Macro Minute: Oil Prices Plunge as Supply Outpaces Demand

Exploring the evolving oil market dynamics: technological advancements, shifting demand, and the impact of U.S. shale production on global oil prices amidst an outdated economic framework.

LIMITED TIME

Supporting independent Bitcoin and Macro analysis!

Enter our monthly Price Forecast competition

Access to the clickable version of the Bitcoin Pre-History infographic

PDF version of The Bitcoin Dictionary

Oil Breaks Support, Supply Surplus

I've been discussing Peak Oil Demand for years now. This concept centers on the outdated and collapsing credit-based system, which is increasingly incapable of supporting the global economic growth necessary for a continual rise in oil demand at specific price points. Combined with technological advances in shale oil production and the growing popularity of hybrid consumer products, supply is outpacing demand at most price levels. Consequently, oil prices must fall at least to the breakeven point for shale production.

The breakeven point for U.S. shale remains uncertain. Although I'm not directly involved in the industry, estimates range widely from $40 to $65 per barrel. Several years ago, I encountered a source claiming the average breakeven for U.S. shale was around $45 per barrel. However, with inflation, that figure could easily be 30% higher today, approaching $60 per barrel.

Moreover, technological advancements haven't stagnated. New methods, such as improved sleeve designs and horizontal drilling techniques, have extended the lifespan of shale wells, exerting downward pressure on breakeven prices. Therefore, it's difficult to pinpoint the current breakeven for U.S. shale. My educated guess is around $50-60 per barrel, but it could drop into the $40s if Trump is re-elected. One thing is certain: it is lower than the current price of $70 per barrel.

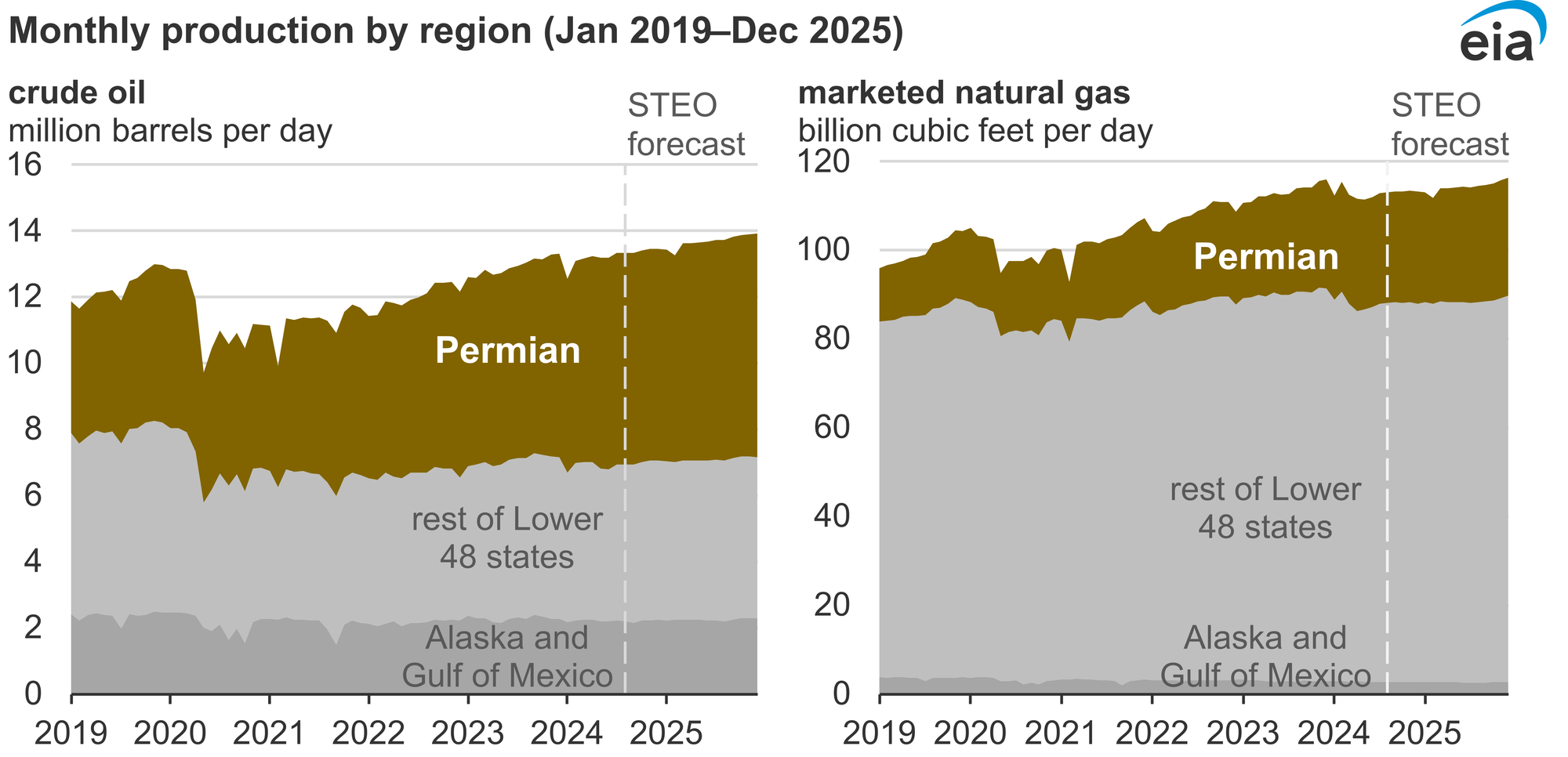

The EIA's base case forecasts U.S. oil production to rise to 14 million barrels per day (mmbpd) by the end of 2025, a 6% increase.

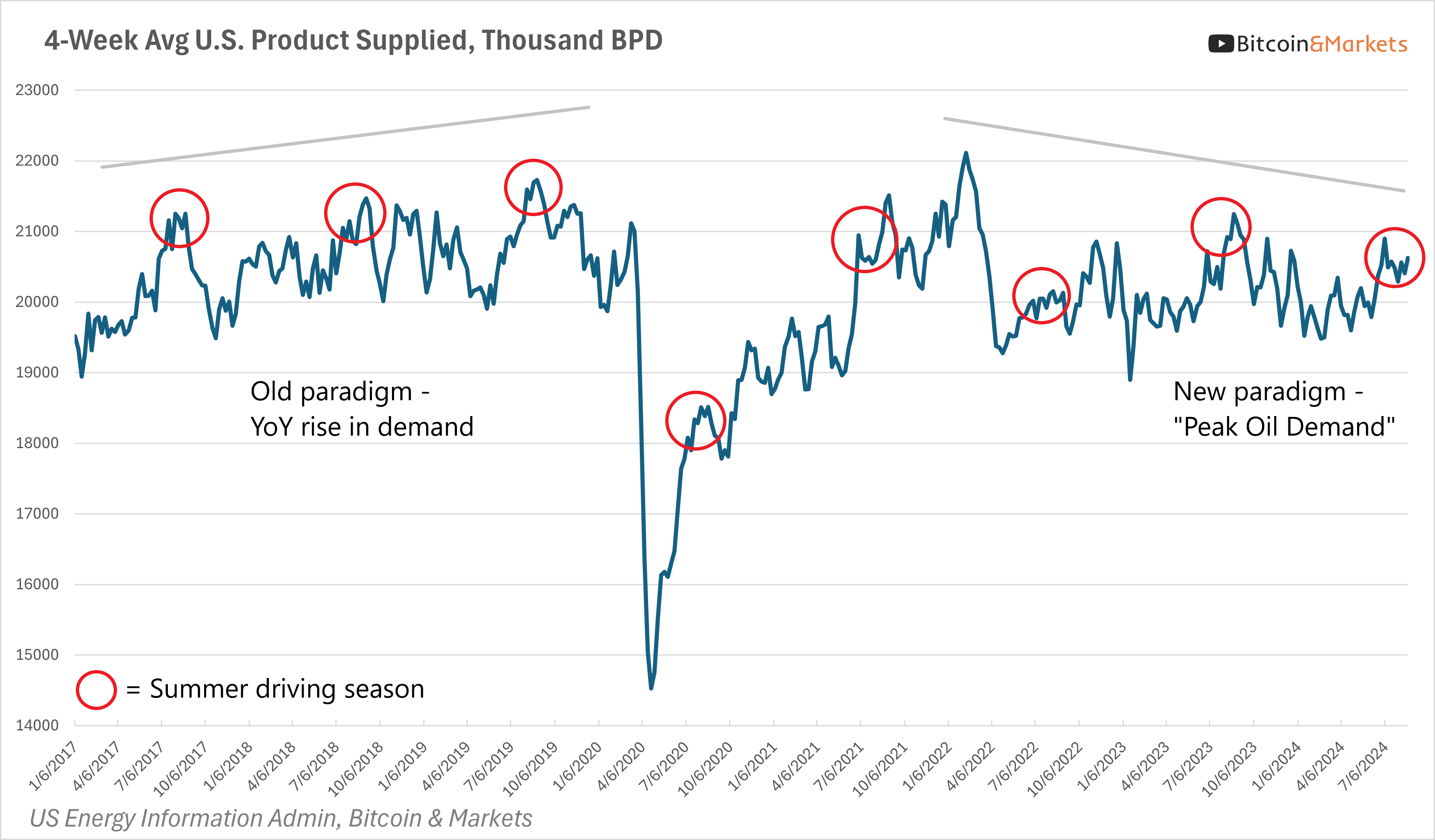

US oil demand is simply not there

This chart shows the petroleum products supplied to the market, which closely mirrors actual demand at market prices—if there is no demand, the oil remains in storage. Historically, summer has been the season of peak demand. Before COVID-19, the prevailing oil paradigm saw peak demand consistently increasing year over year. However, since the pandemic, a new paradigm has emerged, characterized by a slow, year-over-year decline in demand. This trend aligns with my Peak Oil Demand theory.

Gasoline Futures

What does this mean for gasoline prices? I still believe the current U.S. administration will release some of the Strategic Petroleum Reserve (SPR) as we approach the election, which should independently drive prices down.

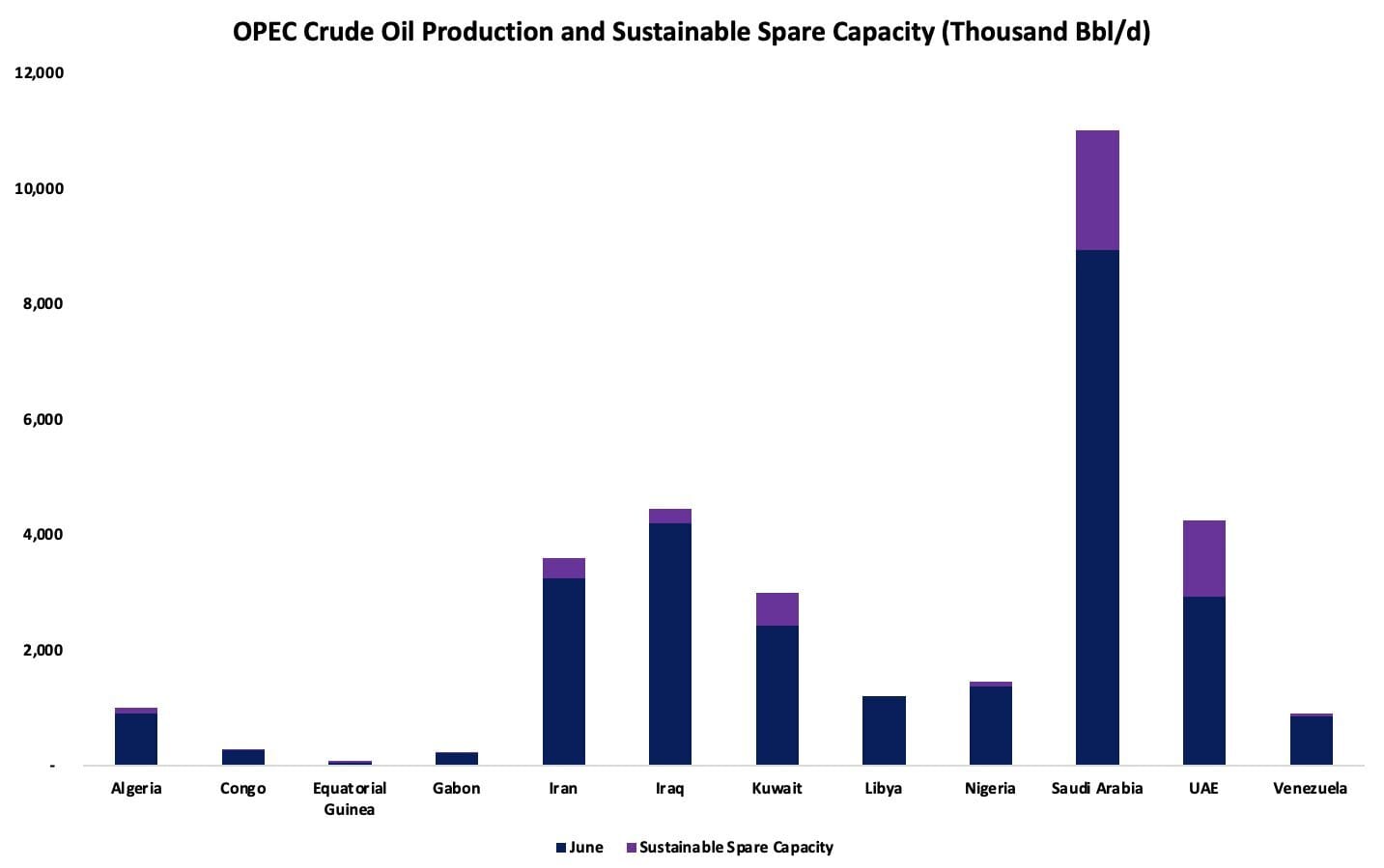

Additionally, gasoline futures are breaking support and trending lower, mirroring the decline in oil prices. With falling demand, rising U.S. oil production, and the gradual rollback of OPEC cuts from recent years, we're witnessing 2.2 mmbpd of cuts being reversed. The chart below illustrates the substantial spare capacity within OPEC.

Low oil prices, driven by weak global demand, are also contributing to budget deficits in oil-producing countries like Saudi Arabia and Russia. I previously argued that OPEC's production cuts would only make their problems worse; artificially higher oil prices would suppress economic growth and lock in lower prices in the long run. Now, OPEC is facing the difficult decision of increasing production in a weak price environment, hoping to compensate for lower profits per barrel through higher volumes.

Conclusion

The oil market is in a precarious position as supply outstrips demand and prices break critical support levels. With US production set to increase and global demand weakening, the traditional dynamics of the oil industry are shifting. OPEC's attempts to control prices through production cuts may have backfired, leaving them with tough choices ahead. As the world moves further away from the old paradigm of rising demand, the market must adapt to a new reality where technological advancements and shifting energy needs redefine what is sustainable.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

LIMITED TIME!

50%-off FIRST MONTH!

Support independent Bitcoin and Macro analysis!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.