Bitcoin Minute: 13F Deadline, Big Players Quietly Expand Bitcoin Holdings

Each quarter, entities with more than $100M in AUM must file a 13F statement of their asset holdings, due 45 days after the end of the fiscal quarter. The deadline for Q2 filings is today, and while there are fewer major developments compared to Q1, there are still some noteworthy updates. The big news is that investment bank Goldman Sachs now holds over $400M in Bitcoin ETFs, and several international companies are buying MicroStrategy (MSTR) shares.

New Updates

- Wisconsin - additional $15M

Last quarter, we learned that the State of Wisconsin bought $160M worth of Bitcoin ETFs. This quarter, they have added approximately 400,000 more shares of IBIT, valued at $15M. - Michigan - $6.5M

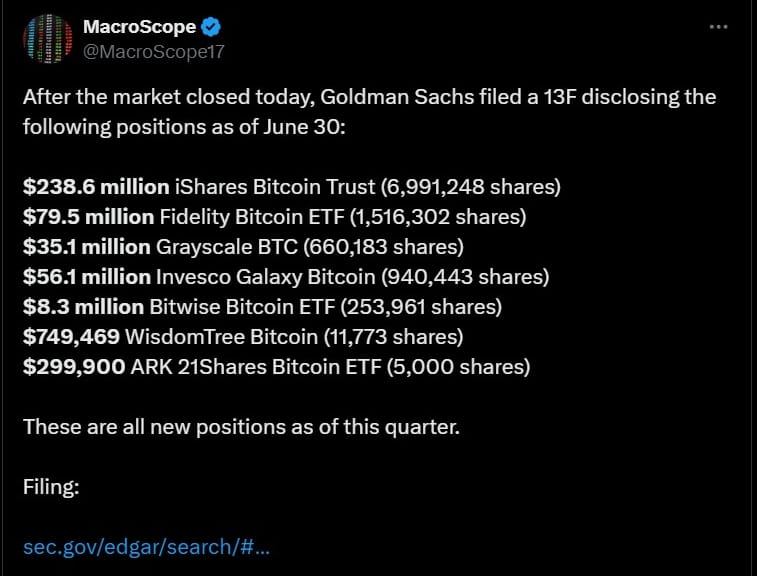

In July, in an early filing, we learned that Michigan's state pension fund had added $6.5 million in BTC in Q2. - Goldman Sachs - $419M

With $2.8T AUM, Goldman's filings show over $400M in Bitcoin ETFs at the end of Q2 - Morgan Stanley - $184M

This is a new position under "Investment Discretion," added to their Q1 total of $270M.

Buyers of Microstrategy MSTR

- Norwegian Central Bank- $152M

- Swiss National Bank - $64M

- Mitsui Sumitomo (one of Japan's largest insurers) - $39M

- South Korea's National Pension Fund - $33M

- Wellington Management ($1T AUM) - $26.7M

While there may be some marginal 13F filings to come at the close of business today, we shouldn't expect any major new position disclosures. Total ETF inflow in Q2 was much less than in Q1, at $2B versus $12B, respectively. However, Q3 is off to a better start with nearly $4B of inflows at the halfway mark.

Sign up for Bitcoin & Markets

Accurate Bitcoin and Macro Analysis you can't find anywhere else!

No spam. Unsubscribe anytime.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.