Bitcoin Minute: False Assumptions About Gold vs Bitcoin

Exploring the misconceptions about gold's failure as money, the role of elasticity in economic systems, and why bitcoin may offer a solution to the pitfalls of centralized, credit-based monetary systems.

LIMITED TIME

Help support independent Bitcoin and Macro analysis!

This is a follow-up to the most recent Bitcoin Minute, where I reacted to Peter Schiff and Jack Mallers. Several people might have gotten the wrong impression of my position, so I wanted to clarify it here. Additionally, this post aims to provide further insight into my perspective.

Gold Couldn't Scale?

First of all, I agree with Mallers stance on bitcoin as the superior asset. I respect his work as a builder and promoter of bitcoin. However, I disagree with him, and most bitcoiners, when it comes to why gold failed and what a bitcoin future will look like.

Jack sums up his position on gold with the statement: "The real problem with gold is, unfortunately, it has to centralize."

This statement contains a couple hidden assumptions which I disagree with and/or believe are empirically false.

1) Gold was not "at scale" prior to going off the gold standard.

This assumption is empirically false. Gold was the money of settlement around the world. It was accepted in every country and, though not used in daily transactions, served as the universal standard for settlement. In fact, gold was more universally accepted 100 years ago than the US dollar is today.

What Jack seems to be implying is that gold could not scale in complexity, which brings us to the next false assumption.

2) The global economy will, by nature, always push toward more complexity and require faster settlement.

This assumption creates the mandate that gold must centralize. That wouldn't be the case if the global economy were to provide pressure the other way, toward less complexity and more certain settlement.

There is no reason to believe in the very progressive vision that history is marching toward some state of ever greater complexity. History is full of periods of complexity interrupted by periods of regression. There is nothing mandating that human civilization or modern society must advance to more and more complex structures. Therefore, gold didn't have to lead to centralization; it could have simply continued in a state of lower complexity.

There are many reasons to believe that we are at just such a period now, where the ever-present growth we middle-aged people have always known will come to an end. Demographic shifts are one of the chief reasons. Over the next 50-100 years, as populations crash around the world, economies will be less complex by necessity. We will experience a reversal of network effects.

Another major factor is the oversaturation of debt globally. We are at the end of a giant credit bubble that has resulted in more advancement in living standards than ever in human history. We could easily argue that living standards have improved more after the gold standard than in the rest of human history combined. Unwinding this bubble will likely result in a regression of many of those advances.

3) Centralization held gold back?

Jack positions centralization as the failure of gold, but this leads to a contradiction: if centralization were the primary reason for gold's failure, why did it lose to a system that was even more centralized? If gold failed due to centralization, then a more centralized alternative like credit-based money should have been even less viable. Yet, it was the centralized, elastic nature of credit-based systems that allowed them to thrive in the modern economy. This suggests that the issue wasn't simply centralization, but something more nuanced—specifically, the need for elasticity.

Elasticity, not Centralization

Jack's characterization of why gold failed is not fully addressed with the adoption of bitcoin. The explanation must cover why gold failed, why credit-based money won, and why bitcoin will win. Claiming that gold failed because it had to centralize to achieve scale is an argument that might make sense for why bitcoin could be selected over gold in the future, but it does not address why gold lost to a more centralized, credit-based system in the first place.

My reasoning explains this. Gold's failure was not about centralization; it was about its inelastic nature. In times of significant economic expansion, the free market chose a money that could expand easily to take rapid advantage of the economic environment. Credit-based money provided this elasticity, allowing economies, populations, and technology to grow in ways that a fixed gold supply could not.

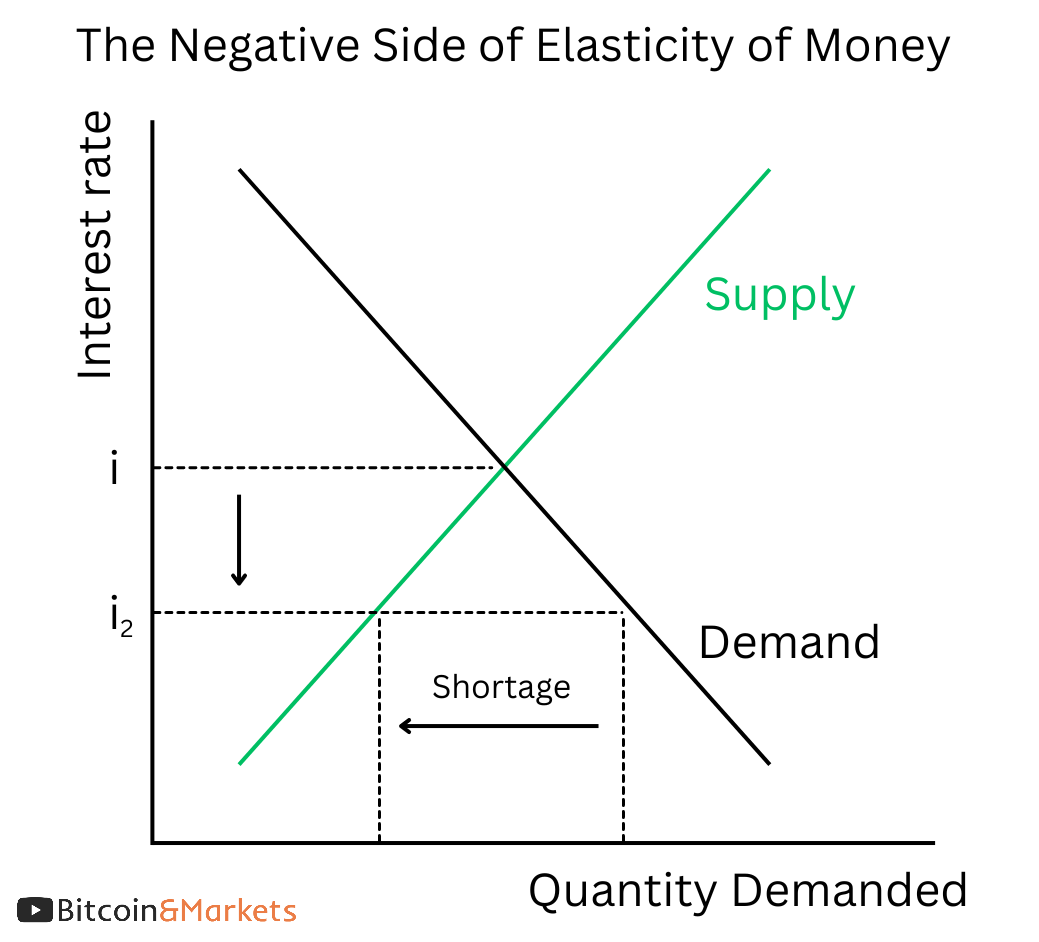

That elasticity was great during the expansion; there was lots of money for investment into highly productive uses of credit, but elasticity becomes a fatal flaw in the bust. The system experiences an ongoing dollar shortage, as predicted by a simple supply and demand graph of money.

As seen in the graph, when interest rates fall for any reason, a shortage of money will appear. Austrians believe this fall in interest rates is due to artificial central bank policy, but I believe this is a natural consequence of a falling marginal revenue product of debt. This means that as the bubble nears its end, debt becomes less and less productive as the debt burden (part of demand) grows.

This is the situation in which we find ourselves today. During the boom, the supply of money was great; it could be productively invested, and the global economy grew rapidly. Then, during the bust, we find ourselves in a constant monetary shortage, maintained through bailouts and changing the rules. To escape this elasticity trap, the market will move to a money that does not lend itself to booms and busts, and which can also solve monetary shortages by increasing in purchasing power without crippling credit markets.

Conclusion

Gold's failure wasn't about centralization but its inability to provide the elasticity required during economic expansions. While credit-based money solved this problem, it led to an ongoing cycle of monetary shortages. The market will seek a stable alternative that can avoid these pitfalls, and bitcoin offers a potential solution by providing a decentralized, adaptable form of money.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

LIMITED TIME!

50%-off FIRST MONTH!

Support independent Bitcoin and Macro analysis!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.