Housing Costs: Inflation vs. Lifestyle

Exploring how expectations, not just inflation, shape housing affordability—and what that means for today’s buyers.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

This post is going to be controversial. We're diving into the cost of housing today versus 75 years ago and exploring whether inflation or our rising expectations are truly to blame for higher prices. We often hear about housing being too expensive for young people just starting out—and while I absolutely understand the challenge (it’s likely tougher to buy a basic starter home today than it was 20 years ago when I did it), there’s a lot more to this story that deserves a closer look.

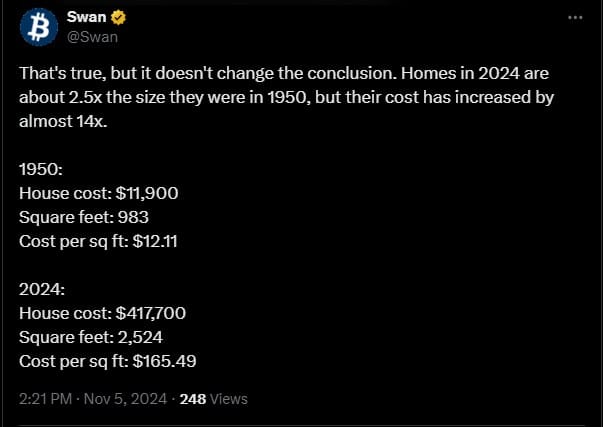

Here’s an example from the other day on X. Swan Bitcoin tweeted about how homes are unaffordable today compared to 1950.

In 1950, the median home price was $7,354. Today? It's $420,600. This is why our parents could buy a house on one income, while we can barely afford rent with two.

— Swan (@Swan) November 5, 2024

Houses didn't get bigger —your dollars got smaller.

Opt-out. Choose #Bitcoin. pic.twitter.com/HX03HKHxCc

They specifically said, "Houses didn't get bigger," suggesting it’s purely an inflation issue, which is disingenuous. So, I chimed in with a simple reply:

Houses literally did get bigger and better though???

1950: 950 SF, no AC, few appliances, no drive way or garage in most cases

2024: 2500 SF, central HVAC, driveway, 2-car garage standard

They replied with this, and it got me thinking more deeply about the conversation.

Making it Apples to Apples

My point isn’t that inflation hasn’t happened over this period, but that focusing only on inflation misses the bigger picture and overlooks the solutions. The implication Swan was making is that people who can’t afford rent should be stacking bitcoin instead, which might not be the most helpful advice. How about encouraging young people to consider buying smaller, simpler homes instead?

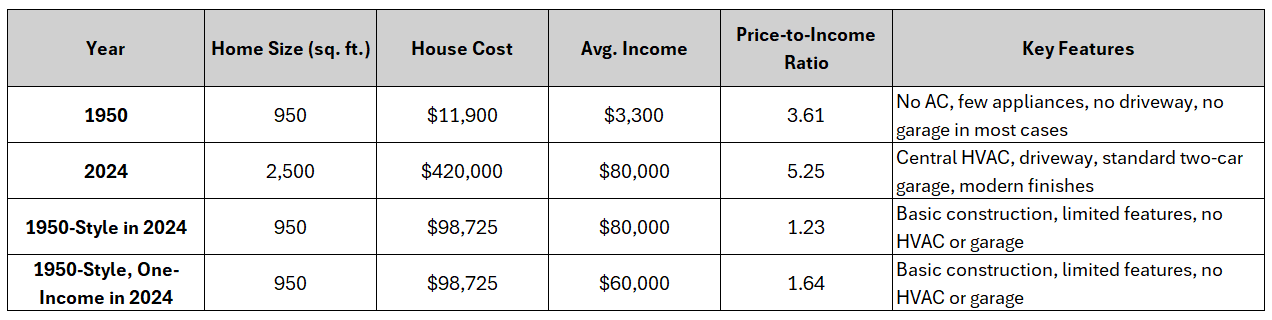

So, I decided to run the numbers myself, with some help from ChatGPT, to create a fair comparison. What if we stripped down a modern home to match the simplicity of a 1950s house, excluding central HVAC, a two-car garage, a driveway, modern insulation, and high-end finishes? Building a basic, 1950s-style home today—using basic construction and limited features—would cost an estimated $98,725. And if we used pre-fabricated construction, the cost could be up to 20% lower still.

This “1950s house in 2024” gives us a clearer picture of how affordability has changed. It is still vastly higher in 2024 than 1950, but our comparison is not done. Is housing today more or less affordable than it was in 1950?

A Look at Affordability Over Time

To measure affordability, we compare the price of a home relative to the average household income:

These ratios reveal that a 1950s-style home is significantly more affordable today than it was in 1950. While the adjusted home lacks the conveniences of a 2024 home, it also shows how much income growth has outpaced the cost of a simple home over time.

The Bottom Line

The housing affordability issue today goes beyond inflation—it’s largely about societal changes and elevated expectations. While homes have become larger and filled with modern features, a simpler, 1950s-style house would actually be more affordable today than in the past.

This isn’t necessarily a practical recommendation for everyone but rather a reframing of the issue: it’s not just inflation, inflation, inflation all the time. This perspective dovetails with my broader demographic prescription—in order to address that issue our living standards will likely have to go down. Many young adults could benefit from reconsidering what they want in a home, realizing that today's realities do not preclude a happy thriving family in a very modest house.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.