Fundamentals Report #131

This week includes bullish headlines of the week, GBTC discount, price analysis, bitcoin mining update, Taproot, NFTs, and Ethereum.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Triffin Dilemma: Fact or Fiction? - E226

- (podcast) Fed, Markets and Inflation w/ Michael Lebowitz - FED 43

- (blog) The Return of American Non-Interventionism

Get our book the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $48,099 (+$217, +0.45%) |

| Market cap | $898 billion |

| Satoshis/$1 USD | 2,079 |

| 1 finney (1/10,000 btc) | $4.79 |

| Market cycle timing | Middle of bull market |

| Weekly trend | Consolidation |

| Media sentiment | Positive |

| Network traffic | Moderate |

| Mining | Supply constrained |

Market Commentary

This newsletter is growing longer each week it seems. The bitcoin space is moving so fast every corner of this industry has something going on. In the sections below, we point out the major developments happening in each, but for this top section today, we hope a list of a few stories this week will suffice.

The third Visa COVID-19 Consumer Sentiment survey sought to assess consumer trends during the lockdown. The survey data revealed that 78% of consumers expect to use new payment technologies in the future—including cryptocurrencies.

The majority of users (58%) expect to make payments through social networks (like WhatsApp Pay or WeChat Pay). Many (42%) also expect biometric payments—transactions authenticated via fingerprints, retinas, or facial recognition.

Cryptocurrencies ranked third in order of importance, with 25% of users eager to use the technology. Digital assets beat other technologies, such as the Internet of Things with 22% and virtual/augmented reality with 10%.

- BITCOIN: At the Tipping Point - a report by Citi bank

Where could Bitcoin be in another seven or so years? The report notes the advantage of Bitcoin in global payments, including its decentralized design, lack of foreign exchange exposure, fast (and potentially cheaper) money movements, secure payment channels, and traceability. These attributes combined with Bitcoin's global reach and neutrality could spur it to become the currency of choice for international trade.

The trading desk reboot comes amid growing interest by institutions in bitcoin, which has soared more than 470% over the past year. The largest cryptocurrency is seen by investors and some companies as a hedge against inflation as governments and central banks turn on the stimulus taps.

- Miami Mayor Suarez: "It doesn't surprise me at all that a Treasury secretary would find a decentralized potential currency to be hostile to a currency that they control."

Like our content? SHARE with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

GBTC

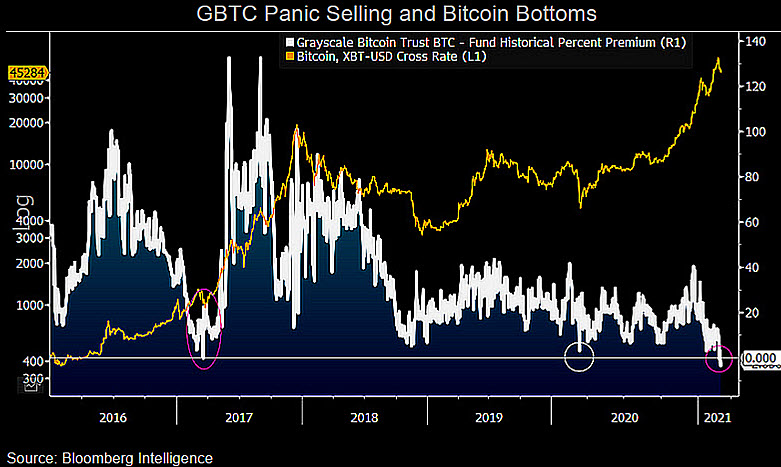

One of the biggest developments for price over the last week is the unprecedented negative premium on GBTC. GBTC is the bitcoin trust which is tradeable in retirement accounts and by typical investors like a stock. GBTC has locked up an immense amount of bitcoin. Currently, they hold 655,570 btc ($35.4 B).

GBTC is designed to track the bitcoin price like an ETF, with some small differences. Grayscale, the parent company of GBTC, can issue new shares directly to accredited investors. These new shares must be held for one year before they can be sold on the secondary market to any other investor.

There is an arbitrage opportunity when the premium is above the market interest rate to borrow bitcoin. This arbitrage trade depends on two things, institutional/accredited investor demand and retail demand. A negative premium signals there has been a significant change in one or the other.

Price

Price is general has been strong. After a rally over $52,000 this week, it pulled back to near $46,000. We view this period as a less volatile consolidation than in January, and expect further upside soon.

The only complicating factor for this point in the bull market is trouble in the traditional markets. The labor market has not improved markedly. Weekly initial unemployment claims remain above the worst week during the 2008-9 GFC. Investors are also getting uneasy about rising interest rates and landmines in the bond market. This will weigh on stocks whose valuations are precarious as we all know. If there is a large correction in traditional markets, bitcoin could follow suit initially.

Despite all this, we remain quite bullish on bitcoin over the next week. Dips should be seen as a buying opportunity. The name of the game is accumulation. Don't sell to the institutions, they won't be as nice to you.

Become a paid member to access our full technical analysis and member newsletter.

Mining

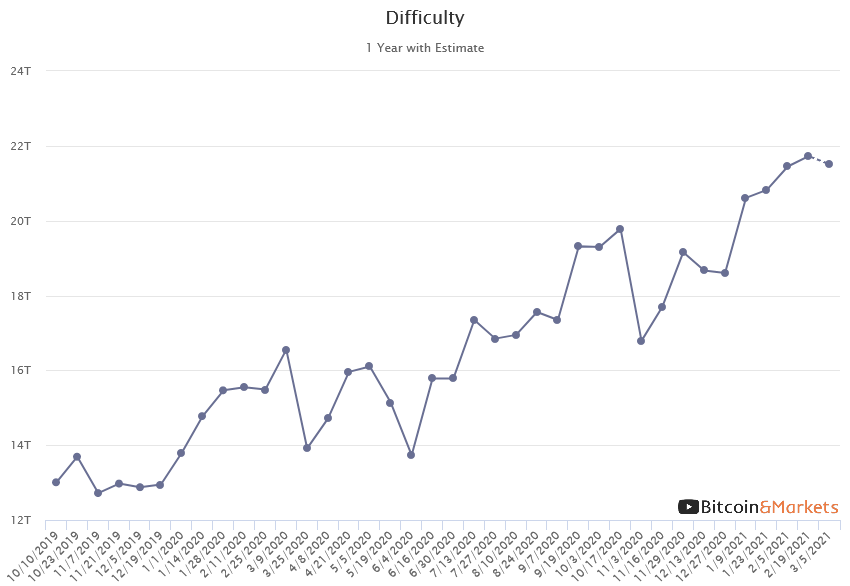

It seems insane but the difficulty will adjust down 1% later this evening making it easier to mine bitcoin while the price hovers near $50k. MSM has been reporting on the chip fabrication shortages for a few weeks and how it is impacting automobile, graphics cards, and cell phone manufacturing, but other than this newsletter, this news has not gotten wide distribution in the bitcoin industry.

Delays on chips are expected to run through the end of the year, resulting in a unique period of rising profitability in bitcoin mining without new computer power coming on to capture it. Bitcoin mining profitability is now higher than it was for the 6 months leading up to the halving. This is a great incentive to diversify chip fabrication globally and bitcoin mining, as more locations become profitable to mine from. We think this is the biggest story not grabbing headlines in bitcoin today.

The mempool (transactions waiting to be confirmed on the network) is still high; sitting at 190 MB with a fee of 100 sats/byte to get in the next block.

Software Development

The upcoming upgrade to Bitcoin called Taproot is running into a little bit of debate at the moment. Taproot is a bundle of several cutting-edge cryptographic upgrades including: digital signature optimization, script improvements for simple contracts, and privacy. Below is a good podcast explaining some of the recent controversy. We expect Taproot to be activated without major incident in the next 12 months.

Stablecoins / CBDC / Altcoins

The last couple of weeks has seen an explosion in interest in NFTs (Non-Fungible Tokens). It is mainly a case of Ethereum folks looking for something to give their network value. More on Eth below, but first a quick summary of NFTs for beginners:

NFT - A class of digital tokens where every unit is distinct and not interchangeable.

Discussion: Non-fungible tokens have no use as money. They are used as either a digital representation of a physical item, like a piece of art, or a purely digital token. As of 2020, two applications for purely digital NFTs are prominent; (a) in-game tokens, representing a scarce item like a sword; and (b) collectibles like trading cards.

Non-fungible tokens technically do not require a block chain or a distributed network, they can be traded in a completely centralized fashion. If they are used on a distributed network via smart contracts, they require centralization. A trusted third-party must be involved to mint the token, maintain, and upgrade the smart contract, manage ownership records, and enable future trading. For example, scarce in-game items cannot be used if the game is upgraded to not recognize that token.

- The Bitcoin Dictionary, pg 50

NFTs are not really that interesting unless they are issued by a centralized party. Decentralized NFTs can be copied. For example, if you produce a digital image you want to sell the rights to with an NFT, nothing is stopping another person from copying that image exactly and issuing their own NFT. Any value of the token will be arbitraged away. Long term there is no value in decentralized NFTs.

Ethereum

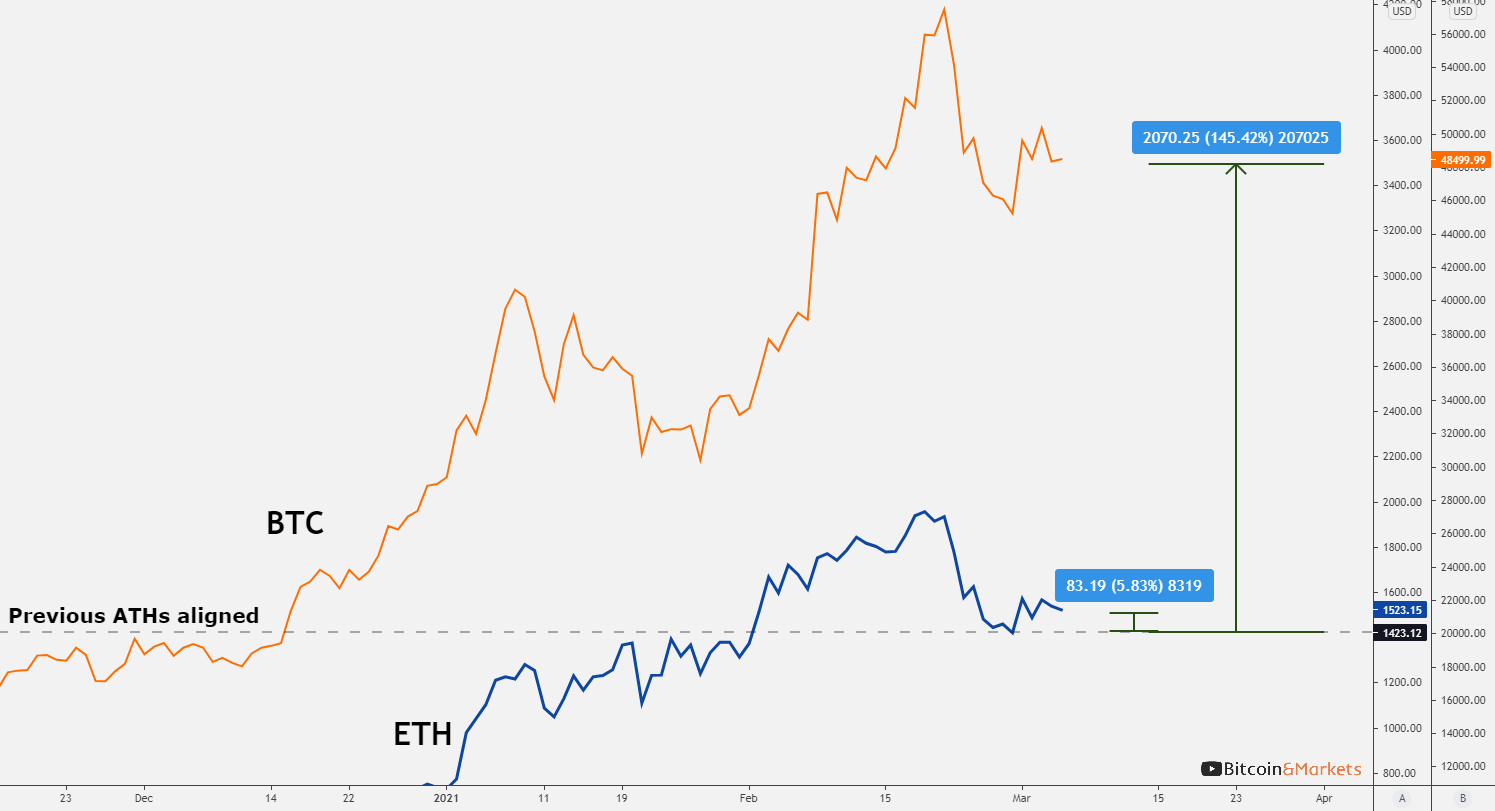

ETH is struggling to maintain above its previous cycle high. Understanding why can give us some insight into this market.

Why should we expect ETH to follow bitcoin's 4-year cycles in the first place? Bitcoin's cycles are driven by the halvings. That's where roughly, every 4 years the issuance rate of new bitcoin gets cut in half. ETH does not have this characteristic. In fact, ETH's supply cannot be directly audited, however, we do know that it will have perpetual inflation. There is no cap, and no concrete policy going forward. ETH insiders call their monetary policy "minimum viable issuance". If that doesn't sound like central planning I don't know what does.

So, we should not expect ETH to have a 4-year cycle like bitcoin. Indeed, we should expect it to consistently lose value over time due to inflation.

The only reason ETH has gone up in price at all recently is because promoters place it in bitcoin's shadow. All altcoins have hitched their wagons to bitcoin as it were. Bitcoin is pulling ETH for the time being, but as time goes on, its competitors will cannibalize its value.

Miscellaneous

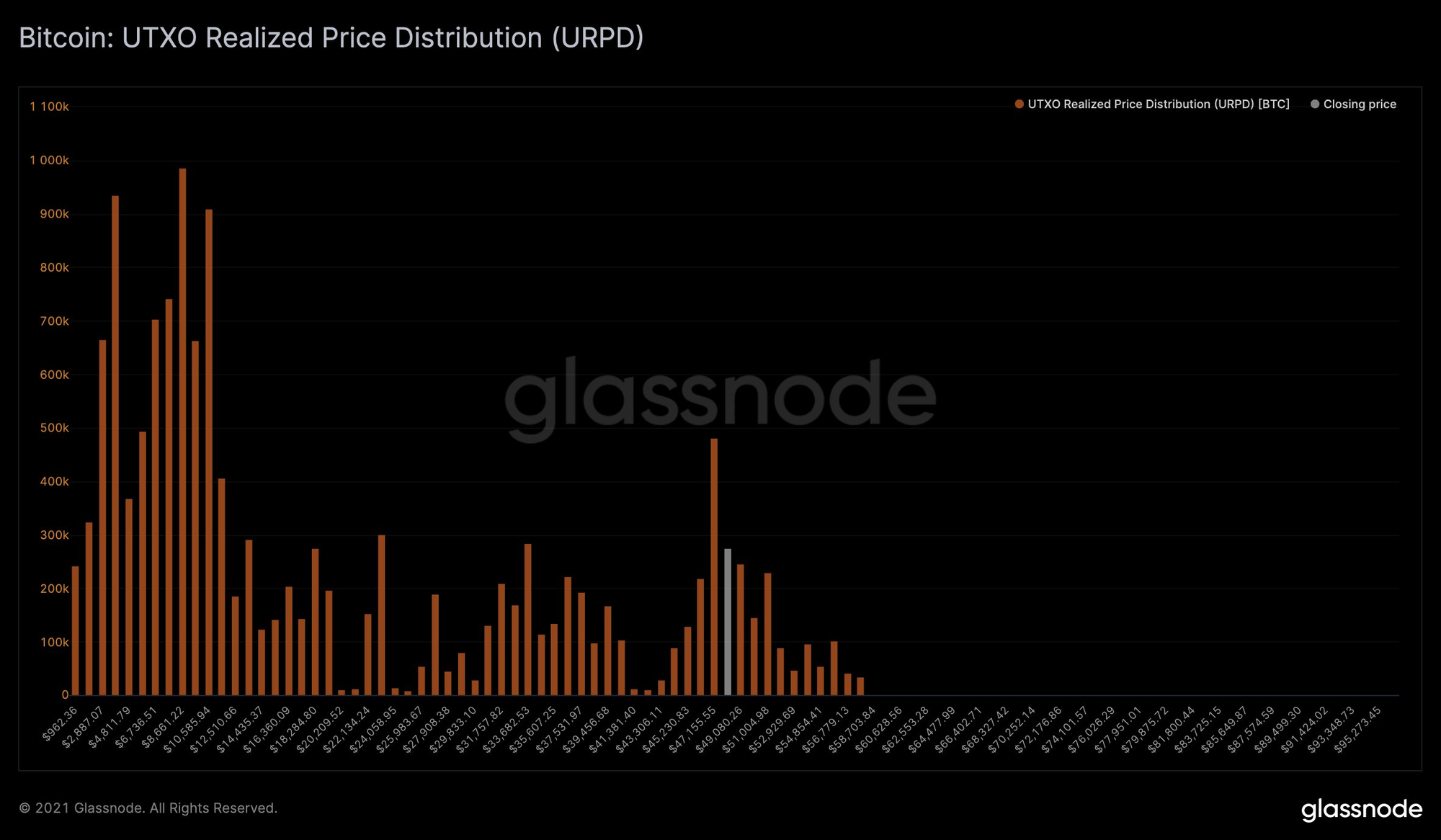

A very bullish event happened at $47,000 this week for bitcoin. People track bitcoin volume on chain, that means bitcoin that has been sent to a new address for one reason or another. It could be buying and selling, or simply wallet management.

This week approximately 500,000 bitcoins moved at $47k. We can't tell if it was all buying and selling, but it is definitely an important price level. Since this move, price can tested support there and it has held. This could be an important sign of system support at that level.

The below chart offers a great visualization of on chain volume by price. Lower prices to the left, higher prices to the right; the taller the bar the more volume at that price. The white bar is the current price level. The chart shows a significant spike just to the left of our current price, meaning it will likely act as very strong support of the price.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

March 5, 2021 | Issue #131 | Block 673,305 | Disclaimer