Fundamentals Report #122

January 1, 2021 | Issue #122 | Block 664,035

January 1, 2021 | Issue #122 | Block 664,035 | Disclaimer

Written by Ansel Lindner and Jeff See

Bitcoin in Brief

| Weekly price | $29,147 (+$5671, +24.2%) |

| Satoshis/$1 USD | 3,431 |

| 1 finney (1/10,000 btc) | $2.91 |

| Stock to Flow (new supply to existing) 463/d | 1.13 |

| Mayer Multiple (ratio to 200 d MA) | 2.17 |

| Est. Difficulty Adjustment | +10% in 8 days |

| Previous Adjustment | -0.38% |

This week's Bitcoin & Markets content

- (Member) Happy New Year Bitcoin! - Bitcoin Pulse #95

- (Article on Bitcoin Magazine) Reviewing 2020’S Central Bank Policies

- (Article on BTM Research) Bitcoin Does Not Need Fiat Inflation to Flourish

Sign up family and friends to the Fundamentals Report! Anyone you think would enjoy the high signal to noise!

Go to our Info Page to join our community, find where to listen, and follow us.

The Bitcoin Dictionary is LIVE on Amazon!

Market Commentary

From Bitcoin Pulse #95

Happy New Year!

Here is to you and bitcoin! For those of us who have made it through this year, surviving and thriving, congratulations. You are reaping the rewards of smart life decisions. Bitcoin will keep changing the world for the better in 2021.

2020 was a crazy year. We are living in historical times, aren't we? The reaction to the first major pandemic in 100 years was surprising and terrible, but not wholly unexpected. A positive byproduct of this disaster is that many people have been red pilled, they saw what we libertarian/crypto-anarchists have been saying for decades, that the government has grown dangerous to the individual and its current incarnation is unsustainable.

The events that began this year will spill into 2021, first with the US Presidential transition in January and then with geopolitical fallout from this financial recession. Eyes on China and Europe. And eyes on bitcoin as it breaks into the geopolitical discussion in a big way.

The next big event of the 2021 on my radar is the double dip of this recession. As the vaccine gets distributed, folks will start to realize it isn't the answer to their prayers, and the real damage to the global economy was caused by the authoritarian reaction. That's when the second shoe drops on the world.

The US will be more insulated in general because of the dollar and the fact that the US doesn't rely heavily on exports. Of course, that makes the US an attractive place for capital extending rallies in US stocks, bonds, and bitcoin. Overall, the US will boom while the rest of the world struggles. Globalization will slow or reverse and the rise of populism will continue.

Strap in for 2021.

Ansel

Quick Price Analysis

Weekly BMI | -1 : Slightly bearish

We are leaning slightly bearish with the understanding that the rally is very strong. Ansel went into the the technicals and fundamentals on the last issue of the Pulse, everything is looking toppy.

Despite what people parrot, technical analysis (TA) gives us a system by which to evaluate probabilities. Naysayers of TA cannot help but use TA themselves. They wouldn't buy bitcoin if they thought the price was going to go down, they just prefer different indicators.

Network stats like traffic and difficulty have been solid but not growing like November and the first half of December. This could be because of the holidays, but the price has continued up during that time. There is plenty of room to go down and find support before the bull cycle continues.

If you are dollar cost averaging, buy the dips a little more heavily. If you are trading, keep your stops close in this area and watch for a temporary reversal.

Become a paid member to access our full technical analysis and member newsletter.

Mining

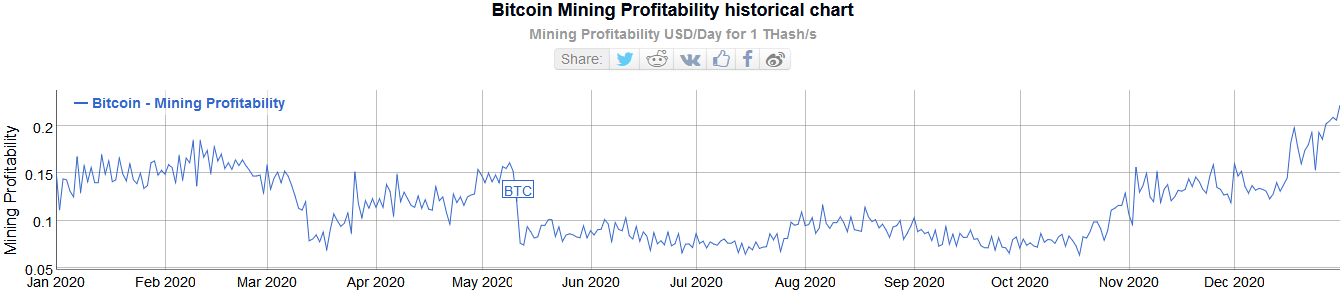

Mining profitability, thanks to price, is now higher than it was pre-halving. Hashrate is now on the rise with the next difficulty adjustment in 8 days estimated to be +7 - 12%. This is the first signs of life out of the mining sector in the last couple of months. The price has finally attracted new investment in this side of the house. We expect hashrate to continue to rise in 2021 as usual, and transform into a more competitive and globally distributed sector.

In 2020, Russia and the US jumped onto the scheme with large hashrate additions. We think that continues and expands in 2021, with growing geopolitical importance.

Network Stats & Development

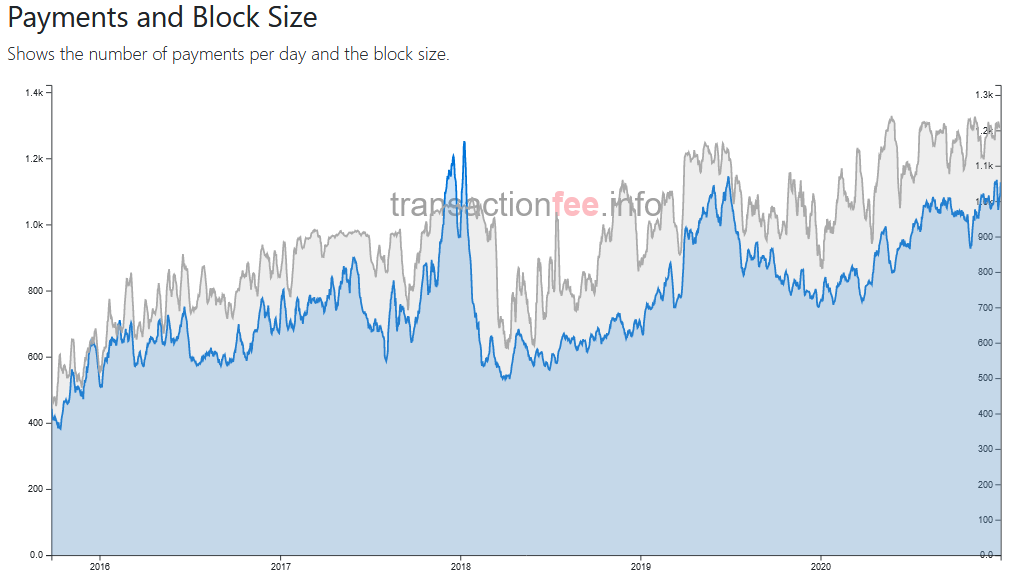

2020 was by far the year with the most bitcoin transactions processed and the most efficient use of block space. Efficient use of space is a much better metric than absolute size, because smaller blocks and keep running a node a manageable thing for any user of bitcoin. As bitcoin progresses, improvements can be made to transaction types and compression, conservatively adding transaction capacity while keeping the rules the same and overall size minimal.

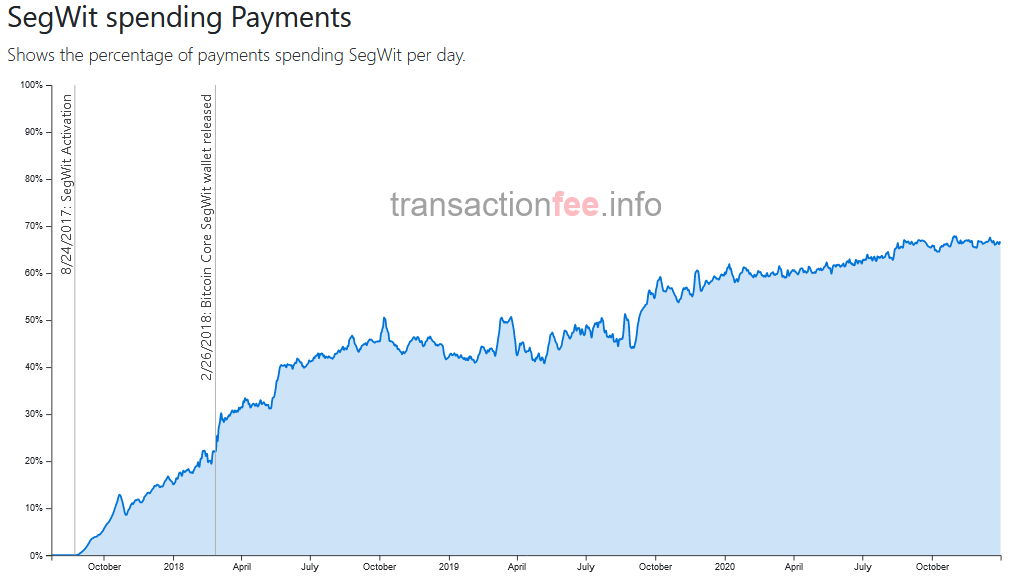

SegWit (a modern transaction type) usage increased from 60% to 66%. That might seem small, but it is room for thousands of more transactions per day.

The next large improvement coming to bitcoin is Taproot, which should increase SegWit usage even more, to take advantage even more modern transaction types. We expect to see SegWit usage increase to 75% in 2021, once Taproot is implemented. More on Taproot and it's activation status below.

Taproot

Taproot is a proposed Bitcoin protocol upgrade that can be deployed as a forward-compatible soft fork. By combining the Schnorr signature scheme with MAST (Merklized Alternative Script Tree) and a new scripting language called Tapscript, Taproot will expand Bitcoin’s smart contract flexibility, while offering more privacy by letting users mask complex smart contracts as a regular bitcoin transaction.

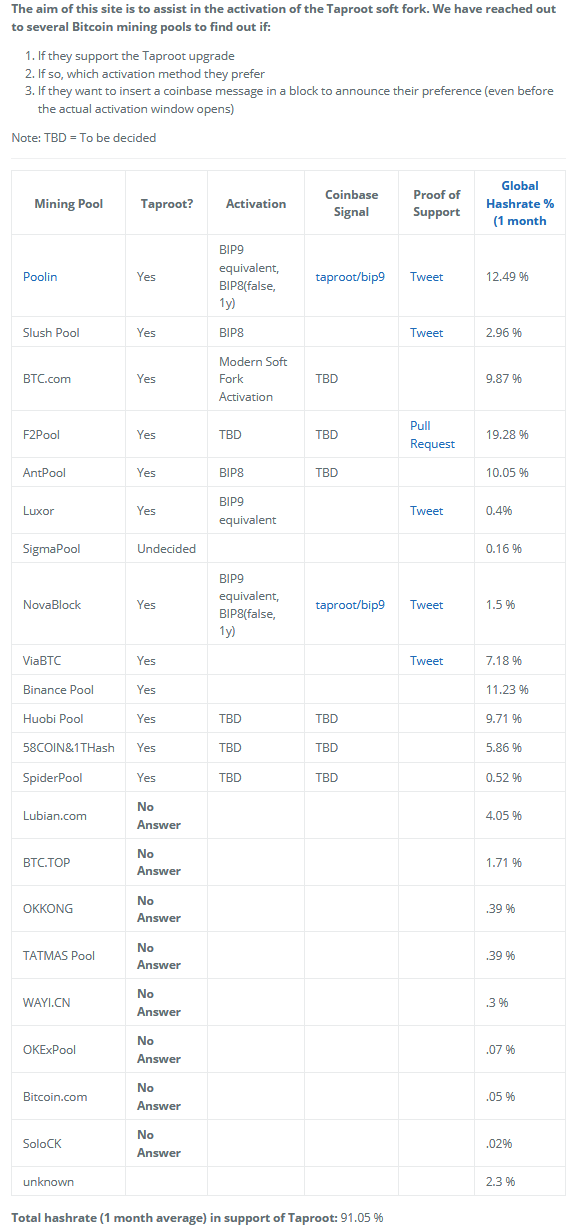

The following information is taken from Taprootactivation.com, a great site consolidating info about Taproot's status from miners and other players. It's a good place to follow the activation process.

Bitcoin is a decentralized entity that resists change. There is no central organization for upgrades, but individuals like this website can offer a method of coordination for the decentralized process.

Taproot is not attempting to compete with expressive smart contract platforms like Ethereum. Ethereum doesn't work as advertised today and is destined for a long struggle as they are forced to solve their problems with complexity and centralization. Taproot is conservative, like all bitcoin upgrades, and provides several more tools which users can creatively build solutions to their individual problems. If users don't want upgrade, they don't have to, and will be just fine continuing to use bitcoin as they already do.

Currently, there is debate on the method of activation, signaling threshold or activation day, or some combination (more info can be found on taprootactivation.com). 91% of hashrate is ready, so we expect the activation window to begin in 2021!

Miscellaneous

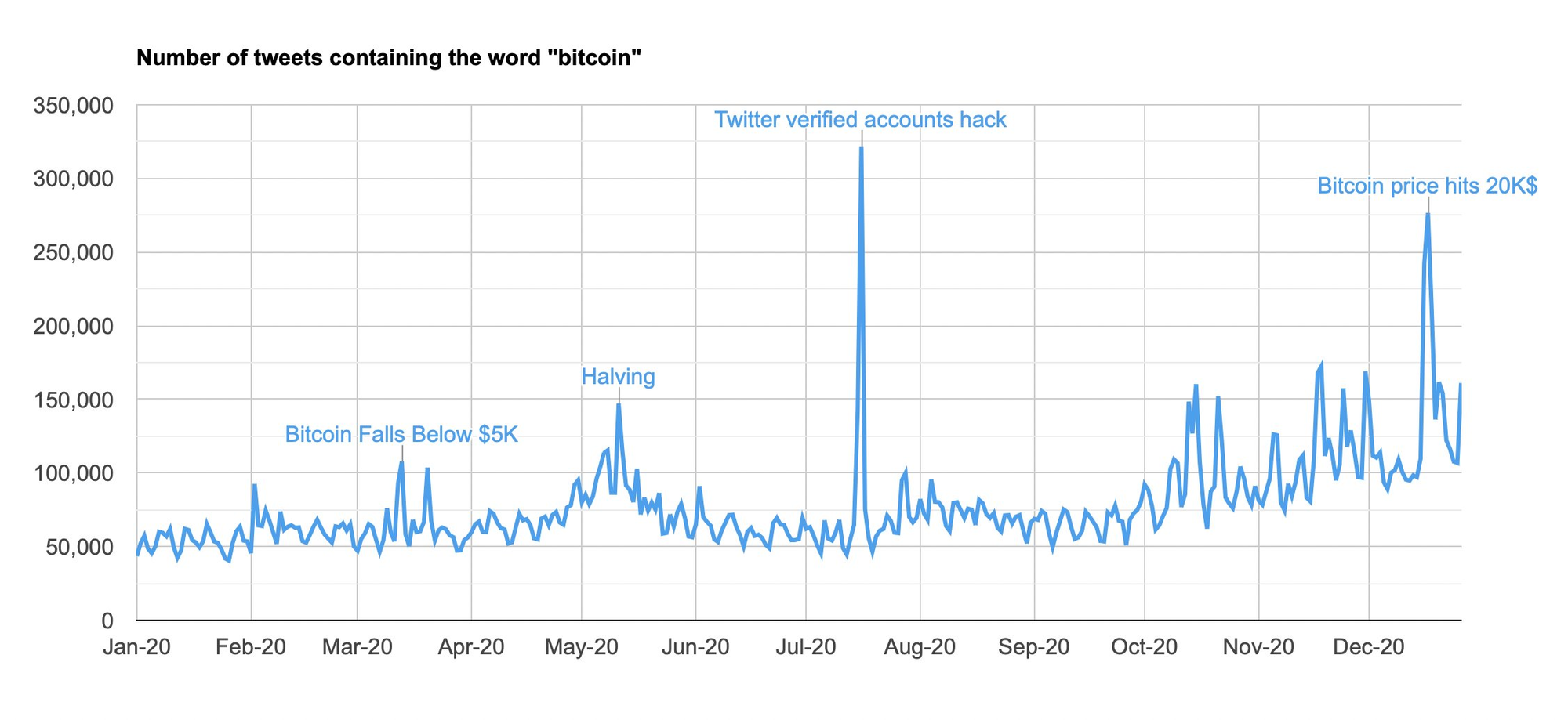

Jameson Lopp dropped an interesting chart on Twitter showing the number of tweets containing the word "bitcoin". There is an obvious growing trend beginning in October, from 50k tweets per day up to more than 100k, and 150k on peak days.

As Bitcoin Twitter becomes more active, the noise will increase and the signal/noise ratio will also decrease. This creates the space for altcoin scams and Ponzis to really take off. Be aware of that trend and tell people about our newsletter to maintain that clear signal!

Tweets per day is a related metric to Google Trends search volume. We'll look at that on next week's Fundamentals Report.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.