Fundamentals Report #107

September 18, 2020 | Issue #107 | Block 645,000

September 18, 2020 | Issue #107 | Block 645,000 | Disclaimer

The Bitcoin Dictionary is Available on Amazon!

Bitcoin in Brief

Weekly price: $10881 (+$566, 5.49%)

Mayer Multiple: 1.21

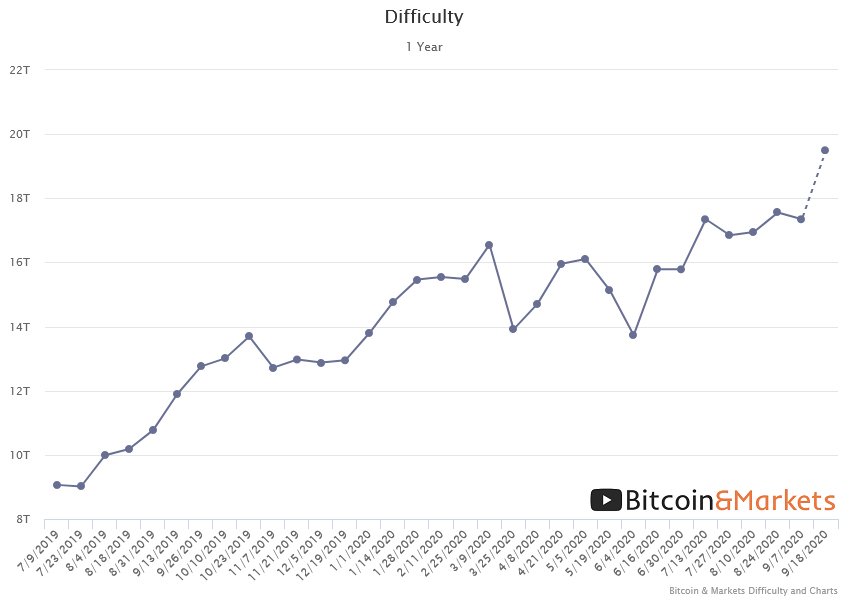

Est. Difficulty Adjustment: +12% in 1d

Prev Adj: -1.2%

Sats/$1 USD: 9190

1 finney: $1.09

Market Commentary

The Bitcoin Bull is waking up and stretching its legs. MicroStrategy and Paul Tutor Jones have awakened the savvy investor who will be streaming in over the next 1-2 years.

Bitcoin's target market is not the common man who has never worried about or looked into money and banking and how it works. Bitcoin's target market is high net worth investors.

The 'money printer go brrr' meme might have marked the top of the inflationist mindset. People are beginning to realize the Fed doesn't create inflation. The next great meme for bitcoin is simply to point to the Fed's inability to create a recovery. Poke the Fed with a stick, "Do something." If you want to prosper you have to think outside the system; don't think in terms of recovery, that's weak and boring, think in terms of growth, that's bitcoin.

Other Top Stories around Bitcoin

MicroStrategy's CEO Michael Saylor tweet's they bought more!

On Tuesday, Michael tweeted out MicroStrategy completed another acquisition of 16,796 bitcoin at an aggregate price of $175m, bringing their total holdings up to 38,250 bitcoin. Michael also appeared on Pomp's podcast and spilled the beans about his thought process and his interesting experiencing holding scare digital assets. On the show he called out Jack Dorsey, CEO of Twitter and Square, for not having bitcoin on those companies balance sheet - which is the big take away here - that the next big wave of adoption will be companies and institutions adding bitcoin on their balance sheet. We welcome Michael, a seasoned hodler of last resort, to the bitcoin space!

Kraken is granted a bank charter in the state of Wyoming

Kraken claims to be the world's first Special Purpose Depository Institution (SPDI) which will provide custody of digital assets and offer other banking services. In 2019, the Wyoming Legislature enacted "HB 74" which created the legal framework for an SPDI to legally operate and be recognized by the state. The legal framework resembles that of "custody banks" for physical assets which require 100% reserves, but geared toward digital assets. This is a reminder of Executive Order 6102 when the federal government confiscated gold from banks in 1933; not your keys not your coin.

Quick Price Analysis

Weekly BMI | -1 : Slightly bearish

Price has been extremely steady over the past couple of months. We have learned that MacroStrategy has been slowly buying 38,000 btc during the time shown on the chart. The overall bitcoin market has become much deeper and more liquid in the last few months since the March sell off.

There is little chance of a big sell off, but we wouldn't be surprised with a dip down to the CME gap levels prior to breaking to the upside through the resistance shown.

Become a paid member to access our technical analysis.

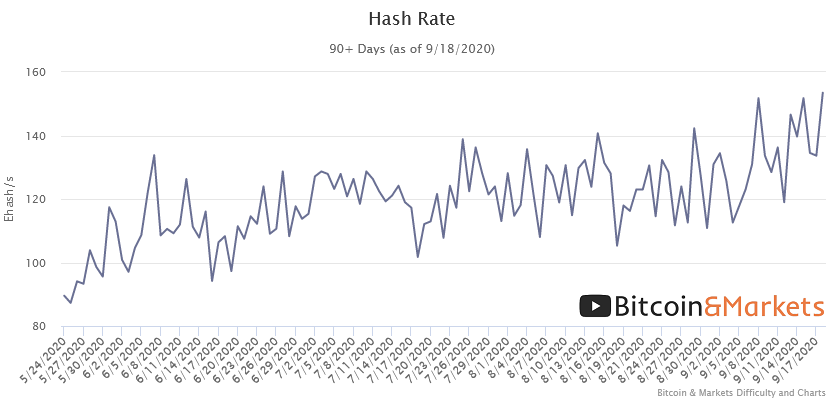

Mining

Hashrate spiked to ATHs and difficulty is now estimated to adjust +12% tomorrow evening. The Chinese operated mining pools affected by floods tracked in previous issues still hold around 64% of the overall hashrate. We'll remind you that this is only where these mining pools are headquartered and have some of their mining operations. It is unlikely that 64% of the bitcoin hash rate is concentrated in a province or two in China.

Shinobi from Block Digest published an article, The Next Decade P4: Actual Predictions, all about bitcoin mining. He predictions the vertical integration of the mining stack, such as with Bitmain: Research & Design of ASICs, Production, Hosting, Operation, Electrical Sourcing, Financial Risk Hedging, and Lobbying. He also uses Bitmain as an example of locating mining facilities in multiple countries, like the US and Canada, diversifying political and environmental risk. As a result, local governments will take note and attempt to exercise influence over the companies. It's important to be aware of possible attack vectors and discuss possible solutions.

Stablecoins / CBDC / Altcoins

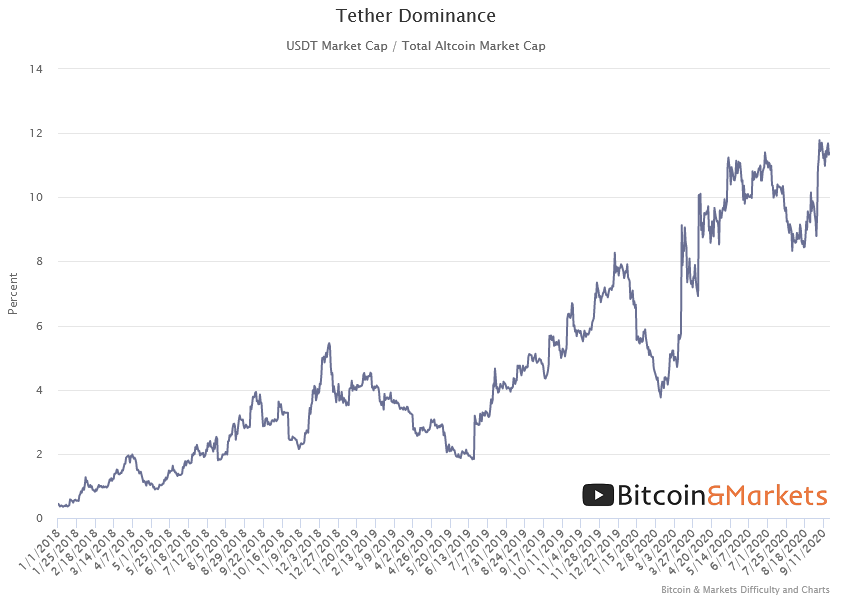

Tether Dominance: 11.4% (+0.1%)

Uniswap UNI token

The altcoin space is buzzing about the new airdrop of UNI a token for uniswap. We don't support government interference in the market, but we also expect to. That's why censorship resistance is such a big deal. If a centralized project like Uniswap launches a governance token and grows to become successful, it likely will be shutdown and censored by the government. You should expect that to happen.

As for the technical critique of these swap protocols, they will be out-competed by honest centralized alternatives. The Uniswap type protocols who claim decentralization are not completely so. They are slightly centralized, which opens them up to regulatory attacks, but they are not centralized enough to offer a cheap, fast, and scalable service.

"Crypto" lawyers on Twitter have started to call out the SEC on it as well.

Anecdotally, from a practitioner, this one, it makes it increasingly challenging to advise people in the “DeFi” space not to sell a governance token which is almost certainly a security when the SEC appears to be doing little to police this. It doesn’t impact our advice *but* >>

Given the announcement from a US based issuer yesterday that they are issuing a massive number of tokens that appear almost certainly to be investment contracts under Howey, Telegram, and the SEC’s own framework document we will surely be hearing more of the same. [...] as practitioners you'd make our lives easier if you appeared to be paying attention.

OR >>

If DeFI governance tokens are a thing you have concluded as a matter of policy aren't going to be shut down and are fine (which they don't seem to be under the current rubric), please say so.

The problem that we have is our clients, who come to us for conservative advice and to stay out of trouble, face a competitive disadvantage when you turn a blind eye on rule breakers, and prejudice their ability to fairly compete.

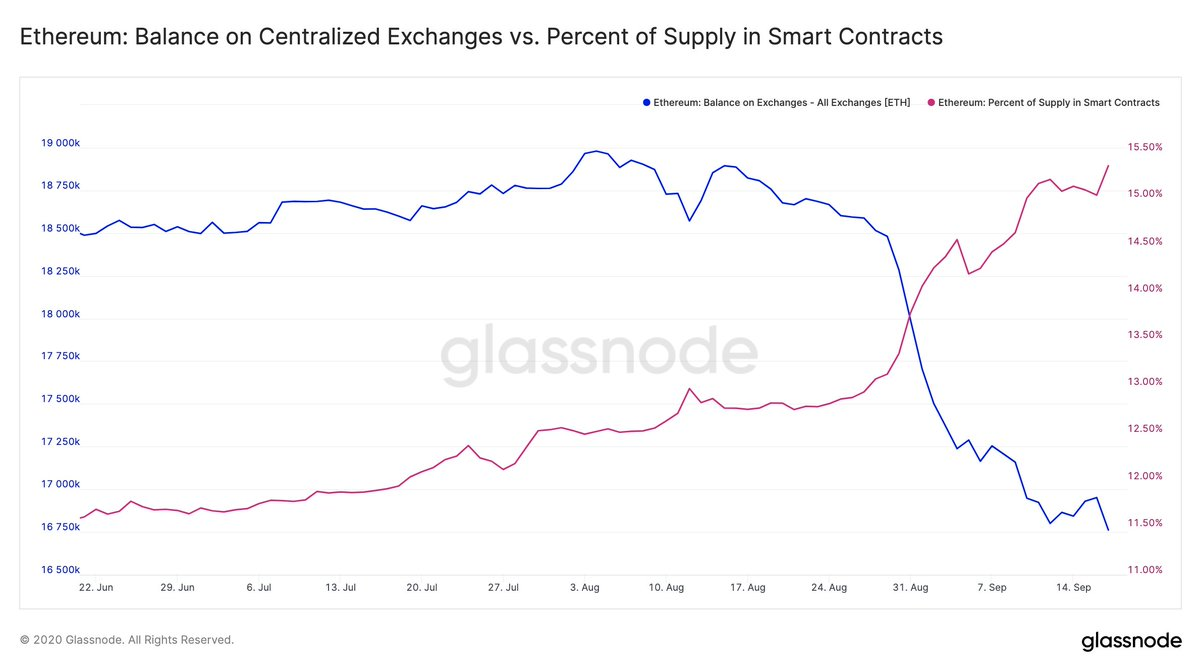

Ethereum Liquidity Issue

This chart has circulated a bit recently, and is often pointed to as a huge positive for ethereum. 10% of Eth have exited the exchanges and been added to illiquid contracts. This screams liquidity issue! Any significant dip in Eth could be magnified dramatically and have devastating consequences on the defi space.

GET THE BITCOIN DICTIONARY!

Demystify Bitcoin Jargon.

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See