Bitcoin Minute: Clarity on Why Bitcoin Is A Geopolitical Hedge

The perennial bitcoin FUD debunked. Tactical versus Strategic Hedges, what's the difference. Why critics are wrong about bitcoin and WWIII.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Bitcoin's Status As Geopolitical Hedge Confirmed

The idea that bitcoin is a geopolitical hedge is no longer confined to native bitcoin claims. Yes, bitcoiners have been saying it for a long time, and implying it with the perfect "gold 2.0" meme, but now it is the institutions, such as Blackrock, the largest asset manager in the world, who claim and show the same thing.

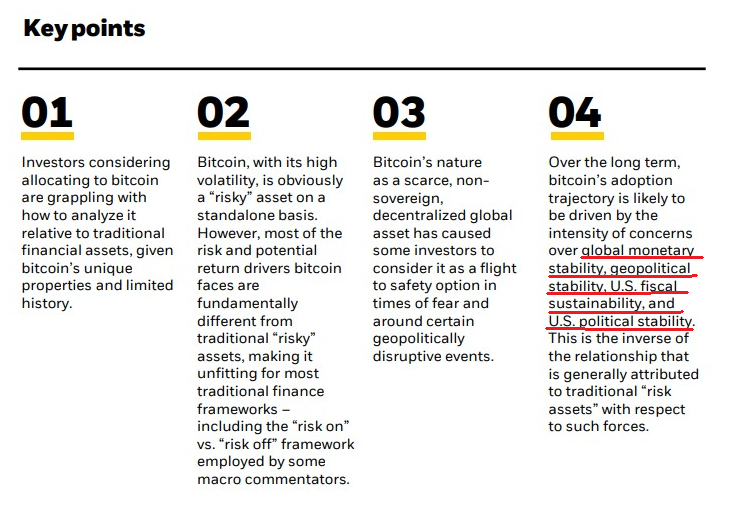

In their recent report, Bitcoin: A Unique Diversifier, Blackrock specifically calls bitcoin a hedge against "global monetary stability, geopolitical stability, U.S. fiscal sustainability, and U.S. political stability" as part of their key points.

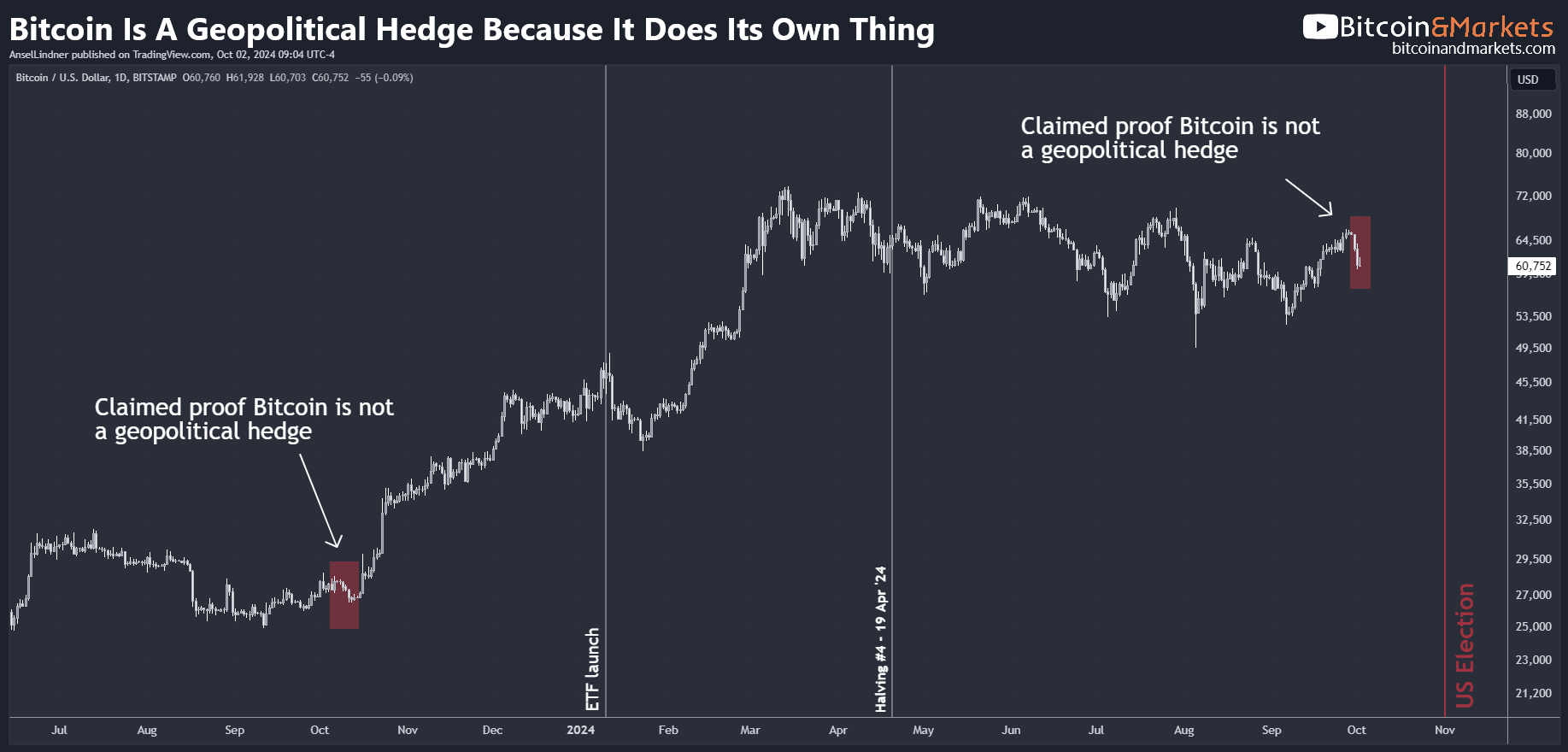

Yesterday, during the attack on Israel by Iran, Bitcoin’s price dipped, prompting predictable reactions from mediocre macro commentators. Some claimed, "Bitcoin dipped as geopolitical tensions spiked," misunderstanding both the nature of geopolitical hedging and the complexity of geopolitical risk itself. Many of these commentators likely consume mass media narratives instead of forming their own critical analyses.

Types of Hedges

Last year, I addressed this topic in response to similar commentary following events on October 7. Back then, commentators claimed that Bitcoin’s brief price dip disqualified it as a geopolitical hedge. This argument, however, is based on a misunderstanding of the term "hedge."

In that earlier post, I used the terms mechanical hedge and general hedge to explain the confusion, but perhaps "tactical hedge" and "strategic hedge" are more intuitive.

A tactical hedge is an asset that responds directly and immediately to specific market events because it is inherently designed to respond directly and reflexively to specific events. They are often inversely correlated to other assets by construction. For instance, a corn farmer is naturally long the price of corn, but he can hedge his risk with short positions in corn futures. If the price of corn falls, the price of their shorts rises.

This is the definition of hedging most familiar to wealth managers and traders, but it is not the type of hedge we are referring to when discussing geopolitical hedges.

A strategic hedge, on the other hand, is an asset that is uncorrelated to specific short-term market events. Strategic hedges are used by investors to protect against systemic risks because these assets maintain or increase in value over the long term, regardless of short-term volatility.

Some assets, like oil, act as a combination of both strategies. Oil is subject to wild price swings in the short term, but it also displays long-term trends associated with broader risk levels.

Assessing Geopolitical Risk

Another critical aspect that macro pundits often miss is understanding when something constitutes true geopolitical risk. While they typically use market pricing to gauge this, they tend to focus on short-term, tactical price movements instead of longer-term, strategic price concerns. Systemic risks rarely appear out of nowhere—they build gradually, over fiscal quarters or even years.

For example, during periods of heightened risk, a geopolitical hedge may not spike in value during a specific event. Instead, it may increase in relative value over a longer period as the situation escalates and more investors seek uncorrelated assets like bitcoin.

The Iran-Israel situation is a perfect example. The rocket attack yesterday did not come out of nowhere. This particular situation has been building for at least a year, and one could argue much longer.

As demonstrated in the oil price chart above, since the start of the Israeli-Hamas conflict on October 7, 2023, oil prices have generally weakened, showing lower highs and recently breaking a year-long support level. Although oil prices spiked slightly yesterday, this doesn’t negate the broader trend of declining prices throughout the conflict. Can you imagine a serious analyst looking at the most recent weekly candle and declaring, "This is a sign of major geopolitical risk"?

The longer-term oil price trend suggests otherwise, conveying that imminent geopolitical risk is not yet reflected in the market.

Bitcoin's role as a geopolitical hedge should not be judged by short-term price movements following specific events. Instead, it functions as a strategic hedge, offering protection over the long term as systemic risks gradually develop. The recent acknowledgment by BlackRock only strengthens Bitcoin's status as a hedge against multiple forms of instability, including geopolitical risk, monetary instability, and fiscal concerns.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.