Bitcoin Is The Antithesis Of Fiat

Debunking the claim that Bitcoin is fiat currency. We explore Bitcoin’s non-arbitrary design, market-driven value, and role as a distributed consensus system, while clarifying the true nature of fiat currency.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Long-time Bitcoiner Shinobi recently claimed in a brief Bitcoin Magazine article that "bitcoin is fiat." While this assertion is provocative, it reflects a misunderstandings about both fiat and Bitcoin, and provides a great opportunity to dispel some dangerous assumptions.

Addressing this issue is crucial because if people accept the idea that 'Bitcoin is fiat,' it opens the door for attempts to tame and control it. Although controlling Bitcoin is not possible, that won't stop authoritarians from trying, who are convinced that it is just a collective decision in Shinobi's terms. History shows that some of the worst economic outcomes are a result of central planners or Marxists trying to fight nature. This article aims to break the perceived link between Bitcoin and fiat to prevent such misguided and potentially harmful attempts in the future.

I shared my initial thoughts on this topic with my community on Telegram, which led to a productive discussion. It was pointed out that debates like this can easily devolve into circular straw-man arguments. To avoid this, I will be very specific in quoting Shinobi and detailing the importance of my disagreements.

What Is “Fiat”?

"What does fiat mean? An arbitrary order or decree. Fiat currencies are given value by the authority of governments. They have value because the State decides they have value, and will accept them in payment of taxes. So how is Bitcoin fiat?"

This is a well-trodden path, and Shinobi's position is a common one. However, that shouldn't stop us from reviewing the term in the pursuit of refining our positions and forming better definitions.

In the term 'fiat currencies,' the word fiat is technically a noun adjunct—a noun used to modify another noun. It acts similarly to an adjective, specifying a particular type of currency. Importantly, this is not an "arbitrary" type of currency but a specific type: one mandated by government decree. This distinction makes the definition of 'fiat currency' different from the plain noun, the lone word fiat. It is a specific type of currency, not arbitrary.

The common pushback will be something like, 'the value of the currency is arbitrary.' But fiat currencies are not given their value by the authority of governments. Tell that to Zimbabwe, Venezuela, Argentina, or the Weimar Republic. The market is in ultimate control of the value of any currency, including fiat currency.

Fiat currencies are simply currencies whose acceptance in payment is mandated by law. This decision by governments is also circumscribed by market forces and incentives, meaning it is not 'arbitrary' either. A government cannot successfully institute a legal tender that ignores the norms previously established by the market. Fiat currency is not a random choice by governments, its value is not random, and the market's reaction to it is not random. In no way can the term 'arbitrary' be accurately applied to fiat currency.

The term fiat in Latin means 'let it be done,' but this should not be interpreted as a resignation to randomness. Instead, it reflects an acknowledgment of complexity.

Markets Are Not Governments

"A king waives his hand and gives fiat value. But there is no King of Bitcoin. Right? Wrong. It’s us."

By falsely defining fiat currency as an arbitrary valuation by a government, Shinobi creates a false equivalence that allows him to substitute the market's valuation for that of the government. This sleight of hand leads to his conclusion that Bitcoin is fiat because it supposedly has an arbitrary valuation by the market. However, the very act of a market assigning value to something—through voluntary exchange—is fundamentally different from a government’s legal imposition.

Market prices emerge from disagreement on valuations. Voluntary exchange happens because person A values what they have less than they value another good, and person B has the reverse preference. This process is anything but arbitrary; it reflects a dynamic interaction of preferences, incentives, and resources, all of which are governed by market forces, not decrees.

"We collectively give value to Bitcoin through our decision to use it. We bring it into existence through our collective arbitrary decision."

This claim reflects a category error. A market does not function as a simple aggregation of individual decisions. While individual exchange decisions occur within the framework of a collective market, the market encompasses much more. It is a synergistic whole, shaped by individual decisions, natural constraints, existing inventories, social norms, and more. Leonard Read’s essay "I, Pencil" illustrates this beautifully. A simple pencil could not be made or directed to be made by any person or politburo. It is the product of a complex market not a mere sum of individual decisions.

Bitcoin's Use-Value or Intrinsic Value

"Bitcoin has no distinct use-value and exchange-value. [...] Its use-value is its exchange-value. They are two sides of the same coin, brought into existence purely through a collective fiat decree."

In classical economics, use-value is a qualitative concept of whether or not it has utility in goods other than as money. Use-value is often invoked to defend certain forms of money by appealing to their so-called intrinsic value.

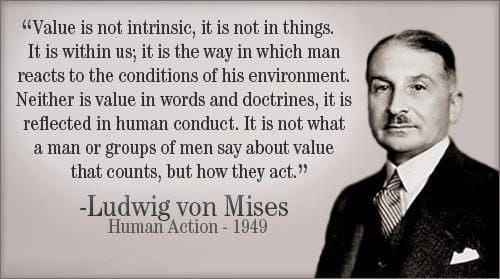

For example, gold is frequently cited as having intrinsic value due to its utility in dentistry and electronics. However, the concept has long been recognized as incorrect, perhaps most famously in Gary North's 1969 essay The Fallacy of Intrinsic Value. Shinobi claims bitcoin's lack of intrinsic value makes it fiat, when we know value is subjective and nothing has intrinsic value. We reject the idea of "use-value," all value is subjective.

Bitcoin is pure monetary premium, which is better than any other commodity money. This trade-off between use-value and monetary premium is a spectrum. A medium for the transmission of price information suffers with greater use-value of that good. For instance, if oil were to be used as money, it would perform very poorly, because prices would be distorted by the high use-value and inclination to consume the supply. The lower the use-value, the better the transmission of prices. Minimizing use-value is perfectly inline with a market driven, non-arbitrary process of selecting the economic medium of money.

That said, one could argue that bitcoin does possess a use-value in creating the block chain. Bitcoin incentivizes miners to expend energy and behave honestly to move the consensus forward. Importantly, this utility exists independently from its exchange value. The block chain was being added to before there was an exchange value, and this process continues every 10 minutes independent of the market price.

Bitcoin Is A Distributed Consensus

"It is not a physical raw material that can be converted into something else. It’s a database that sits on your computer. And mine. And everyone else's."

Bitcoin tokens do possess physicality, though not in the traditional sense, and at first glance, seemingly a trivial cost to individual nodes. For argument's sake, we can estimate that a UTXO occupies approximately 100 bytes of storage on a single node. However, Bitcoin's distributed nature means that this 100-byte UTXO is replicated on every node in the network—approximately 20,000 nodes globally—resulting in around 2 MB of total storage.

While this remains a relatively small amount, each UTXO is also dependent on hundreds or even thousands of megabytes of antecedent transaction data. In fact, the existence of any individual UTXO is ultimately dependent on the entire block chain, which currently totals around 626 GB multiplied by 20,000 nodes. This represents physical storage dedicated to preserving Bitcoin’s transaction history. Furthermore, Bitcoin’s physicality extends beyond storage—it requires substantial mining equipment and facilities to maintain the network and push the consensus forward.

Bitcoin is not merely a database. The database is the byproduct of a functioning distributed consensus. Bitcoin is the self-sustaining distributed consensus that emerges from its underlying rules. This was Bitcoin's monumental achievement: the creation of a live, distributed consensus network—not just a static database.

Adding All The Mistakes Together

"The only reason Bitcoin is even a coherent singular thing in the first place is because of everyone’s arbitrary decision to use the same rules to validate changes to its database. [...] Every property it has, everything it is, exists purely because of our collective and arbitrary decision to make it exist.

Bitcoin is the world’s first stateless fiat."

Now that we've covered all of that, Shinobi’s climactic argument borders on the illogical. Ask yourself: how would Bitcoin be different if a few individuals had made different decisions? The answer is simple—it wouldn’t be different at all. Perhaps, if a billionaire or two had chosen not to buy, the price might be lower, but Bitcoin’s consensus rules would remain identical. There is no plausible counterfactual to point to and say, “See, Bitcoin would have been like that if we had chosen differently.” The very notion is almost comical.

Bitcoin's rules were specifically designed. Once those non-arbitrary rules were set in place, individuals and markets reacted in a non-arbitrary way to the incentives and constraints embedded within the design. We did not magically end up where we are. It is not the case that Bitcoin can be any arbitrary old thing and succeed.

Nodes follow Bitcoin's rules in an ongoing process driven by market history, current conditions, and economic incentives. Economics, at its core, is about trade-offs, subjective value, and the constraints imposed by both human nature and the natural world. Bitcoin's success is rooted in these realities, not in arbitrary decisions. Bitcoin is the antithesis of fiat.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.