What Caused Bitcoin's Mid-Cycle Correction?

Factors ranging from regulation in China to the Taproot protocol upgrade were driving bitcoin price charts to a decisive point for weeks.

Originally published on Bitcoin Magazine with the title: What Caused This Mid-Cycle Bitcoin Price Correction on July 10, 2021. Support our content by giving that article a visit as well!

The bitcoin price rallied last week, but the move did not come out of the blue. While some people attributed the spike in price to the fake news about Amazon planning to accept bitcoin, the charts had been signaling a move was coming, approaching a decisive point for weeks.

I attribute this mid-cycle correction to three dominant and simultaneous narratives that, before resolved, caused major uncertainty and price declines. These events affected sentiment in all segments of the bitcoin market — miners and retail, developers and high-net-worth individuals. Any single one of these narratives on their own could have caused a dip, but all three together combined to cause a major drag on price.

A NEW CHINESE BAN ON MINING

The plunge in mining hash rate resulting from the Chinese mining ban (highlighted in red above) turned the mining industry upside down. Miners were dramatically affected, already dealing with a global chip shortage, and then this news was added to their plate. Retail holders and traders were also affected by this development, being bombarded with negative headlines for weeks.

Hash rate (the cumulative computer speed at which miners search for the next block) peaked just prior to the ban, on May 9. I suspect that this is when miners in China began hearing rumors of what was to come. The official public statement from the Chinese Communist Party banning mining came on May 21. Over the next four weeks, hash rate kept falling, in total crashing from 190 exahashes per second (Eh/s) to 58 Eh/s at the bottom.

This was unquestionably a huge concern for many casual investors. Would the network be able to deal with such a fundamental blow? Those deeply into the weeds in Bitcoin, however, were much less worried about this situation. Bitcoin is adaptable. Blocks were found a little slower, but continued to tick away. Difficulty adjusted down a few times as designed, and the network itself suffered no lasting damage. The hash rate plunge finally bounced on June 27 and as of this writing, is up 98% off the lows.

The recovery will be slow but steady as Chinese mining equipment is moved or sold, ending up in more friendly and distributed jurisdictions and resulting in a more robust mining industry. Investor uncertainty decreased rapidly as the hash rate bounce continued into July. Today, the network is stable and strong.

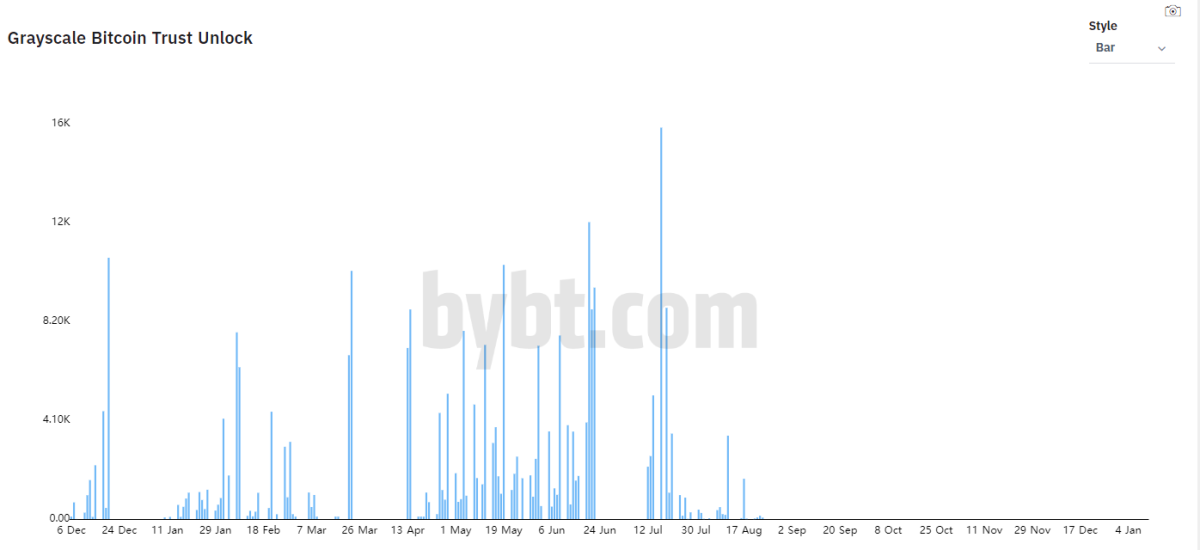

GRAYSCALE TRUST’S RECORD UNLOCKS

The second major cause of uncertainty in this period was the Grayscale Bitcoin Trust (GBTC) release schedule (highlighted in gray above). This narrative affected the sentiment of high-net-worth investors and professional trading outfits in the space. There was a fairly strongly-held belief among whales that their peers would be leveraging into arbitrage trades immediately after unlock periods.

A quick 101 on the GBTC: GBTC is a closed-end trust, where investors can get exposure to the trust’s underlying asset, bitcoin, without personally holding the bitcoin, similar to an exchange-traded fund (ETF). Accredited investors can buy new shares directly from Grayscale at the price of net asset value (NAV) (the spot price equivalent), increasing the supply of outstanding shares, then after a six-month lock-up period, can sell the shares on the secondary market to investors of all types. Buying new shares from Grayscale requires Grayscale to go out into the market and buy bitcoin, causing a rise in price.

There is also a feedback loop aspect. As price rises in bitcoin, it drives more secondary market demand and a higher premium, then more demand for new GBTC shares and more spot buying by Grayscale. It pays well as long as the premium in the secondary market lasts. For example, if the premium is 20%, investors can buy a share of GBTC at NAV then, six months later, sell it at a 20% gain. (It’s slightly more complicated than that, but that’s the basic idea.)

For GBTC’s short lifespan, it had always enjoyed a premium, but in the week of February 23, price on the secondary market slid into a discount, meaning that the price in the secondary market went below NAV. It effectively cut off the feedback loop, and demand by accredited investors to buy new shares abruptly stopped, hence Grayscale buying bitcoin stopped as well.

Long story short, market participants were tracking the six-month lockup periods for blocks of shares. Some analysts were expecting a large price drop coinciding with the last and largest unlock on July 17. It was not uncommon to hear price predictions in the mid-to-low $20,000s. When the dip failed to materialize, the uncertainty around GBTC disappeared.

The GBTC discount has recovered from 15% to only 6% today, and is quickly approaching parity.

BITCOIN’S TAPROOT UPGRADE

The third narrative for bitcoin was the Taproot upgrade (highlighted in orange above). This narrative affected developers and long term HODLers. They are well aware of the recent history of Bitcoin upgrades turning dirty, and were understandably concerned this upgrade could lead to similar division. Afterall, Taproot is the first soft fork for Bitcoin since the hotly-contested SegWit upgrade in 2017. In general, there was much less drama around this upgrade from the beginning, people were still uncertain just how it would play out.

Bitcoin upgrades are slow and meticulous things, because it takes years to work through the process in a decentralized and trustless way. No one individual nor one group is in charge to tell people to upgrade. The hardest thing is simply getting everyone to agree.

The nature of the Bitcoin upgrades as soft forks makes this process a little bit easier. A soft fork is a change that is backwards compatible with previous versions, it does not enable new behavior that would break old, non-upgraded nodes. (There is a lot of nuance missing from that statement, but that’s the general idea.) Coordination techniques used by more centralized altcoins are not possible in Bitcoin, so it becomes a lengthy, uncertain process of open and public debate.

Despite all this, a loose compromise was reached and on May 1, two activation mechanisms were initiated, one called Speedy Trial, the other a simple date for activation in the future. If Speedy Trial was successful in reaching a critical level of support by August 11, the two mechanisms would merge into one. If not, the main Bitcoin application would have to go back to the drawing board, and it might result in a network split.

The community didn’t have to wait long, Speedy Trial was a great success, locking in activation very quickly on June 12. The whole process turned out to be relatively painless and transparent, but it was the result of years of prior back and forth discussion, planning and compromise. Taproot will fully activate in November.

This upgrade flew somewhat under the radar this summer, but when it was locked in, many of the hardcore Bitcoiners, people deeply involved in the space, breathed a big sigh of relief. There would be no community split like in 2017.

THE REST OF 2021

These three major narratives are mostly wrapped up, but there are still some minor lingering issues. A few relatively insignificant GBTC unlocks are scheduled for the rest of July and into August. Miners have not completed their recovery, but are well on their way. I expect, by the end of the year, hashrate to be back to full strength and breaking all-time-highs in computational speed. Taproot is locked in but not activated. That doesn’t come until November. A few well respected cypherpunks in the space are still concerned, but they are nuanced arguments not shared by everyone.

The exciting thing is what happens now. If and when the GBTC price turns back into a premium, it will provide a strong incentive for investors to buy new GBTC from Grayscale, forcing Grayscale to buy bitcoin on the open market. Therefore, the effect of GBTC on price for the remainder of the year will likely be positive.

Miners will be less beholden to a fickle authoritarian state like China. Perhaps that leads to cost savings if in a friendlier jurisdiction that has less corruption, leading to more hoarding or expanding of hash rate.

Finally, Taproot enables many new high-powered features in the Bitcoin protocol. It will open up many unseen opportunities for financial services and businesses of all types.

The second half of this bull market will be intense.

Become a paid member and receive timely bitcoin price analysis. Or sign up for the free tier to receive our free weekly newsletter the Bitcoin Fundamentals Report.