Fundamentals Report #133

This week we cover big banks growing obsession with bitcoin and the likely bitcoin ETF, as well as news from all the important sectors.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Triffin Dilemma: Quick Part 2 - E227

- (podcast) The Great Wealth Transfer w/ Mark Moss - FED 45

- (podcast) NFTs and Bitcoin Fungibility - E228

- (member) Break this week for vacation

Get our book the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $59,120 (+$1,728, +3.01%) |

| Market cap | $1.104 trillion |

| Satoshis/$1 USD | 1,691 |

| 1 finney (1/10,000 btc) | $5.91 |

| Market cycle timing | Middle of bull market |

| Weekly trend | Ready for next move |

| Media sentiment | Very positive |

| Network traffic | Moderate |

| Mining | Healthy and expanding |

Market Commentary

Our newsletter is shorter than usual this week due to Ansel being on vacation, but that works out because it was a slower news week once again in bitcoin. We will summarize a couple of the big stories for you below.

This was the first week in years that we have released two podcasts on the Bitcoin & Markets' feed (see above). The first one concerned finishing up the Triffin Dilemma and the second, released just today, has very important information on NFTs and fungibility. Make sure to check them out!

Bitcoin ETF

This will likely be the year when a Bitcoin ETF finally launches in the US, following the 3 ETFs in Canada launched in February. Former SEC chairman Jay Clayton was famously anti-bitcoin but is now gone. The powers that be simply can't put it off anymore unless they want to lose 10s of billions of dollars of investment to competition north of the border.

"CBOE on Monday filed a Form 19b-4 seeking permission to list and trade shares of the VanEck Bitcoin Trust." The event starts the clock where the SEC has 45 days to reject or approve the ETF. If not rejected it is approved by default. Perhaps this is will be the time that the long awaited US bitcoin ETF gets approved. Bloomberg ETF analyst Eric Balchunas has said the SEC is likely to approve one this year, and we at Bitcoin & Markets think VanEck has a great shot of being first. They are a very well established ETF provider after all.

Big Banks and Bitcoin

The big banks are apparently getting very excited about bitcoin. These are the headlines from only the last couple of weeks

- Citi Bank authored a report Bitcoin: At a Tipping Point saying, bitcoin could "become the currency of choice for international trade"

- Goldman Sachs restarts their bitcoin trading desk

- JP Morgan files for a bitcoin basket of publicly traded companies that hold bitcoin

- Morgan Stanley now says they will allow clients with $2 mil in funds invest in bitcoin through them. It was all positive

- Bank of America, while not saying they wouldn't trade in it, slammed bitcoin as slow, impractical and environmentally dangerous in a research note

And dropping overnight, Morgan Stanley is reportedly bidding to acquire a previously top-tier bitcoin exchange (Bithumb has slowly become less relevant over the last 3 years).

Wow.

— Joseph Young (@iamjosephyoung) March 19, 2021

Morgan Stanley is reportedly bidding for Bithumb, South Korea's top crypto and bitcoin exchange, for $2 billion valuation.

Slowly, then surely.

The explosiveness of institutional interest in this space right now is unprecedented.

A Too Big To Fail bank acquiring a bitcoin exchange will definitely make waves and perhaps put the nail in the coffin of the tired argument that "governments will simply ban bitcoin whenever they want before it catches on." If the most powerful banks in the world are getting involved and making a market, there isn't much hope for government to ban it.

Of course, this does open up the door for a new silly theory, namely that "bitcoin is being allowed because it's a trap to introduce a cashless society." We'll have to deal with that theory for another few years, but if people don't want buy bitcoin and have fun staying poor, that's up to them.

Like our content? SHARE with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Along with the slow news cycle, the price has been relatively calm. It is slightly higher than last week, and consolidating very nicely for the next leg up.

We remain very bullish and expect price to start heading up relatively soon to remain in the large rising wedge. In the bullish case, bitcoin should approach $75,000 by the end of the month. Rising wedge patterns in bitcoin bull markets usually break upward, too. This could result in a massive move, up to as high as $100k, followed in typical bitcoin fashion by a 40% correction back to $60k.

However, we can consider a bearish scenario as well, which will increase in likelihood the longer price stays stuck between $50-60,000. The bearish scenario would look like a breakdown from the rising wedge toward the 50 EMA and support at the $45-47,000 level.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Mining

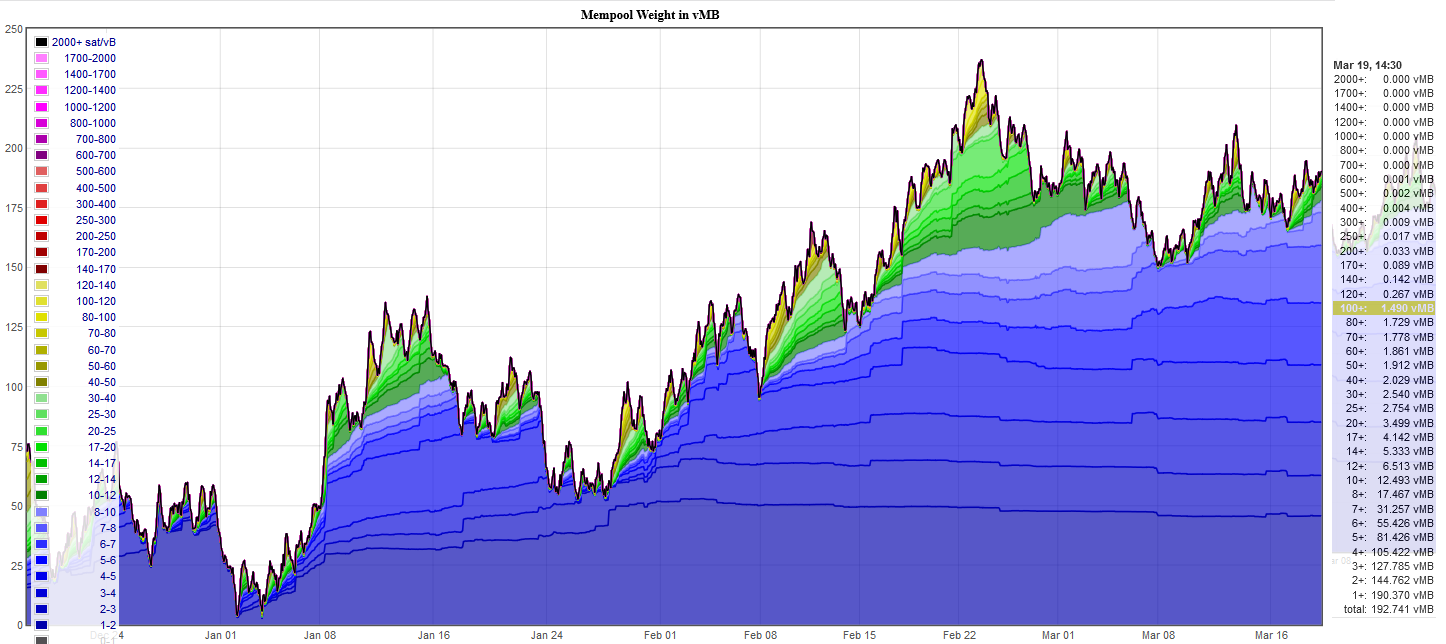

Transactions were confirming this morning with fees of ~40 sats/byte which is on the cheap end of recent rates (~$12). The mempool is still quite full at over 190 MB (150 full blocks or 1 day to completely clear the backlog without any new transactions).

The difficulty adjusted up 1.9% today and we estimate it will continue going up 1 - 2% every two weeks for the foreseeable future. If the chip supply issues affecting the entire world were to magically be remedied, the difficulty would leap 50% in short order. Until then, we expect a steady climb of 1-2% every two weeks.

Bitcoin miners are enjoying sky high profitability for the time being.

Stablecoins / CBDC / Altcoins

Jerome Powell on Fedcoin

The Fed has been fairly consistent in its position on Central Bank Digital Currencies (CBDC). They are in no rush to develop anything, unlike the ECB and PBoC. Powell has commented previously on the need for a future CBDC to be a compliment to cash not a replacement and re-emphasized that point this week.

We are quite certain that the Fed has no plans to build a CBDC anytime soon, and are happily surprised that bitcoin regulation has been relatively restrained compared to the worst case scenario many predict. There are no signs of an imminent crackdown and we don't expect one to come before bitcoin is simply too large for a ban to even be considered. In 5 years, bitcoin will be a $20 trillion market and nothing will stop it.

Central banks like the ECB continue to make the whole CBDC issue about "payments". Faster payments, cheaper payments, etc. There is no recognition of the fact that a CBDC is a new form of money provided by the central banks and cuts out the big banks. It is an attack on the banks. A CBDC is not a payments innovation, it threatens to completely change the financial system as it exists, and the Fed is rightfully cautious.

Miscellaneous

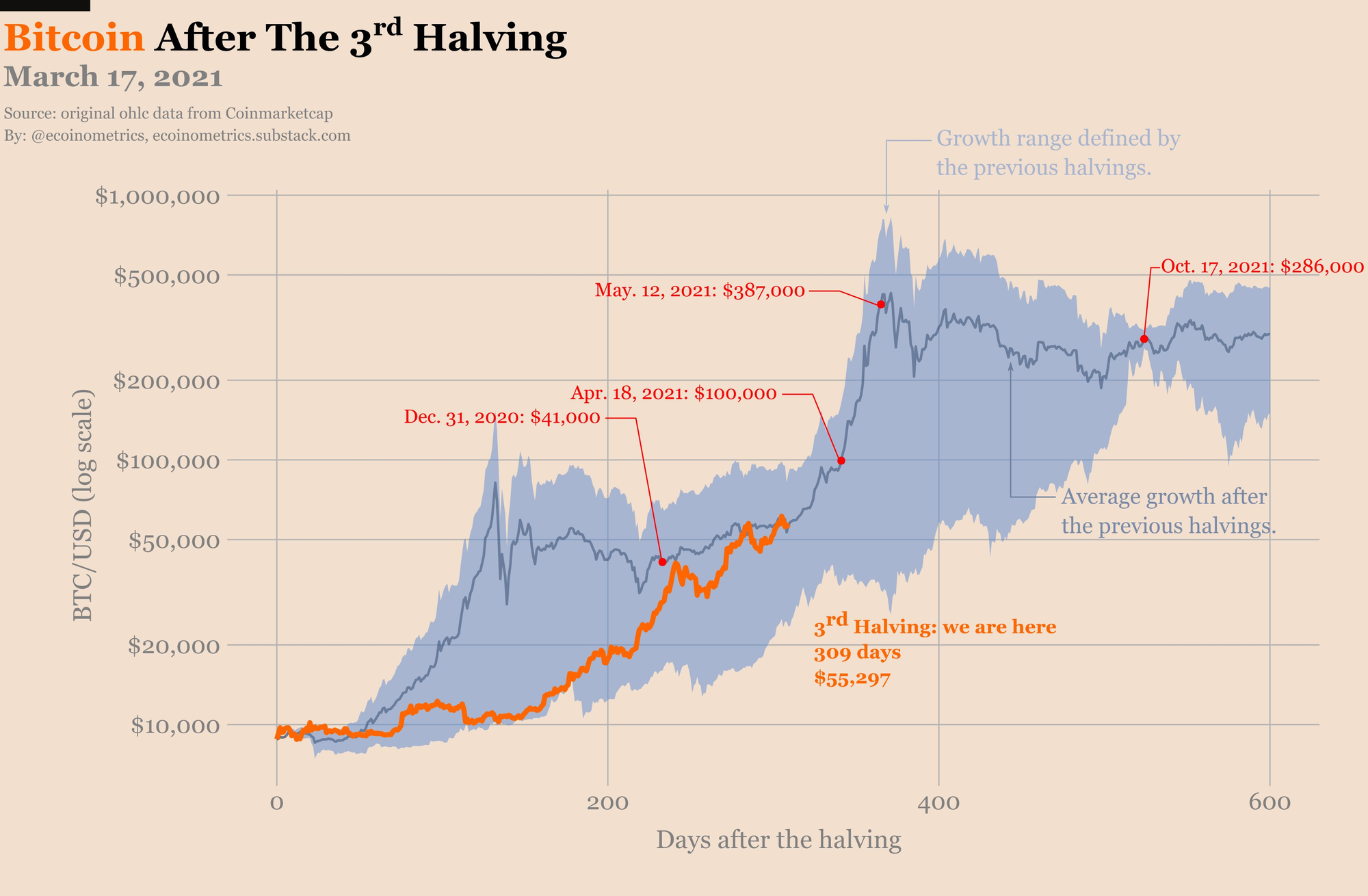

This chart shows the overlap of the two previous halving cycles normalized along with current cycle in orange. Of note, price is smack dap in the middle of the historic precedence.

The halving is when the mining reward is reduced by half roughly every four years, creating the fundamentals of each cycle. Despite all the talk of it "being different this time" this chart shows we are perfectly within the historical trend.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

March 19, 2021 | Issue #133 | Block 675,368 | Disclaimer