Macro Chart Rundown - Sept 16, 2021

In this post we take a detailed look at factors affecting the oil market, dive into the dollar chart, and stress over gold.

If you like this content, SUBSCIBE and SHARE! Thank you. Support by becoming a paid member or subscribing for the free weekly updates.

In this post:

- Oil (very important developments)

- Dollar

- Gold

Oil WTI

Several market events in Oil have thrown my predictions out the window for now. 1) Hurricane Ida, 2) Saudi relations, and 3) Evergrande. We should all be familiar with Ida and Evergrande by now. If not, suffice it to say for Evergrande, it poses a huge threat to the Chinese economy, and in my opinion marks the end of the Chinese Miracle. That will negatively affect China's demand for oil. So, out of the three key developments I'll focus on the Saudi relations below, after some basic charts.

I still am thoroughly convinced that oil will trend lower over the next couple of years, but I was not expecting this recent jump in price. All things considered oil prices are still relatively low, especially if viewed through the lens of "money printing". Demand will drop as the global economy slows, but the unanswered question is how much supply will drop.

We have broken the short term downward trend, but in a somewhat weak fashion. I added a box to the 2018 price action that saw a series of higher highs and higher lows, but eventually broke down. Something like that will likely happen again. This is especially true if China sees a massive slowdown due to the Evergrande debacle.

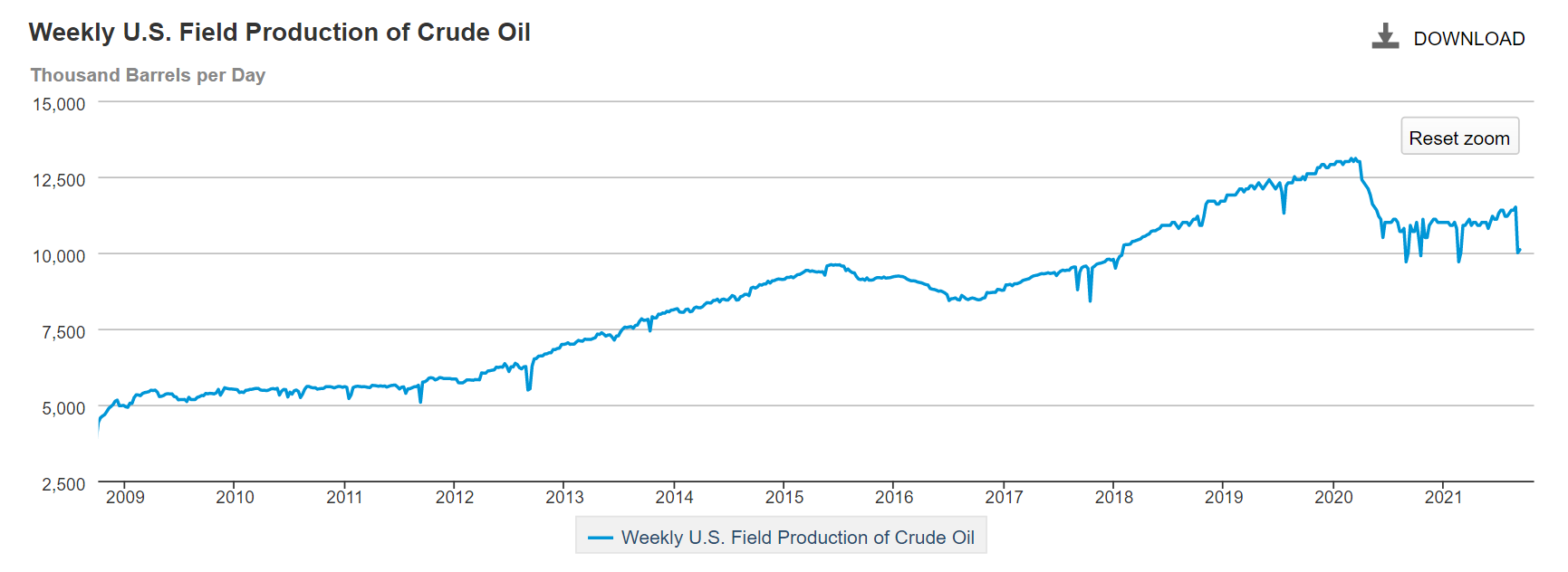

US oil production crashed 1.5 million bbl/d, due to affects of Hurricane Ida. This means supply is temporarily cut, leading to temporarily higher prices. It will bounce back very quickly, like we see elsewhere in the chart.

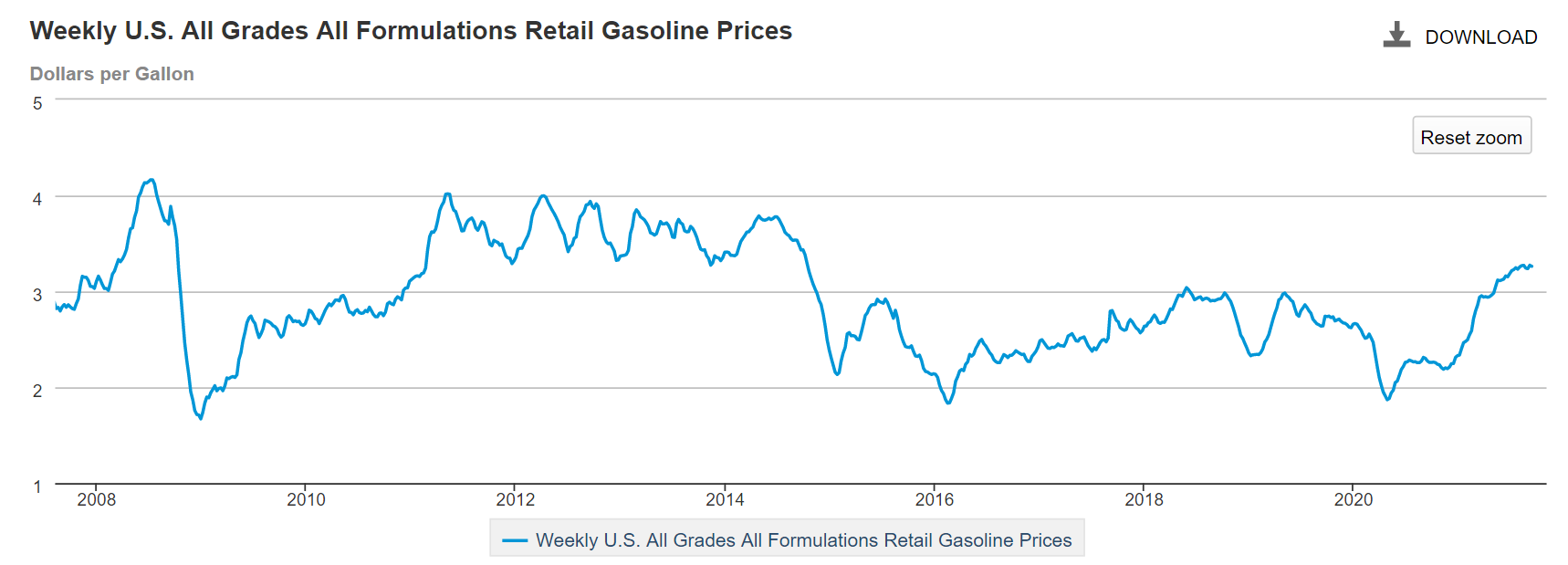

Despite that, gasoline prices were flat in the US, forming an ominous hanging chart that does not look like it wants to go up further.

Saudi Relations

This is possibly the least reported, major event since the Afghanistan debacle. Leaders in Persian Gulf countries are getting very worried about their place under the US umbrella as the US unilaterally withdrawals its Patriot batteries from the country. From Yahoo Finance, "Saudi Arabia On Edge As The U.S. Withdraws From The Middle East"

The strategic relationship between the House of Saud and the US Administration is worsening by the day, as shown by repeated unexpected changes in president Biden’s approach to the Kingdom and its rulers. [...]

If Afghanistan turns out to be a one-off event, there will be limited negative repercussions for Saudi Arabia, the UAE, and even Egypt, but some Washington insiders believe it is the start of something larger. All eyes are now focused on the US position in Iraq and its active involvement in Syria and Libya. Arab assessments are rather negative, expecting an all-out American military retraction in the coming months. [...]

It has been confirmed that the US has removed its most advanced missile defense system and Patriot batteries from Saudi Arabia in recent weeks. The removal of the defense system was done despite repeated requests made by Saudi officials and royals to keep the weapon systems in place to counter continued air attacks by Yemen’s Houthi rebels. [...]

The US unilateral decision to redeploy the anti-missile systems and Patriots from Prince Sultan Air Base outside of Riyadh is remarkable, especially taking into account that most US-Gulf allies are worried about the fall-out of the Afghanistan disaster. Analysts in Riyadh, Abu Dhabi, and Bahrain are also very worried about possible new US plans to even remove large parts of the tens of thousands of American forces in the region, now in place as a bulwark against Iran and possible insurgencies.

Remember, my thesis is that the US will withdrawal from the role as world policeman. While the US is responsible for many thousands of deaths in the Middle East (perhaps hundreds of thousands), it will pale in comparison to human suffering that will happen if (when) war breaks out in the region. Not only human suffering in the immediate area either, 20%+ of the world's oil goes through the Persian Gulf and Strait of Hormuz.

Of course, war here would make oil spike, making CPI spike, causing a massive credit squeeze as companies strained to find revenue. Inflationists would have a ball. But geopolitically the US can be self-sufficient in energy. A Persian Gulf war would affect US rivals much much more, namely China.

Dollar and DXY

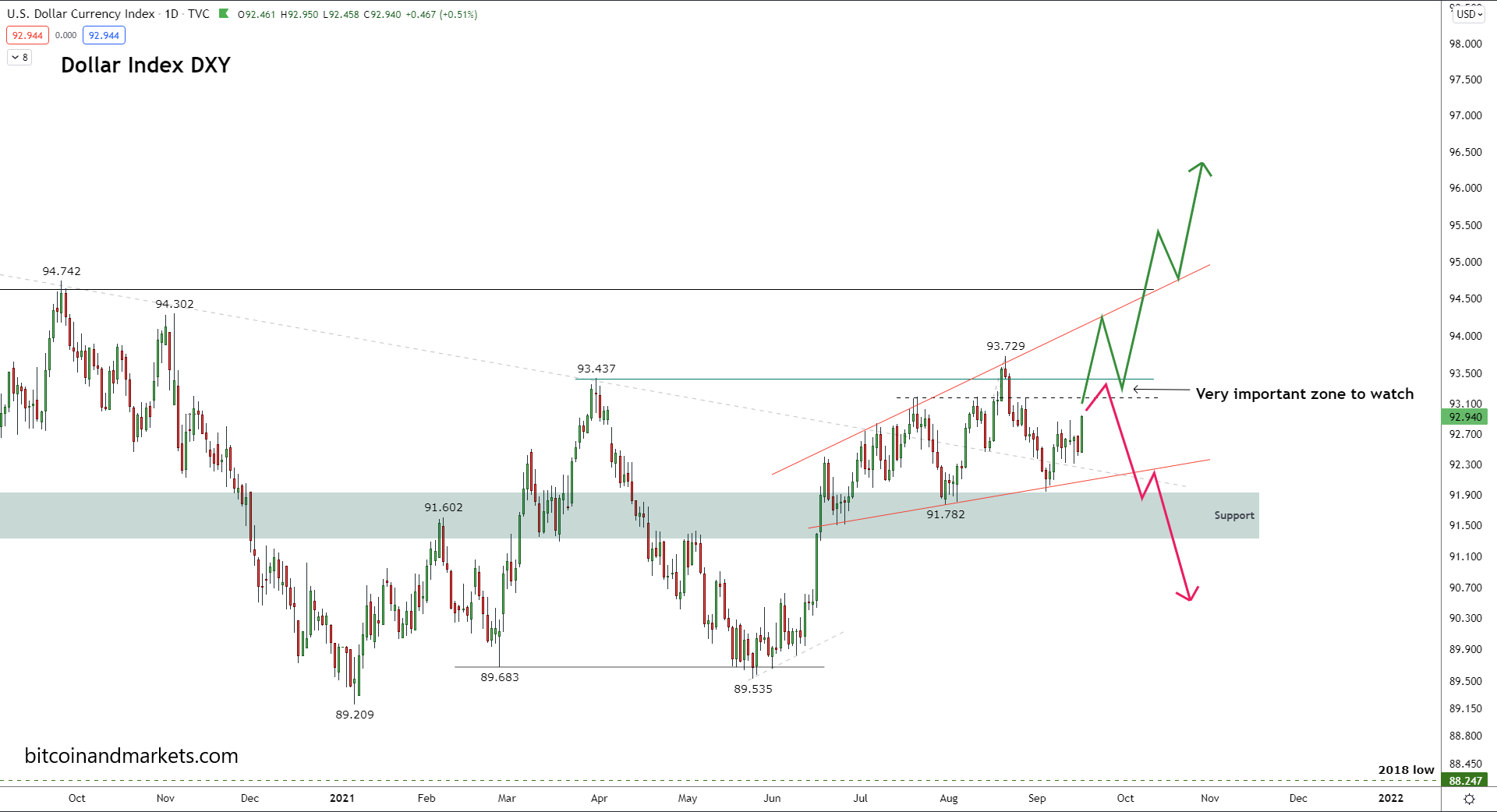

A lot has changed in the dollar over the last few weeks. Instead of picking a direction, it has traveled sideways. It has yet to truly break higher, though it has shown signs of getting ready to move in that direction.

Right now, there is very strong support/resistance level, between 91.3 and 92, which we have been pointing out for months. That range sits right below the immediate pattern of a broadening wedge or megaphone. There is a series of higher highs and higher lows in line with each other, that until proven otherwise, is a bullish trend.

I'll be watching for is for a bounce in the middle of the wedge, either bullish or bearish, as below.

Evergrande Effect

The big macro story right now is, of course, Evergrande. They are largest real estate developer in the China and their $300 billion in debt is worth about 10 cents on the dollar. It is getting very dicey over there in China at the moment. What every major investor is waiting to see is if Evergrande is going to get bailed out or not.

Many pundits are saying there is a high threat of contagion spilling over globally. I think this is unlikely to have a major effect on the US market. In 2011, 2014, 2018, when the rest of the world had recessions it did not spread to the US very much at all. The reason for this is because these are Eurodollar recessions, and the US is insulated from that. But the EU and emerging markets would be hit hard by a Chinese "Lehman" event.

Investors in China will first rush to the Yuan, but then make their way into other assets including the USD and USTs.

Gold

I do not like the look of the gold chart. Today, it is getting slammed again after reaching only $1834.01, a few pennies below the 15 July high, but basically a triple top, a sign of weakness. There is no global follow through on gold at this time, and with a stronger dollar likely coming in the next few months, gold is going to be hard pressed to rise.

I'll bring up my gold prediction from last year again. I thought the gold price would get as low as $1550, before bouncing. But after the double bottom in March and the subsequent rally through May, I accepted that my target was a little bit bearish. However, now I'm second guessing that call.

The price of gold is now nearly 10% below the 2011 high once again. I get anxious looking at this chart. It brings back memories of being a gold bug during the first several rounds of QE and knowing, KNOWING, that inflation was coming and gold would moon, yet it never came. I get the feeling that gold has topped for this cycle.

The one glimmer of hope for gold is that the volatility is waning. The range is tightening, meaning there is a possibility that it can break up after a squeeze. But it will take months for that to happen. At this time, I'm not convinced either way, but starting to lean back bearish toward a possible lower price like below.

That's where I'm going to leave for this issue. Questions or comments, reach out on twitter to @AnselLindner.