Why a Bitcoin 6102 Won't Happen

There are several misconceptions about the details of the program that make people unreasonably worried today in regards to bitcoin

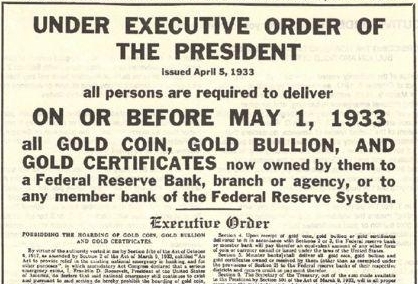

Executive Order 6102 back in 1933 required Americans to turn in their gold coins. There are several misconceptions about the details of this program that cause unnecessary concern about the potential for a similar government action regarding bitcoin today.

First, gold was not confiscated in the strictest sense of the word. Every American was instructed to turn in their gold coins and was paid $20.67 per ounce. Although it was "compulsory" and reprehensible, many believe that the gold was seized outright without compensation, which is incorrect. It was a government buyback program of sorts.

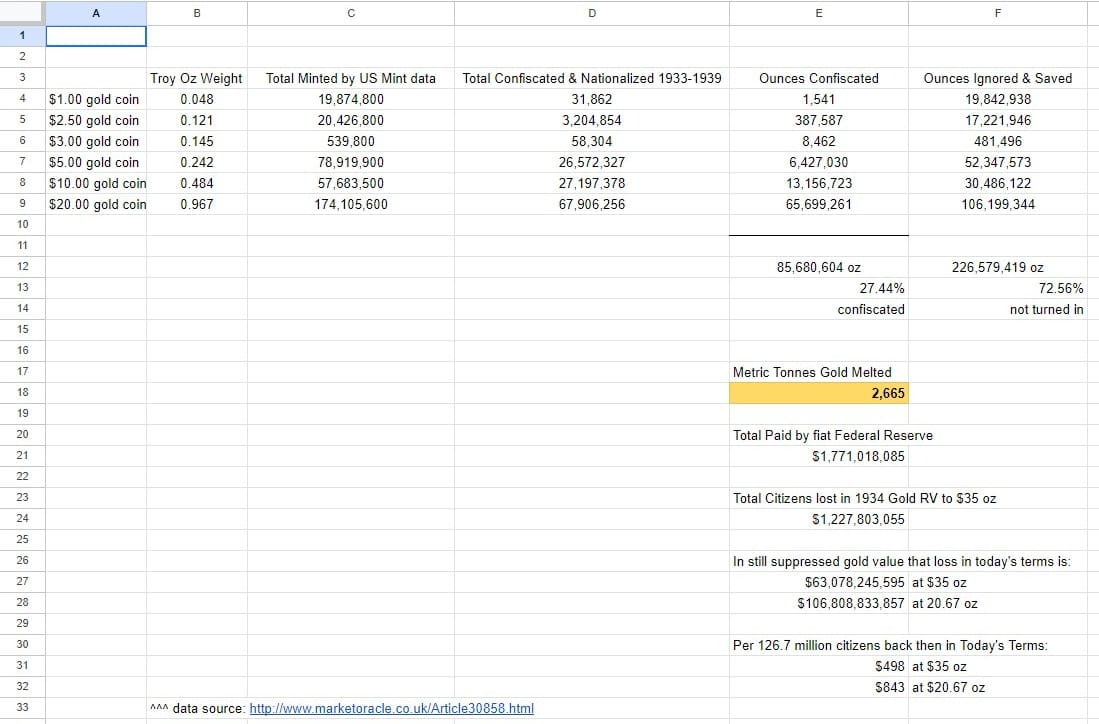

Second, not all the gold was taken—not even close. According to SD Bullion's analysis, 85,680,604 ounces of gold were bought back, representing just 27.44% of the gold in circulation. There were also broad exemptions: artists, jewelers, dentists, collectors, and industries that used gold were not subject to the order. Additionally, each individual was allowed to keep up to 5 ounces—worth $100 at the time, or approximately $10,000 in gold today.

The reasons behind the order are also frequently misunderstood. While it's true the government wanted to print more money, why didn't they just do that? Why did they need to seize the gold? The dollar was backed by gold under the Federal Reserve Act of 1913, which required that 40% of the dollar's value be backed by gold. However, by the onset of the Great Depression in 1929, the government was nearing that limit, making it difficult to print more paper dollars to stimulate the economy. Whether you agree with it or not, the gold backing and the Great Depression are what drove FDR to issue Executive Order 6102.

Today, the situation is very different. The dollar is not backed by bitcoin (yet), and we are not in a deep deflationary depression like the Great Depression. Most believe we are dealing with high levels of inflation.

In 1933, a large percentage of the population held gold, whereas today, very few people hold bitcoin. At the time, politicians and their Keynesian economists blamed the Great Depression on people hoarding gold and silver, which they believed reduced money circulation and hindered the economic recovery. FDR sought to increase money circulation to end the depression.

Today, policymakers do not face the same constraints imposed by a gold-backed currency. The current Silent Depression is not blamed on people hoarding bitcoin. Confiscating bitcoin would not enable the government to print more money. Bitcoin is not legal tender and would not undergo revaluation as gold did.

Another critical difference between the 1930s and the 2020s, as Balaji recently pointed out in a tweet, is that the 1930s occurred during an era of increasing centralization of power by governments. It was a period between the world wars, characterized by a focus on national industrial output and government control over the economy's critical sectors.

HISTORY IS RUNNING IN REVERSE

— Balaji (@balajis) January 11, 2024

The Bitcoin ETF is the spiritual reversal of Executive Order 6102. Back in 1935, they seized the gold. But now, digital gold is back.

Ninety years ago, FDR and his fellow travelers rode the 20th century arc of centralization. The chokepoints of… pic.twitter.com/oZ7I8q1sQZ

Today, the trend is in the opposite direction. We are headed into an era of more decentralization. International order is fragmenting, US hegemony is waning, and the prominent political aim is to break the economy through cultural revolution, not fix it. The modern elites want to humble the US by keep it dependent on international trade and the world dependent on the US military. In other words, avoid US isolationism. The US naturally sliding back from its hegemony is the opposite to the situation in the 1930's.

Lastly, today’s elites are deeply reliant on the fragile financial system, unlike the masses who have little wealth. The system is credit-based and highly leveraged, and its stability depends on trust—trust in regulators, participants, and the system itself. Seizing bitcoin would severely undermine that trust, especially given that many billionaires and institutional investors own bitcoin, and significant financial products are tied to it. The elites have more at stake.

Summary

Executive Order 6102 was not as severe as many believe. While it was wrong and deeply unpopular, gold was not taken without compensation, and the government only took 27% of the gold in circulation, with significant exemptions for individuals and professionals.

The primary reason for 6102 was the gold standard, which we don't have a bitcoin standard (yet), and the Great Depression. The tyrannical executive order was executed in a time characterized by a centralizing of power, unlike today, US dominance is waning and globalization is threatened. Moreover, the elites now have more to lose from a loss of trust in the system due to its credit-based nature.

For these reasons, a Bitcoin 6102 is highly unlikely in the foreseeable future.