Bitcoin Minute - Bitcoin's Historical Performance in Q3 and What to Expect This Year

How End-of-Quarter Trends and Fiscal Calendars Shape Market Crises and Economic Activity

1 MONTH FREE - Member or Premium

The Worst Month in the Worst Quarter

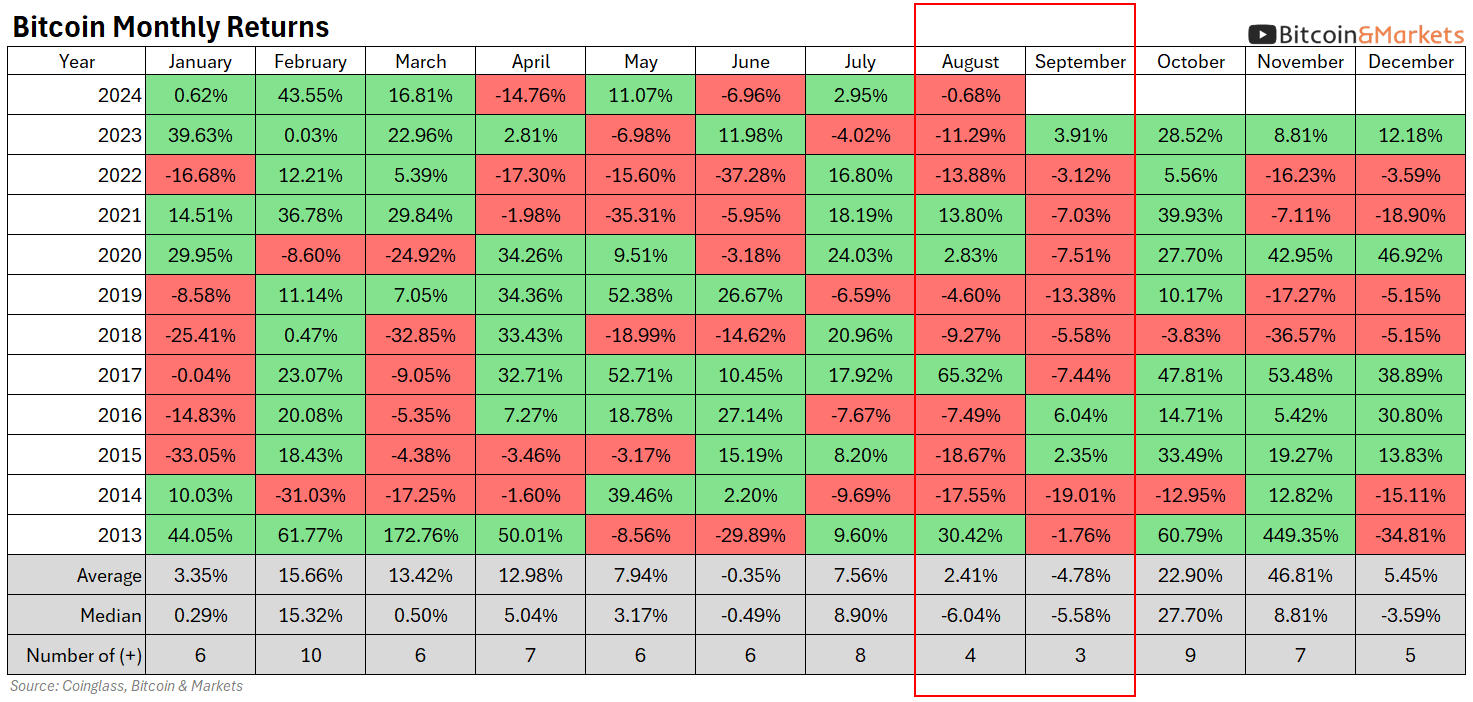

The two worst months for Bitcoin returns have historically been August and September. In Bitcoin's history, September has recorded a positive return only three times, while August has been positive just four times.

Currently, as we approach the end of this month in two days, the price opened at $64,612, so it's likely to also close negatively. At the time of writing, Bitcoin is down -8.8%.

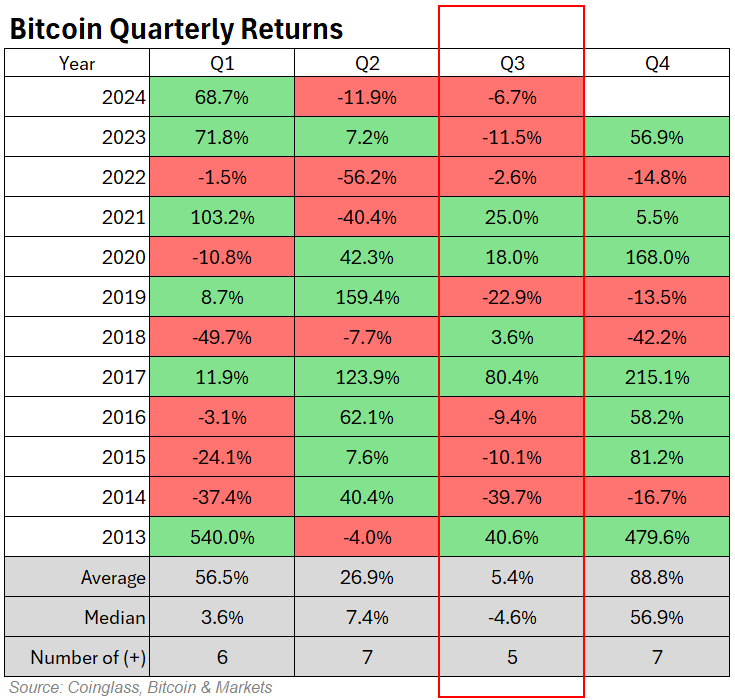

Additionally, Q3 stands out as the worst quarter by far. Only five out of twelve years have shown positive returns in this quarter, with a median return of -4.6%.

However, if we examine the data more closely, Q3s following halving years—2013, 2016, and 2020—have been positive two-thirds of the time.

This suggests a potential pattern influenced by the halving cycle, which plays an intricate role in Bitcoin's price dynamics. The halving reduces the rate of new Bitcoin supply, creating a deflationary pressure that typically precedes a price surge.

It's worth mentioning that August and September are also generally difficult months for traditional markets due to seasonal effects. I explained why in a post last September. Seasonality significantly impacts major market movements, especially at the end of Q3, when most crises occur, and to a lesser extent at the end of Q1. This trend is seen in banking, where loans and interest rates peak around August or September, and government spending, which aligns with the fiscal year ending on September 30th. The agricultural cycle, with harvests ending in Q3, also influences futures and options trading. Removing seasonal adjustments from economic metrics could better highlight these patterns.

The thing I'll give you in this post to consider is the shifting of the halving earlier in the year. We might expect the gains traditionally seen in Q4 to start materializing earlier as well, perhaps even in the latter part of Q3. September is shaping up to be a very critical month.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights! Follow me on X @AnselLindner.

LIMITED TIME!

Join the community today and get 1 MONTH FREE!

Member or Premium

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.