Macro Minute: Demographics Impact on Global Oil Demand

How Aging Populations and Shrinking Growth Rates Are Reshaping the Future of Oil Consumption Worldwide

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

For years, I’ve discussed the concept of Peak Oil Demand, a theory describing a turning point in global oil consumption. Unlike past predictions of peak oil that centered on dwindling supply, today’s reality is shaped by a combination of a slowing global economy, demographic shifts, and a collapse in population growth, especially in developed nations like Japan.

At the same time, technological advances, particularly in the United States through fracking, have enabled us to extract more oil at any given marginal price. This means that while the capacity to produce oil continues to rise, the demand is no longer keeping pace.

Japan is a prime example of this phenomenon, as its aging population contributes to a gradual decline in oil consumption, signaling the broader trend of a world approaching peak oil demand.

A Look at Japan's Oil Consumption Today

Currently, Japan consumes around 3.2 million barrels of oil per day, making it one of the world's largest importers of crude oil despite recent shifts toward renewable energy. This translates to roughly 1.2 billion barrels per year, with the majority of demand driven by transportation, industry, and residential heating.

However, this demand is not evenly spread across age groups. Younger people contribute less to overall oil consumption, while the working-age population—those between 15 and 64 years old—drives the majority of demand through daily commuting, economic activities, and industrial use. As this group shrinks and the share of elderly people grows, the country’s oil demand is likely to change significantly.

How Demographic Shifts Influence Oil Demand

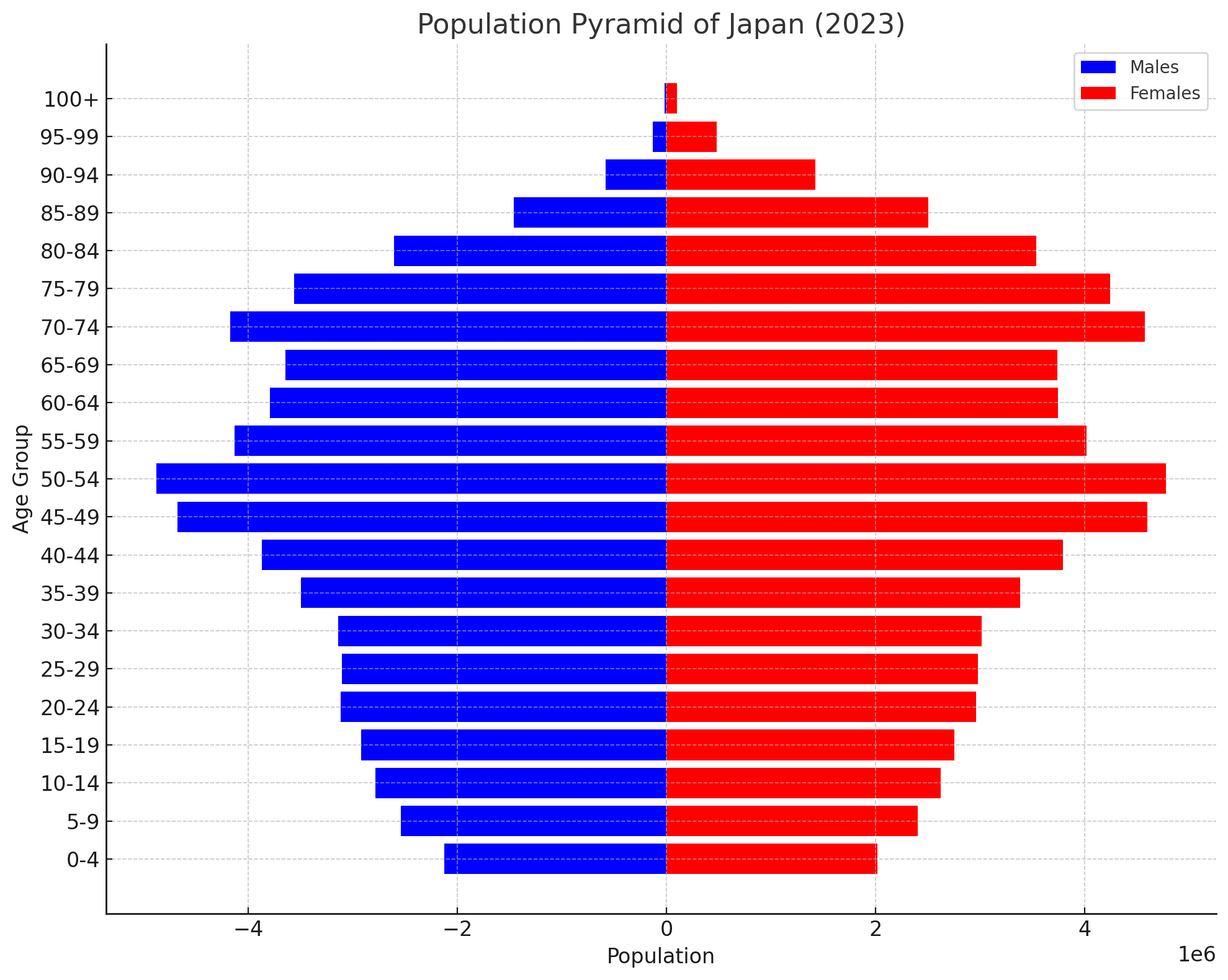

To understand the potential impact, I constructed a population pyramid for Japan, showing the current age distribution and its effects on oil consumption. Using this data, I estimated the consumption patterns across three key age groups:

- Young Population (0-14 years): Around 2 barrels per person per year due to lower economic activity and transportation needs.

- Working-Age Population (15-64 years): Approximately 5 barrels per person per year, reflecting higher mobility and industrial contributions.

- Elderly Population (65+ years): Roughly 3 barrels per person per year, accounting for reduced commuting but a stable need for residential energy use.

The Dual Impact of an Aging and Declining Population

Japan’s demographic challenges go beyond an aging society; the country is also facing a decline in overall population, losing about 1 million people per year. This loss further impacts the country’s oil demand. If we calculate the effect of both aging and population shrinkage:

- Effect of Aging: If the average age increases by one year, the shift from working-age to elderly populations leads to a reduction in oil demand. Our estimates suggest this shift could reduce Japan’s annual oil demand by about 5.1 million barrels per year as older individuals consume less oil on average.

- Effect of Population Shrinkage: Simultaneously, as Japan loses 1 million people each year, the drop in demand is up to 9.6 million barrels per year. This loss comes directly from the reduction in the total number of people, each contributing to some level of oil consumption in transportation, heating, and daily activities.

- Combined Impact: Together, these factors suggest that Japan could see an overall decline in oil demand of approximately 14.7 million barrels per year due to both its aging population and its annual loss of citizens. This reflects a gradual yet significant shift in energy needs, with potentially profound implications for Japan’s energy imports and broader economic structure.

Long-Term Implications for Global Energy Markets

Japan's demographic changes are only an example of the demographic challenges facing many developed nations and energy markets worldwide. Many countries, including China, South Korea, and several European nations, are facing similar demographic challenges with aging populations and disastrous fertility rates. The resulting shifts in energy demand from all these combined decreases will be very measurable.

China, as the world’s largest oil importer, faces a significant demographic shift after decades of rapid growth and its one-child policy. Over the next few years, population there will decline also at roughly 1 million per year, and will pick up pace over the next two decades. As its average age increases and economic activity slows, China's demand for oil will plummet.

South Korea, with 51 million people and one of the world’s lowest fertility rates, is on a similar path. Its population is expected to start declining this year or next, but then rapidly intensify over the following decade. South Korean government experts are estimating a 96% population decline over the next 100 years.

In Europe, countries like Italy and Spain are also facing extremely low fertility rates and aging populations, with all European countries under replacement fertility. As these populations age and decline, their energy needs—particularly for oil—are likely to decrease, following the trend seen in Japan.

I used ChatGPT to estimate a global effect on oil demand. Here's what it came up with using my data and assumptions:

Extrapolating Japan’s annual oil demand decline to a global scale, we find that demographic shifts could reduce global oil demand by approximately 482 million barrels per year. Japan’s decline, driven by both an aging population and a shrinking population of 1 million annually, is estimated at 14.7 million barrels/year or 0.1176 barrels per person per year. Applying this rate to the top 20% of countries experiencing similar demographic pressures, which account for about 35% of the world’s population, results in a demand reduction of approximately 329.3 million barrels/year. For the remaining 65% of the global population, assumed to experience a less intense demographic transition at 25% of Japan’s rate, the estimated reduction is 152.9 million barrels/year. Together, these factors contribute to a total global oil demand decrease of 482 million barrels/year.

These are only crude estimates (pun intended) but suggest that global oil demand could decline by as much at 1.3 mmbpd due the the demographic decline. If current global demand is 102 mmbpd, a conservative estimate for the total effect on oil demand of demographic shifts in the next 10 years are for it to decline by -0.5 to -1.5% per year by the end of that period.

Japan’s demographic shift is a glimpse into a global trend. As populations age and birth rates fall, oil demand is set to decline over the coming decades, even as production capacity remains high—a core aspect of Peak Oil Demand. Global energy markets must adjust from expecting growing demand to managing a new balance. Policymakers will need to adapt strategies, and investors should seek opportunities in a world with slower demand growth.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.