Macro Minute: Markets Stabilize Amid Overblown Fears

Analyzing the Panic-Driven Market Moves, Japan's Economic Struggles, US Treasury Yields and Bitcoin's Path to Recovery

A little bit of an adrenaline dump today after yesterday's excitement. As expected, the market move seems to be stabilizing, at least temporarily. In yesterday's Bitcoin Fundamentals Report, I argued that what we were seeing was largely driven by panic. The moves were overextended, with RSI hitting oversold across the board in affected asset classes. A hard bounce was likely.

Today, we got some numbers from JP Morgan. They claim retail traders net sold $1 billion in stocks, while institutions net bought $14 billion yesterday. In Bitcoin, IBIT did not sell a single coin. I think we can safely label this a panic move, and not necessarily a massive change to the fundamentals. Claims of a carry trade unwind may be wildly inaccurate.

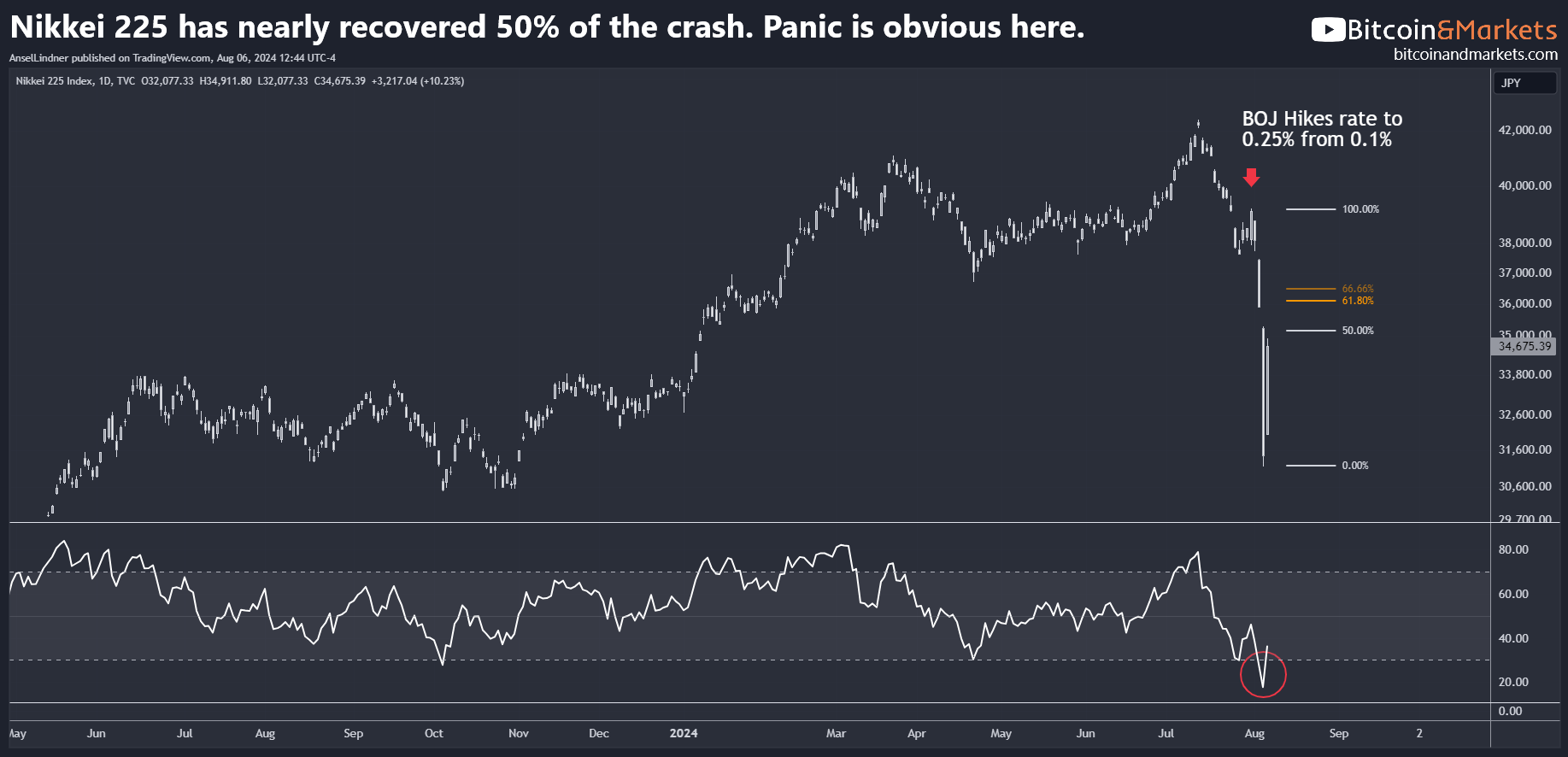

We are not out of the woods yet. The Nikkei is approaching a 50% retrace of the sell off, likely with heavy government support. I wouldn't be surprised if we learn the Federal Reserve was involved in extending emergency loans to the BOJ to prop up markets. Interestingly, the JPY has not bounced and, this morning, remains at 144 to the dollar.

Japan's economy is in a tougher place than the US economy. They are aging rapidly, so losing productive middle aged workers, and the work force is shrinking. They are also the most highly indebted government relative to GDP. While the US market will likely recover to new ATHs relatively quickly, Japan could be facing another generational high in their stock market.

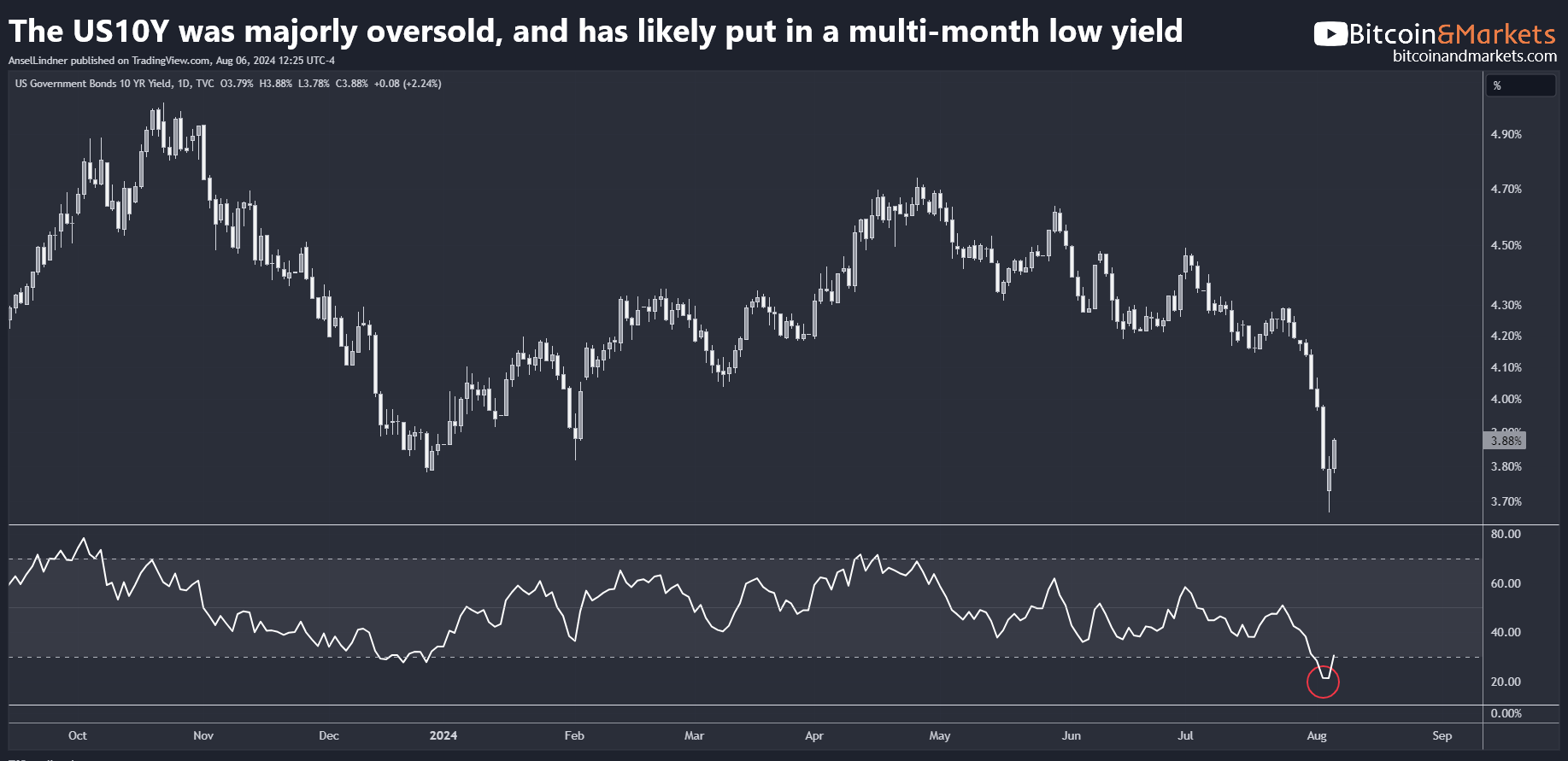

Other markets are also oversold. The US10Y Treasury is bouncing after yields collapsed over the last week.

The same goes for the 2Y. These moves were so overdone, I expect this to be putting in a significant low in yields, not to be beat for a couple months. This could be further supported by a significant rate cut by the Fed in September. I also included the TD Sequential indicator which show the 2Y bottoming on a red 9 which adds more power to this bounce.

That 2-month timeline takes us into October, aligning with the tail-end of a seasonal Q3 effect, and just before the election.

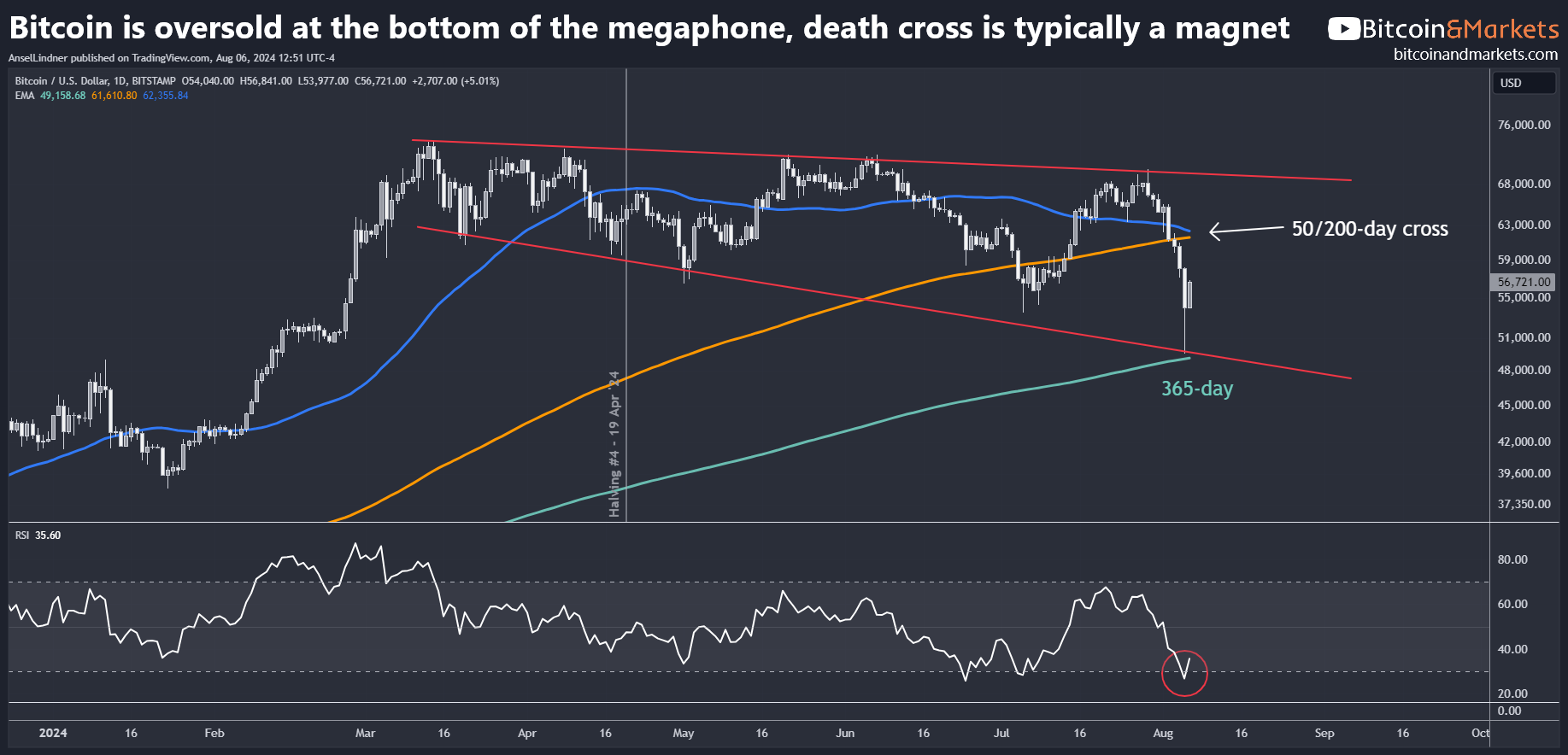

Bitcoin also hit oversold on this move, at the 365-day MA and the bottom of the megaphone.

In conclusion, this move was driven by panic and pushed markets deeply oversold. Most assets will recover, however, the background fundamental deterioration remains the same. This wasn't the big one, but there is a building deflationary impulse coming and a harsh recession. I've been waiting for the Q3 timing, which this fits, but it's not quite ready.

A 6-8 week bounce before further downside in traditional markets is likely. That means the S&P to new ATH or very close to it and yields on Treasuries to inch higher. This will give Bitcoin time to re-leverage, attract more institutional inflows, and rise to the top of the megaphone and beyond.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.