Bottom Up Adoption: A Theory Based In The Inflation Argument

In a follow up to last week's post on gold versus bitcoin monetization and monetary evolution, this post tackles the technical consequences of an inflation-hedge mindset and how it led to the scaling conflict.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Last week, I argued in a blog post that Bitcoin's path to global adoption is unlikely to follow the inflation-hedge narrative. Gold was free to remonetize after 1971 following a similar path as Bitcoin the last 15 years, but it failed to do so, despite higher inflation in the 70's. While we do have inflation today, the primary driver of bitcoin adoption is a general deflationary pressure at the end of a global credit bubble.

This post is a follow-up, expanding on the flaws of an inflation-centric ethos around Bitcoin. Not only does it not fit the macro environment, as pointed out last week, but it also conflicts with Bitcoin's design. Below, I detail why an inflation-hedge mindset necessarily leads to the conclusion that Bitcoin must be altered to accommodate bottom-up adoption.

This inverted logic persists today, with Roger Ver trying to stoke division, bots pushing a distorted "bottom-up electronic cash" vision of Bitcoin, and I even place the ongoing debates about self-custody in this category as well.

An Inflation Hedge Is Bottom Up

Inflation disproportionately affects the lower and middle classes more than the upper class, because the middle and lower classes spend a larger percentage of their income on essential goods and services. When prices rise, these necessities consume an even greater share of their limited resources. In contrast, the rich often have diversified investments, including assets that can appreciate during inflationary periods, such as real estate, stocks, or commodities. This financial insulation allows them to maintain or even grow their wealth, minimizing their incentives to seek alternatives like Bitcoin as an inflation hedge.

For the lower classes, however, Bitcoin’s appeal as an inflation hedge is far greater, naturally leading to bottom-up adoption. From this perspective, we can trace the mental framework of the inflation ethos:

- We are in a highly inflationary environment.

- Bitcoin was created to combat this inflationary environment.

- The lower classes bear the brunt of inflation’s impact.

- Bitcoin will therefore be adopted from the bottom up.

However, Bitcoin’s actual design is fundamentally at odds with this inflationary mindset. To understand why, we must understand its core breakthrough.

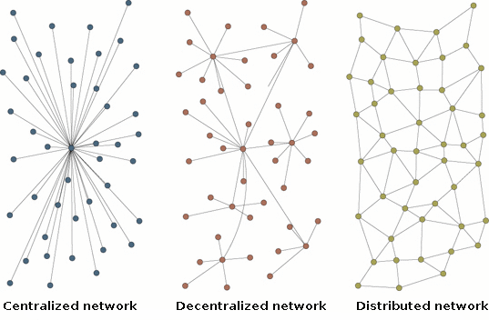

Bitcoin Is A Distributed Consensus

Bitcoin’s primary breakthrough is a robust distributed consensus, a network property where participants collectively agree on the validity of transactions without the need for a central authority. This consensus is maintained through incentives created by native, censorship-resistant money, which aligns participant actions with that goal.

Bitcoin is designed to establish and maintain its distributed consensus, rather than to create a perfect form of money or achieve global adoption. While those outcomes are desirable, they naturally follow from Bitcoin's foundational goal. To sustain its consensus, Bitcoin must maximize monetary properties; otherwise, a competing network or fork could incentivize participants to leave. The logic is as follows:

- Bitcoin (the network) is a distributed consensus.

- To maintain the distributed consensus it needs a native money (bitcoin the token).

- That native money must have optimal monetary properties.

- Optimal money will achieve global adoption.

At its core, Bitcoin’s foundational goal is maintaining a robust distributed consensus from which all else follows.

Bitcoin Cannot Be Bottom Up

Crucially, for Bitcoin to maintain a robust distributed consensus, it cannot align with the inflation-hedge ethos of bottom-up adoption. This is not merely a design choice—it is a fundamental necessity. A system that prioritizes cheap, unlimited transactions to facilitate bottom-up adoption would compromise the network’s distributed consensus.

Limited transaction throughput, for example, is a trade-off that mitigates the risk of spam attacks that could bloat nodes and make them prohibitively expensive to operate. By restricting block space, users must bid for transaction confirmation through fees, which rise with demand, naturally pricing out small, everyday transactions along with spam. Users are then incentivized to build and use derivative layers, whether through the Lightning Network, a sidechain, or a centralized solution.

The Scaling Conflict Was An Inflation Debate

The idea that Bitcoin must be fundamentally changed to achieve scaling and mainstream adoption is derived from an inflation ethos. This unavoidable tension between Bitcoin’s design and the inflation-hedge mindset became a focal point during the scaling conflict of 2015–2017. Some Bitcoiners, fully convinced by the inflation narrative, believed the trade-offs for their fundamental changes were worth it. To them, limiting Bitcoin’s transaction capacity made bottom-up adoption impossible and, by extension, doomed Bitcoin to failure. The problem was, they misunderstood both the underlying economic condition and Bitcoin's design.

Believing that Bitcoin needed to save the world by facilitating small, frequent transactions, they sought to reshape it to fit this vision. Their efforts ultimately led to multiple forks and the creation of alternative networks. That was desirable to them because according to their lens of inflation, bitcoin had failed to fulfill its promise of bottom-up adoption. A promise that never existed by the way.

The inflation-hedge ethos is flawed not only from a monetary evolution standpoint, as I argued last week, but also because it creates perverse incentives that conflict with Bitcoin’s foundational goal of maintaining its distributed consensus.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.