Bitcoin Minute: Here is what to expect from the Ethereum ETFs Launch This Week

Ethereum faces a rocky road with its spot ETFs launch. Explore the contrasting pre-launch movements, fundamental differences, and what lies ahead.

NOTE: I'm traveling for several days to see family. There will be no large newsletter this Monday, to resume next week, but I will be able to get out these quick updates. I will be able to LIVE stream react to much of the Bitcoin conference in Nashville starting Thursday.

Hold Strong,

Ansel

The string of huge news weeks will continue this week with the start of the Bitcoin Conference in Nashville, headlined by Trump perhaps calling for a US Bitcoin Reserve. That may kick off a major front-run in the next couple of months.

The other big news this week is the Ethereum spot ETFs launching. I have a negative view on the effect of this launch on its price, but let's walk through a couple of differences.

Pre-launch price movements

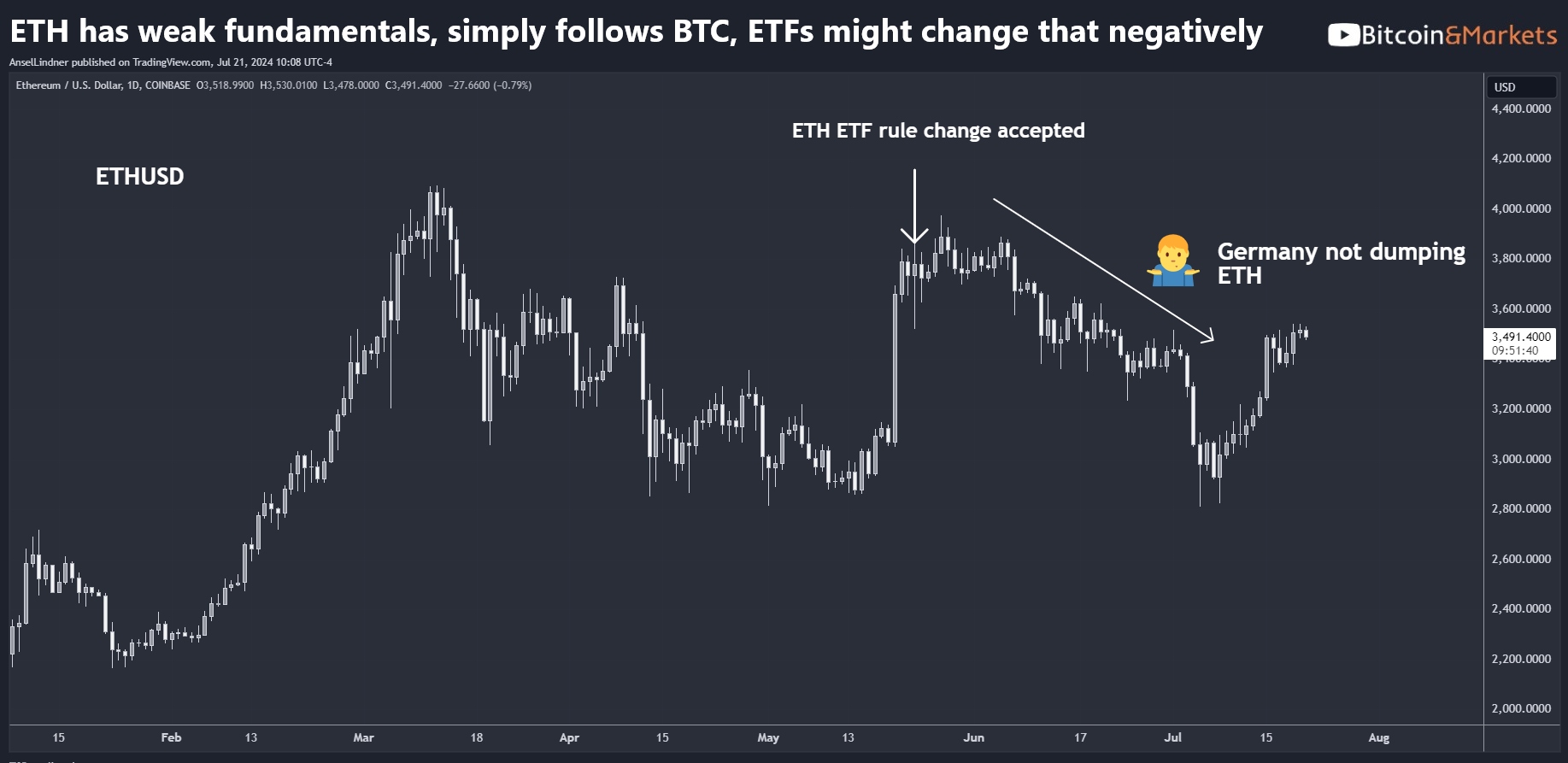

First, the Ethereum price has performed badly relative to Bitcoin since the announcement of its pending approval. Currently under the 50-day MA and threatening to break support, perhaps testing the all important 0.05 ETHBTC price.

Relative to the USD, it has also performed very badly. This is telling because its price movement has more to do with Bitcoin fundamentals than its own. Eth sold off harder than bitcoin while Germany was dumping 50,000 BTC and 0 ETH.

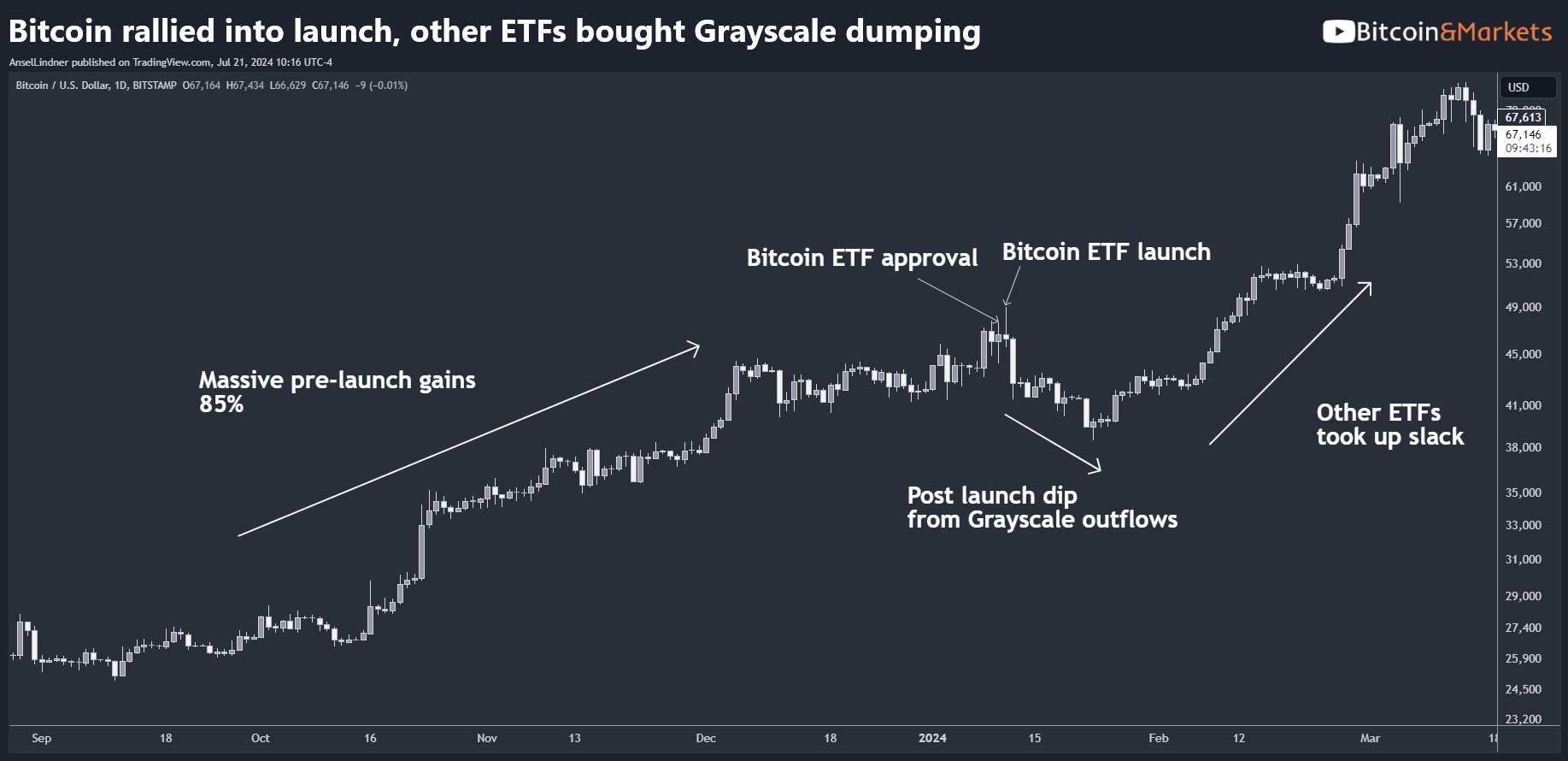

Below is how Bitcoin performed leading up to its ETF launch, it's night and day with Ethereum.

Differences between Bitcoin and Ethereum ETFs

Bitcoin's post-launch dip was caused by two main factors:

1) Grayscale GBTC dumping previous captive supply on the market. This is because while a closed-end Trust, GBTC (and ETHE by the way) could go in but not come out.

2) Authorized Participants were able to stack in the spot market early. In the months leading up to approval and launch, Market Makers were able to stack bitcoin in anticipation, minimizing a supply squeeze at launch.

There are different factors at play in Ethereum's launch:

1) Ethereum is selling off prior to launch, more influenced by Bitcoin's fundamentals than its own (zombie coin).

2) The Proof-of-stake (PoS) opportunity cost. Holders of Ethereum can lock up their coins and participate in making blocks earning them ~4% annualized. PoS is comparable to Bitcoin's Proof-of-Work (PoW) mining. Therefore, ETF owners eat the opportunity cost by owning ETH in the ETF. This will limit demand.

3) Bitcoin is easy to understand, "Digital Gold." Ethereum has no easily articulatable value prop. They have proven to be flaky and centrally controlled, while constantly changing hype strategies. This makes the sales pitch to Boomer investors MUCH more difficult.

4) There will be little demand to offset the dumping of Grayscale's ETHE that will be unlocked in the conversion. Grayscale's ETHE fee is staying at 2.5% (GBTC was lowered to 1.5%) AND they cannot stake.

Everything is set up for massive sell-off at launch.

Most Ethereum folks think the ETFs will bring as much relative demand to Ethereum as the Bitcoin ETFs brought to Bitcoin. I think that is highly unlikely. Considering the history of weak fundamentals, the inability for the ETFs to stake, and the captive coins in Grayscale's Trust being dumped, the base case for the ETH price is lower.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.