Answering The Critics Of The Bitcoin Reserve Bill

A comprehensive refutation of Chris Hayes and Cenk Uygur's misleading criticisms of the Bitcoin Reserve Bill, highlighting its strategic importance and debunking bailout myths.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Critics of the Bitcoin Reserve Bill are beginning to air their distaste for, and frankly, their ignorance of bitcoin. Chris Hayes, host of All In with Chris Hayes on MSNBC, and Cenk Uygur, political commentator and co-creator of The Young Turks, have generously summed up the opposition to this bill. Their critiques, however, are a mile wide and an inch deep. Let's take a closer look.

Hayes and Uygur have very strong criticisms of the Bitcoin Reserve Bill, claiming the plan disproportionately benefits wealthy bitcoin holders by enabling them to offload speculative assets for real money at inflated prices. Hayes frames this as a thinly veiled transfer of wealth from taxpayers to bitcoin elites, orchestrated by Republican lawmakers and their donors. Uygur goes a step further, calling it a robbery, arguing that the bill would add $100 billion in debt while failing to deliver on its promise to reduce the national debt. Both commentators assert that bitcoin, being speculative and volatile, is unsuitable for such a strategic government initiative.

Their arguments also emphasize the irony of libertarian-leaning bitcoin advocates, who traditionally oppose government intervention, now pushing for state support. Uygur warns of a future scenario where bitcoin prices crash after government purchases artificially inflate the market, leading to demands for further bailouts—once again at taxpayer expense. Hayes and Uygur cast the bill as emblematic of political corruption and economic inefficiency, suggesting that it prioritizes the interests of a select wealthy few over the public good.

Sources of Funding

Hayes and Uygur have curiously strong opinions on this bill despite not being well-versed in the subject matter. For example, they repeatedly misuse the term "crypto" when referring specifically to bitcoin and ignorantly misrepresent the funding mechanisms for the purchases. Their concern far exceeds their knowledge level, as demonstrated by several key errors.

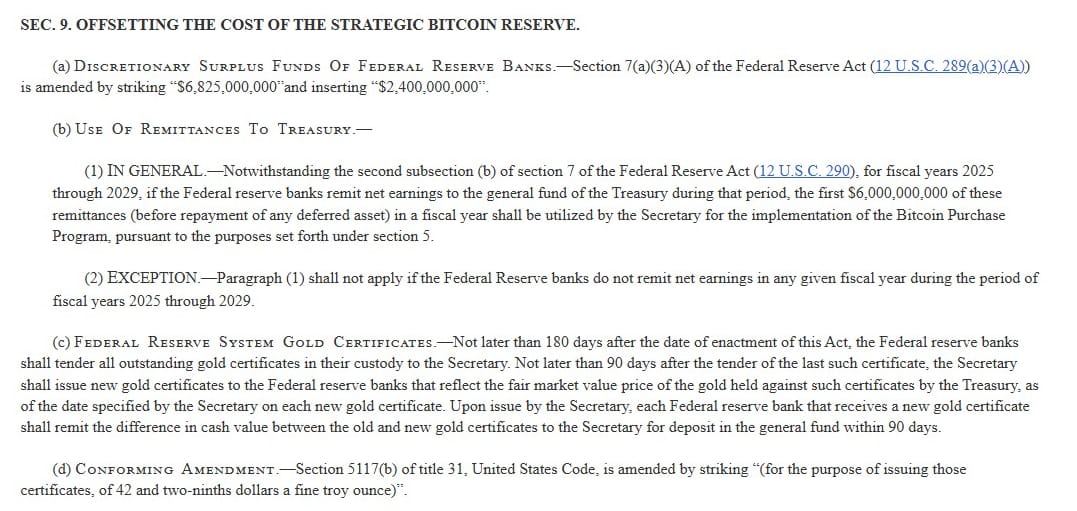

The intended source of funding is clearly spelled out in the bill. The Treasury is to cover the cost of the bitcoin purchases through three primary mechanisms:

- Federal Reserve Surplus Funds: The bill reallocates surplus funds retained by the Federal Reserve, reducing the cap to $2.4 billion.

- Yearly Retained Earnings of the Federal Reserve: Funding from the Federal Reserve’s net earnings is capped at $6 billion per year for five years.

- Revaluation of Official Gold Reserves: This is the most significant mechanism. The government currently values its 261.6 million troy ounces of gold at $42.22 per ounce, a statutory rate unchanged since 1973. Revaluing this gold to the current market price of $2,700 per ounce would generate $695.28 billion. This amount is sufficient to fund the purchase of 1 million bitcoins, averaging $695,280 per bitcoin, without using a single tax dollar.

Bitcoin Is Not Partisan

Next, their claim that this is a purely partisan issue doesn’t hold up. While it is true that this bill has more Republican support, bitcoin enjoys bipartisan backing in Congress. For example, the recent attempt to repeal the SEC's Staff Accounting Bulletin (SAB) 121, that forbids banks to directly custody clients' bitcoin, garnered votes from 21 Democrats in the House and 11 Democrats in the Senate, including Senate Majority Leader Chuck Schumer (D-NY).

Moreover, bitcoin’s supporters include a diverse group of individuals and entities, often unaffiliated with traditional partisan lines. President-elect Trump’s cabinet nominees reflect this nonpartisan trend, with traditional Democratic figures like RFK Jr. and Tulsi Gabbard crossing the aisle to work with him—both of whom are also bitcoin proponents.

Libertarian Commitment to Sound Money

Uygur’s criticism of libertarian hypocrisy misses the mark entirely. Libertarianism has always been rooted in a commitment to sound money, which bitcoin represents. This bill aligns with that principle, as it seeks to diversify national reserves into an asset with finite supply and robust decentralization. Far from being a bailout, this is a strategic investment in a digital-age reserve asset that strengthens financial sovereignty, with benefits for everyone. It is a step along the path to fixing the money, a very libertarian thing.

Bitcoin Is Not as Speculative as You Think

Hayes and Uygur both missed the opportunity to invest early in bitcoin. Not once or twice, but repeated for 15 years. Therefore, they would not be great sources of investment advice or analysis on the value of bitcoin. To be fair, The Young Turks did accept bitcoin donations for a brief period back in 2014 and 2015, but there is no mention of bitcoin on their donation page today.

All investments are speculative. Even purchases of goods and services are speculative, in that you expect a certain value in return but may be disappointed. Financial investments vary in their level of speculation, with some having greater uncertainty in their future value. However, it is the role of risk-takers and entrepreneurs, who either have greater insight or a higher risk tolerance, to invest in these emerging assets.

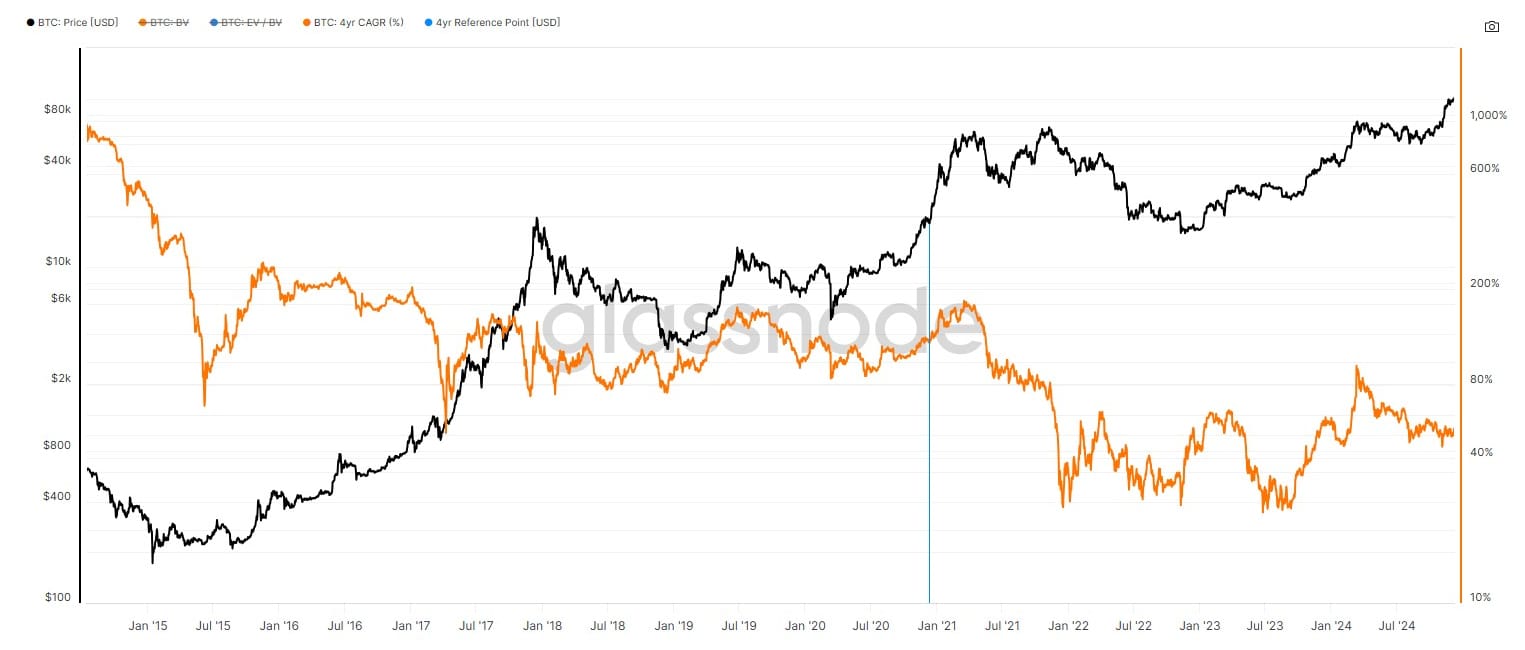

The last 15 years have proven the insight of bitcoin investors correct. Bitcoin's 4-year Compound Annual Growth Rate (CAGR) has never dropped below 23%. That is despite the periodic drawdowns, and bull-bear cycles in bitcoin. It is volatile, but within an overall upward adoption path. While it is possible that bitcoin growth slows down, there is no actual evidence that this trend will reverse. In fact, the more speculative position is believing it will reverse, contrary to the typical pattern for adoption of new technology and the logical path due to the evolution in the broader macroeconomic environment. More on that below.

Bitcoiners Want to Accumulate, Not Offload

Bitcoin investors are not looking to offload their assets onto the government; they are dedicated to accumulating more bitcoin. Supporting the entry of a gigantic competitor for that accumulation runs directly counter to the interests of bitcoin investors. While it will likely cause the price of bitcoin to rise, it also crowds out their ability to accumulate more.

There is a common refrain in the bitcoin space, a holdover from gold and silver investors. To paraphrase, 'I'm thankful for the dip, so I can stack more.' It’s absurd to claim bitcoiners are lobbying for government involvement to offload their holdings. Bitcoiners, who are primarily libertarian-leaning, want everyone to benefit from sound money adoption—that is the primary reason for supporting this bill.

Bitcoiners Don’t Need a Bailout

Hayes’ and Uygur’s argument that bitcoin investors want a bailout is also unsupported by any empirical evidence. With bitcoin at all-time highs, bitcoiners are not in need of financial rescue. However, their argument reveals a deeper strategy to conflate bitcoin with the broader “crypto” industry. By lumping bitcoin in with FTX, Terra/Luna, and other high-profile collapses in the fraudulent crypto industry, they attempt to tarnish bitcoin’s reputation by association.

This tactic purposefully ignores the crucial distinction that this is a bitcoin bill, not a crypto bill. Bitcoin is fundamentally different from the speculative tokens and scams that have plagued the crypto industry. Bitcoin’s decentralized nature, fixed supply, and 15-year track record of resilience set it apart from the centralized frauds, naïve NFT pumpers and poorly designed projects that have come and gone. Bitcoiners aren’t in need of a bailout—crypto scammers are.

Bitcoin Is the Best Defense in a Changing Monetary Landscape

Lastly, we must tie this into the overarching monetary conditions in which we find ourselves, as this is one of the primary driving factors behind bitcoiners’ support for this bill. Bitcoiners are much better versed in the financial system than the average person, recognizing that the current debt-based system is malfunctioning and unlikely to last another generation. They see bitcoin as a viable solution to heal both the economy and the world.

My macro thesis argues we are at the end of a 75-year credit bubble. With diminishing returns on debt and the breakdown of international trust, credit-based money can only lead to economic deterioration. Sound money restores the trust lost by global institutions and enables mutually beneficial trade. Would it be better for your country to lead this transition or lag behind? The answer is clear.

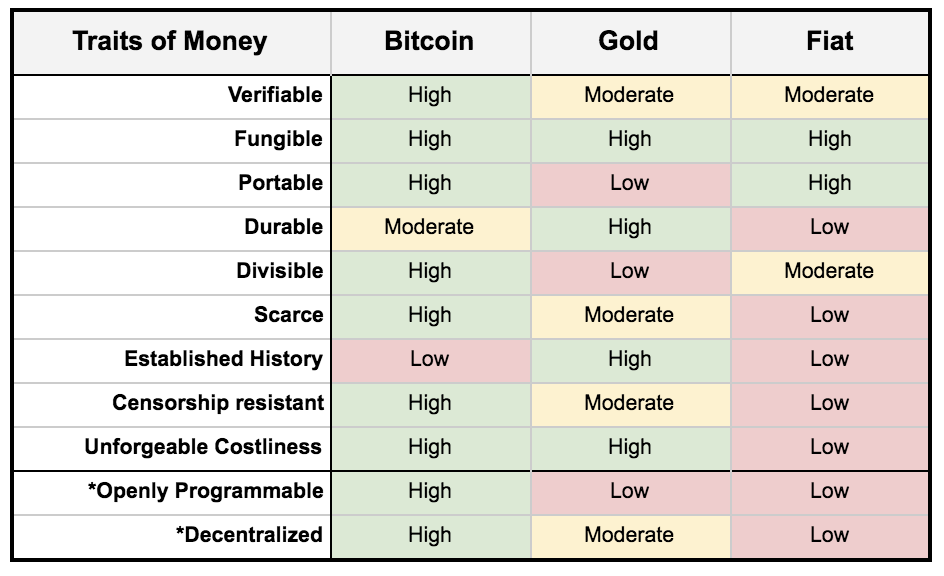

Without bitcoin, gold would likely be chosen in the sound money transition. However, bitcoin has better monetary properties and has outperformed gold in the initial innings of the shift. There is also the emerging risk that nations and institutions could begin dumping gold for bitcoin—the harder money will win in a return to sound money.

The Bitcoin Reserve Bill allows the U.S. government to mitigate risks associated with holding gold while strengthening its balance sheet during a rough transition, all at very little cost to the American people.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.