Endogenous Money and Bitcoin: A Shift in the Monetary Order

Exploring how the decline of the high-trust system that enabled endogenous money creation could lead to a transition toward bitcoin and trust-minimized forms of money.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Recently, I encountered the term 'endogenous money,' a concept that nicely aligns with my view of how the current system creates money. This is one of the hardest aspects for people to grasp when discussing the nature of money. Naming the process of money creation makes the idea clearer and easier to explain.

As a Bitcoiner, I’ve long pushed back against the oversimplified idea that central banks like the Federal Reserve are solely responsible for "printing money." Instead, I’ve argued that money creation today occurs primarily through lending, driven by demand within a high-trust system of banks and institutions. This system—rooted in post-WWII economic order—has worked for decades but now appears increasingly fragile as global trust erodes.

This post is a brief introduction to the concept of endogenous money and an exploration of how it fits into my broader macro thesis.

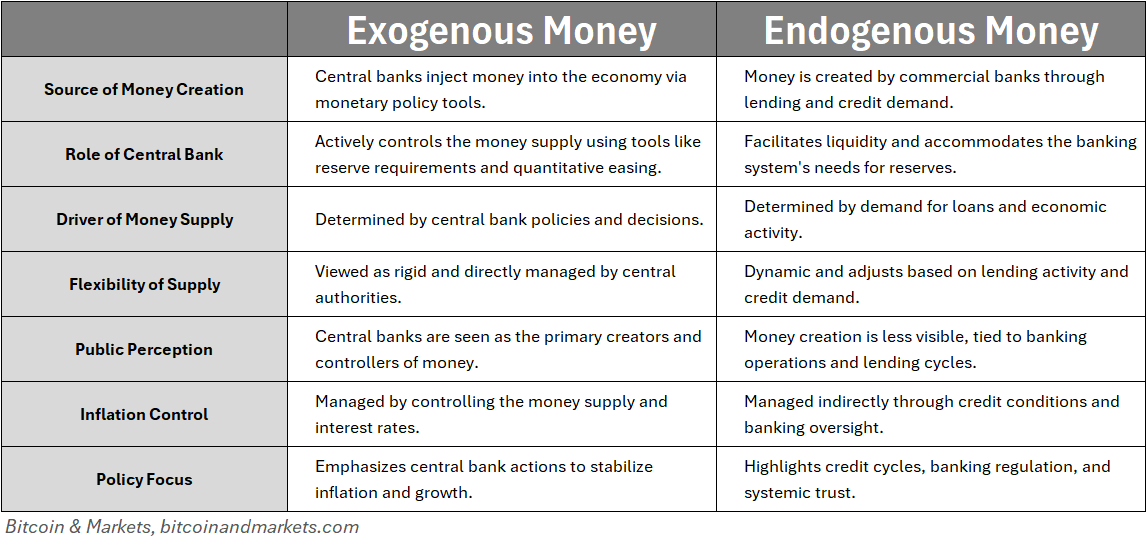

Comparing Endogenous and Exogenous Money

The overwhelmingly popular theory of money creation is that of exogenous money. Most people have been taught that the Federal Reserve or central banks 'print money,' directly controlling the money supply through mechanisms like open market operations, quantitative easing, or setting reserve requirements. This view simplifies monetary policy into a top-down process where central banks act as the primary drivers of inflation or deflation by regulating the flow of money into the economy.

Endogenous money flips this narrative on its head. Instead of central banks being the primary actors, this theory argues that money is created from the bottom up, driven by the lending activities of commercial banks. When a bank issues a loan, it simultaneously creates a matching deposit, expanding the money supply. Central banks, in this framework, don’t dictate money creation but accommodate it, trying to maintain liquidity and stability within the banking system.

Endogenous Money Evolved and Can Devolve

Endogenous money is not a universal trait of all money; it has been selected for by the market within a specific historical and economic context. The current system of credit-based money creation (endogenous money) evolved in the post-World War II era, shaped by the establishment of a high-trust global order led by the United States. This period saw the rise of robust international institutions like the UN, WTO, IMF, and World Bank, along with the dollar's dominance as the global reserve currency. These structures created the stability and trust necessary for banks to confidently hold debt as an asset and create money through credit. Moreover, during this period, debt was highly productive, driving what is arguably the greatest flowering of prosperity in human history.

This system of endogenous money works as long as there is broad confidence in the institutions that underpin it and highly productive uses of debt. Both of these pillars are under fire. The world is saturated with debt, and that debt is becoming much less productive. Look at the great and wonderful and fantastic Belt and Road Initiative (BRI): massive loans were issued to fund infrastructure projects across the globe, but all of these investments are failing to pay for themselves. It become so bad, China had to completely change course with BRI. This is a clear example of the state of productivity of debt on the international scale.

When growth begins to deteriorate like this, nations and people naturally start viewing the world as more of a zero sum game, which is currently manifesting itself as a wave of nationalistic and conservative feelings sweeping the world. Trust in global policy initiatives, liberal globalist governments, international institutions, and the banking system is eroding under the weight of geopolitical tensions, diminishing marginal returns on debt, systemic debt levels and demographic crisis. As this trust breaks down, so does the viability of the endogenous money model. Money creation tied to bank lending depends on a reliable, high-trust environment to function. Without it, the system risks devolving into stagnation or instability, forcing a reversion to more transparent and trust-minimized forms of money.

Trust-Minimized Bitcoin

The evolution to bitcoin-backed money represents a fundamental change in the nature of money itself. Endogenous money, which can expand under proper conditions, has a critical weakness: it contracts under adverse conditions. When demand shifts from growth and expansion to preservation, the limitations of endogenous money become glaringly obvious.

Bitcoin is theoretically the optimal value preservation tool. We don't know if it will ultimately end up dominating the world, but every single sign so far has been positive. Bitcoin’s fixed supply, permissionless nature, and ability to settle value over communication channels make it the ultimate trust-minimized asset for global money.

Bitcoin is neither endogenous nor exogenous money. It inherently limits the ability of both banks to create money through lending and governments to create money through fiat issuance. While bank-driven money creation will not vanish completely or overnight, the role of credit in backing the economy, its privileged place on balance sheets and as the economic structural supports will all shrink relative to harder forms of money. We already hear loud voices from BRICS nations declaring that the dollar, in its current form, no longer works for them. These countries openly discuss a gold-backed currency, but they are just one step away from realizing that bitcoin solves these same problems—and does so more effectively than gold.

The evolution of money is ongoing. I am convinced that the high-trust, highly productive foundations that enabled endogenous money to endure are rapidly changing. This shift is creating a new environment that favors sound money adoption—a money well-suited to a low-trust, insecure economic order.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.