Bitcoin is a Hedge Against Geopolitical Risk (continued...)

This is a written response to accompany my recent podcast.

Bob Elliot and Michael Green appeared on Blockworks podcast. Starting at minute 49:00 they talk about bitcoin. Their basic premise is that bitcoin has not performed as a hedge against geopolitical risk in the few days since the Israel-Gaza war started, or as an inflation hedge during the recent spike in CPI. Bob says, "We have to be honest, it failed." That is not true, and I will detail why.

High Geopolitical Risk

Bob's claims are based on two false premises, I will discuss both of them in turn.

1) That this period was a period of particularly high geopolitical risk.

2) A hedge against geopolitical risk should react immediately and emotionally at every event that might be a geopolitical risk.

It might come across as ignorant to say the Israel-Gaza war was not a period of high geopolitical risk, but let's let the charts talk.

While it is a tense time, it pales in comparison to other recent events like Russia-NATO. We don't even know why it happened. Why was the most sophisticated and guarded border in the world left unprotected, not just initially but for hours after the attack started? Who was involved as far as funding, planning and training goes? What is true or fake news? We were inundated by visuals of Hamas supporters rallying around the world, and Israeli government officials using extremely violent rhetoric. Stories of events on the first day were the subject of heated back and forth, with very little supporting evidence.

As Bob requires, let's be honest here. What, who, how and why are not clear at all in this situation. Why should we conclude this is highly geopolitically important?

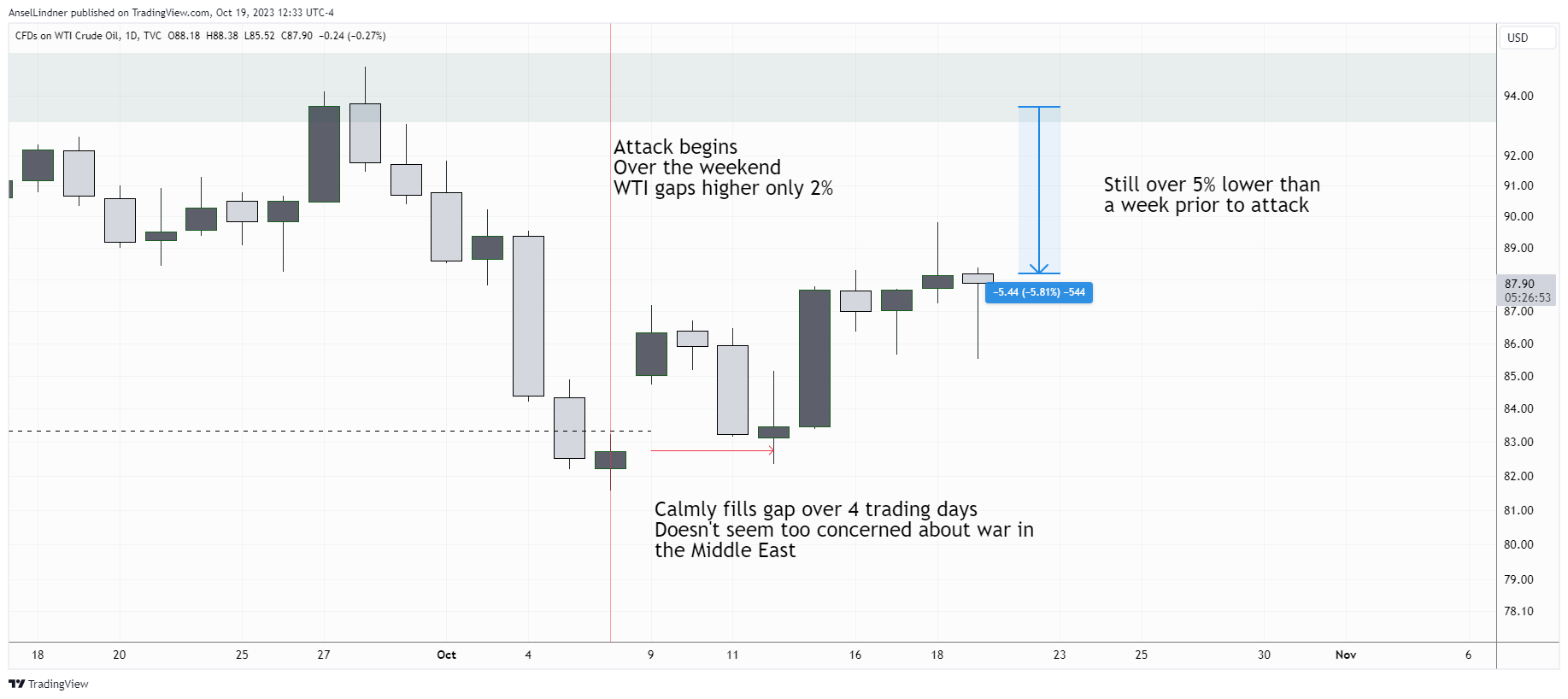

The market seems to agree that this was NOT a particularly high risk-level. War in the Middle East with allegations of Iranian and Qatari involvement, with US politicians calling for bombing Iran, and the oil price drops in the first few days?? Come on, can we be honest here?

That is not how a market would react to a massive geopolitical risk of war in the Middle East, and US politicians threatening to bomb Iran. If the market viewed this event as a massive geopolitical event that Bob and Michael are claiming it was, we would expect oil to rise relatively rapidly, not just make technical moves.

We can use more charts. What about gold other safe haven assets? Gold was cited by Bob as trading as we would expect in a high risk event. What he either doesn't realize or is purposefully avoiding is that gold also is just making a technical move. I pointed out days before hand, gold was the most oversold since 2016 and coming into horizontal support. It behaved exactly as the technical set up would expect, as well.

If I were to show you the above chart, with all axes taken hidden, and you didn't know that this attack had just happened, and I asked you to point out the period of high geopolitical risk, would you pick the little rip at the end? No. You'd probably pick February 2022 or late 2022. And what was going on then? Actual geopolitical risk.

The current conflict is nothing compared to nuclear war between Russia and NATO. There is plenty of propaganda, but the market tells us it's not a significant shift in risk level.

Bob and Michael also claim that, "we have a sample size of one, and bitcoin failed." I don't know what planet these two guys have been living on. Maybe they don't remember February 2022 because they were wrong on their calls back then, I don't know, I don't follow them that closely. But that was a period of actual geopolitical risk.

The Ukraine war is not over either. Recently, under cover of this manufactured geopolitical crisis in Gaza, the US shipped ATACMS to Ukraine. Those are ballistic missiles! The US gave crack-heads Azov in Ukraine ballistic missiles to fire at Russia! Perhaps, any reaction in the markets right now is due to that escalation and not Israel.

Crimea was initially annexed in 2014, bitcoin was around for that. The Syrian civil war started in 2011 and is still going on, along with the fight against ISIS, threatening Middle East peace. Russia was there, too, do you remember Turkey (a NATO member) shot down a Russian jet in 2015? Bitcoin has been here for that. The armies of nuclear powers India and China fought on their border in 2020. Bitcoin was here.

The sample size for how bitcoin behaves in elevated geopolitical stress is its whole existence. It is a relatively new field of study, but here is a study from 2022 that runs detailed statistical analysis on bitcoin and gold against an index of geopolitical risk. They find the following:

The present research is the first, to the best our knowledge, to compare the safe haven abilities of Bitcoin and gold with respect to different geopolitical risk indicators (namely US-China relations, global trade disputes, Gulf tensions, European fragmentation, North Korea conflict, Russia-NATO tensions and major terror attacks). To do so, we carry out a flexible copula approach to shed new light on Bitcoin and gold safe haven statuses under low and high geopolitical risk regimes. Having shown heterogeneous Bitcoin and gold reactions to the seven aforementioned geopolitical risk measures, we develop a composite index that summarizes the seven factors within one risk measure.

Our results consistently reveal a positive and significant relationship between Bitcoin returns and geopolitical risk under rising geopolitical risk periods; similarly for gold returns.

- emphasis added

How Should It Behave?

Bob and Michael claim that bitcoin didn't not perform as we would expect in a period of high geopolitical tension if it was a hedge against that risk. They claim a geopolitical hedge is supposed to rise immediately in reaction to the event. Forget that I just showed that the markets didn't agree that this was a particularly dangerous event, but if it were, how should bitcoin have behaved?

These men might dispute that is their claim, but that is the standard they are holding bitcoin to, saying it failed. Specifically, they imply a safe haven asset would have immediately, and in the fog of war, emotionally reacted to news events within days. That is not the case.

The term hedge has, at least, two related but different meanings. First, a hedge is something that offsets a directional move in something else, I'll call this a mechanical hedge. This would include directional trades like shorts or more complex trading strategies. These types of hedges are by definition perfectly inverse/indirect. Mechanical hedges look to create returns by themselves or returns to offset losses elsewhere.

Second, a hedge can be an asset immune to geopolitical risk. This type of hedge is not necessarily looking to make a return, but to limit losses. They do not mechanically react to events or price movements. They will not perform in a narrow prescribed manner like the first type. I'll call this type a general hedge.

They have their own market dynamics, but are a hedge because their fundamentals are insulated from rising geopolitical risk. They might not perform well at the outset of a crisis, but will catch up later. Perhaps, they spike early but fade, even though geopolitical risks may continue to rise, over the entire period of say months, the asset will end the period higher than it started, even though it fades toward the end.

The way gold and bonds behaved in the few trading days after the attack on Israel is used by Bob and Michael as evidence that bitcoin is not a geopolitical hedge. They are right, bitcoin did not perform like a short or a mechanical hedge, but it is a general hedge.

Inflation Hedge

As a bonus, I'm going to discuss bitcoin as an inflation hedge, because Bob and Michael bring it up in the podcast. They claim bitcoin is not an inflation hedge based on its performance in 2022 against CPI alone and disregard all other data.

Bob wants us to be "honest," so let's do that. Inflation and CPI are not the same thing. If I were more cynical, I'd assume these men were not arguing in good faith, after claiming we need to be honest. Perhaps, it is a little subconscious projection?

Inflation and CPI are not the same thing. Inflation is money printing, more specifically in a credit-based currency it is net credit creation. CPI is a basket of prices that is meant to be a proxy for inflation. CPI closely follows energy prices, which can be drastically affected by non-monetary events (as discussed above). It is slightly ironic that in the same episode, these guys go from claiming geopolitical events can cause price movements, and then implying that prices movements are inflation. There is a deep dissonance in that thinking.

Let's define an inflation hedge. An inflation hedge protects you against losses due to a rise in the money supply. As the units of money go up relative to things in the economy (more money chasing the same amount of goods), it is logical that assets with more inelastic supply curves would retain more of their purchasing power. There could be some assets that disproportionately go up when money printing occurs, but as an "inflation hedge" we, most commonly, are referring to assets that keep up with inflation.

An inflation hedge is a logical construction. Assets whose supply is relatively fixed will tend to perform better during periods of inflation. To say that the first asset in history with a fixed supply is not an inflation hedge, will take much more than arbitrary timeframe comparisons. A logical argument has to be made. Why would a fixed supply asset go down in value in an period of inflation?

Bob and Michael's dismissal of bitcoin as an inflation hedge centers, again, around two false assumptions.

1) CPI measures money printing and 2022 was significantly inflationary.

2) That bitcoin didn't outperform CPI.

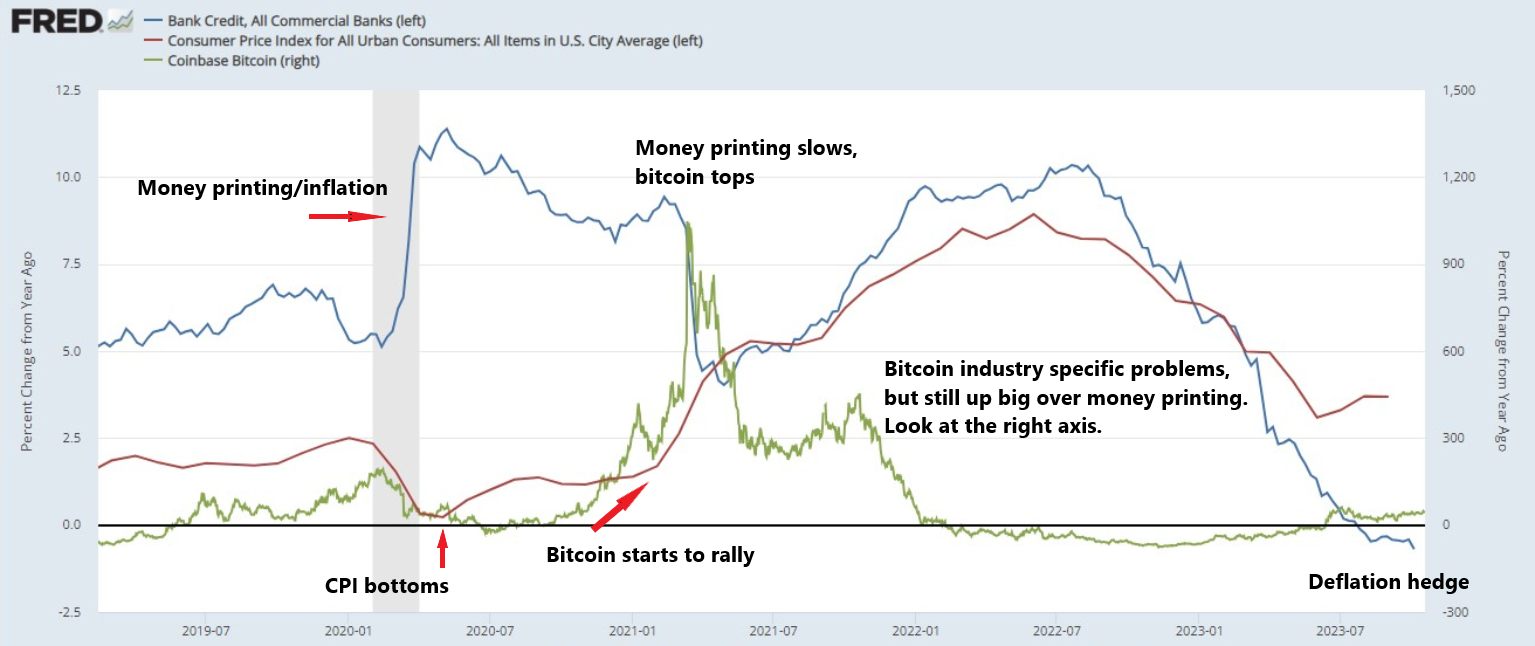

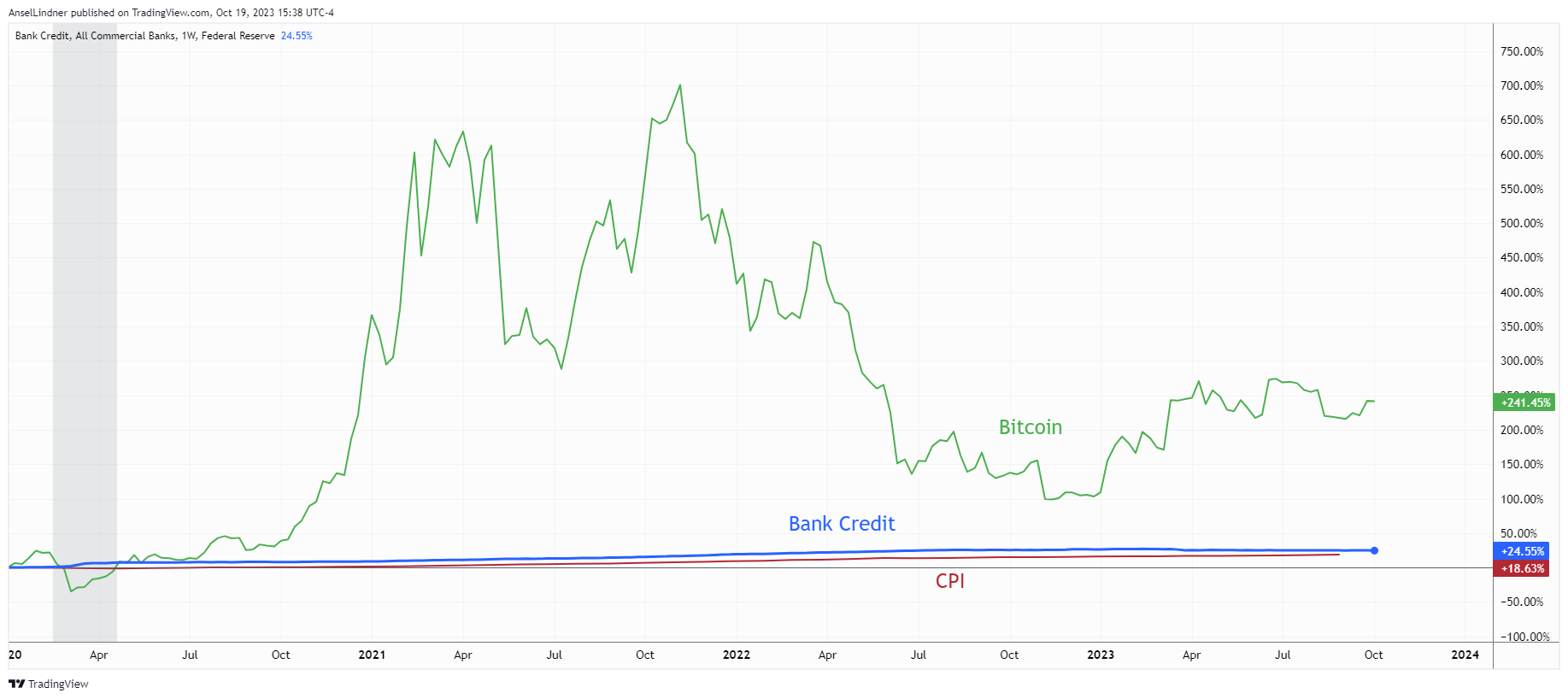

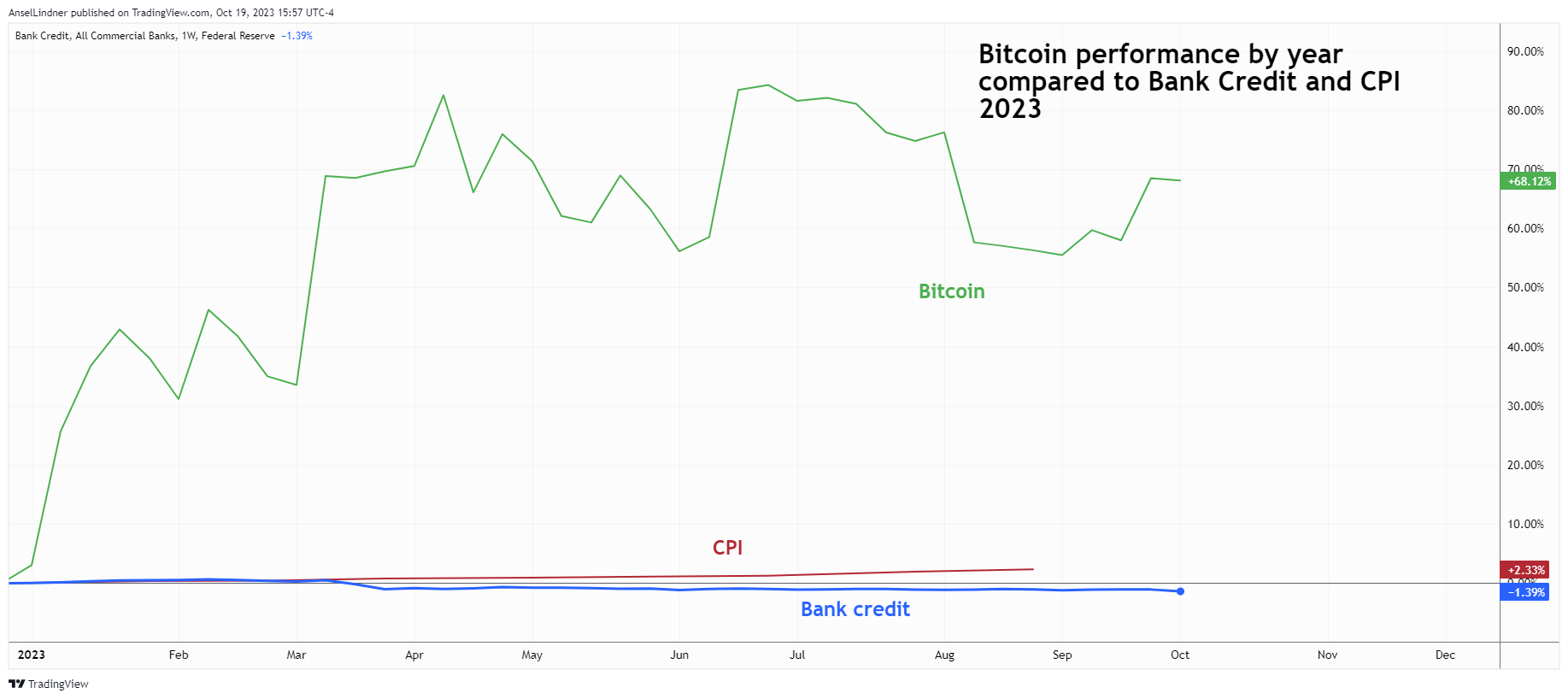

On the chart below, you can clearly see that the money printing (bank credit) comes right before bottoming in the CPI and the start of the bitcoin rally. Once credit creation slowed, bitcoin rises slowed. Then there were some internal industry problems for bitcoin forcing price down in 2022, however, it is still massively outperforming bank credit and CPI.

Also, as an aside, notice the bottom right above. Bank credit is contracting. Bitcoin (and gold) are also deflation hedges in a credit bust.

Year-by-year Performance

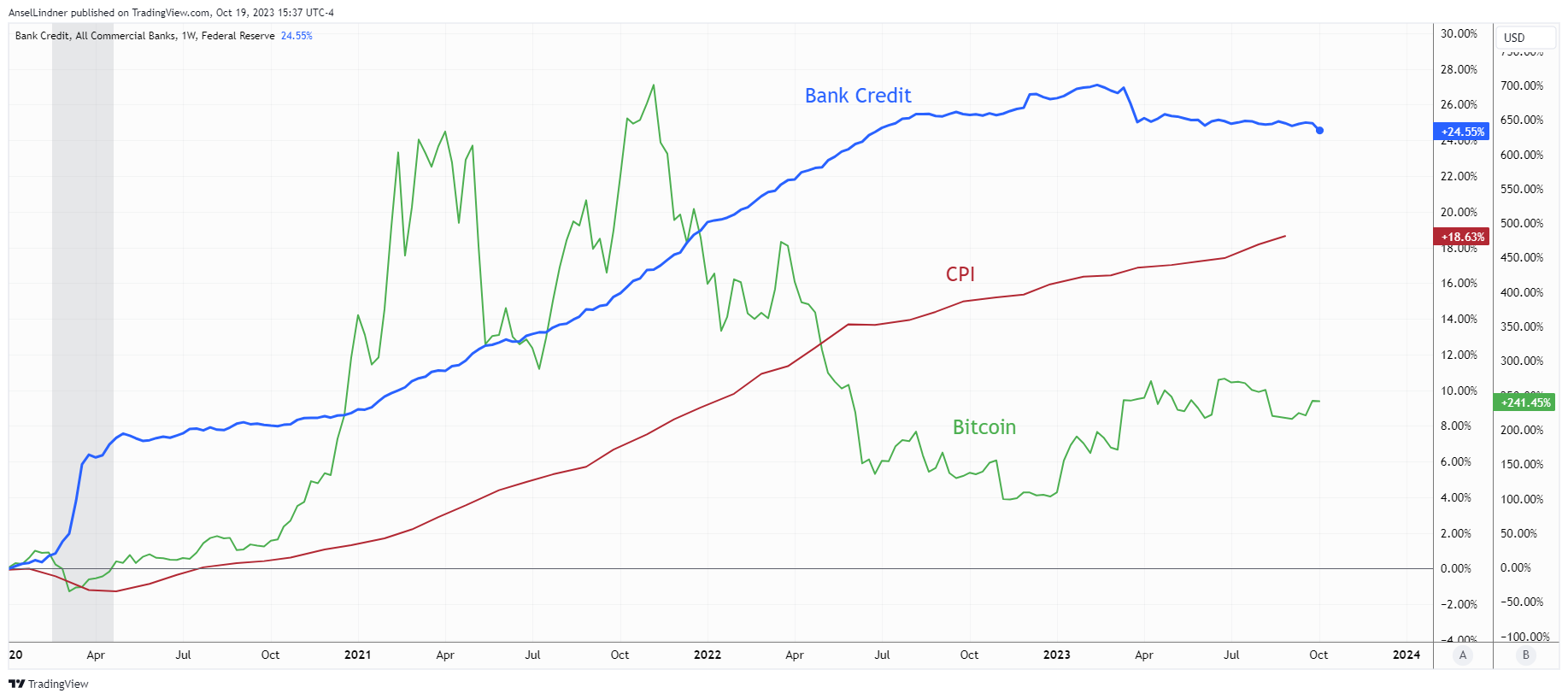

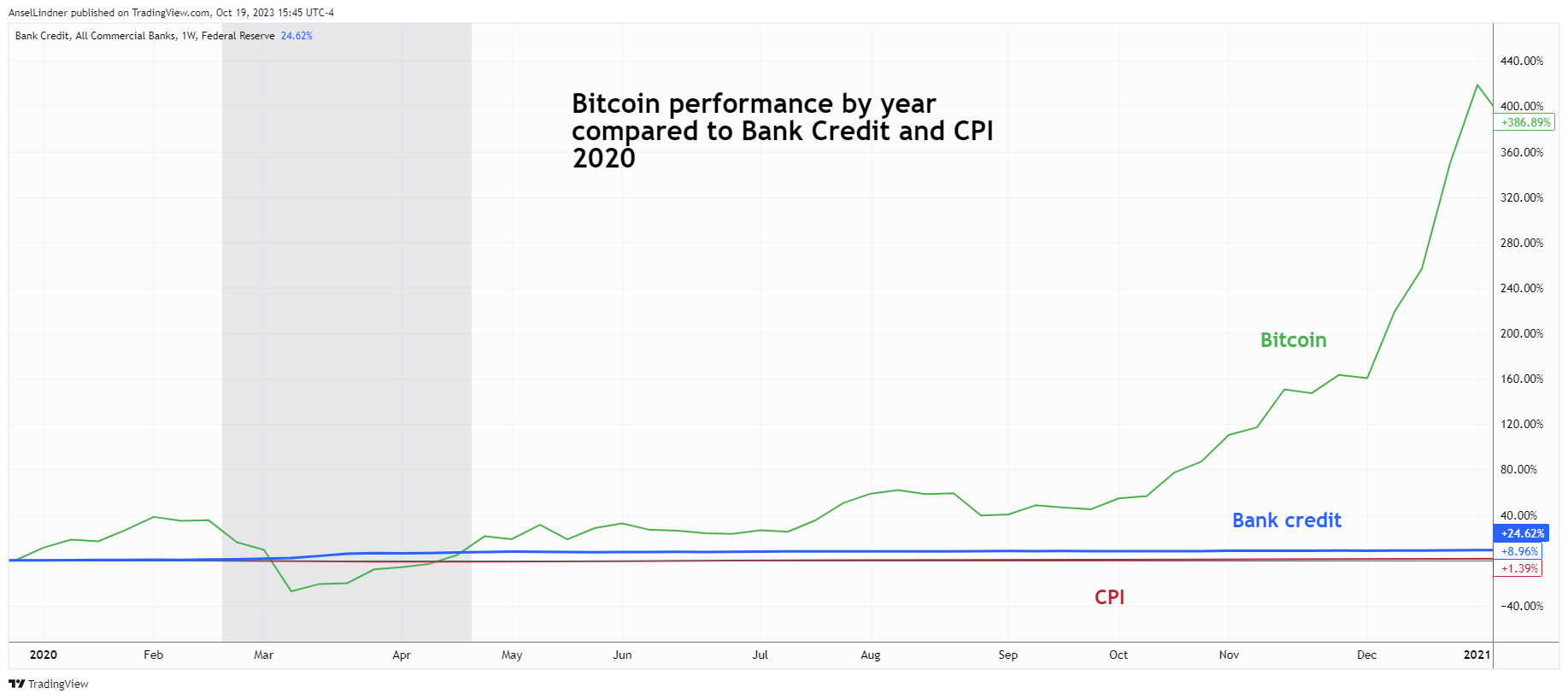

First, 2020. Bank credit (money printing/inflation) rose by 9%, CPI by 1% and bitcoin by 380%. Bitcoin outperformed money printing and CPI by A LOT.

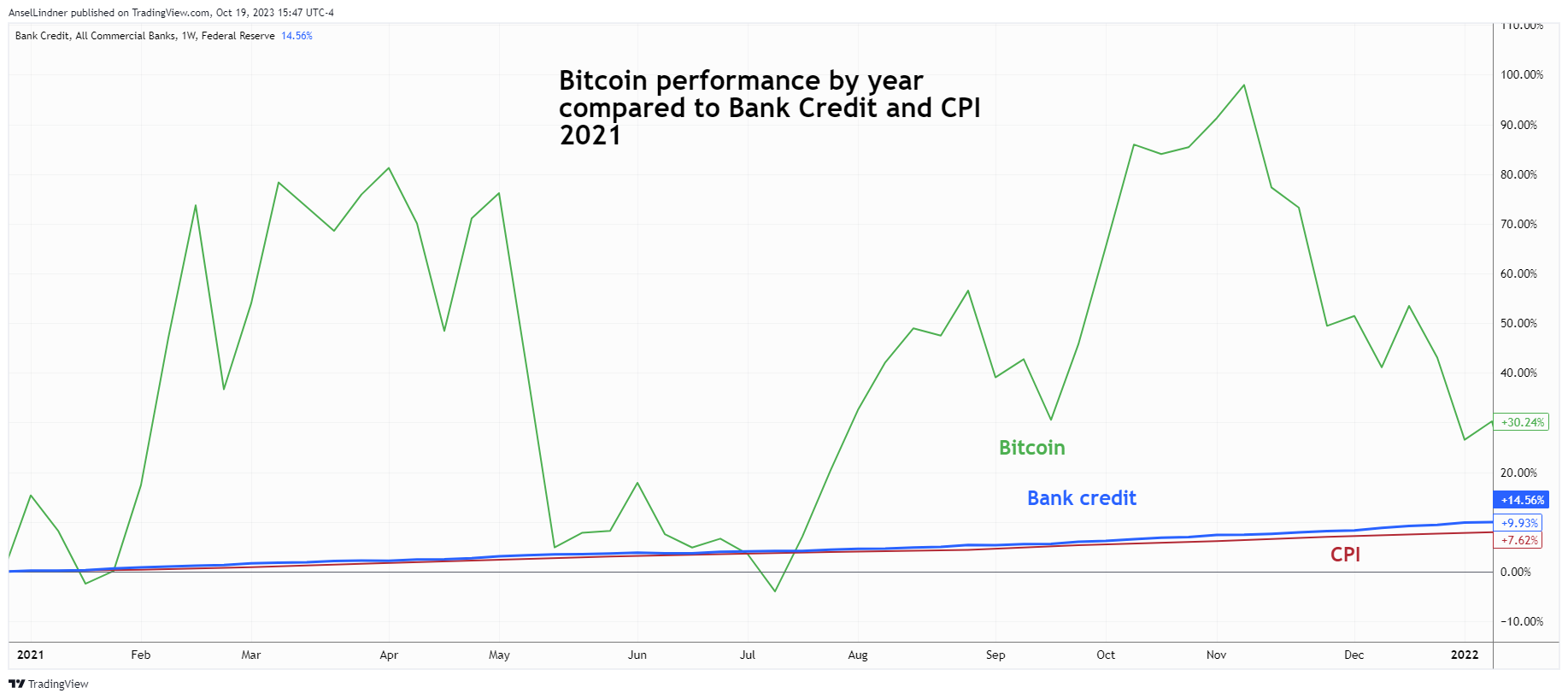

In 2021, bank credit rose by 10%, CPI by 8% and bitcoin by 30%. This is the highest calendar year for credit creation and CPI of the COVID era, and bitcoin outperformed.

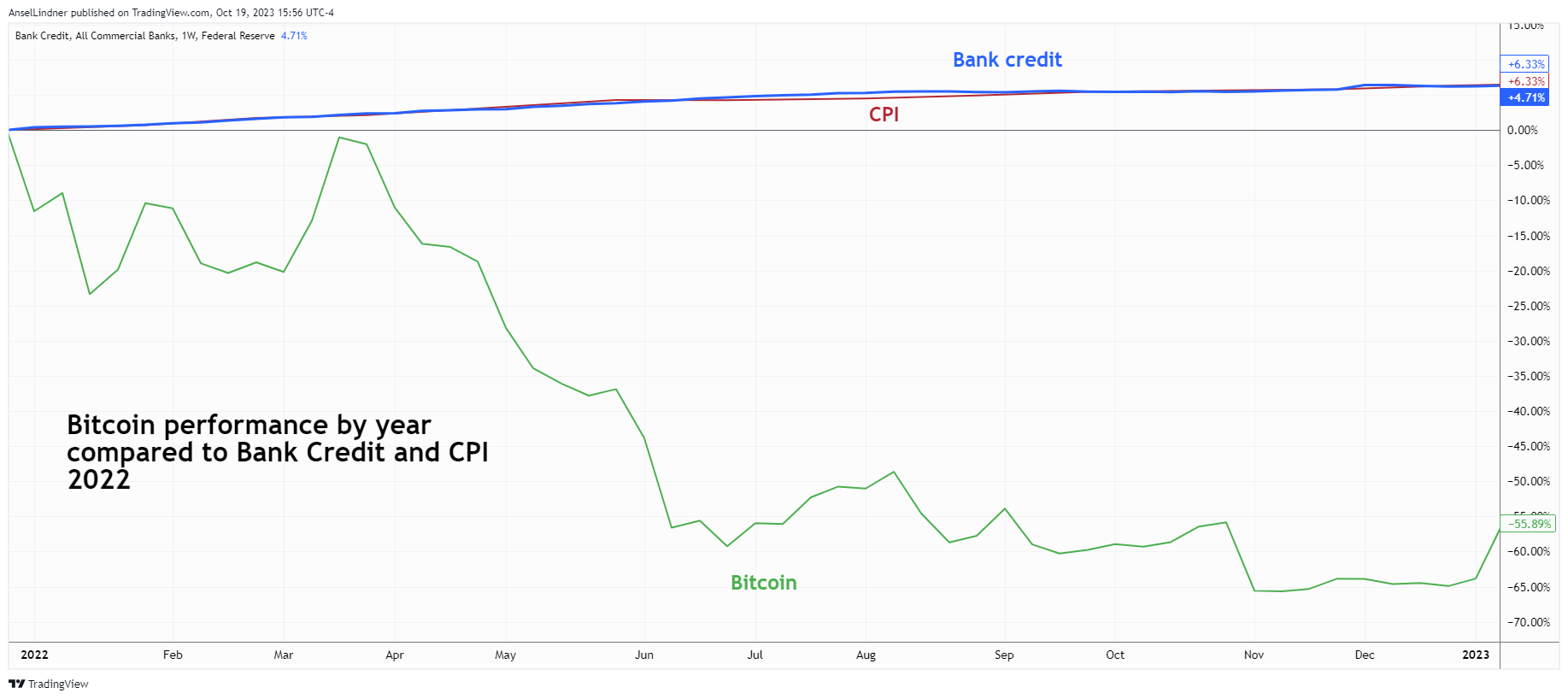

In 2022, bank credit slowed to 6%, CPI slowed to 6%, and bitcoin dropped by 55%. Industry problems set it back, but bitcoin was still massively outperforming the other two as an entire episode of money printing since COVID. This year is an outlier and disingenuous people will hold this single example as evidence bitcoin failed as an inflation hedge.

So far in 2023, bank credit is contracting at -1%, CPI has slowed to only 2%, and bitcoin is up 68%. Bitcoin is also a deflation hedge so win-win.

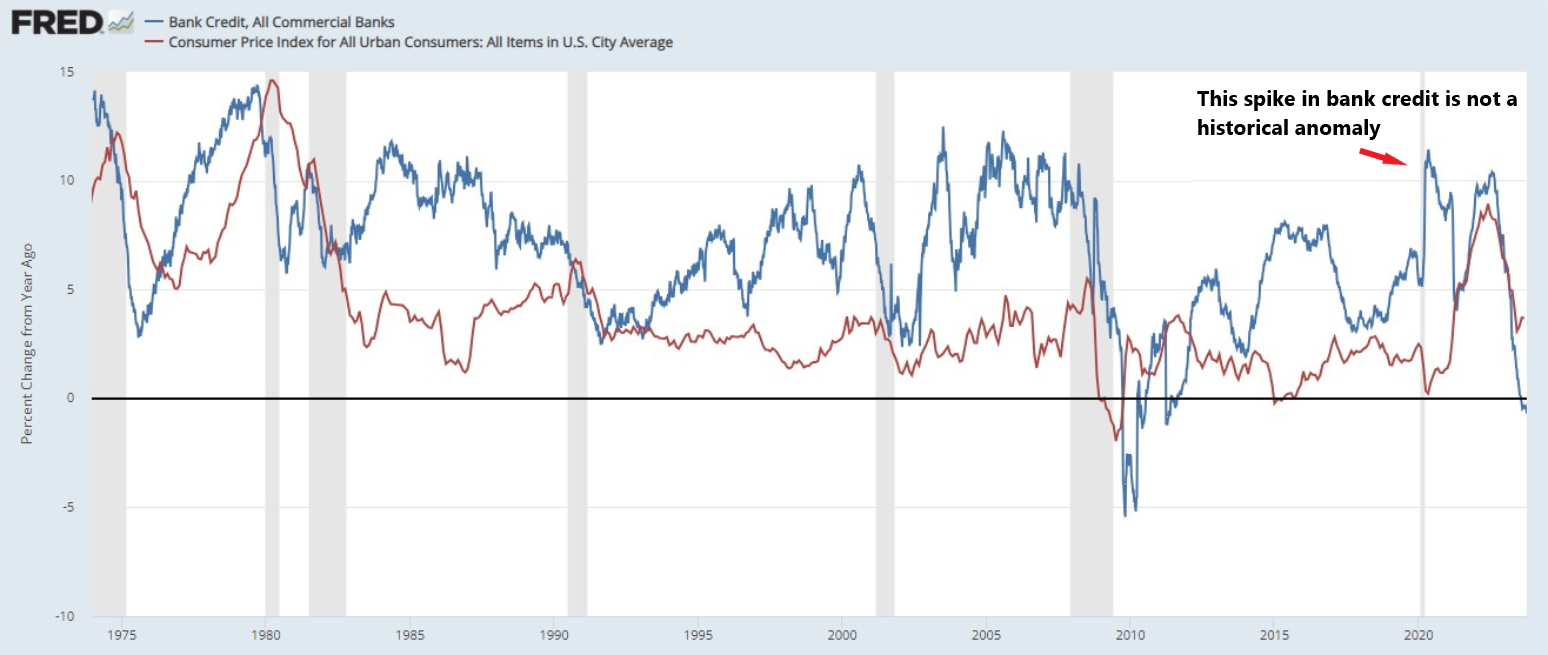

Lastly, to put a stake in the inflationista narrative, certainly post-COVID must have been abnormally high credit creation if CPI got to the highest in 40 years, right? Nope. it didn't even reach the nearly consistent heights pre-GFC. It is simply wrong to claim CPI since COVID is due to money printing alone.