Bitcoin Minute: Bitcoin ETFs Hold Strong Amid Market Panic

A review of recent Bitcoin and Ethereum ETF flows, highlighting the resilience of Bitcoin amid market turbulence and the disastrous performance of Ethereum ETFs

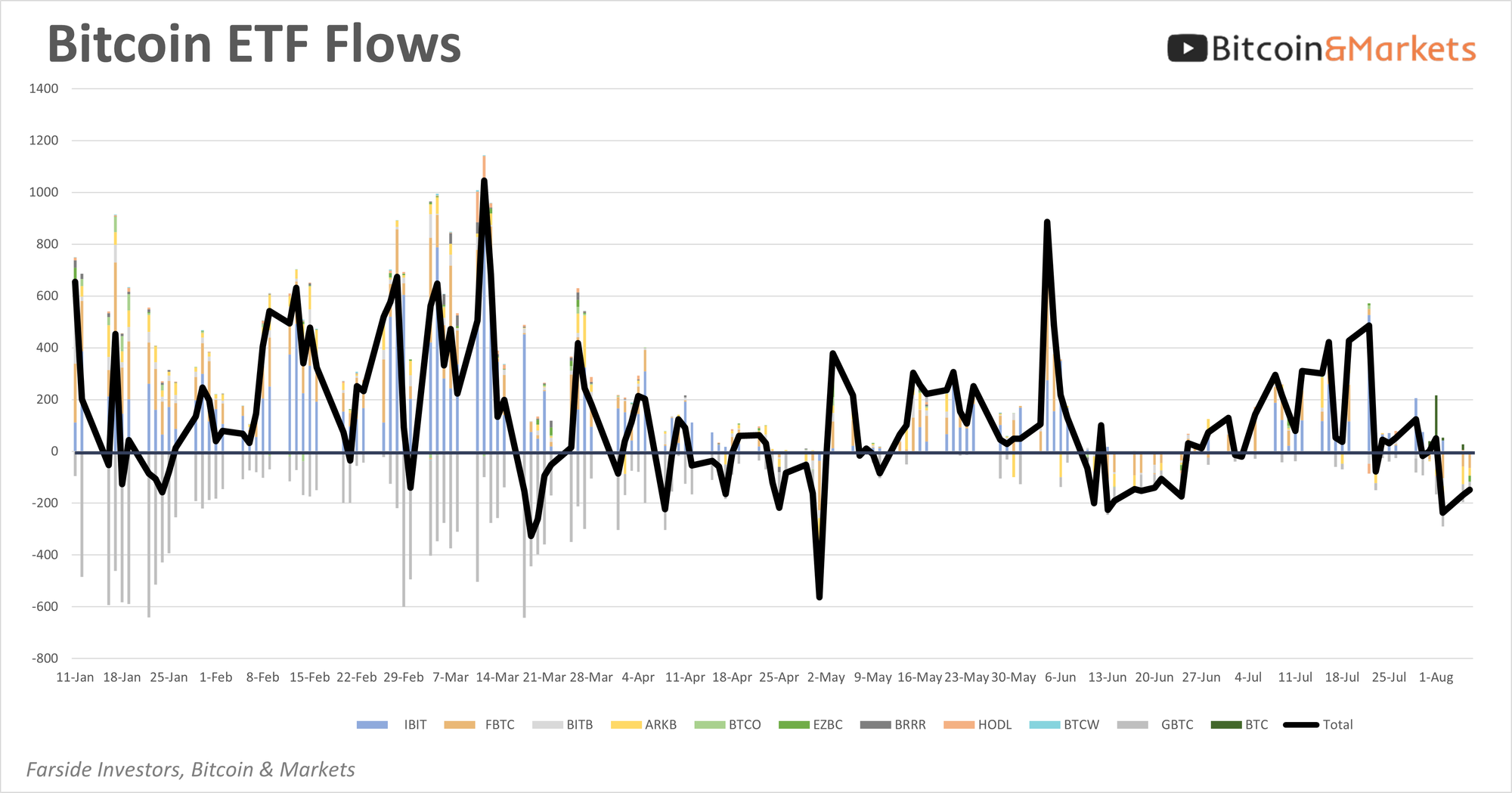

Bitcoin ETF flows have been significantly negative over the last few days. Here’s an update and my commentary.

After a nice run from late-June to mid-July of big positive inflows, the last few days have been largely negative. That is logical considering the broad market sell-off on Friday and Monday. However, it's important to note that BlackRock's IBIT did not experience a single coin leaving their ETF during this period. In fact, IBIT has only had one day of net outflows since its launch, that being on May 1st.

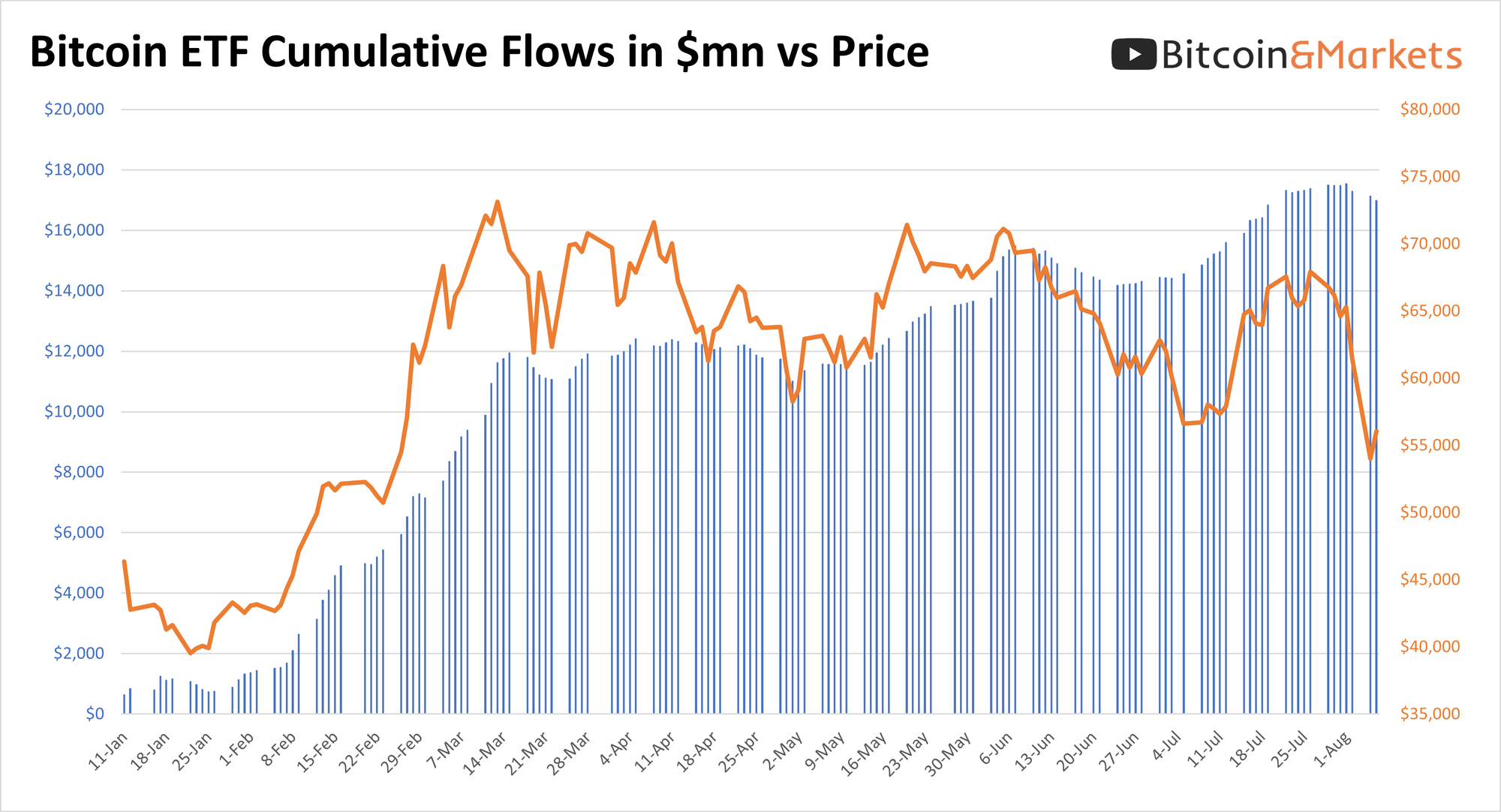

When examining total flows versus price, there’s a striking decoupling from fundamentals. Despite total flows hitting new record highs, the price failed to make new highs. In fact, the price began to dip in late July even as inflows continued.

The German dumping of 50,000 BTC could explain this divergence along with the MtGox coins, which have primarily been held, but surely some leaked to the market.

Bitcoin ETF fundamentals remain strong and should soon be reflected in the price. I am watching the flows relative to the broader market panic, and it has been a good sign that Blackrock did not sell any during the panic we just lived through. This suggests we might see Bitcoin's performance decouple from the broader economy as it solidifies its safe-haven status.

In summary, Bitcoin ETF flows are strong and suggest much better fundamentals than the current price indicates. In the coming weeks, these fundamentals should start to be represented in price as we regain our footing and push back toward ATHs.

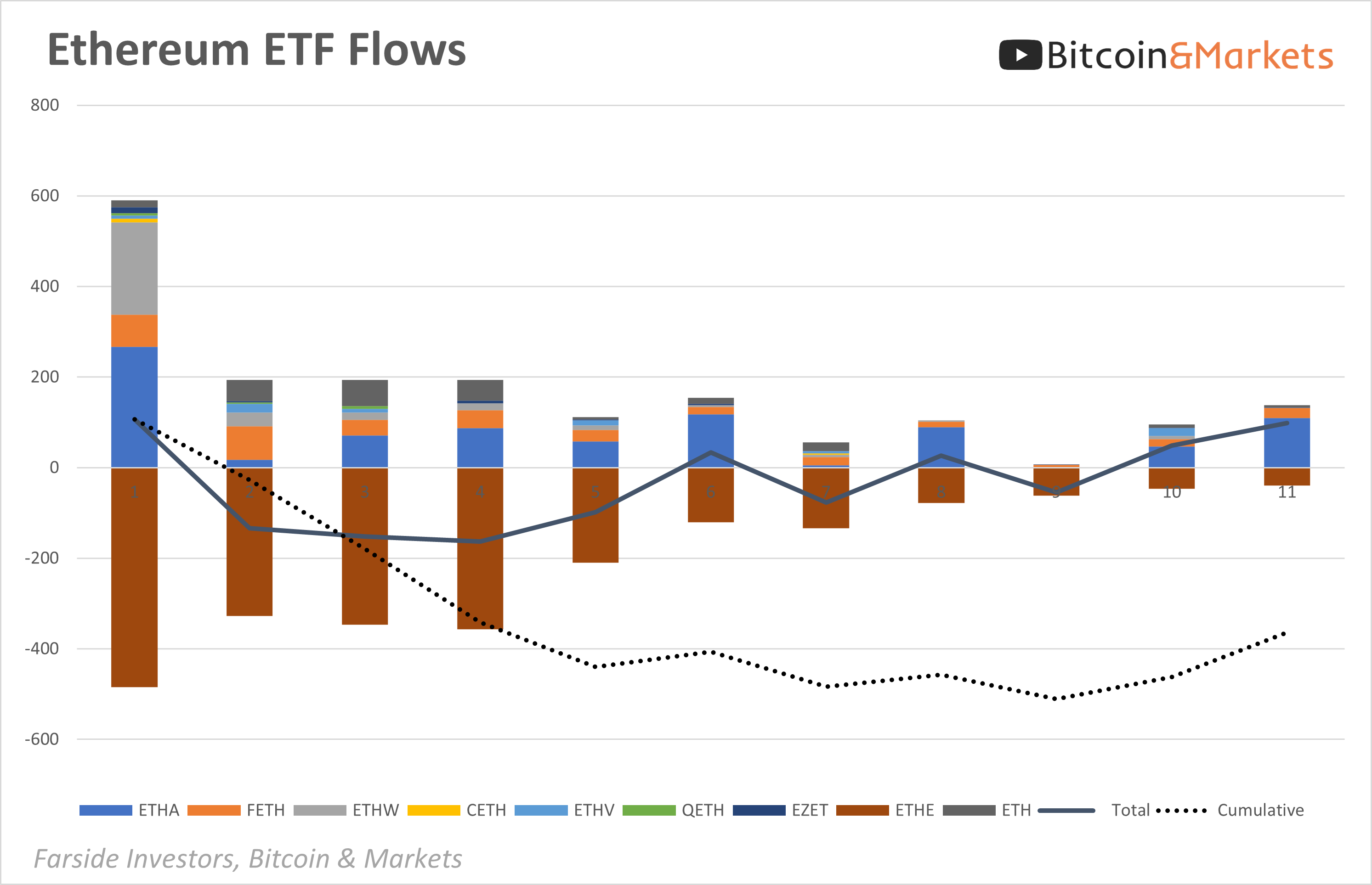

Ethereum ETF flows

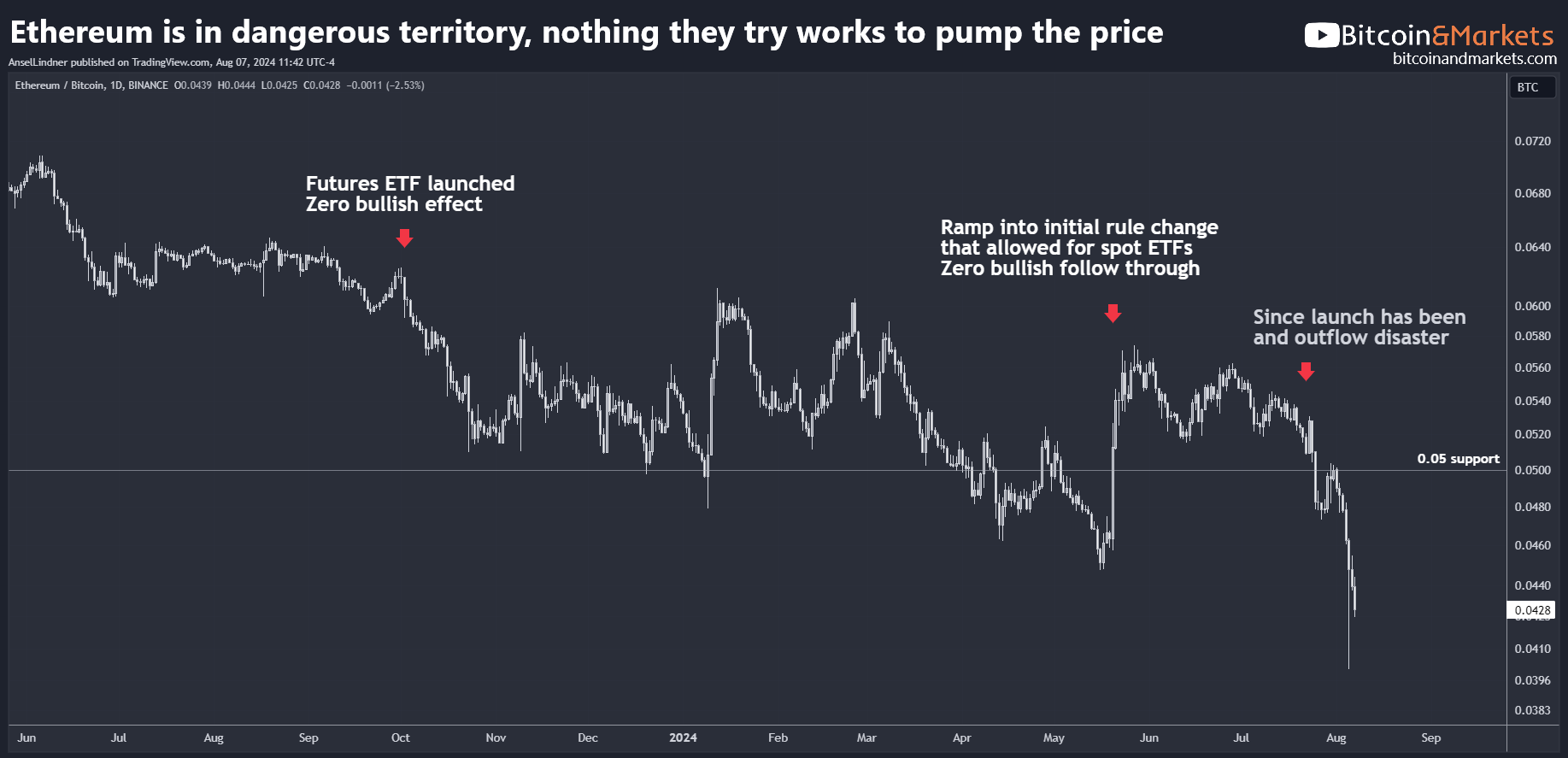

As for the Ethereum ETFs, the launch has been a total disaster, just as I predicted. In fact, it's been worse than I anticipated.

I did not anticipate such a strong negative outflow. My prediction for the initial launch period was generally zero net flow as Grayscale customers did not want to crash the market. Whereas Bitcoin ETFs have never experienced a single day where cumulative net flows were negative, despite massive Grayscale outflows, Ethereum remains in negative total flows and is unlikely to turn positive anytime soon.

Below, you can see the disastrous performance since the futures ETFs and through the spot ETFs.

Nothing Ethereum has tried has worked. They tried to shrink supply with fee burning, didn't work. They tried to become environmentally friendly with Proof-of-stake (Merge), that didn't work. They completed the transition to PoS with the Shanghai fork, allowing stake withdrawal—but that didn’t work either. Finally, we have the ETF debacle.

My prediction I made around this time last year, has held up quite nicely I'd say. There was a slight delay from the flip-flop approval of the spot ETFs, as the Biden administration didn’t want to be seen as hating "crypto" while Trump was embracing it. But the downward trend has since resumed.

This is a strong sign that the broader scam/crypto space is dying. I'm so glad.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.