Macro Minute: Commodities Under Pressure, Support Recessionary Signals

Exploring the weakening trends in oil, copper, and the commodity index, and what they signal for the global economy and Bitcoin.

It's been a while since I've updated readers on commodities and provided my commentary. Today, we will examine oil, copper, and the commodity index.

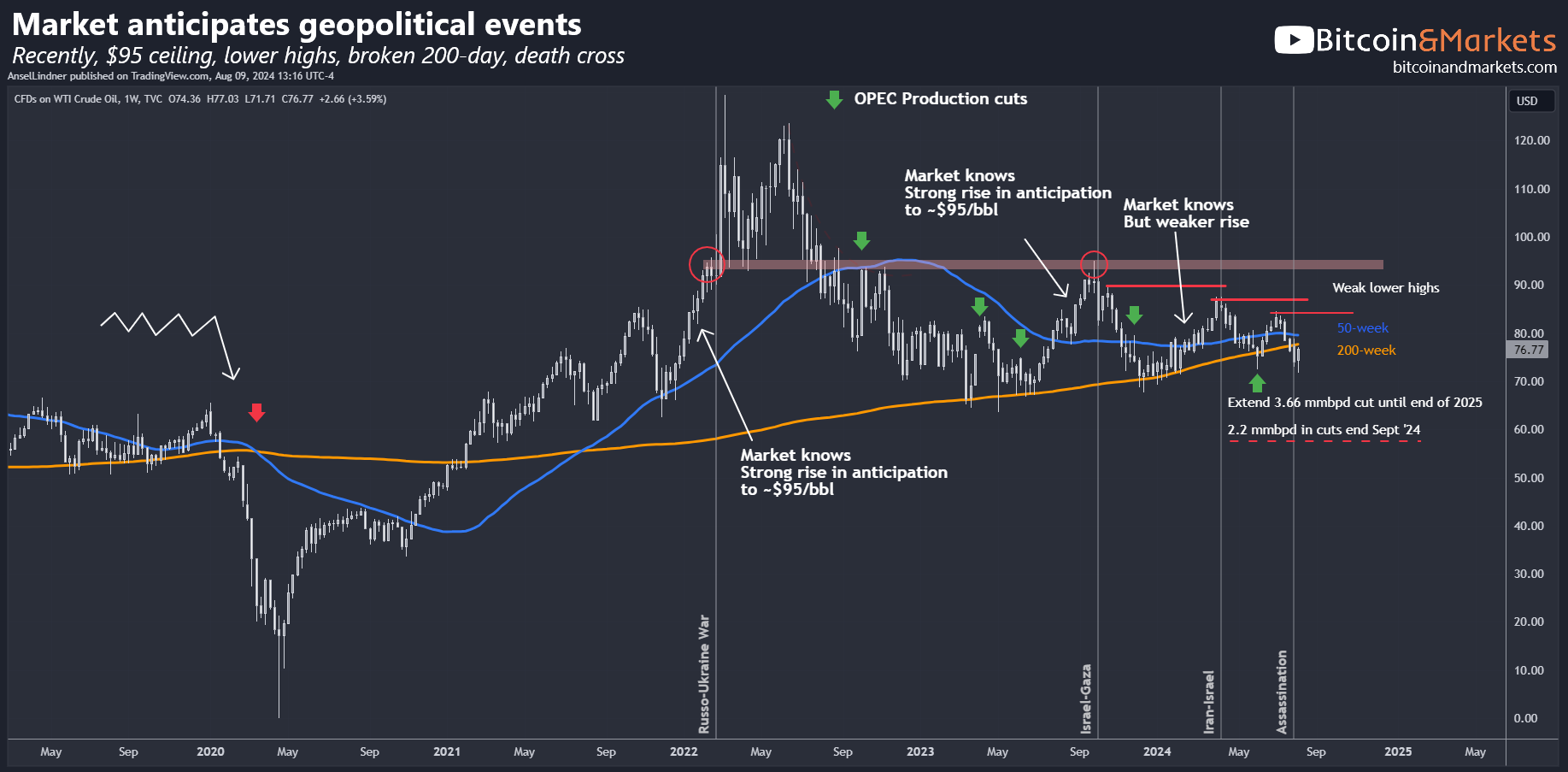

Oil and Gas

Let's begin with a comprehensive look at the WTI Oil chart (USOIL) from the last few years to bring readers up to speed on my analysis. Overall, we should expect secular weakness in the price of oil due to increased supply capacity, decreased economic vibrancy, and population decline in major markets. (You can also consider the impact of clean energy efforts, though I believe they are less significant.) The above chart should bring you up-to-speed.

Despite aggressive OPEC production cuts of 5.85 mmbpd, or approximately 6% of daily global oil consumption, price is very weak.

If you've watched my live streams on this topic, you'll recognize this pattern, which I've been predicting for some time now. Whether this trend continues is uncertain, but my theory suggests that the price will eventually approach a breakdown point. We are currently in an overall oil glut, reminiscent of the 1980s and 90s, which could potentially extend far into the future due to demographic shifts.

Natural gas has been relatively uneventful. European futures (TTF1!) are rising slightly but remain far below the prices seen during the panic following the start of the Russo-Ukrainian War. U.S. Henry Hub Natural Gas futures (NG1!) are near record lows and are only being held up by the anti-energy policies of the current administration. U.S. gasoline futures (RB1!) are tracking closely with oil, or slightly lower relative to moving averages.

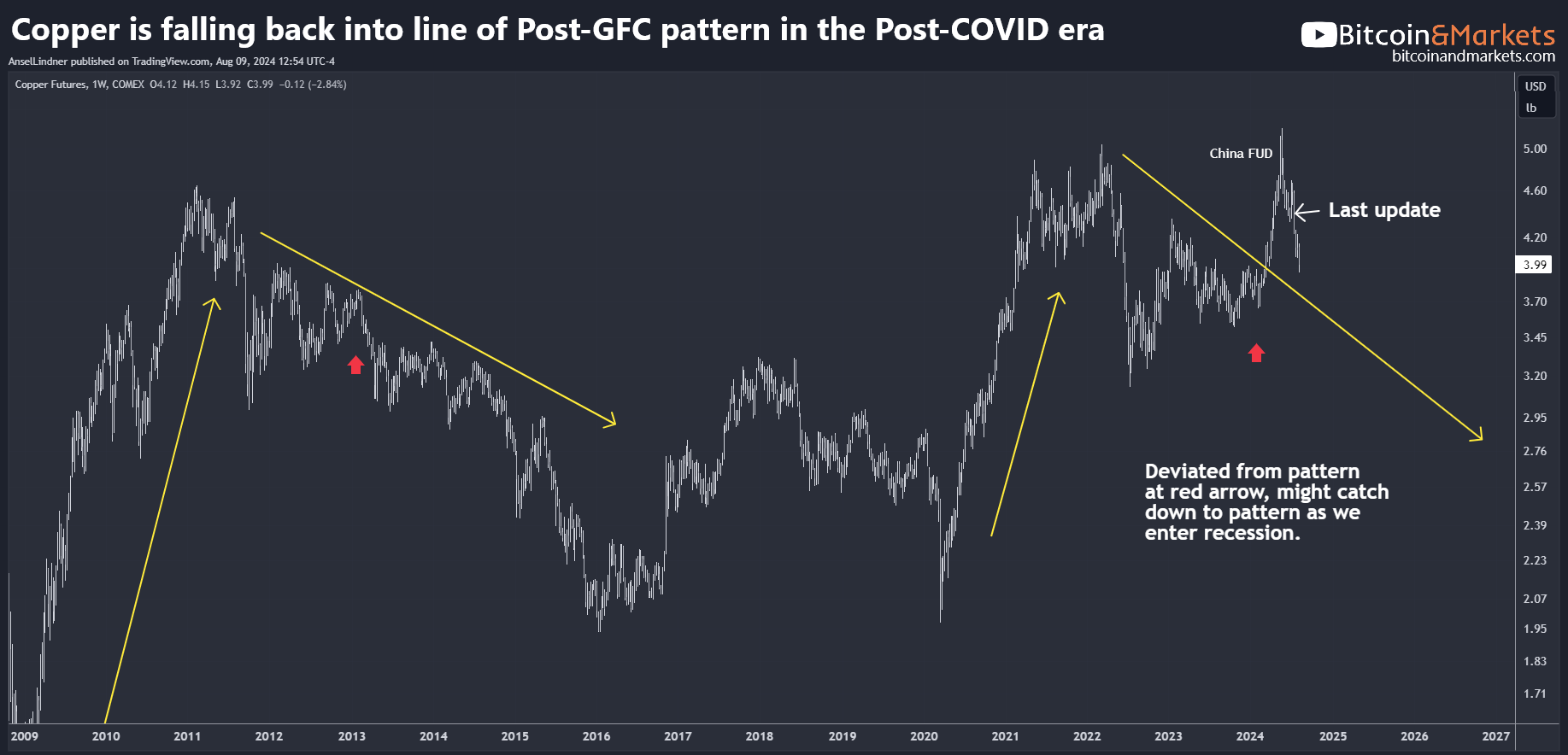

Copper

I published this chart on Jul 19, 2024 on a Macro Minute, where I examined the China hoarding FUD.

I was surprised by the recent spike, but still be be proved correct as copper continues to decline. Global economic activity is definitely decreasing, and copper demand along with it. China is now selling copper, and mining will likely recover from last year's 25 year lows. All this leads to the likely possibility of a crash in the price of copper.

Today, copper prices are rapidly falling back in line with expectations. I forecast that they will continue to decline as the global recession deepens and demand dries up further, while supply comes back online from Chile. Importantly, this is not the behavior one would expect if "inflation" were to continue. Currently, the price is $3.99/lb, the same level it reached in 2006, and it is likely to go much lower.

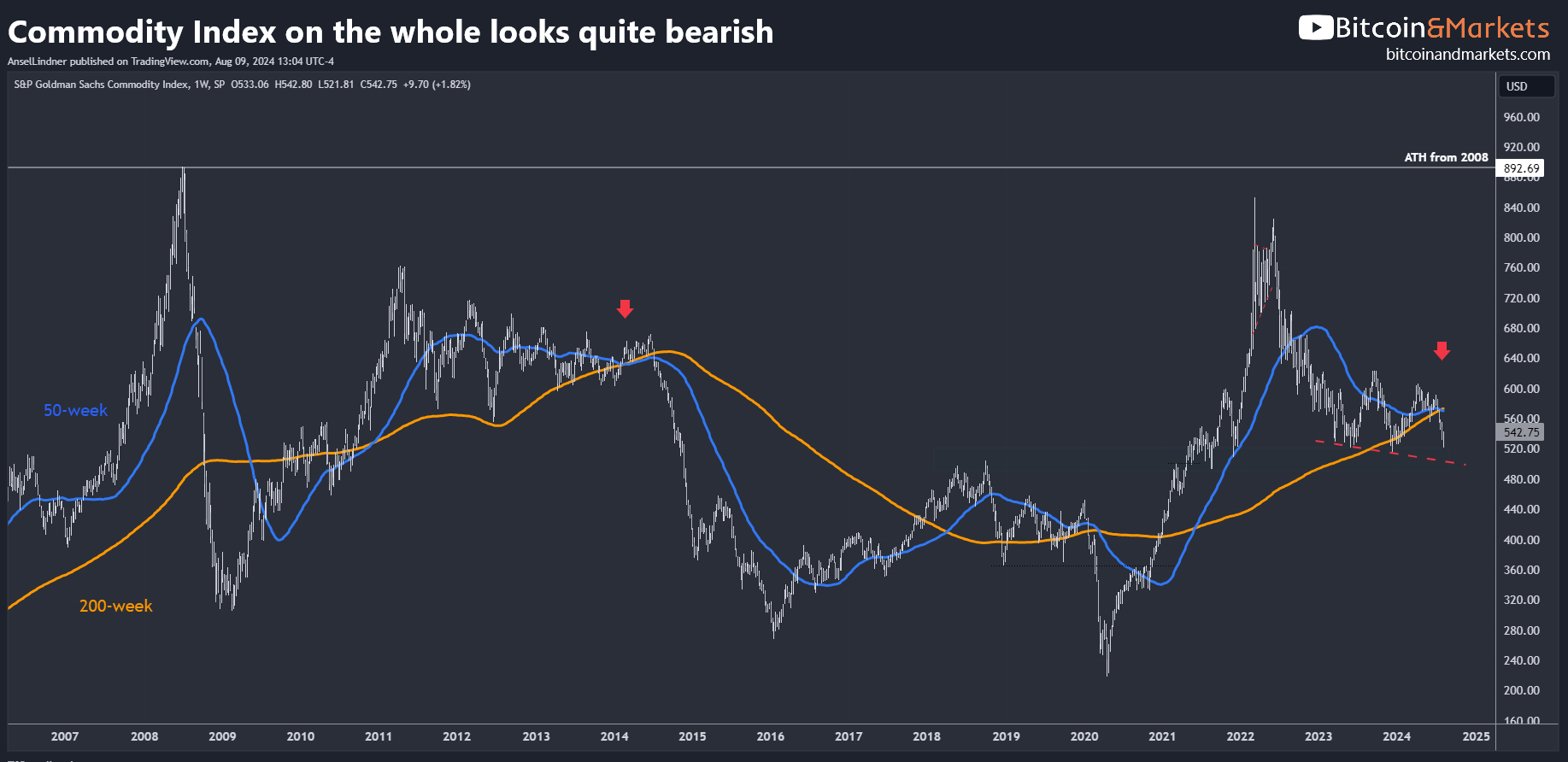

Goldman Sachs Commodity Index

I have rarely written about the commodity index (SPGSCI) because it closely tracks oil prices. However, to support my argument, I'm including it today.

People might ask, "How did you know inflation was going to be transitory?" Well, the commodity index was one good indicator. Even with the global economy shut down, the commodity index never reached the 2008 all-time high. Instead, it exposed the weakness in real inflation—money printing in the form of credit expansion, was insufficient.

The commodity index has now strongly broken below the 200-week moving average, and we are headed for a death cross. The red arrows highlight the pattern we might repeat this time. If that happens, it will be the end of the inflation narrative. Regardless, we are far from any real threat of prolonged "inflation."

Conclusion

In summary, commodity prices continue to support the recessionary outlook. There is a real threat of collapse in the coming months. How this will affect Bitcoin remains to be seen, but I remain confident that, with all the attention around Strategic Bitcoin Reserves and demand from ETFs and corporate balance sheets, we should see a relatively typical bull market.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.