Bitcoin Minute: Institutional Giants Clash Over Bitcoin

BlackRock’s CEO embraces Bitcoin’s rise, while Fed critics call it useless. Who's right? The market will decide.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Larry Fink, CEO of BlackRock, and Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, are emblematic of the tectonic divide Bitcoin is causing within the financial world. In BlackRock’s recent earnings call, Fink made a bold statement: Bitcoin is a legitimate asset class, comparable to commodities like gold, the possible size of the housing market, and institutional interest is growing.

In stark contrast, today Kashkari continued to dismiss Bitcoin as "useless," echoing a sentiment often found among those entrenched in the traditional monetary system. This split between two influential figures in the monetary system and global finance highlights the ongoing debate over Bitcoin’s role in the future of money. So, who’s right? At the moment, the market is siding with Fink.

Bitcoin and Microstrategy's Price Performance

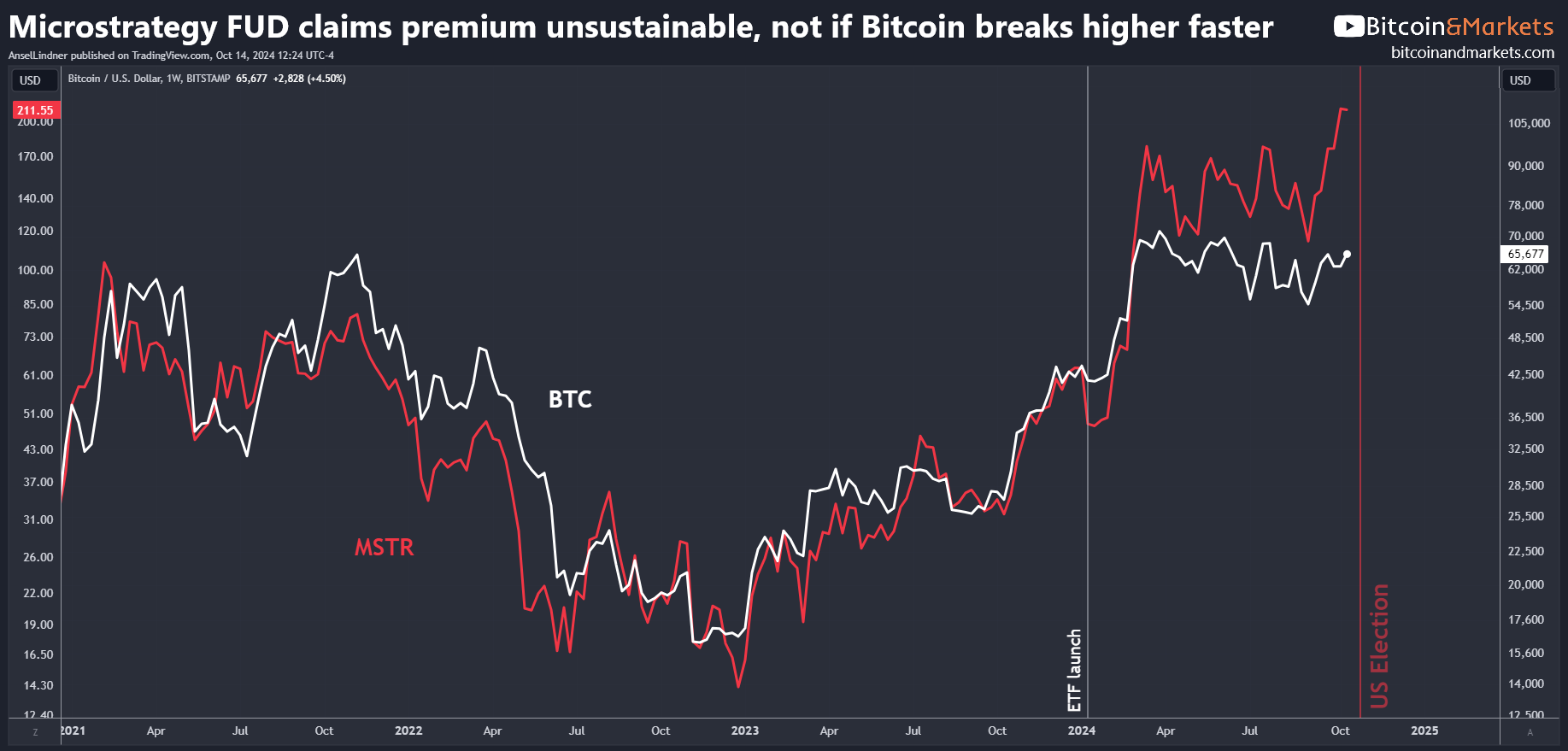

As Bitcoin's price surged to nearly $68,000 today, rising 15% in six calendar days to a new higher high, and threatening a breakout back to the all-time high, it’s hard to argue that the market thinks Bitcoin is irrelevant. The price action reflects a growing demand from institutional players.

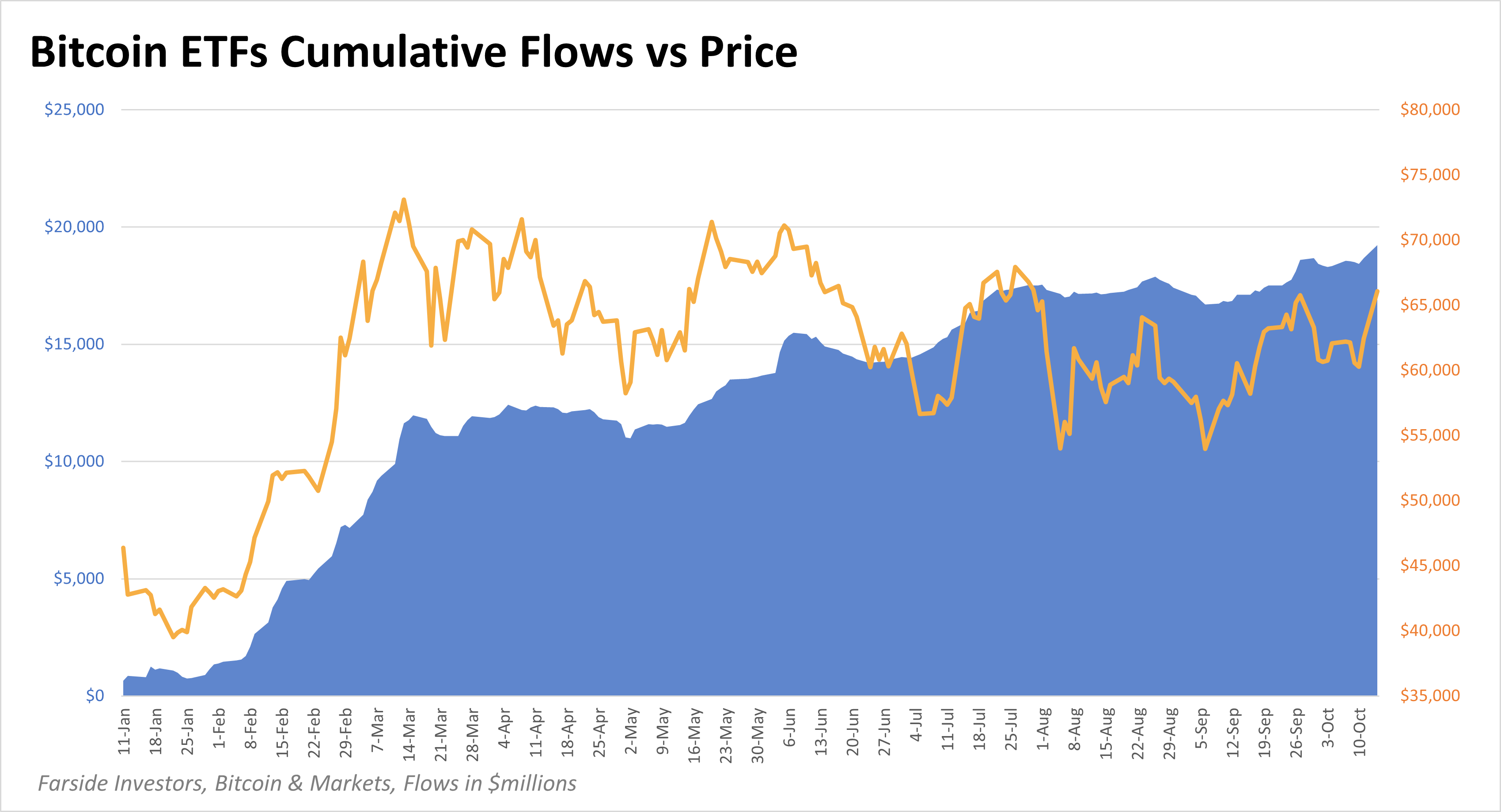

Spot ETF inflows also reinforce this. Yesterday saw $555M in net inflows, surpassing $19 billion in total inflows.

Meanwhile, MicroStrategy (MSTR), which has been a proxy for institutional Bitcoin adoption, recently spiked to 25-year highs, further supporting Fink's bullish outlook. The rising spot price, ETF flows, and MSTR’s performance all validate Fink’s vision of Bitcoin as a maturing asset class gaining more traction.

Explaining the MSTR Premium

Bitcoin insiders, myself included, have offered explanations for why MSTR trades at such a high premium. Certain large buyers can only gain exposure through a tech stock like MSTR due to regulations or preexisting allocations. The most recent 13F filings for Q2 of this year show entities like the Swiss National Bank, the Norwegian Central Bank, Mitsui Sumitomo (one of Japan's largest insurers), and South Korea's National Pension Fund gaining Bitcoin exposure through MSTR. That demand is likely increasing right now, pushing the premium up.

Lyn Alden recently analyzed this situation in her premium newsletter. She defends MSTR's price rise, noting it reflects strong market demand. While the premium adds risk compared to holding direct Bitcoin, MicroStrategy is leveraging it to issue more capital, buy more Bitcoin, and increase Bitcoin holdings per share.

Alden points out that investor mandates play a key role. Many institutional investors, restricted from directly owning Bitcoin, use MSTR stock or convertible bonds to gain exposure. This creates a "flywheel" effect, where demand keeps driving the stock higher, enabling more Bitcoin purchases. It's similar to the effect seen with Grayscale’s closed-end trust several years ago.

Joe Burnett of Unchained Capital adds further insight. He explains that MSTR's price is also driven by a potential short squeeze. For example, Kerrisdale Capital shorted MSTR for $3 billion while going long on Bitcoin, expecting the premium to shrink. However, the premium has only grown, putting pressure on shorts and potentially leading to a GameStop-like squeeze.

Burnett also highlights MSTR’s reported 17.5% Bitcoin yield growth, where the company increases Bitcoin per share. This can be used to model the company’s valuation similarly to traditional earnings, justifying the high premium over NAV.

Institutional Interest In Something "Useless"?

Fink’s comments carry weight because they signal that Bitcoin is no longer just a speculative asset for retail investors—it’s being seriously considered by institutional giants. This marks a significant shift in Bitcoin’s evolution. According to Fink, BlackRock's discussions with institutions worldwide about Bitcoin’s role in portfolios echo the early days of other asset classes like high-yield bonds or mortgages. As those markets grew with better infrastructure, so too will Bitcoin.

Bitcoin's implications are bigger than ever. It is creating a divide between institutions and influential figures. On one side, people like Fink are aligning with long-time Bitcoiners in seeing the asset as a game-changer. On the other side, skeptics like Kashkari continue to dismiss Bitcoin’s utility, despite the market showing otherwise. If recent price movements and the bullish performance of closely related stocks are any indication, Fink and Bitcoin supporters are winning. The market is the ultimate arbiter—and it’s favoring Bitcoin as a global monetary game changer.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.