Bitcoin Headlines that Matter - 11.12.2020

This is the first post of consolidated headlines.

Billionaires talk about bitcoin

Bridgewater’s Dalio Sees Governments Banning Bitcoin Should It Become ‘Material’

Ray Dalio is a internationally known billionaire and has never been a friend of bitcoin. He is also very close to the CCP for what it's worth. In this article, he lays out three basic elementary criticisms: 1) I can't spend bitcoin anywhere, 2) it is too volatile, 3) governments will outlaw it. Did we get transported back to 2014?

Billionaire Investor Stanley Druckenmiller: Bitcoin Better Bet than Gold

Ray Dalio is nearly alone on his bitcoin bearishness. Billionaires like Paul Tudor Jones and Stanley Druckenmiller are lining up on the bull side.

Bitcoin businesses

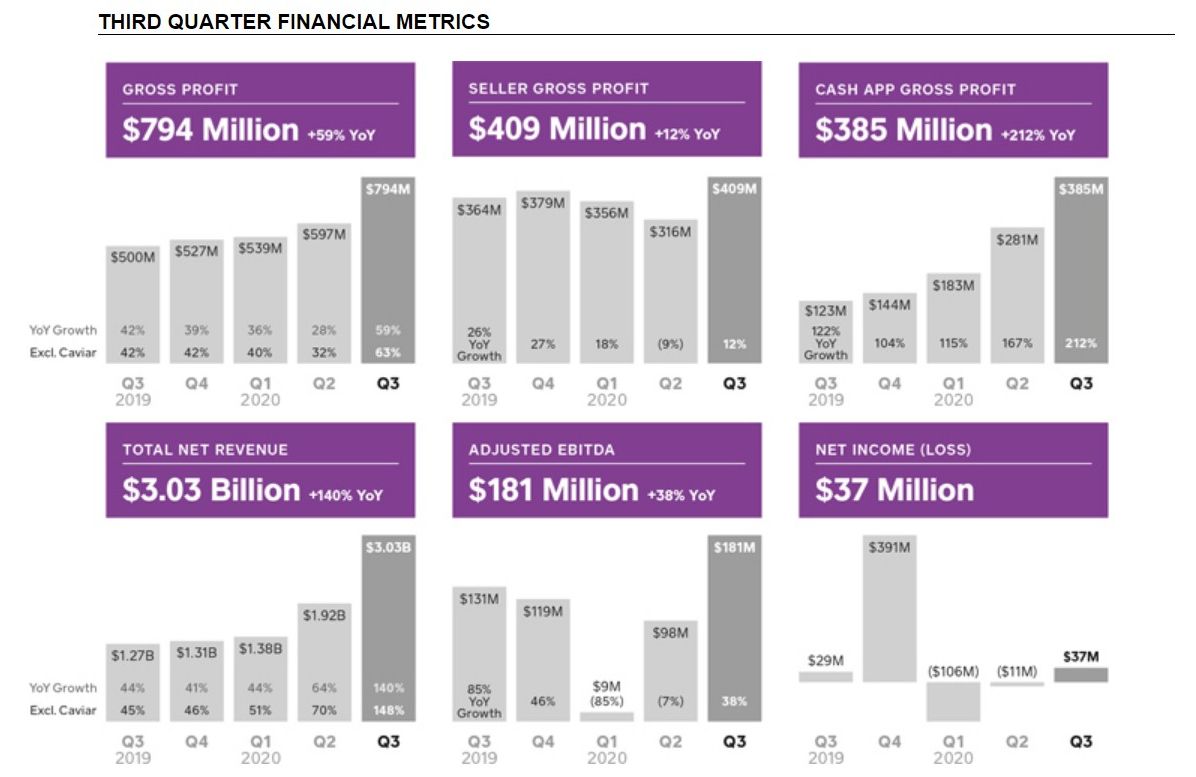

Cash App generated $1.63 bn of bitcoin revenue and $32 million of bitcoin gross profit during the third quarter of 2020

These figures were up approximately 11x and 15x respectively. Cash App is crushing it on the spot market right now. They are friendly to withdrawals and does not track bitcoin beyond the minimum requirements.

A great thing about Cash App surging as a leading place to buy bitcoin is Coinbase gets competition. Coinbase is still one of the biggest vulnerabilities to bitcoin and distributing that potentially harmful influence is key.

Bitcoin Mining

Largest Russian hydropower producer to mine bitcoin

En+ is beginning a project called BitRiver and building a 100 MW bitcoin mining farm, putting it in the top tier of bitcoin mining farms worldwide. En+ operates 4 hydropower facilities in Russia with plans to expand bitcoin mining in other locations.

This is only the most recent of many new mines opening up this year, truly decentralizing bitcoin mining from Chinese dominance.

Defi and Altcoins

ETHEREUM experienced an unintended Hard Fork

Ethereum's hard fork consensus failure was a result of centralized developers pushing a secret bug fix and not telling exchanges, Infura, or other major players. These players didn't update their nodes immediately and the bug was exploited.

Infura, home to most ethereum apps, went offline for an extended period. This hard fork consensus bug has been called the biggest failure of ethereum since the DAO intentional hard fork to steal funds through an "irregular state transition."

This news is extremely problematic for their desire to go Proof of Stake. In the new ethereum PoS algorithm, this hard fork would have resulted in many huge stakers losing their staked coins via the punitive consensus tool called "slashing." The upcoming "transition" period from Eth1 to Eth2 will consist of a very complicated web of consensus, staking, and Proof of Work. Get your popcorn ready.

(1/2) Ok, so what happened today on #Ethereum🦄:

— Nikita Zhavoronkov (@nikzh) November 11, 2020

1. At some point Ethereum developers introduced a change in the code that led today to a chain split starting from block 11234873 (07:08 UTC)

2. Those who haven’t upgraded (@Blockchair, @infura_io, some miners, and many others)… pic.twitter.com/mbRYFU5tgn

Not Enough People Are Staking on Ethereum 2.0.

Again, this is not ETH2.0, this is the first milestone on the path to ETH2.0. The developers have released the code for phase zero with the activation mechanism being a threshold of Ether that must be staked, comparable to Bitcoin's activation mechanism for soft forks of a certain percentage of blocks signaling ready.

They need 524,288 Ether (0.5% of the total supply) from 16,384 stakers to activate and only have 57,000 Ether (10% of the total needed) from 276 stakers (1.5% of the total needed). This is a huge issue! And it points to one of the fatal flaws of PoS, apathy. We can even use this data to estimate the size of the hardcore ethereum community. With only 276 stakers participating up to this point, the total size of the community is likely a small multiple of that number, say 1000.

Hackers Draining $10 Million a Month from DeFi: Report

DeFi hacks have cost crypto platforms and users $100 million so far this year, according to CipherTrace. During the first half of 2020, DeFi thefts accounted for 40% of all crypto thefts and hacks. CipherTrace suggested DeFi protocols are particularly vulnerable to fraud and money laundering.