Fundamentals Report #104

August 28, 2020 | Issue #104 | Block 645,727 | Disclaimer

The Bitcoin Dictionary paperback is LIVE on Amazon!

Vital Bitcoin Stats

Weekly price: $11530 (-$190, -1.62%)

Mayer Multiple: 1.29

Est. Difficulty Adjustment: -2.0% in 10d

Prev Adj: +3.6%

Sats/$1 USD: 8673

1 finney: $1.12

Market Commentary

Somewhat of a slow week this week in bitcoin minus all the noise on twitter. Price has been slightly down, but generally flat. Stocks continue their precarious climb for now as riots explode on the streets across the US. It is becoming harder to pick out the signal in the news cycle. It makes me want to retreat to my garden LOL.

The Fed livestreamed their Jacksonhole Summit this week. It's usually a private affair that we get the transcripts of the speeches a day later, but this year, Powell's speech was the pumped for a week as a revolutionary development in how the Fed will fight this slow down. Um, question, if they are so big-brained and powerful, why do they need "new tools" in the midst of an economic crisis? It is becoming tiresome to read all the pundits saying, "the end of the dollar is nigh!" Give me a break. The dollar is expanding its dominance.

These same pundits, mostly free market proponents, gold bugs, and bitcoiners, are quick to point out that central planning doesn't work, that it's impossible for the Fed to effectively manage the economy. We agree, but instead of thinking of the Fed as incompetent and impotent, all of a sudden these people are falling into the same blindness they accuse academic normies of having. They are endowing the Fed with superpowers, arguing that they will be able accomplish exactly what they intend, inflation.

This whole Jacksonhole build up was so Powell could say the Fed will be targeting "average inflation". Yes, that's not a mistake, that was the monumental earth-shattering announcement. We are to believe that targeting average inflation is the final straw that will finally make the Fed effective at getting the inflation and stimulus they have been trying to get for 12 years. What a joke.

The US and global economy is sputtering, not because of Covid but because such high levels of debt will not allow growth. We've pulled forward all the spending and growth we can. And with a credit-based money, inflation is the same thing as credit expansion is the same thing as growth. We don't and won't have inflation anytime soon.

But what about prices going up? Some prices will go up, sure. But this isn't due to expanding credit (inflation), it's due to contracting credit (deflation). When supply is reduced, prices go up. We can't look to prices to define inflation. Inflation is a very specific thing in today's credit-based money system, and that is expansion of the money supply, or expansion of credit. Likely what we'll see is a temporary spurt of price increases, followed by tightening of people's belts and then stagnant prices. We will not see runaway inflation.

The Fed is incompetent, debt levels are too high, the streets are ablaze, and there's no growth in sight.

Other Top Stories in Bitcoin

On the heels of the massive MicroStrategy announcement that they are now hold 21,000 bitcoins as a reserve asset for their corporation, other corporations are following. This week Snappa CEO Christopher Gimmer wrote an extremely high quality blog post explaining why his company is now holding bitcoin as their cash reserve asset. Bitcoin Maximalists Get Dragged for INX Hypocrisy

Samson Mow and Jameson Lopp were involved in a scammy launch this week. (This article is on the new BTCTimes.com, a bitcoin focused news outlet. Check it out!)

On Tuesday, a crypto startup called INX Limited became the first company to have a token-based initial public offering registered with the SEC. Instead of launching on a national exchange on Wall Street, INX is hosting the IPO on its website. Eventually, INX plans to have tokens available for trade on registered trading facilities, including its own trading platform.

Ideally, the INX team would have liked to use Liquid, a settlement network built as a sidechain on Bitcoin. In fact, INX recently joined the Liquid Federation along with 52 other exchanges and service providers. But it takes time to explain new technology to the SEC, and Liquid only began to support securities this year with a limited test group. Give it a few more years and some high-profile scams, and then the regulators might be ready to consider it.

Fidelity President Files For New Bitcoin Fund

Fidelity is the largest provider of 401k in the US, has $8 trn under management, and has been a big supporter of bitcoin for several years. The President is famous for having a bitcoin miner in her office several years ago.

Price

Weekly BMI | 1 : Slightly bullish

Today $700M in bitcoin options are expiring, along with the August futures contract on CME. It is interesting that the trading on the August contract opened August at $11,350 and price is currently $11,450 at time of writing. More price analysis for members on the Bitcoin Pulse.

Upgrade to the Bitcoin & Markets member posts for

exclusive commentary, charts and forecasts! Get the Bitcoin Pulse!

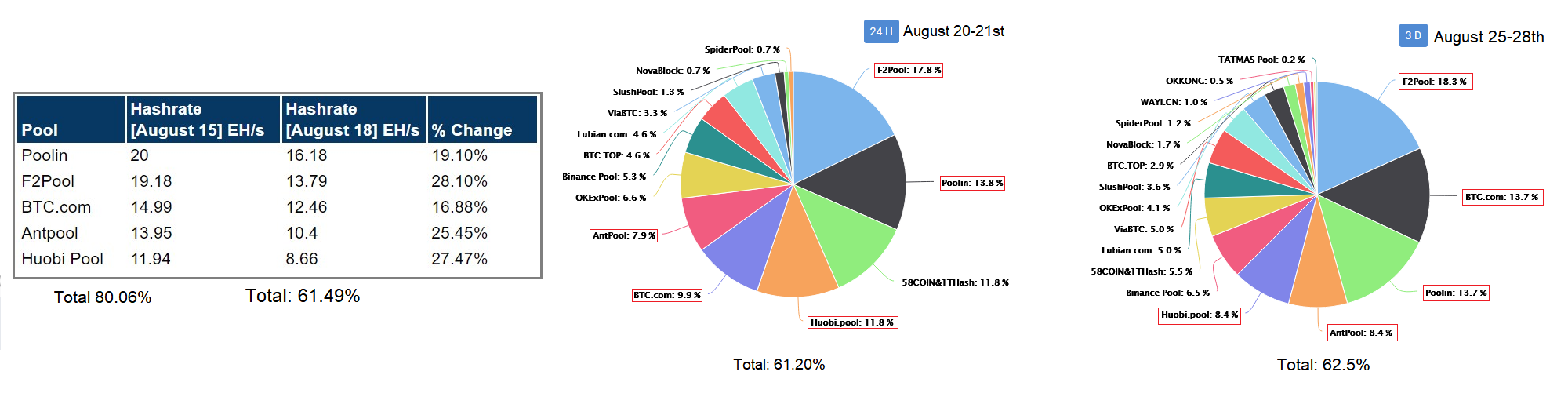

Mining

We have not heard much news coming out of China regarding the floods impacting miners but we did throw another update of the hash rate pool distribution. Unless the August 15th data pictured was an outlier for a 24hr period, there is still about 17% less blocks being mined by the 5 Chinese pools. It is possible for miners outside of China to mine in those pools so it's hard to determine if the data is useful.

Regardless, the difficulty adjustment is trending to -2% for this period which is estimated to end in about 10 days. Based on historical data and trends, we would expect a normal difficulty adjustment period to adjust up 2%. The mempool has about 40mb of 1 sat/b transactions, so if you need to get in the next couple blocks you may need a fee of 4 sats/b.

Stablecoins / CBDC / Altcoins

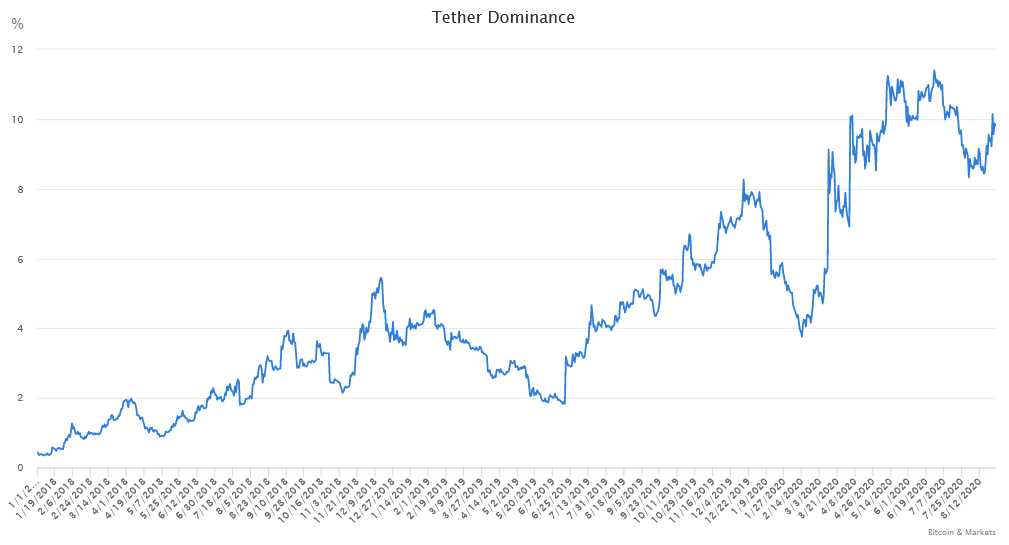

Tether Dominance : 9.8% (+0.2%)

Ethereum

Rushed upgrade made 12% of Ethereum clients unusable

A bug in the Parity client forced many of their nodes offline. Parity development was recently handed off from the original developers to a DAO, and the founding team transitioned to the Ethereum competitor Pokadot. According to Ethernodes.org, there are only 6500 fast-synced (trusted setup) nodes on Ethereum. These nodes are so difficult to maintain that in a recent video Andreas, the author of Mastering Ethereum, said he won't be able to keep a node on the network.

CBDC

Commentary: China's new digital currency is a bit of hot air

Asian focused news outlets are starting to question the revolutionary claims of the Chinese CBDC. In this article they claim it's not going to catch on anytime soon. Great quote:

In any event, foreign and domestic investors are unlikely to view the yuan as a safe haven currency in times of global financial turmoil. That requires trust, which is fostered by adherence to the rule of law and well-established checks and balances in the political system.

Miscellaneous

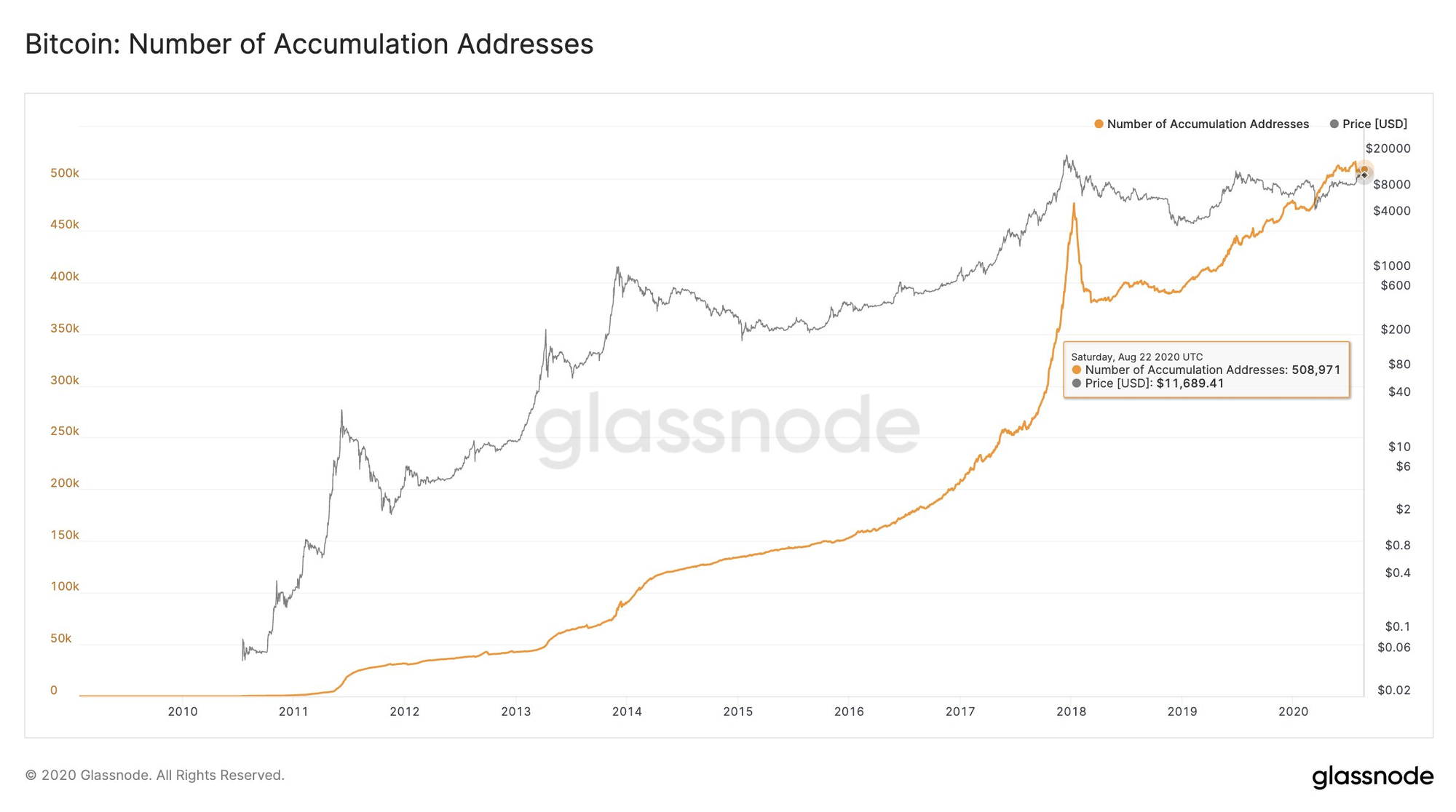

Here is a chart from glassnode where they are tracking bitcoin addresses that have received 2 transactions and have not sent any transactions. The data shows these addresses are now at over 500k which is an ATH and growing. This is bullish for a couple reasons:

1) It shows people are accumulating bitcoin

2) It shows these people are likely newer to the space because they are re-using addresses, which is a privacy "no-no"

Demystify Bitcoin Jargon. Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages.

Over 180 Bitcoin related terms, concepts, and idioms.

This work exposes the reader to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Send feedback and/or take our quick survey!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See