Fundamentals Report #103

August 21, 2020 | Issue #103 | Block 644,743 | Disclaimer

The Bitcoin Dictionary paperback is

LIVE on Amazon!

Vital Bitcoin Stats

Weekly price: $11720 (-$83, -0.7%)

Mayer Multiple: 1.32

Est. Difficulty Adjustment: +4.0% in 2d

Prev Adj: +0.595%

Sats/$1 USD: 8532

1 finney: $1.17

Market Commentary

There is no free lunch. Value doesn't arise quickly out of no where without a crash. Ponzi schemes don't pump forever, eventually they run out of greater fools.

Whether this pseudo-finance (aka defi) craze is legitimate or a mania, nothing naturally doubles in value in a few days and stays there. The defi prices will revisit those prior lows without exception.

Bitcoin is moored to existent utility

In bitcoin's case, Bitcoin goes up relatively slowly in value, taking years to regain previous ATHs and then doubling every couple of months. Even at that relatively slow pace compared to Ponzi altcoins, Bitcoin still crashes because it gets ahead of itself. The difference between bitcoin's pumps and crashes and altcoins swings is two fold. 1) Bitcoin is rooted firmly in cost, i.e. energy expenditure to mine. This does not give it inherent value (that doesn't exist), but the incurred cost gives miners a price below which they can't sell and make a profit so they hold, and the cost gives bitcoin a reference point above zero which lends psychologically support. 2) Bitcoin already is complete. It says what it does and does what it says. Sure, things like the Lightning network are incomplete, but even that is in a usable state. Bitcoin's value prop and use sustains its value.

Altcoins, and particularly defi tokens, do not have these moorings for price. They are at best poorly-designed experiments in incentives sold as revolutionary world-changing developments ("poorly-designed" because the pump weakens the protocol's incentives to handle a crash). At worst they are total scams. Bottom line is they are gambling pure and simple, complete with backdoors for the house. The only reason to hold them is because you think they will outperform bitcoin or a short period.

There is no free lunch, and the defi explosion isn't "the future of finance". We've seen it all before.

Defi Inflationary Stimulus

I'll also point out that gains from locking coins in defi doesn't have the same powerful inflationary effect as pure ICOs. ICOs are printed out of the ether (pun intended) and even a single trade can establish a market value, imparting their whole printed supply with that value, which they can spend elsewhere on the next ICO or on ETH. That has a hyper-stimulatory effect.

Locking coins in defi has a similar effect, but manages to neutralize much of the inflation, because the initial coins are held as collateral out of circulation. Whether by design or accident, this creates a lower effective stimulation effect on the defi craze relative to the ICO craze. Low inflation is bad for tokens which have no productive use or utility outside pumping, and no mooring to cost of production. The created value flows to substitutes and pumps the whole category of tokens until it runs out of greater fools and pops.

Altcoin investors are expecting a powerful rally this time around similar to the 2017 ICO bubble, but underestimate the much weaker inflationary stimulus provided by defi. Altcoins' utility hasn't changed, the ecosystem isn't growing. Investors are currently investing as though it is. When it crashes, many will be rekt.

"Yield farming" is dangerous marketing. In reality it is farming value from noobs. It exploits the least prepared to evaluate scams. Some gainz made by the scammers themselves will find its way back into bitcoin, but most of it will just evaporate.

Other Top Stories in Bitcoin

Former CEO of Prudential, George Ball, says "Time to buy Bitcoin"

One week after the world's largest business intelligence firm MicroStrategy bought 21,000 bitcoins, the former CEO of Prudential, the US's largest insurance company, and the 11th largest asset manager worldwide, recommends buying bitcoin.

VC-Backed Crypto Exchange Mexo Launches in Latin America

Big update for Latin America, where all countries except Mexico and Chile cannot buy bitcoin on coinbase. They are starving for access and getting a large exchange in Latin America will be huge. These countries have been rekt by inflation in the last 2 years, with gold and Bitcoin spiking in their local currencies. However, their Bitcoin infrastructure is lagging far behind the ease of buying gold there. Giving these folks an easy on ramp to bitcoin will tap a large population looking to preserve wealth.

Binance Launches DeFi Staking With Cryptos Kava and Dai

Exchanges like Binance are beginning to allow users to stake and yield farm defi from their accounts, adding to the defi mania. The speed of staking and unstaking is unclear. In an attack scenario, are these customers sitting ducks? It seems safe to assume that they are less informed and technically competent, meaning they likely will be the dumb money during an attack.

Reminder: Bitmex starts KYC on August 28th

People in the US will no longer be able to trade on Bitmex in one week due to their new verification program.

Price

Weekly BMI | 1 : Slightly bullish

To get more charts and detailed commentary on technicals, subscribe on Patreon.

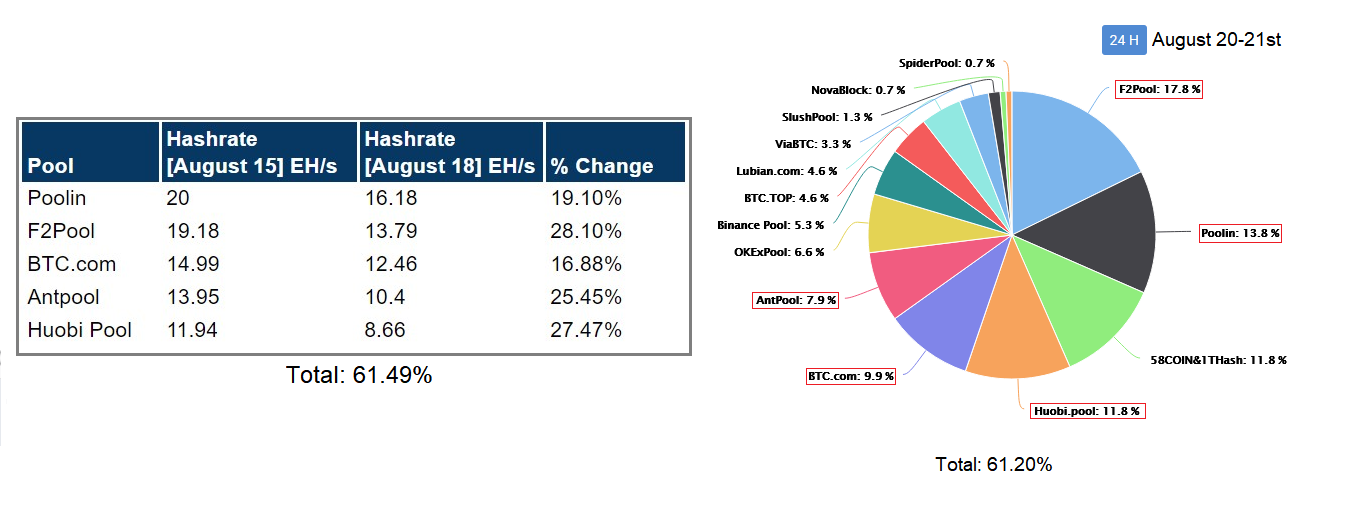

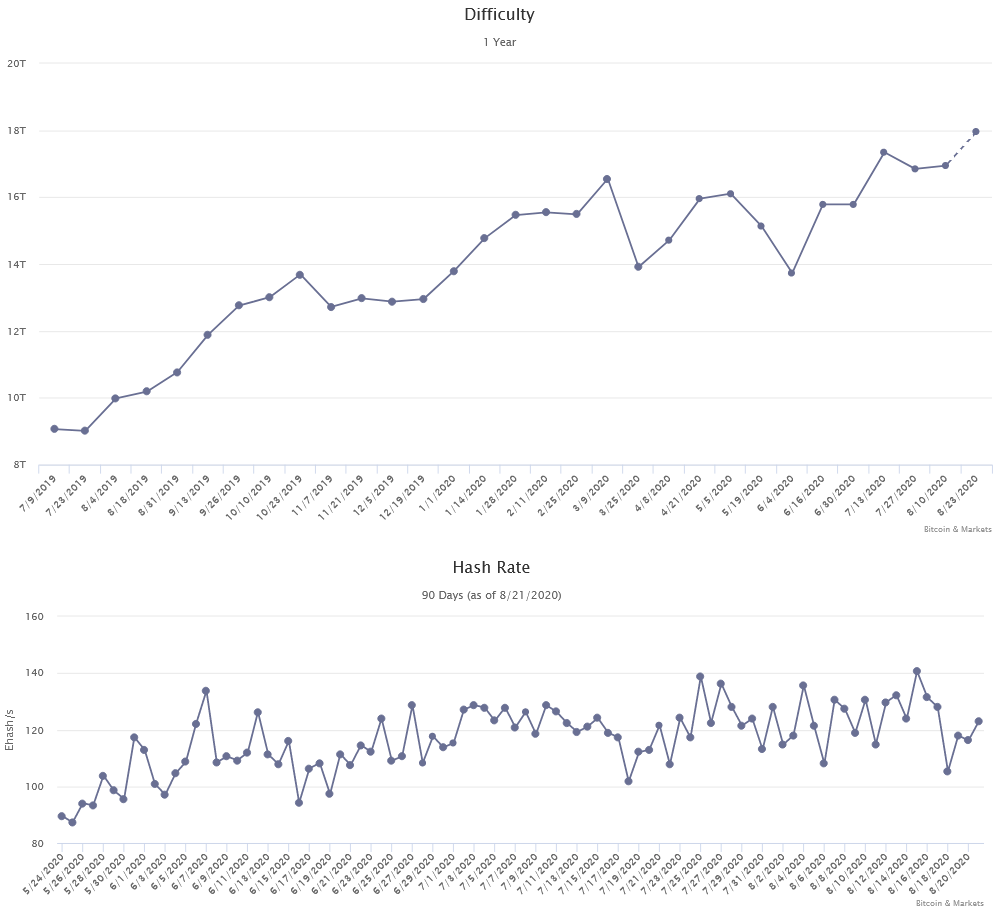

Mining

The difficulty adjustment is estimated to be +4.0% early Monday morning despite reports of the hashrate in the Chinese pools dropping 20% due to floods in the Sichuan province impacting miners. Below is some data from AMBCrypto showing the hashrate of the mining pools on August 15th and the 18th. On the 18th, these mining pools accounted for 61.49% of the total. Today, they still total 61.2% they have not recovered yet.

There are three possibilities we can see. 1) We believe the reports and say there's tons of new hash rate coming on line outside this province (and likely outside China), 2) that the reports are overstated, or 3) mining concentration in China has falling dramatically. Of course, it could be a mix of all three.

Stablecoins / CBDC / Altcoins

Tether Dominance : 9.6% (+2.4% ! )

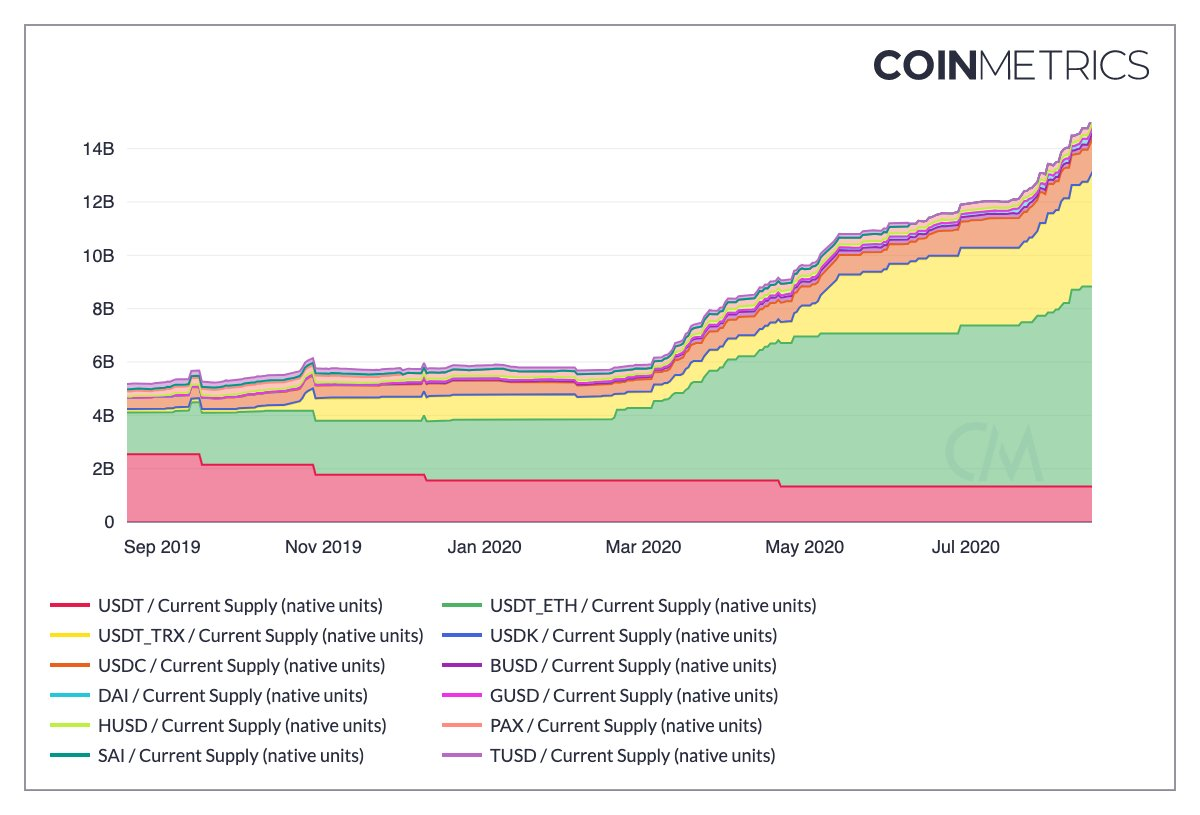

This week saw Tether transfer $1 billion USDT from the Tron network to Ethereum. No specific reason was given, but it was a chain swap involving Binance, leading to speculation that it was due to a growing difference in volume of trading pairs based on the two different form of Tether. Much more volume is traded using the Eth Tether version.

The Ethereum network continues to be clogged destroying many apps' ability to function and stimulating layer two type solutions. The big difference between Eth L2 and Bitcoin L2 stems from the differences in the base layer. Bitcoin's base layer is much more robust and simple to build on, while Ethereum is constantly shifting and harder to interact with in a secure way.

The market cap of stablecoins keeps climbing, recently hitting $15 billion, $13 billion of which is Tether. That is a steady 230% increase YTD.

Miscellaneous

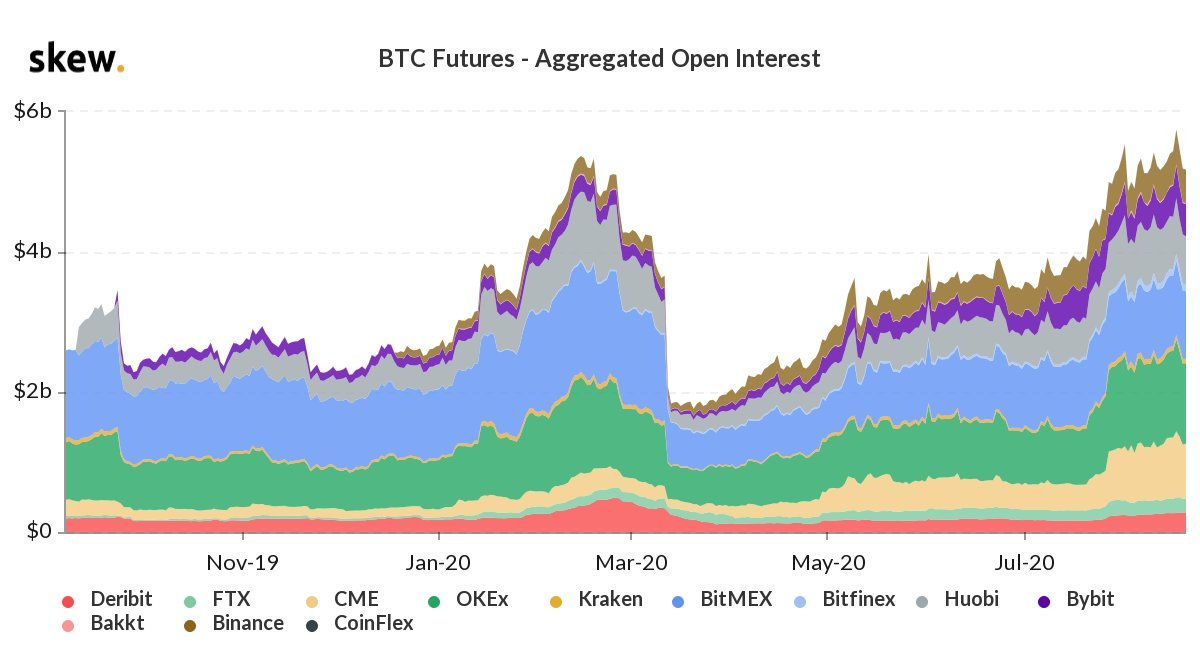

Bitcoin futures open interest hit an all-time-high of $5 billion driven by CME.

Demystify Bitcoin Jargon. Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages.

Over 180 Bitcoin related terms, concepts, and idioms.

This work exposes the reader to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Send feedback and/or take our quick survey!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See