Macro Minute: Federal Reserve Is Playing A Different Game

The Federal Reserve isn't trapped; it plays a different game, managing existential threats through narrative and psychological influence rather than just reacting to economic data.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Many people misunderstand the Federal Reserve's role, attributing it with near-omnipotent powers to control the economy. This belief leads to a contradiction: seeing the Fed as both all-powerful and constantly trapped in a lose-lose situation. Critics argue that the Fed is always reacting to outdated data while trying to shape the future.

Anthony Pompliano’s recent tweet is a prime example. Responding to the slightly higher than expected September CPI print this morning of 0.18% MoM, he claims that the Fed is in an "impossible" position, caught between managing inflation and navigating backward-looking data. But is the Fed really as constrained as this narrative suggests? In this post, I’ll break down why this perception is flawed and reveal what the Fed is actually trying to do.

The Fed as a Follower, Not a Leader

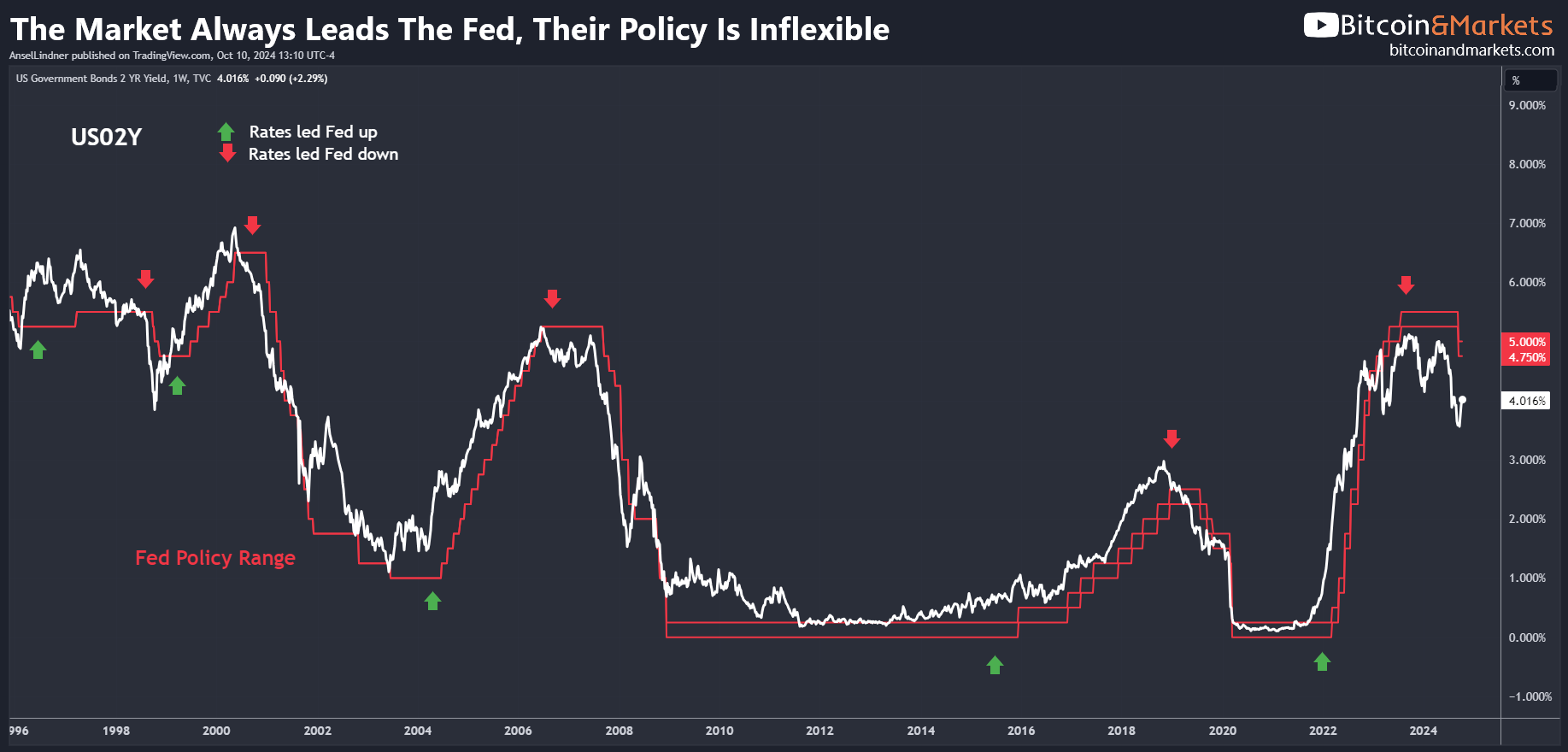

The Federal Reserve is, by its own admission, a follower of the market, reacting to economic conditions rather than setting them. This data-dependent stance means that the Fed adjusts its policies based on what is already happening in the broader market. A close look at the relationship between Treasury yields and Fed policy highlights this dynamic—yields move before the Fed makes its policy adjustments, disproving that the Fed leads the market mechanically.

Yet, this does not mean the Fed is trapped in a lose-lose scenario. The perception that the Fed is always reacting and never driving stems from a misunderstanding. While the Federal Reserve doesn't directly manipulate the market through its policy to a significant degree, it influences it by shaping a narrative. Their aim is to guide the market into acting a certain way, not mechanically intervene to achieve a specific outcome.

While their Fed Funds target range is based on backward-looking data, their forward guidance is strategic narrative building. This forward guidance is aligned with their economic school of thought. They are generally monetarists, targeting a 2% increase in the money supply. However, they can't directly target the money supply anymore due to the complexity of modern financial instruments, so they focus on PCE (the cousin of CPI).

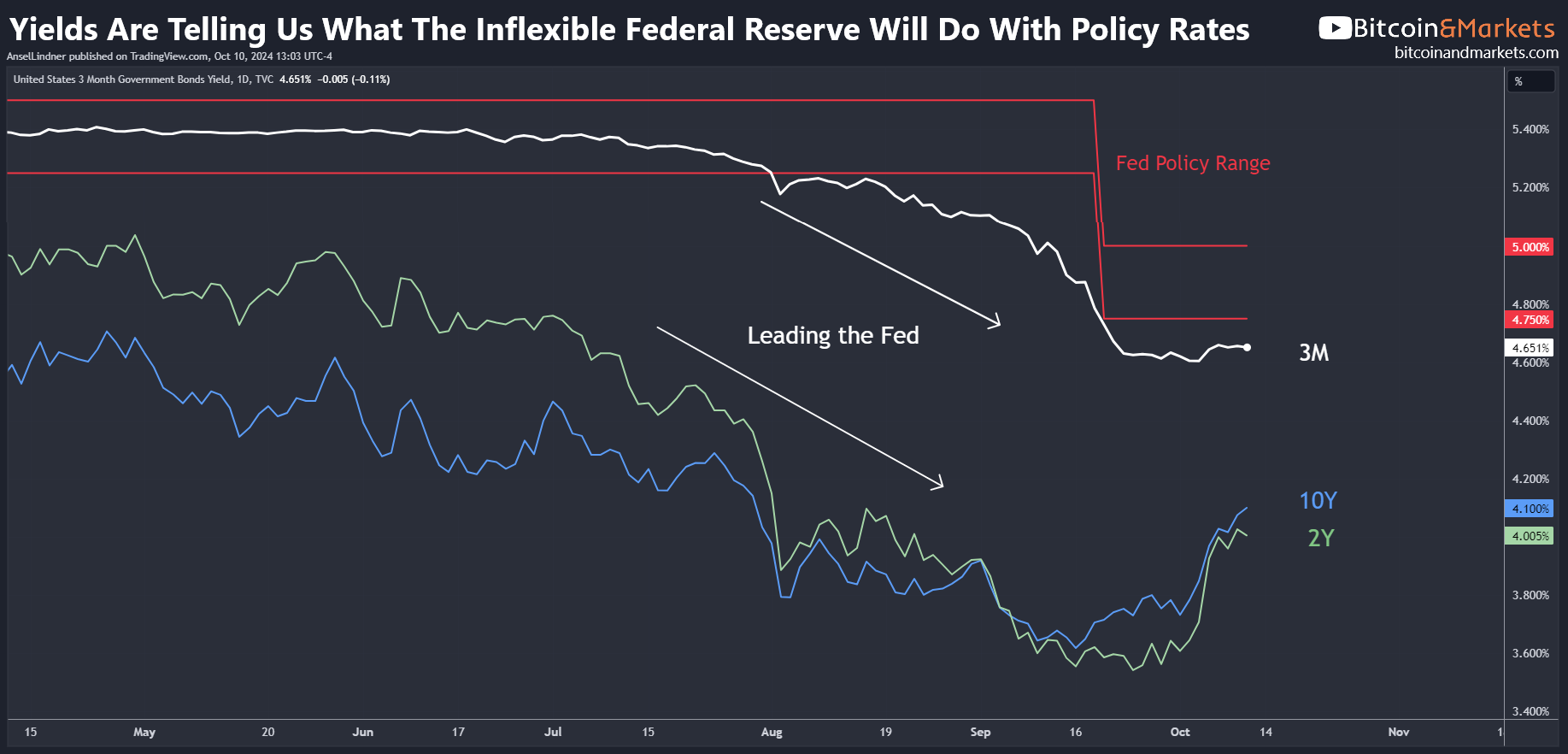

Therefore, their monetary policy cannot be in a lose-lose situation because they simply follow what the market is already doing. They are not playing the mechanical game. Chairman Powell is not losing any sleep worrying about what the FOMC is going to do; the market has already signaled what comes next. For instance, the 2-Year Treasury yield is at 3.97% today after a stressful rise over the last week. That is still 75 bps below the bottom of the Fed Funds policy range! The 3-Month Treasury bill is at 4.67% this morning, also below the Fed Funds policy range. The market is showing the Fed what to do, keep lowering rates.

The Real Game The Federal Reserve Is Playing

While many believe the Fed's primary focus is its dual mandate—controlling inflation and promoting employment—these are short-term concerns, not existential ones. Short-term issues like a spike in inflation or a recession are technically "failures" of the Federal Reserve, but they are not systemic threats. The Great Financial Crisis was an existential risk for the credit-based system. Same with the Repo Rumble in 2019 and the COVID crisis in 2020.

Failing to address these risks could have collapsed the financial system. Therefore, the Fed’s primary concern is not inflation or a recession but rather the stability of the entire financial system.

Two major concerns dominate this focus. The first is the risk of an uncontrolled deflationary spiral, where credit markets freeze and banks fail. In a credit-based system this is an existential threat; inflation is not. The second is a loss of confidence in the Fed’s ability to manage markets. If market participants lose faith in the Fed’s competence, it can lead to increased volatility and unanchored expectations, making economic guidance much more challenging. These risks drive a more strategic approach than simply managing inflation or unemployment data.

Data, Theory, and the Power of Narrative

We've established that the Federal Reserve does not use its data dependence to make decisions; the market largely dictates those choices. However, the Fed uses incoming data to inform its broader economic framework, which is still grounded in monetarist theory.

While the Fed Funds rate and policy range are relatively inflexible tools, the Fed's real flexibility comes from its narrative guidance. By interpreting past data through the lens of theory, the Fed projects future scenarios and adjusts its messaging to influence market expectations. This narrative is a powerful tool, allowing the Fed to shape the market’s perception and guide economic behavior in a desired direction.

Their economic framework serves as a bridge between data dependence, inflexible monetary policy, and forward guidance. This allows the Fed to use past data to craft a narrative that shapes market expectations and guides future behavior. The contradiction in Pompliano’s tweet—seeing the Fed as both powerful and stuck—comes from overlooking this narrative power. The Fed isn’t merely reacting to data; it’s shaping a story that aims to manage larger risks like financial stability while steering market sentiment. In this way, the Fed is not trapped in a lose-lose situation; it’s playing a strategic game of influence and long-term stability.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.