Macro Minute: As Economic Data Weakens, Bitcoin Takes Cues from Gold

With economic indicators pointing to a downturn, exploring how gold's historical role as a safe haven asset can guide Bitcoin's future performance.

Check out our tier perks. 1 MONTH FREE - Member or Premium

Fed Surveys Signal Recession Risks

Recent regional Federal Reserve surveys from Philadelphia, Dallas, and Richmond indicate growing economic concerns, with business activity contracting further.

Key economic indicators such as Capital Expenditures (CapEx), New Orders, and employment numbers are all trending downward, reflecting diminishing optimism among businesses. The sentiment is clear: a recession is likely on the horizon as consumer spending shows signs of significant pullback, raising alarms about potential severe impacts on businesses if the current trend continues into the year-end.

Despite declines in consumer prices, many industries, including design and construction, report sustained cost increases without corresponding relief. We've discussed this in recent streams, where layoffs result from producers being unable to pass on price increases to weakened consumers.

Compounding this, rising personal debt and uncertainty about interest rates are delaying consumer purchase decisions and stalling economic activity. Business owners also highlight their uncertainty around the upcoming U.S. elections, which will significantly influence the direction of American business and its competitive stance globally.

Bitcoin and Gold

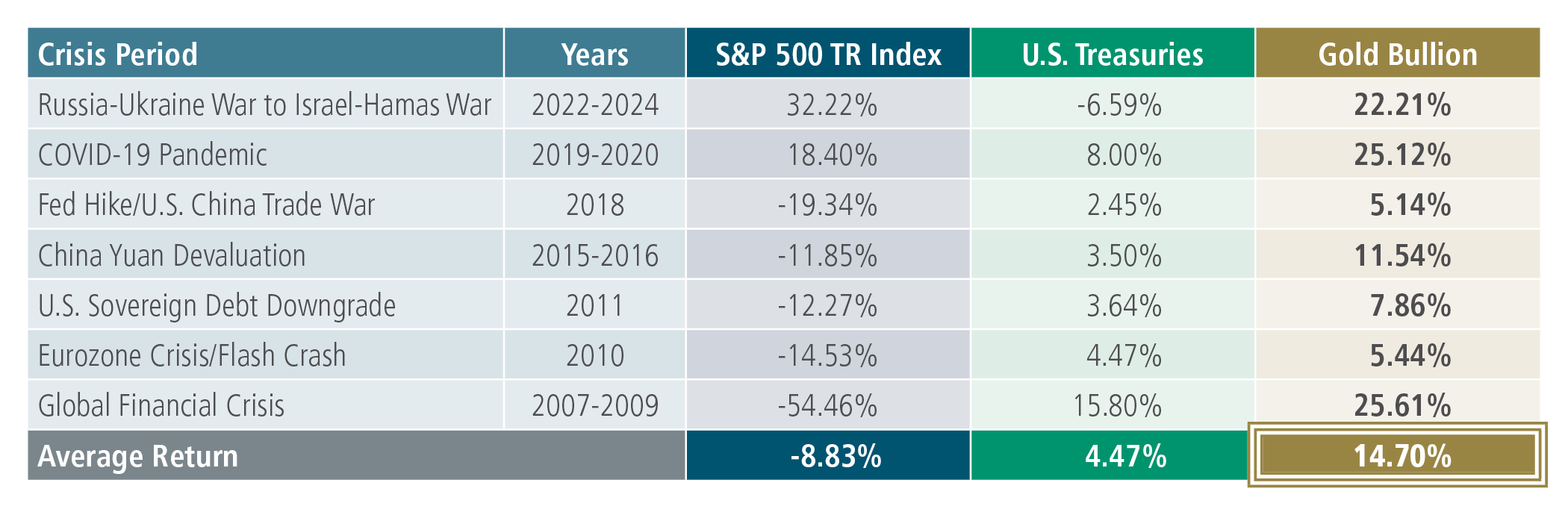

Gold has long been considered a safe haven asset, especially during periods of economic and geopolitical instability. Historical data shows that gold has consistently outperformed both the S&P 500 Total Return Index and U.S. Treasuries during several notable crises over the past two decades.

This trend illustrates that gold serves as an effective hedge during crises, often outperforming other traditional safe-haven assets like U.S. Treasuries. Simply put, gold is an asset that is not subject to the same counterparty risks as bonds or stocks. As we know, the same exact argument can be made for Bitcoin, which is why I have expected both gold and bitcoin to do well this year with bitcoin dramatically outperforming.

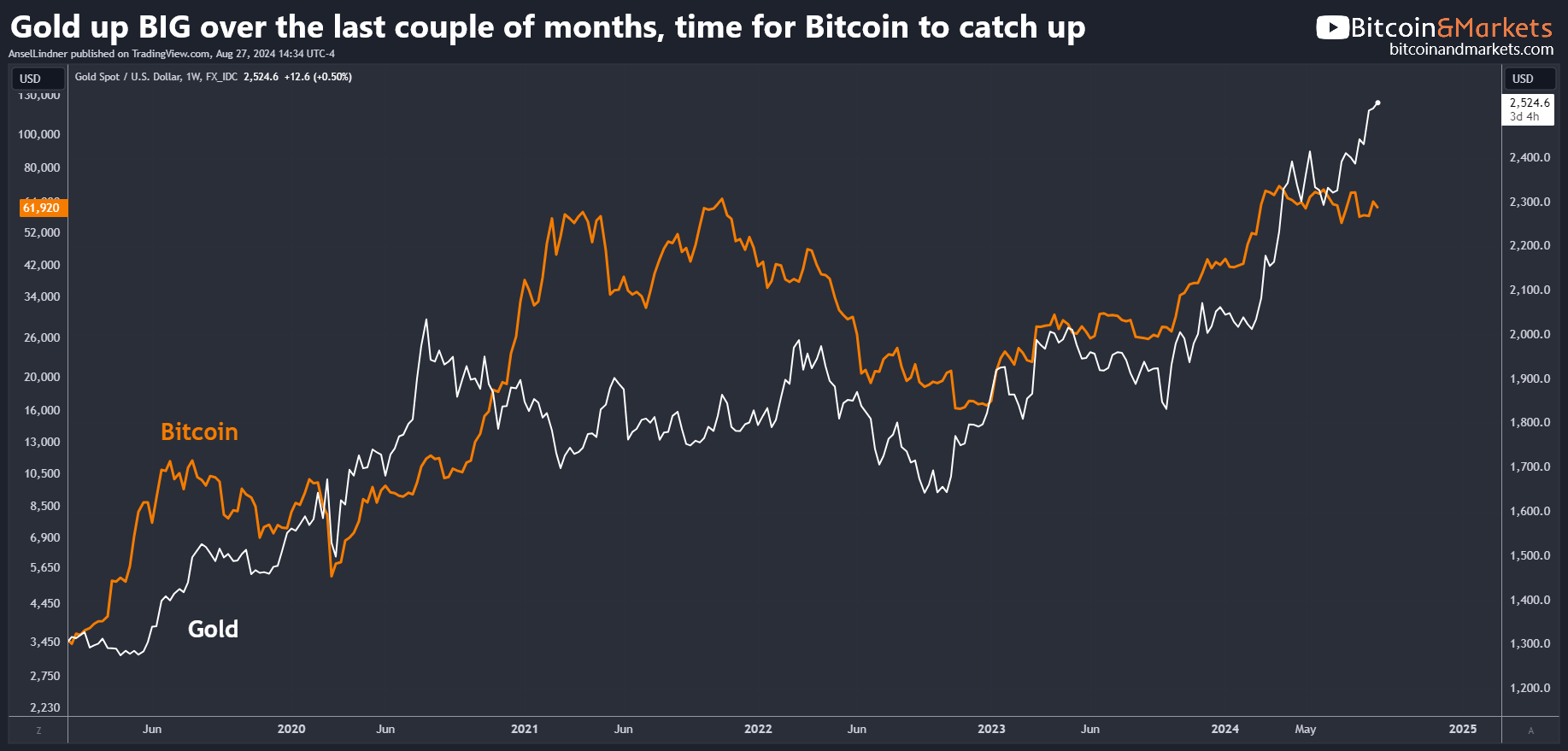

However, the same argument can be made for Bitcoin, which shares similar attributes with gold as a store of value. This year, both gold and Bitcoin have shown impressive gains, with gold up 23% and Bitcoin up 41%. Yet, since June, gold has diverged from Bitcoin, which could be attributed to several factors related to legacy market behaviors. Nonetheless, the fundamental drivers of both assets' prices remain aligned, and it is likely only a matter of time before Bitcoin's price catches up to gold's trajectory, on the chart below, implying roughly $100k per bitcoin.

The analysis of gold's performance highlights its response to growing uncertainty about the global economy. With China's economic crash, Japan's demographic challenges and weak yen, and Europe's ongoing struggles, there are multiple factors contributing to this uncertainty. Beyond economic reasons, the rise of populism globally adds another layer of unpredictability to the market, suggesting we are experiencing more than just a typical recession; we are witnessing significant global realignments.

Conclusion

In the current climate of economic uncertainty and downturn, there is a clear flight to safety. With U.S. economic data worsening and global instability rising, both gold and Bitcoin are proving to be strong safe haven assets. Gold's recent gains highlight its enduring appeal, while Bitcoin, with its similar safe haven characteristics, is likely to follow. Unless there is an unexpected economic recovery, both assets are positioned to continue their upward trajectories as investors seek stability and wealth preservation in an increasingly volatile environment.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights! Follow me on X @AnselLindner.

LIMITED TIME!

Join the community today and get 1 MONTH FREE!

Member or Premium

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.