Bitcoin Minute: Weird Cycle Patterns and FOMC Watch

Analyzing Bitcoin's Cyclical Patterns, Fed Rate Cuts, and Why All Roads Lead to Bitcoin

Happy FOMC day. I'll be LIVE streaming at 2 pm ET. Hope to see you there!

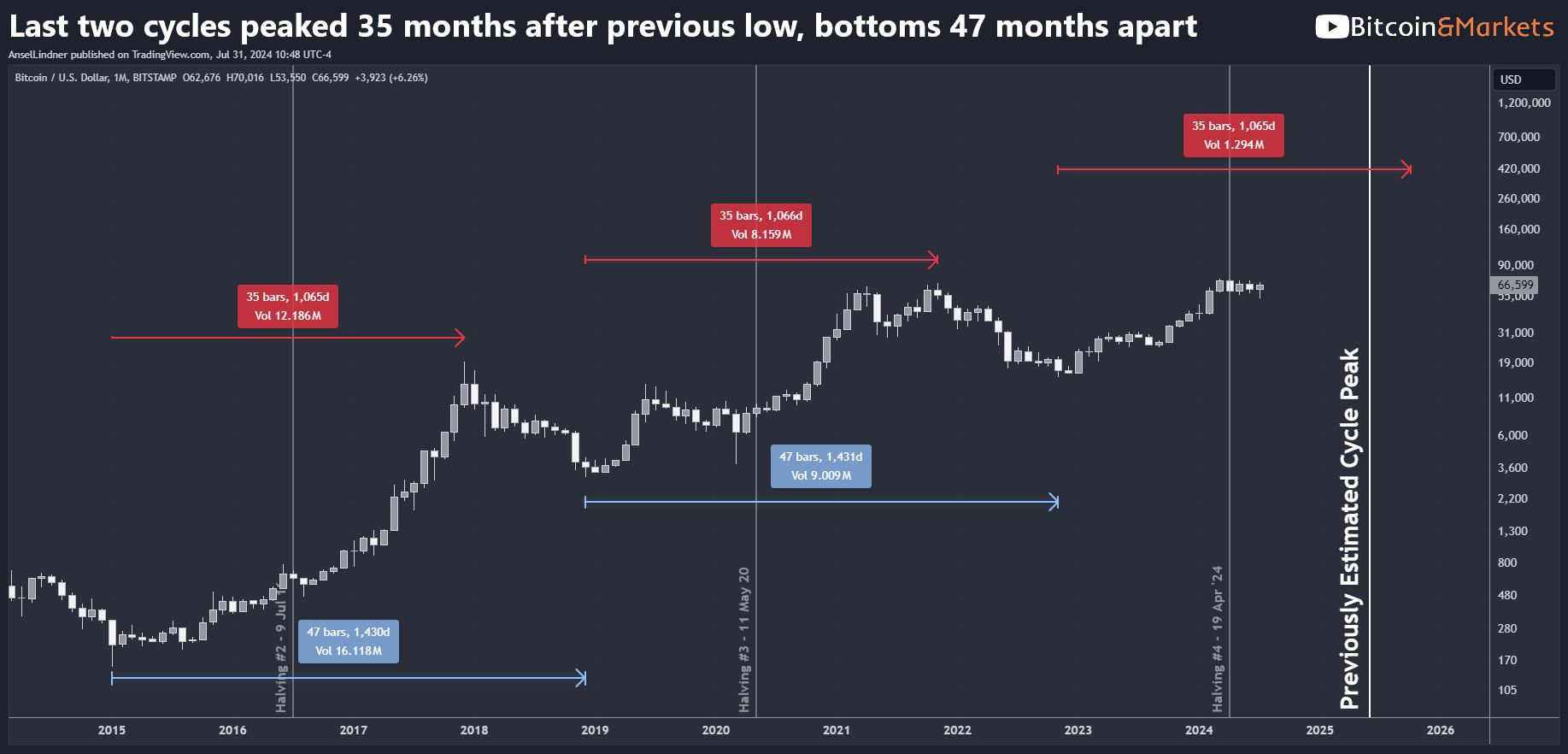

The regularity of the bitcoin cycles is kind of eerie. In each of the last two cycles, the cycle peak has occurred 35 months after the previous cycle's bottom. The time from bottom to bottom has also been the same at 47 months.

Extrapolating this pattern out, this cycle should peak in October 2025. This differs from my previous estimate of June. I do like the October timeline because it is closer to a normal Nov-Dec peak.

Additionally, when comparing past cycles, the 2017 peak was a 2000% gain from halving price, while the 2021 peak was 600%. If this trend of diminishing returns continues and we estimate a 400% gain from the halving price, that brings us comfortably north of $300k—within my target range for this cycle.

Bitcoin stands to benefit from a Fed rate cut, not in the way it’s typically understood (you can find more on that topic throughout my content), but because Bitcoin serves as a hedge in two scenarios. For those who view Bitcoin primarily as an inflation hedge, a Fed rate cut will be seen as inflationary, leading them to buy Bitcoin. For those who correctly view Bitcoin as primarily a deflation hedge, a Fed rate cut signals a deflationary recession, prompting them to buy Bitcoin because its value is not dependent on counterparty solvency. Either way, the conclusion is the same: buy Bitcoin.

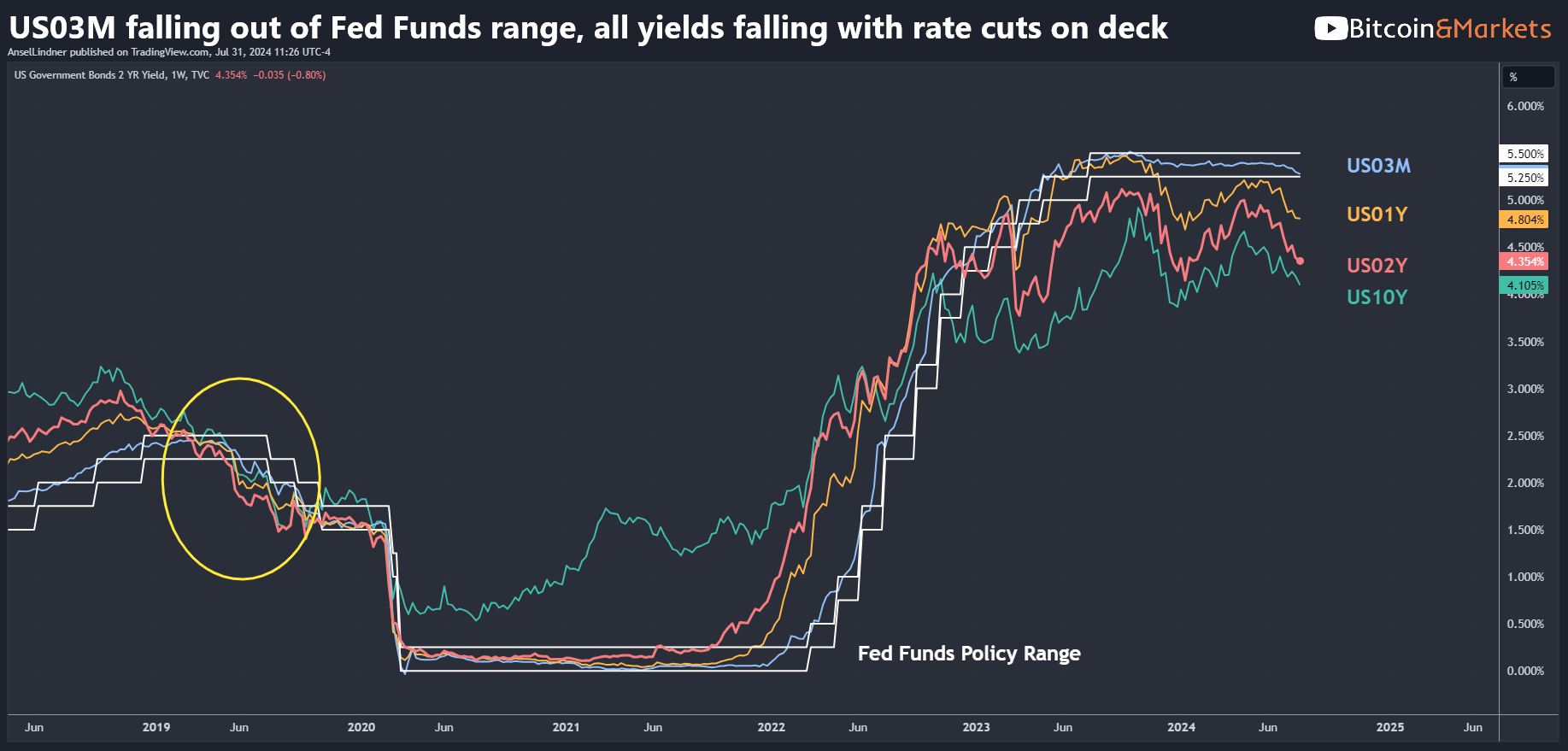

This is why I’m closely watching charts like the one below. The US 3-Month T-bill is on the verge of falling out of the bottom of the Fed Funds policy range for the first time this cycle, and other yields are dropping as well. This is very bullish for bonds.

Contrary to popular belief, what the Fed does today doesn’t matter much in the grand scheme. If they cut rates (which I believe is more likely than what's currently priced in, though still a small chance), yields will fall. If they adopt more dovish language (the most likely scenario), yields will fall. Even if they maintain their hawkish stance without cutting rates, yields will still fall because investors will fear the Fed is damaging the economy with high rates. All scenarios lead to lower yields and a rush into Bitcoin for safety.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.