Macro Minute: Myths and Realities of Global Dollar Dominance

Why the Dollar's Reign Isn't Ending Anytime Soon and How Bitcoin Will Play a Role in Its Future

🎆 🥳 CELEBRATING 300 REPORTS!!

LIMITED TIME

A FREE MONTH WHEN YOU BECOME A MEMBER!

Join the community supporting quality Bitcoin and Macro analysis! Check out our tier perks.

1 MONTH FREE - Member or Premium

Global Dollar Dominance

We are often told by many macro professionals, especially within the Bitcoin space, that the dollar is dying and on its way out. They claim it’s only a matter of time before less "evil" hegemons rise to challenge the dollar's supremacy. Sorry, but that is not happening. The most likely scenario is that the dollar will eventually be backed by Bitcoin as any cracks begin to appear in its dominance.

I found a website you can bookmark to keep track of dollar dominance. The Atlantic Council is a nasty globalist organization, but maintains this page that is quite useful because it consolidates all the relevant stats in one place and is regularly updated (most recently on June 25th). You can select from the drop-down menu to check data on the major currencies.

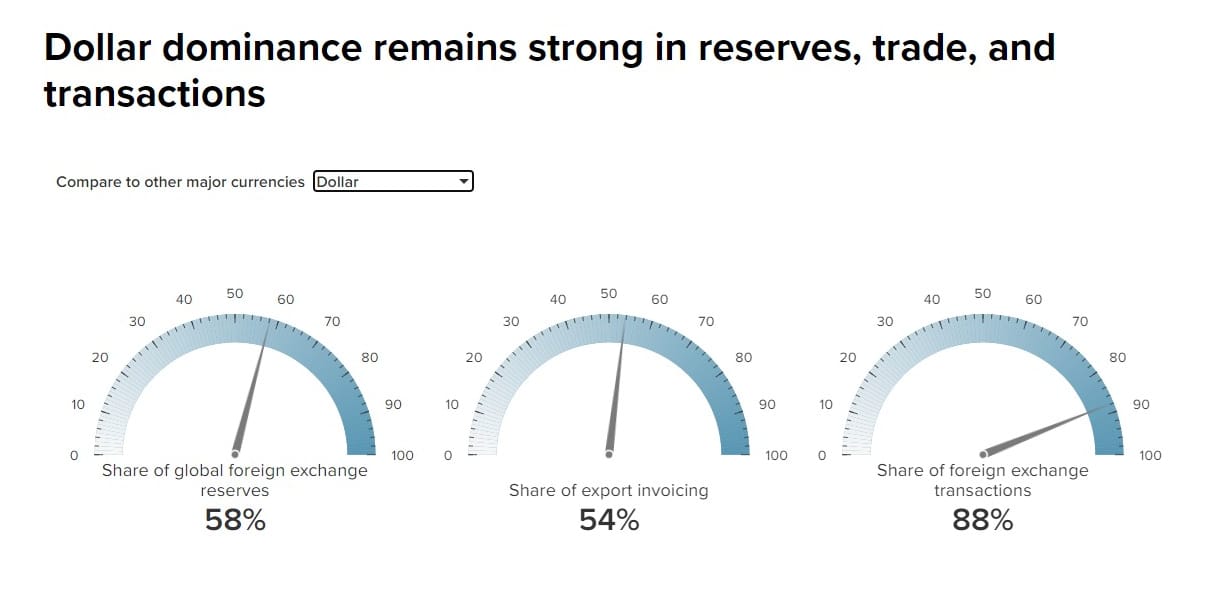

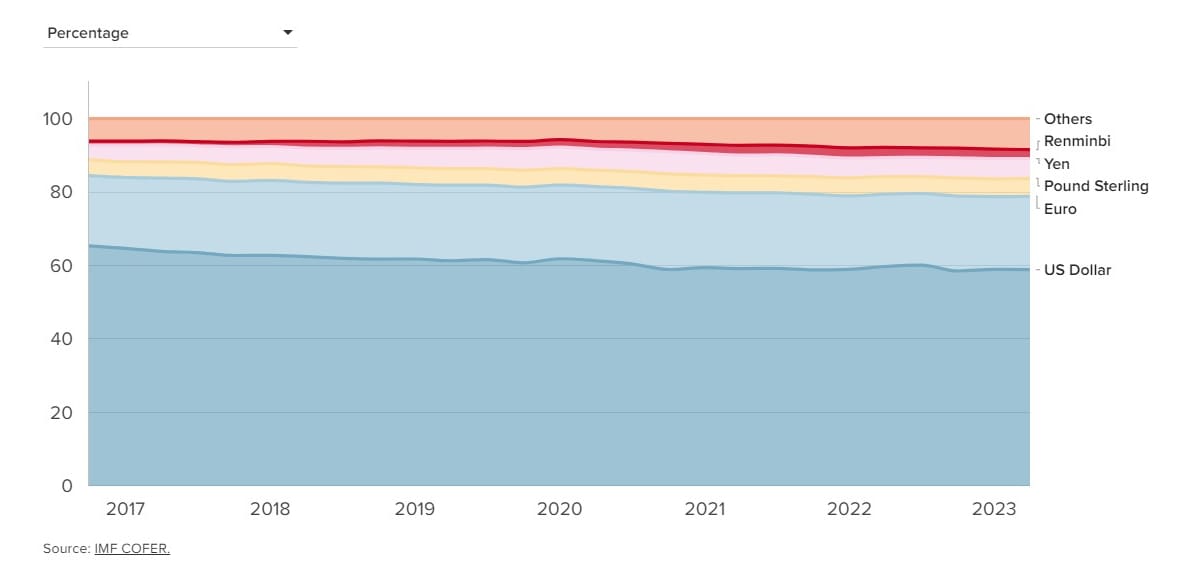

Dollar dominance in foreign reserves is often quoted because it has an easy, fallacious counter—the petrodollar. Currently, the dollar still holds a 58% share of foreign reserves, despite China and others being forced to sell off some reserves to balance their own currencies. The dollar also maintains a 54% share of export invoicing, despite only 10% of U.S. GDP coming from trade outside of North America. Additionally, the USD is involved in 88% of all Forex transactions.

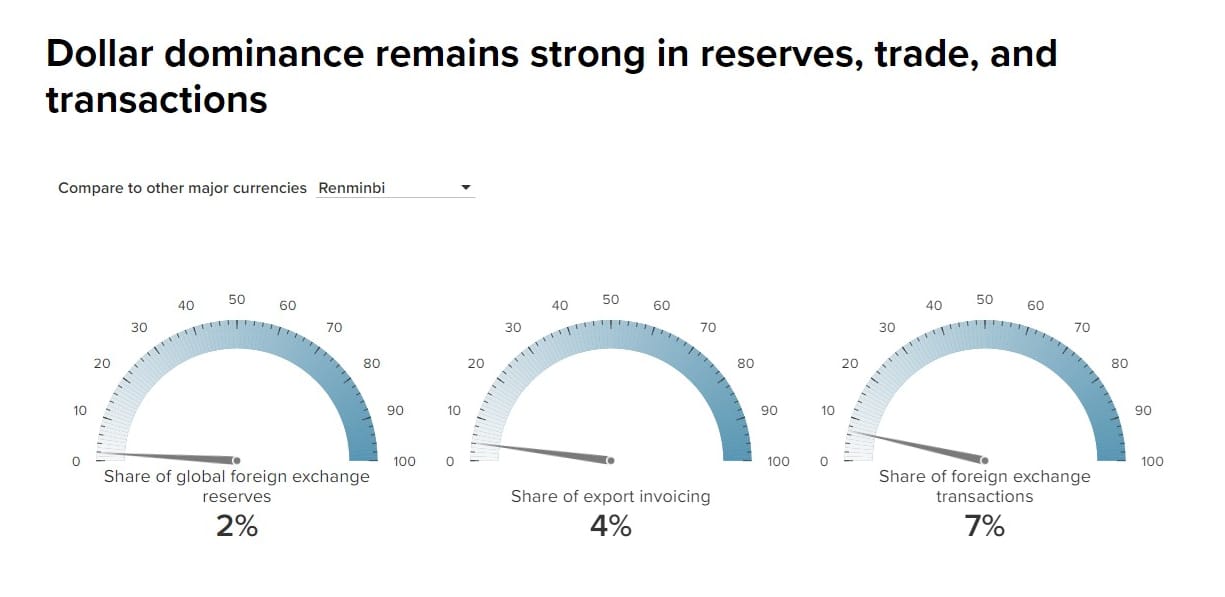

For the pro-CCP folks out there (probably not among my readers, LOL), the Renminbi’s share is a joke. It still ranks far below the EUR, GBP, or JPY.

While the USD’s share of foreign exchange reserves has fallen slightly since 2016, it has been stable since 2020 and has even ticked up slightly over the last year. This is still much higher than the modern era low of 46% in 1991.

This site also has a section on BRICS swap lines and their Cross-border International Payment System (CIPS), a competitor to the U.S.-operated CHIPS. It's kind of funny, to be honest. CHIPS settles $1.8 trillion per day. After nine years, CIPS totals are pitiful.

For mobile readers who might not be able to see the images:

- Brazil: $30B in swaps, 1 bank in CIPS

- Russia: $2.8B in swaps, 4 banks in CIPS

- India: $0 in swaps, 0 banks in CIPS

- China: $0 in domestic swaps, 119 banks in CIPS

- South Africa: $4.8B in swaps, 3 banks in CIPS

After nine years, the total amount of international swaps conducted by BRICS is only $37.6 billion, with just 8 banks outside China participating in the official core BRICS countries.

Conclusion

The narrative that the U.S. dollar is losing its dominance is complete fiction. Despite the noise, Chinese-built alternatives are struggling to gain any meaningful traction on the global stage whatsoever. Meanwhile, the dollar's role in global finance remains firmly entrenched, supported by its deep integration into international trade, foreign reserves, and Forex transactions.

A change to a new global reserve currency, or even a significant competitor is not going to save the world from the economy troubles coming. It would only be a sign of global depression when there's not one standard that unites international trade.

Looking ahead, the potential integration of Bitcoin into the dollar’s strategic reserves, as proposed by the leading candidate for US President, could further strengthen the dollar's position. As cracks worsen in the global financial system, it’s more likely that the dollar will adapt by adding a bitcoin backing.

Hope this helps someone.

LIMITED TIME! Join the community today and get 1 MONTH FREE!

Member or Premium

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our community on Telegram!

- Become a Professional member and unlock premium content!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.