Fundamentals Report #117

November 27, 2020 | Issue #117 | Block 658,936

November 27, 2020 | Issue #117 | Block 658,936 | Disclaimer

Written by Ansel Lindner and Jeff See

The Bitcoin Dictionary is LIVE on Amazon!

This week's Bitcoin & Markets content

Go to our Info Page to join our community, and find where to listen and follow.

Bitcoin in Brief

Weekly price: $16748 (-$1900, -10.2%)

Mayer Multiple: 1.49

Est. Difficulty Adjustment: +8% in 2d

Prev Adj: +4.82%

Sats/$1 USD: 5971

1 finney: $1.67

Market Commentary

What a wild week. Bitcoin reached for All-time-highs and then crashed, while the legacy markets inched up. Gold was smashed as expected in a perfect repeat of the last financial crisis in 2008. And the US dollar dripped downward.

Altcoin pump and dumps

Altcoins within "crypto" have had a pretty big rally over the last few weeks, even against bitcoin. Many people are now calling for altcoins to continue this rally, but we think that is not the most likely scenario. 79% of all gains in altcoins over the last couple of weeks has been from only Ripple and Ethereum.

The largest percent gains in the altcoins was seen in Ripple (XRP). This is a complete scam coin with no fundamental use case other than to pump and dump for the centralized Ripple Labs, Inc. Rumors that often circulate about Ripple on the verge of getting used in international finance by central banks or multinational conglomerates of one sort or another are false beyond any doubt. Also, important to note is the ex-founder Jed McCaleb owns billions of ripple coins and by court order is allowed to dump a billion coins a month.

The other major altcoin mover, Ethereum, is the master of marketing. They recently reached the first milestone in a multiyear (multi-decade) upgrade process. This insignificant step toward ETH2.0 is always sold by its developers as ETH2.0 itself. Many unsuspecting investors will be fooled by the fake headline, "ETH2.0 Launched" or some other deceptive headline designed to make investors think Ethereum is succeeding (instead of just being a huge MLM scheme).

Coinbase Rumor

The other big story in bitcoin we must mention here is the tweet thread by Brian Armstrong, CEO and Founder of Coinbase. He is well connected CEO in Silicon Valley, with many high-powered VC investors. He posted a thread to Twitter on Wednesday starting a rumor that Mnuchin, US Sec of the Treasury, is going to institute some very draconian regulations on his way out of his office in January.

The specific type of regulation Armstrong mentioned was KYC to receive coins from Coinbase customers. For instance, if a Coinbase customer wants to send their bitcoins to buy a t-shirt from a random website, the customer would have to provide identifying information for the recipient of the funds. It becomes even weirder if the recipient is a smart contract and not even a legal entity. This would be so difficult that it sounds illogical for Mnuchin to impose.

Some in the space pointed to malicious intent of the tweet itself, saying the timing was suspicious, on the eve of the banking holiday for Thanksgiving when people wouldn't be able to make wire transfers in or out of Coinbase, and how it seemed to be coordinated with the large crash that followed, all around the bitcoin market, hitting altcoins very hard.

We wouldn't put it past Brian Armstrong to do something like this. His personal portfolio being heavily in altcoins, and his company enabling many altcoins, speaks to his lack of ethics in profiting from scams.

We do not, however, think his tweet was the cause of the crash. We've been saying for weeks that price will come back to test support. Also, that nothing goes up in a straight line. Bitcoin felt resistance at the previous All-time-high and pulled back is all. Let's go on to price...

Quick Price Analysis

Weekly BMI | 0 : Neutral

We are currently neutral on price as this pull back develops. There are several levels which could offer support on the chart. (1) is the most recent formation of resistance turned support, and is very near the current price. (2) is a longer term area of resistance dating back to 2019. It is possible price makes its way down to that level but is unlikely to break below $12,500.

Historically, bitcoin corrections during bull markets have been between 20-40%. That works out to a range from $15,500 down to $11,500.

Become a paid member to access our full technical analysis and member newsletter.

Mining

The mempool started growing a few days ago and currently holds about 40mb of transactions (~33 full blocks) with fees around 50 sats/byte. Users will likely be able to transact for single digit sats/byte over the coming weekend if they are able to wait. Difficulty is on pace to adjust upward 8% in two days.

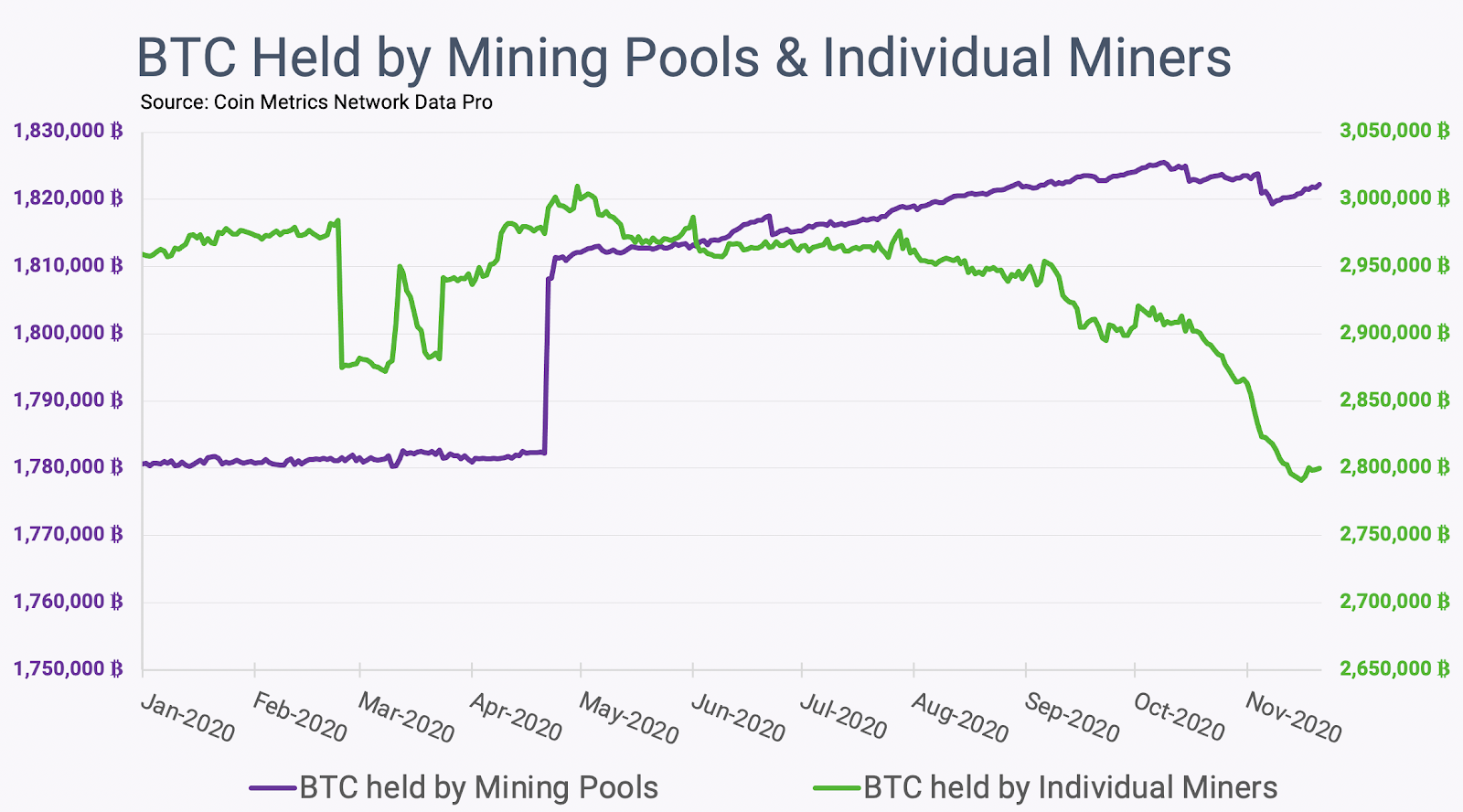

Pictured below is an update from Coinmetrics showing their effort to track mining pool and individual miners spending. It's hard to draw any conclusion from it, but with the recent price run up we thought it would be interesting to share.

Stablecoins / CBDC / Altcoins

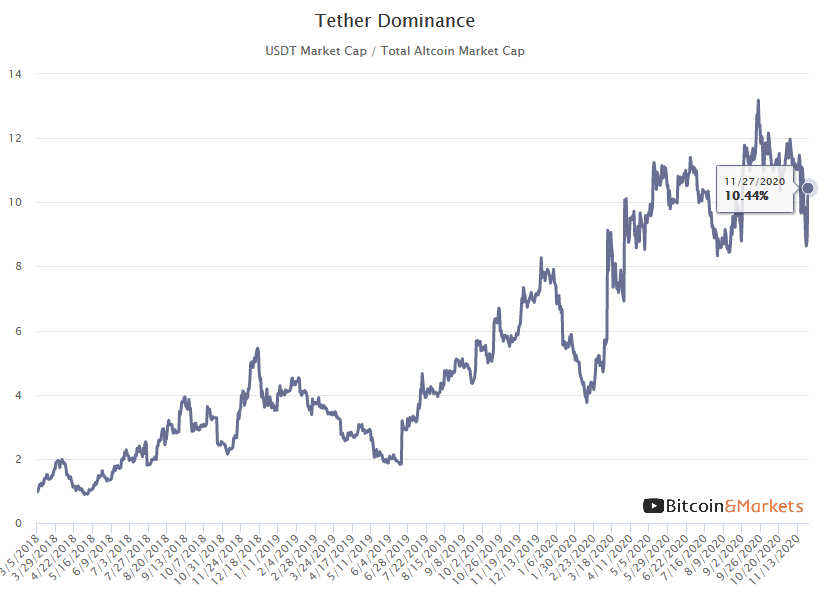

Tether Dominance: 10.4% (-0.3%)

The dramatic drop in tether dominance preceded the recent drop in prices. The theory holds that a drop in tether dominance leads to a drop in liquidity, since tether is half of most altcoin trading pairs. Tether's dominance has rebounded, but is still relatively low when compared to the last 2-3 months. Altcoins still find themselves in a somewhat illiquid volatile position.

Miscellaneous

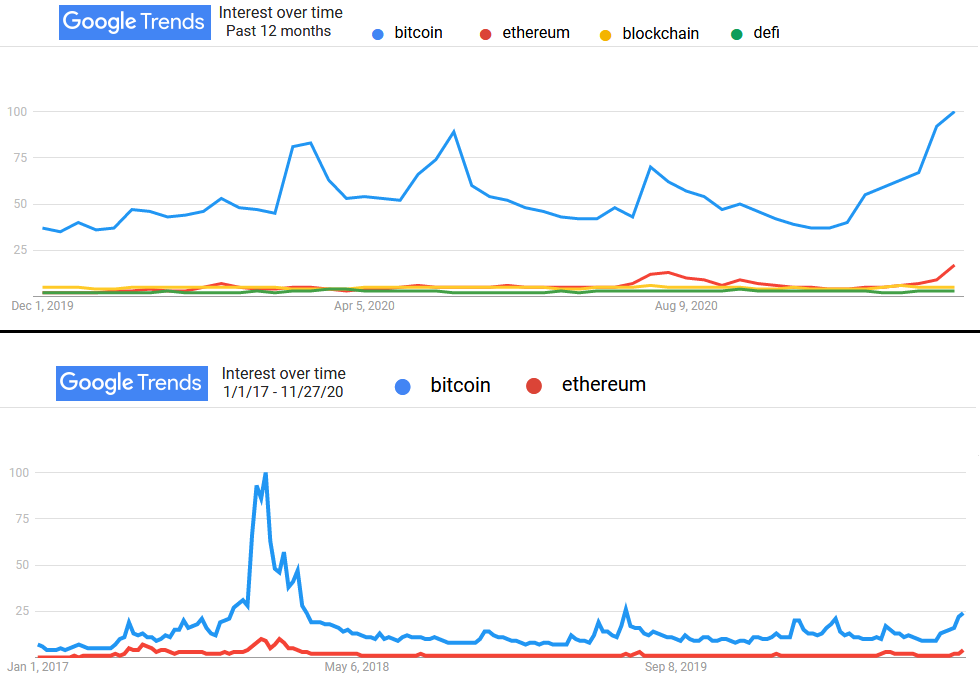

Below, we take a look at Google Trends for several search terms. On the first chart we compare "bitcoin" to other popular memes in the space over the last 12 months. Defi may seem like all the rage, but it has a long way to go to peak the interest of people outside of the cryptosphere.

On the ~4 year chart we see Bitcoin interest pushing toward a new 3 year high, but as you can see, it has a long way to go to get to mania levels. We anticipate bitcoin search volume to continue to go up after everyone has their Bitcoin talk with their family during Thanksgiving.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.