Reflexivity and the Merge - E248

This episode is a read through and reaction to Arthur Hayes' recent post about Ethereum's merge from a reflexivity perspective.

Listen to podcast here

This episode is a read through and reaction to Arthur Hayes' recent post about Ethereum's merge from a reflexivity perspective.

Summarizing my major gripes:

- There are many outcomes to the Merge, yet Hayes only considers two, success or failure. Bugs and/or consensus failure could appear weeks or months later, and is the major source of overall uncertainty, not simple Merge success.

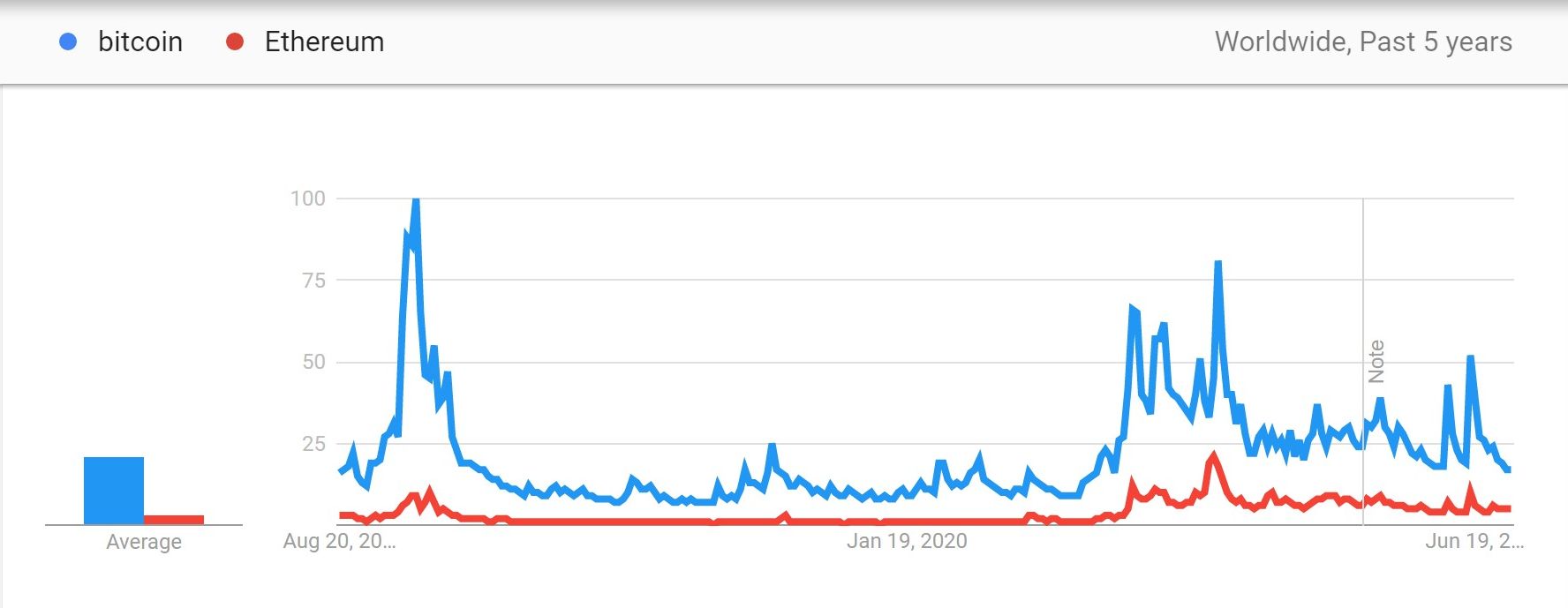

- Mindshare is not linear as Hayes claims. The correlation between ether's price and the search term "bitcoin" would be equally as strong. Indeed, a rising ether price is likely to cause more interest in cheaper substitutes.

- Dapps don't care about quality, if so they'd create their apps on a centralized platform, instead of with the pretense to decentralization, hacks and failures.

- Pump potential is the reflexive relationship, not mindshare or apps.

- Rising price has reflexive loop with quality apps and developers. Most likely, as the ether price pumps, the marginal investor or developer or app is less sophisticated and less "quality". Therefore, as price pumps, the average quality of these things goes down.

- "The amount of users and quality of applications have a reflexive relationship with the price of ETH." There is no feedback loop here. A higher price of ether means there will be more holders not spenders. Also, it will incentivize substitutes that have a perceived advantage in potential upside. Users follow speculation not applications.

- Ethereum is dependent on inflation like the legacy system. Growth == inflation. That inflation can be on Ethereum itself or second order inflation through apps built on Ethereum. By reducing free-wheeling scams through regulator capture of validators in POS (already happened), second order inflation is going to harder to come by, especially relative to substitutes. Also, Ethereum is dramatically cutting their own inflation.

- All this adds up to danger and uncertainty completely outside Hayes' narrow reflexive argument.

Get The Bitcoin Dictionary!

Bitcoin jargon demystified. Over 180 Bitcoin terms, concepts, and idioms.

The Best Free Bitcoin Newsletter!

Don't miss another issue. Subscribe to the Free tier!

Subscribe to the Pod!

iTunes | Stitcher | Google Pods | YouTube | Soundcloud | RSS

The Show Needs Your Support

We’re a small operation and producing quality content people find valuable.

Check out our big list of ways to help the show

Affiliates

- Chart Like A Pro With TRADINGVIEW

- The Best WordPress Theme I’ve Ever Used! GeneratePress

- Sign Up For Audible And Get 2 FREE Audio Books

Have Feedback? All feedback is welcome!

**DISCLAIMER: This is not investment advice, do your own research.**