Bitcoin Minute: A Tale of Babylon, PoS and Fees

Analyzing the Sudden Spike in Bitcoin Transaction Fees Due to Babylon's Staking Launch

🥳 CELEBRATING 300 REPORTS!!

LIMITED TIME

Join the community supporting quality Bitcoin and Macro analysis!

Check out our tier perks.

1 MONTH FREE - Member or Premium

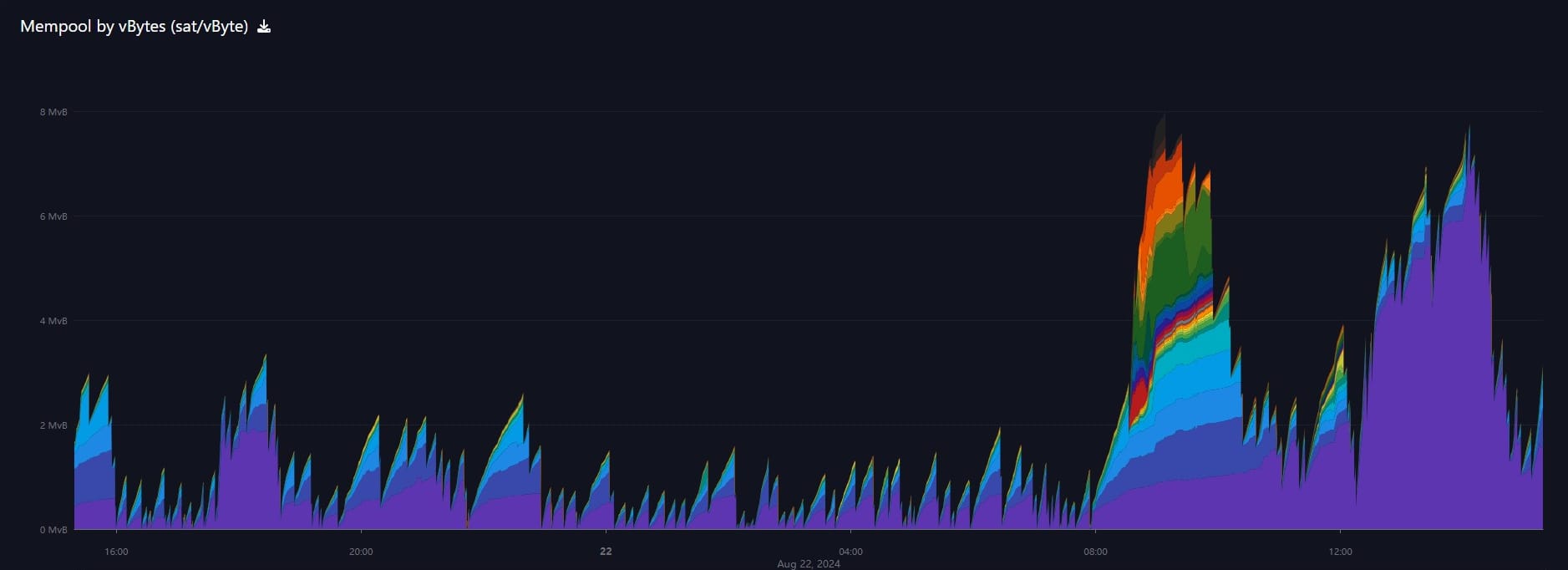

Bitcoin Mempool and Babylon

Today, the mempool rocketed higher and fees exploded. Fees got as high as 6000 s/vb, and several blocks contained as many as 15 BTC in rewards. In dollar terms fees reached over $500 for a couple blocks. There were roughly a dozen blocks severely affected, and fees are now back down to 13 s/vb or about $1.10. The impact on the day's total fees will be significant, making up about 19% of the block reward at the time of writing. This should fall slightly by the end of the day, but will remain far above the normal 2%.

I tweeted about it approximately 1 hour into the spike, but was unaware at the time what had caused it. I've written many times about the mempool and fees being a leading indicator for volatility. If bad news is leaked, or the market is just starting to anticipate a sell-off, the mempool and fees will rise as people move their coins to exchanges to sell.

However, the move this morning did not constitute that kind of build-up; it was a sudden spike higher. People on X started to relay events from the altcoin/scam-verse to bitcoiners, explaining that it was the launch of Babylon staking that was the culprit.

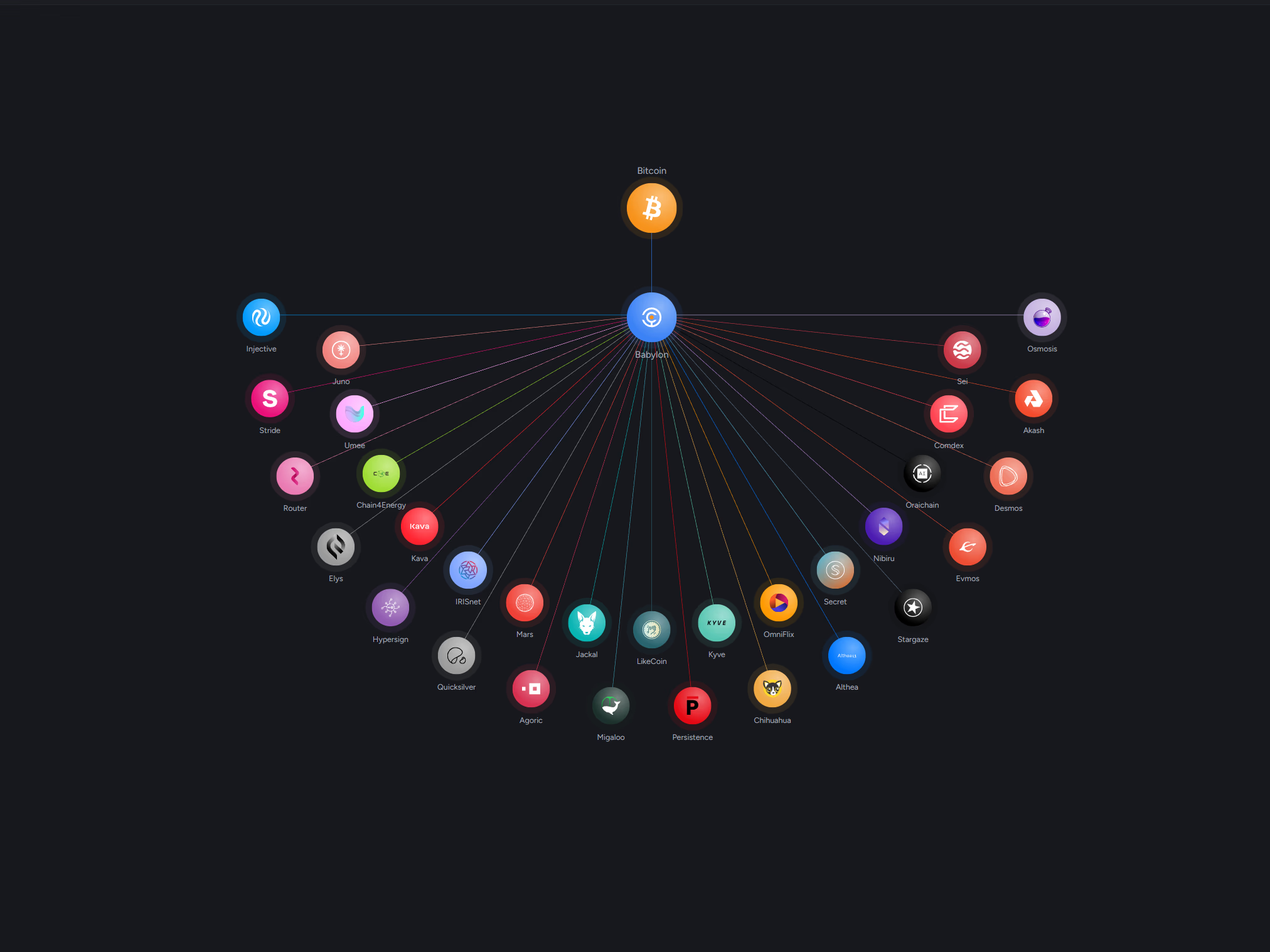

Babylon is a Proof-of-stake scheme that uses staked bitcoin to secure altcoin PoS networks. Once coins are "staked" they can be used with multiple altcoins PoS protocols, earning yields from each.

Quick refresher on PoS for beginners

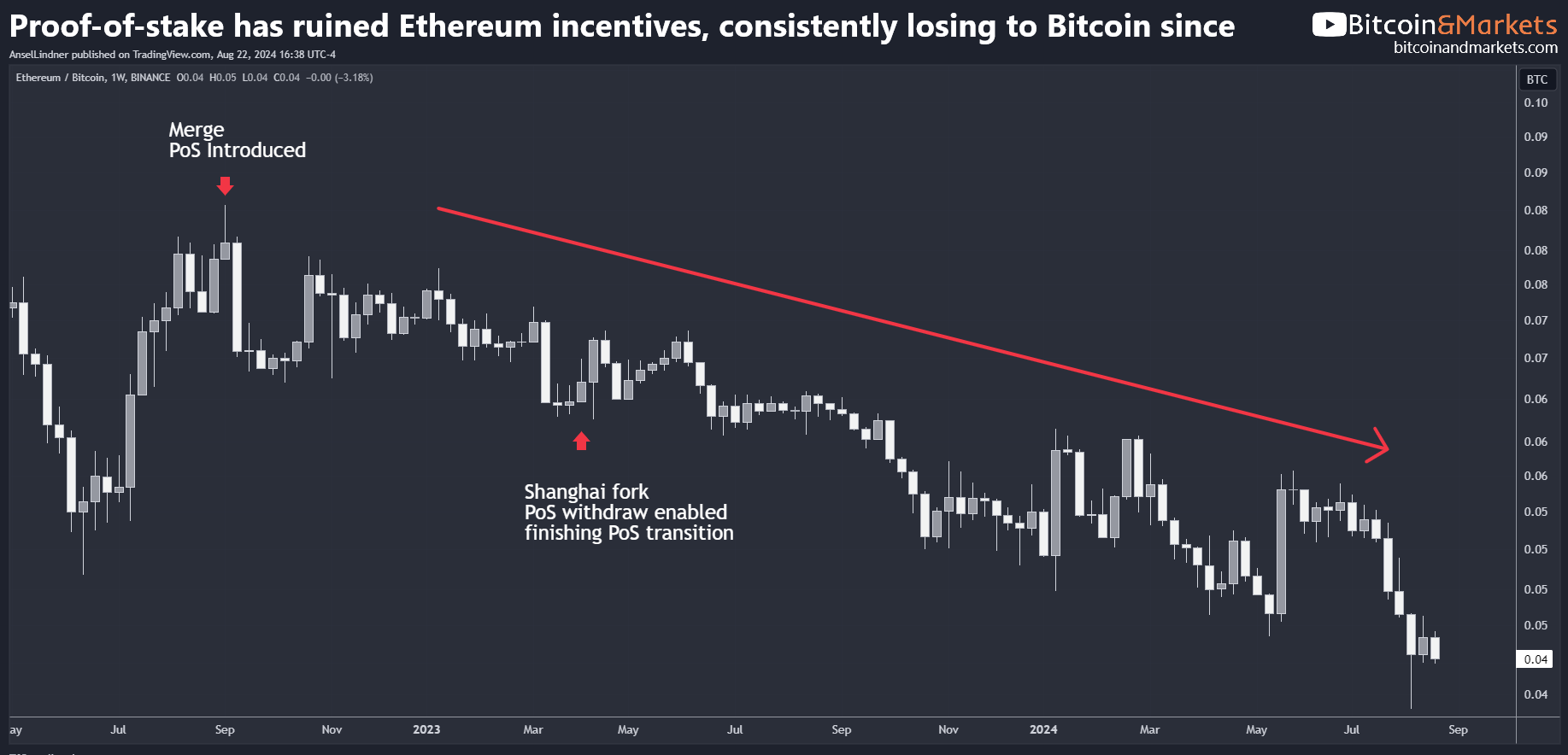

PoS is an alternative mechanism that pre-dates Bitcoin PoW to maintain decentralized consensus about the current state on a network. Instead of mining to pick the next block producer, they use a randomization algorithm to remove the energy requirement of mining. However, in doing so, it opens many vulnerabilities that Bitcoin doesn't have:

- The algorithm can never be truly random, leading to prediction attacks.

- Stake grinding, where the block producer runs through many potential blocks to find one that biases the protocol toward them being selected again by the random draw.

- History attacks, since there's no work needed to mine, theoretically rewriting history is nearly costless.

To incentivize honest behavior by the block producers you must lock up a stake or an amount of tokens. If you are caught attacking the network, you lose your tokens. This consensus mechanism is more complex and introduces many competing incentives. Until Ethereum, no PoS network successfully thrived or even maintained consensus for very long. Ethereum hasn't thrived either; it is basically a dead chain due to all the perversion of the pure PoW incentives present in PoS.

There are patches to these problems, however, each patch adds complexity and more potential vulnerabilities. So, you can create a fix, but it always reduces security relative to simple Proof-of-work mining. These problems are not present in PoW.

Back to the Babylon

The mempool filled up rapidly as shitcoiners were trying to stake into Babylon as it went live today. This is a very similar situation to the Runes protocol's effects after the halving and should be even more temporary.

There was minimal effect on the bitcoin price during the Babylon disruption. Fees peaked at 09:00 ET this morning, and the price slid slightly lower, but nothing of note.

A build-up to high fees can be seen as bearish for the price, but a spike in fees like this should provide a temporary pressure on price to rise. All else equal, as fees rise rapidly to $100+, people who need to receive a transaction might instead go to the exchanges and buy bitcoin. Senders will also need more bitcoin to pay the fees, perhaps causing them to buy some to replace it.

At the end of the day, the disruption was so short-lived that price did not react much and the network is chugging along in perfect shape.

Conclusion

The Babylon staking launch caused a significant but short-lived disruption in the Bitcoin network, characterized by a sudden spike in transaction fees. Despite the frenzy, the Bitcoin ecosystem demonstrated its resilience, with the price remaining largely unaffected and the network continuing to operate smoothly. This event underscores the potential for external factors to influence Bitcoin's transaction environment temporarily, yet it also highlights the robustness of Bitcoin's underlying technology in handling such anomalies.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights! Follow me on X @AnselLindner.

LIMITED TIME!

Join the community today and get 1 MONTH FREE!

Member or Premium

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.