History of World Reserve Currencies: Part 1 - The Italian Renaissance Standard 1250-1535

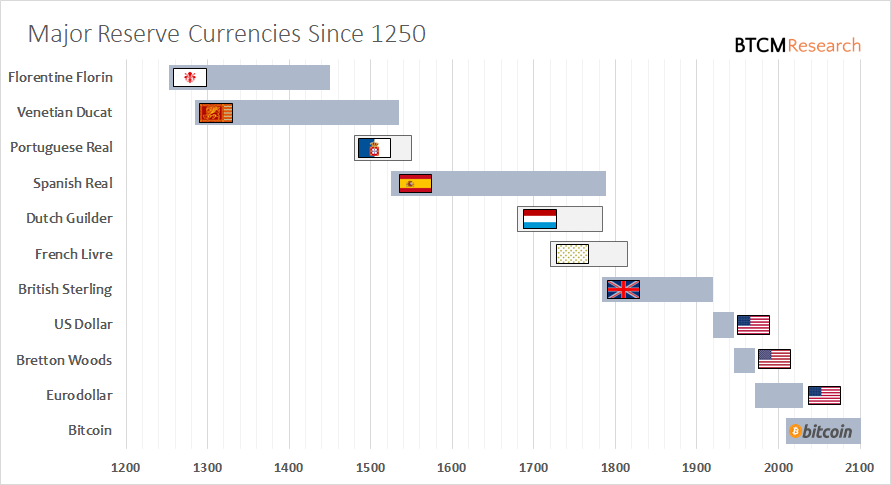

The world's reserve currency fulfills a unique role in the global economy. It is the currency held in reserve by sovereigns, central banks, banks, and large businesses to facilitate the financing and transactions of global trade. Importantly, all the currencies on the chart were backed by precious metals until we got to 1971 and the Eurodollar system.

It is important to view the world reserve currency as the currency which, during its time, facilitated the largest trade network. International trade is what a reserve currency is all about.

For over 1000 years, the Byzantine solidus, along with nearly identical offshoots like the gold dinar, dominated trade. However, by 1250 the solidus had been massively debased leading to contracting economic integration between Central Asia, the Mediterranean, and Europe. This is the void into which the Italian city-states stepped, by providing quality gold coins and facilitating trade in routes they maintained. Below we will examine these Italian coins and trace them from 1252 until 1535.

Florentine Florin

When the florin was minted in the 13th Century it was the first European gold coin struck in significant quantities for more than 500 years. In the 8th Century, the Carolingians introduced a silver standard to Northern Europe. The florin spread quickly throughout Western Europe becoming widely recognized as the coin used in trade, debt, and accounting. A vast network of Florentine bankers formed the first large international business enterprise and, when combined with a standard coin, were able to expand trade dramatically.

The florin was in many ways the first modern currency. We can see aspects of our current system emerging back then. For example, modern accounting allowed the Medici bank to balance their books amongst branches which reduced the need to transport gold across the continent. The florin was copied by others across Europe and is similar to the Eurodollar system today where dollars are created outside US jurisdiction. For example, Genoa's genovino, Hungary produced the forint and the Dutch minted the Guilder. Altogether about 150 locations minted a florin to the same weight and measure as the Florentines. The most important being Venice.

Venetian Ducat

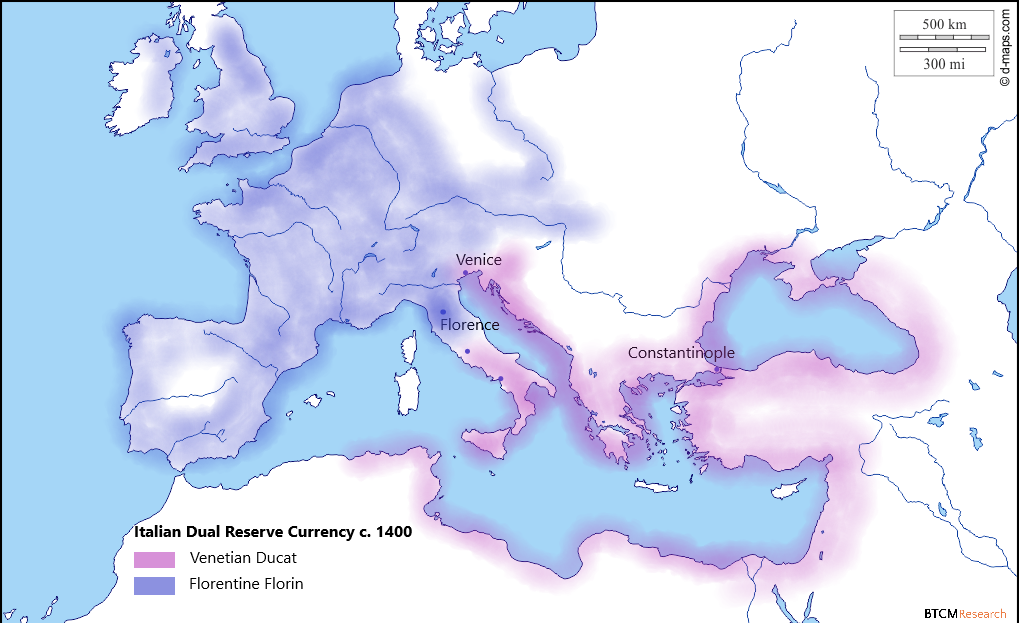

After a particularly troubling debasement of the Byzantine hyperpyron in the 13th Century, the Duchy of Venice started producing the Ducat which was modeled on the florin. The ducat was almost identical in weight, at 3.545 grams, to the florin's 3.5368 grams (the slight difference due to the measurement systems in the two city states). The Venetian coin was used throughout the Levant, Anatolia, the Black Sea, and the Adriatic, circulating simultaneously with the florin in the West. The ducat and the florin were very similar and could be looked at as a single Italian reserve currency.

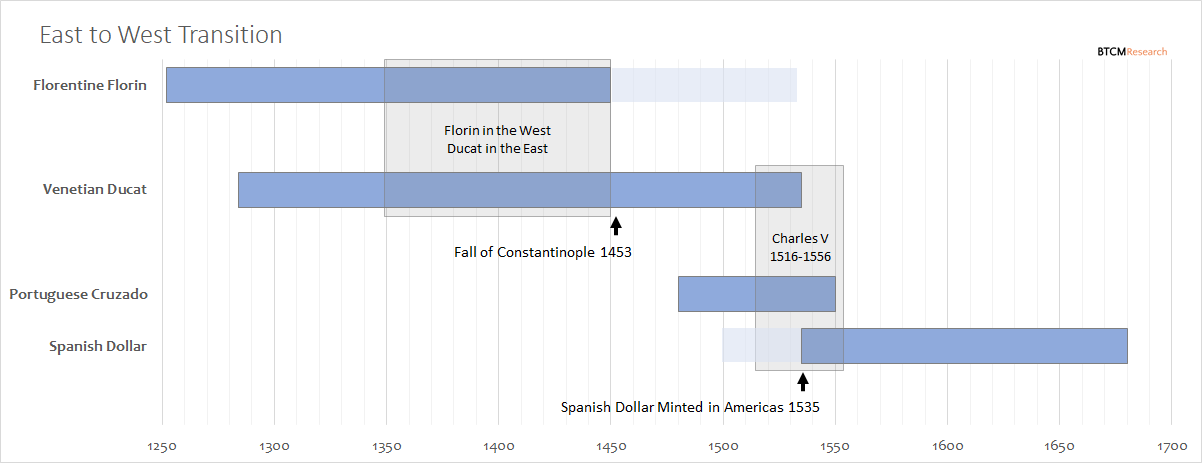

In the 15th Century, florins in several places in Western Europe suffered from debasement leading to a distinction between lower and higher quality florins. The debased coins eventually evolved into "guldens" while the higher quality florins were re-issued as ducats. Therefore, by 1450, use of the term ducat incorporated much of what was previously known as the florin.

In the early 16th Century, the ducat's role as reserve currency peaked and, by the middle of the century, suddenly lost its dominant role in trade. This 16th Century shift was similar in magnitude to the 14th Century shift from Byzantine coins to Italian. The epicenter of currency now moved from Italy to Spain. Several important historical events precipitated this move: the uniting of Castile and Aragon (1479), the end of the Reconquista (1492), expansion of maritime exploration and trade (Columbus 1492), Hapsburg Spain (1516), and American silver mines (1535).

The year 1497 saw the ducat come to Spain when Ferdinand and Isabella enacted monetary reform with the Pragmatica de Medina del Campo. This reform created a copy of the ducat, initially called the excelente, but which became known as the ducado (Castilian Ducat) in 1504. Seven years later, in 1511, Maximilian I of the Holy Roman Empire began to mint a ducat (which was still produced in Austria until the 20th Century).

These two developments, the minting of a ducat in Spain and the Holy Roman Empire, fit nicely together five years later (1516) in the person of Charles V who was the Holy Roman Emperor and King of Spain (which included Sicily, Naples, Sardinia, and the Low Countries). He controlled the largest trade network in the world at the time, and hence the world reserve currency. The ducat was used throughout his domains, but not for long, a new standard was just around the corner.

We will continue this series by first looking at the monetary changes occurring in the 14-15th Centuries and which culminated in a return to the silver standard 1535.