Ancient Greek Interest Rates

Author: Kent Polkinghorne

Source material: A History of Interest Rates, Fourth Edition by Sidney Homer and Richard Sylla (1963, 2005). This book covers interest rate history dating back to ancient times and contains very interesting charts, tables, and analysis which I will attempt to modernize and summarize with contemporary tools. This data can expand our understanding of different eras of monetary and financial information to make us better investors.

***

Last week, we covered Mesopotamian Interest Rates: 3000–400 B.C. This week we find ourselves in Ancient Greece covering a span of time from the 6th Century B.C. to the 1st Century A.D. As one might expect, with the passage of time, there is more available data on Ancient Greek interest rates than what can be found in Mesopotamia. Loans were still denominated in silver but we now have more specifics as to the types of loans being made.

Background on Money and Banking in Ancient Greece

There are a few facts that can illuminate what money and banking were like in Ancient Greece. Livestock were an important unit of account. The Iliad and Odyssey (8th Century B.C.) mention oxen being used as a unit of account but payments were likely made in bronze or gold. For example, our source text cites an ancient inscription that reads:

“we will pay in bronze and gold to the value of 20 oxen.” - (page 33)

A variety of metal was used in a monetary role at the time such as: bronze, copper, silver, gold, electrum, and iron. Sparta used iron as a monetary metal prior to the classical Greek period. The new heterogeneous form of money, the coin, didn't appear until the 7th Century in Lydia, just east of the Aegean Sea. These coins were made of electrum, a combination of gold and silver. The gold and silver elements were soon isolated and coined independently a few decades later.

The role of private bankers, called trapezitai, became more pronounced in ancient Greece during the 4th Century B.C. Their duties included: changing money, receiving deposits, making loans, making remittances, collecting revenues, honoring checks, keeping books (records of transactions), and so on. When Alexander conquered Persia during the same century, Persia’s precious metal hoard was seized and distributed throughout the Greek territory and, by extension, around the Mediterranean. This caused a period of inflation, along with a period of falling interest rates, thus creating an economic boom.

Background on Ancient Greek Loans

From our source material we can also gather some important information about Greek credit. The earliest recorded loans were made in cattle and by the 7th Century B.C. branched out to the financing of seagoing shipping, thus expanding trade, but was limited by the harsh punishments for unpaid debts. In the 6th century and prior, enslavement of entire families was permitted for unpaid debts; these debt slaves could be sold abroad on the whims of the slaveholder as well. Solon’s reforms ended this practice and as a result, effectively cancelled most of the outstanding debt.

Financial innovation was present throughout these early centuries. In the time of Socrates, during the 4th Century B.C., traders and manufacturers borrowed to maintain inventory while farmers borrowed on land. An interesting category of loans were known as “bottomry loans” which involved providing credit for sailors who were in the business of shipping goods. The hull of the ship and its cargo often served as security (collateral) for the lender. In the event of shipwreck, the loan would not be repaid; however, in the event of a successful voyage, the capital would be repaid with interest.

The book indicates that interest on a round trip between Athens and the Bosphorus would be 30% during wartime and 22.5% during peace. For longer or more dangerous voyages, rates would go even higher. States rarely borrowed, however, in the event borrowing was needed, States had to offer a guarantee of repayment secured personally by some of their citizens in good standing. Money was scarce during these ancient times making the issuing of credit equally scarce. The typical duration of a loan was 5 years.

Types of Ancient Greek Loans

From Greece, we are provided with six different types of loans, along with their corresponding interest rates, which are described below.

1. Normal loans

This is a general category for a variety of loan types which may overlap with some of the other loan types below. Normal loans were provided to men of means, likely with a short duration, and were often unsecured. Our source compares this type of loan with modern personal bank loans. They could be used for personal or productive purposes.

2. Real estate loans

Real estate loans were sometimes differentiated by property in the city and property in the country. Duration ranged from as little as one year (common) to more than five years (less common).

3. Loans to cities

I would assume that these loans would function as municipal bonds do today but no additional details about these loans are provided in our source material.

4. Earnings of endowments

Based on real estate loans and other types of investments. Cities would use these endowments as a means to fund important festivals and religious ceremonies. The endowments were set up and operated by wealthy men of a given city and sought a rate of return commensurate with their needs.

5. Loans for commerce and industry

This category includes loans for sea vessels and trade expeditions. They were likely used for speculation over a short duration. The source text mentions there was little in the form of large industry during this time period and that loans for commercial and industrial activity were risky. Industry in classical Greece would have likely consisted of a workshop and a few slaves.

6. Personal, usurious, and miscellaneous loans

Unfortunately, interest rate data for this loan type was not provided, and thus, will not be featured in the chart provided below. It is worth noting that this loan category would likely involve highly volatile interest rates. Rates under this designation include: rates on “hard bargains,” pawnshop rates, loan-shark rates, etc. These were short term rates by contract but compounded over long periods.

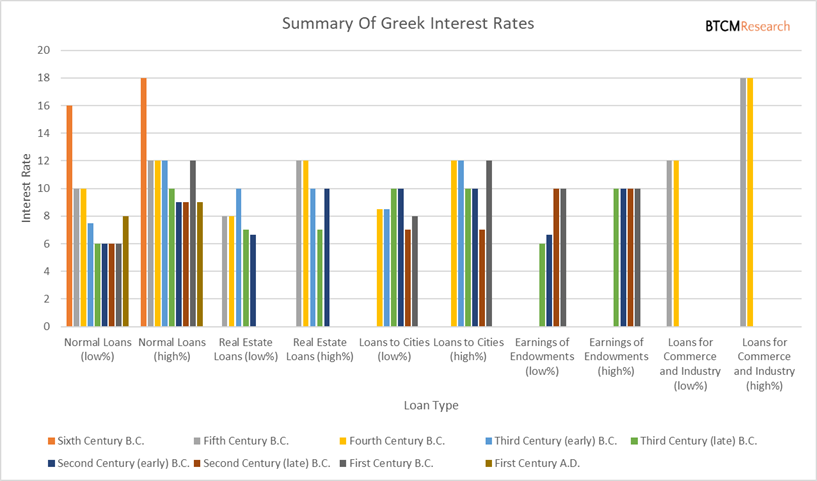

Charting These Loan Types and Interest Rate Data

The interest rates in the chart below are on an annualized basis. When available, the book provides a range of interest rates. I have segmented the low and high-end rates, within a given range, as independent data points. Therefore, the realized rate will fall somewhere between the low and high percentages provided. As an example, we can identify Normal loans during the Sixth Century B.C. according to the orange bars. Each type of loan has two sets of columns, the one on the left representing the low-end of the interest rate range and the one on the right representing the high-end of the range.

Examples of Ancient Greek Loans

Though Greece offers more data than Ancient Mesopotamia, rates are still only available in a range and by century. The information provided is also almost exclusive to Athens. Below, a few examples of loans are provided separated by type. I specifically chose the loans where the loan arrangement itself was personal in nature and most clear.

Real Estate (page 40)

- 369 B.C. A man borrowed on multiple dwellings at 16%

- 346 B.C. Horoi pledge, mill and slaves at 12%

Note: Horoi was the ancient Greek word for “boundary marker.” These boundary markers were placed on land that was being used as security for a loan.

Loans to Cities (page 41)

- Fourth Century B.C. To Oreos; Demosthenes loan secured by revenues at 12%

- 205 B.C. Miletus borrowed on life annuity at 10%

- 71 B.C. Loan made to Gythium (poor credit) by Romans at 24-48%

Rates Earned by Endowment Funds (page 41)

- 221-205 B.C. At Thespia 6-8%

- 100 B.C. At Amorgos 10%

Personal, Usurious, and Miscellaneous Loans (page 42)

Fourth Century B.C.

- Aeschines the philosopher borrowed at 36% and later refunded his obligations at 18%

- Phormio the banker borrowed at 16 2/3%

- Stratocles loaned his money out at 18%

As Greek power waned, they were eventually conquered and annexed by the Romans. Next week's installment will cover the interest rate history of Rome.