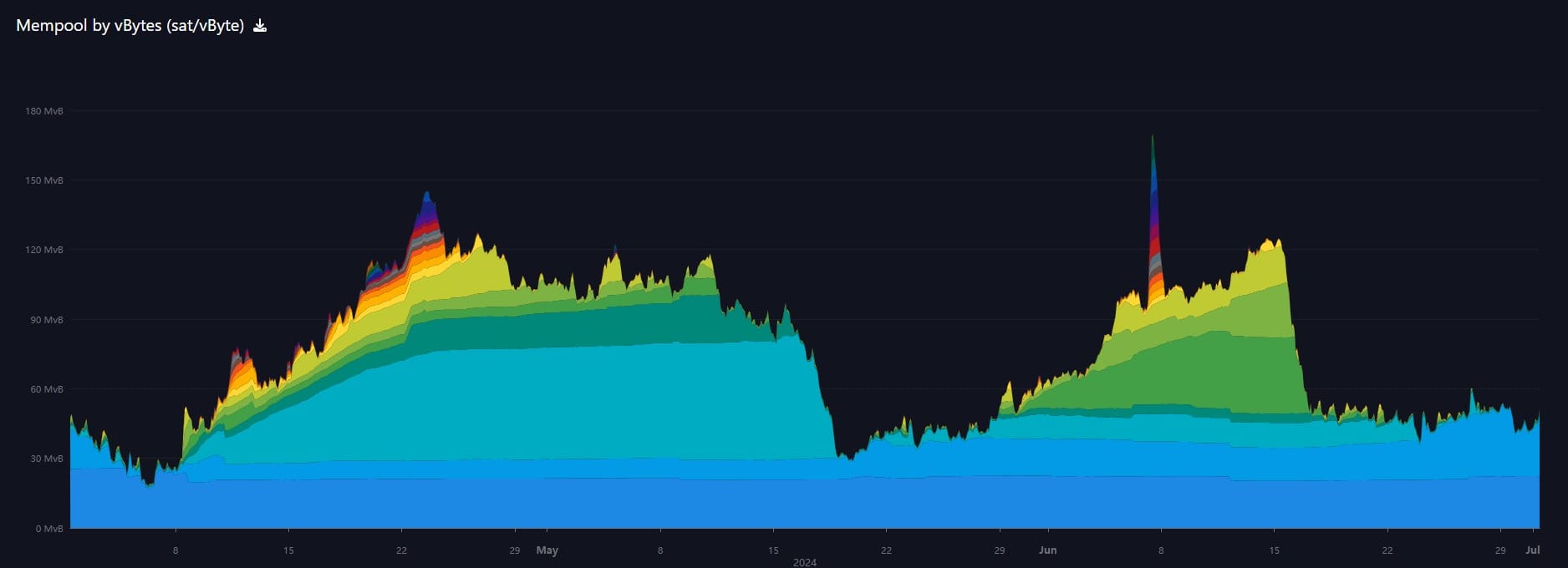

Mempool

The mempool is stable and represents the boring nature of bitcoin activity at this moment.

Layer-2 and Tokens

NSTR

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com