Macro Minute: Fed Rate Cut Odds Soar, Bitcoin is Ready

Interpreting the 2-Year Treasury Yield's Decline and Its Bullish Implications for Bitcoin Amid Rising Expectations of a Fed Rate Cut

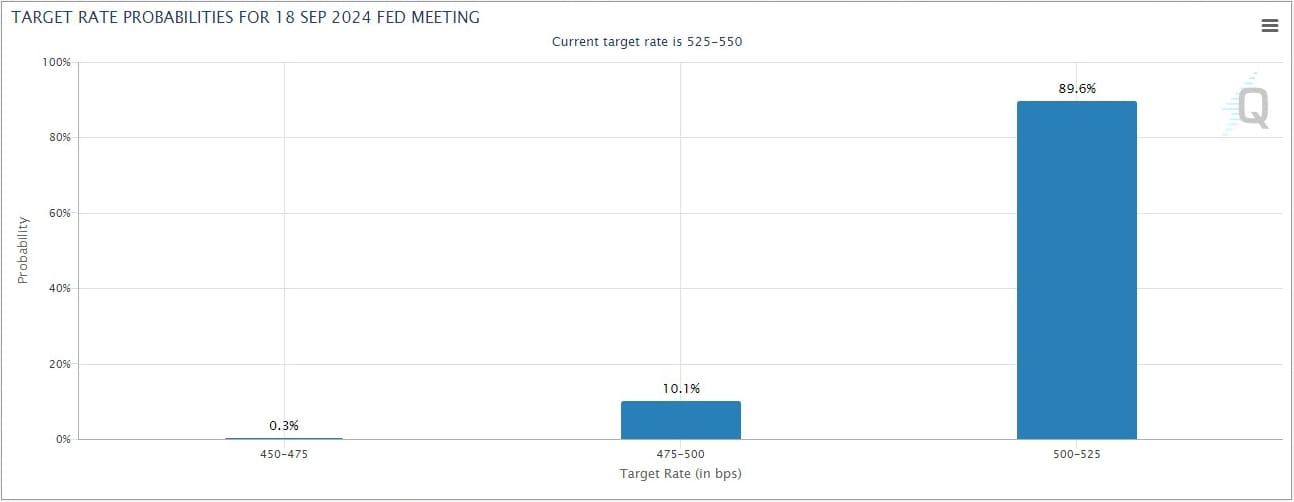

The market has shifted dramatically in the last few days as the 2-year Treasury yield has resumed its downward move. Currently, the market is pricing in a 100% chance of a Fed rate cut at their September meeting.

The Federal Reserve is also meeting next week, with a decision and press conference on Wednesday, July 31. The market only sees a 5% chance of cut at that meeting, but I personally am not discounting that possibility.

Powell thoroughly understands that their policy is psychological not mechanical in nature, and that the economy has taken a turn for the worse. He may want to use the surprise of an early cut to help get the market effect he wants. Don't forget, other major central banks have already started cutting, the ECB, Bank of Canada, the Swiss National Bank, and the latest is the PBOC.

If they don't cut next week, I expect the verbiage in the statement and at the press conference to turn about as dovish as it gets.

Below is the US 2Y Treasury yield versus the Fed Funds policy rate. As you can see, yields always lead the Fed's cutting cycle, and it is at a possible breakdown point. If we compare the Dotcom and GFC cutting cycles, we can see the Fed waited longer and then cut rapidly. However, in 2019, under Powell, the Fed started cutting earlier as a way to cushion the market. It would make sense for Powell to do the same this time.

All this adds up to a very bullish scenario for Bitcoin. Of course, we have the conference going on right now and the ETFs continuing to gobble up supply, the halving just occurred and cut supply, and the disappointment over the ETH performance post ETF launch could chase bag holders into Bitcoin.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.