Fundamentals Report #134

This week we discuss the coming bitcoin ETF approval, list all the ETFs who have filed, bitcoin mining hashrate is growing again, and ethereum gas price problem.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Valuing Bitcoin using Credit Default Swaps (CDS) w/ Greg Foss - FED 46

- (member) Reversals - Bitcoin Pulse #104

Get our book the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $53,665 (-$5,455, -9.23%) |

| Market cap | $1.004 trillion |

| Satoshis/$1 USD | 1,863 |

| 1 finney (1/10,000 btc) | $5.36 |

| Median fee confirmed (finneys) | $6.18 (1.2) |

| Market cycle timing | End 1st half of bull market |

| Weekly trend | Ready for next move |

| Media sentiment | Positive |

| Network traffic | Moderate |

| Mining | Healthy and expanding |

Market Commentary

ETF Update

Tons of ETF filings being fired at the SEC for bitcoin in the past few months. Below is a list of these possible US bitcoin ETFs. Not all will get approved necessarily, but it is getting more likely by the day that a bitcoin ETF will be approved very soon. The lucky first will have a massive first mover advantage and see record ETF volume even for the established traditional exchanges. Furthest along in the process so far is the VanEck, with a deadline for rejection at the beginning of May.

- Valkyrie Digital Assets

- NYDIG

- VanEck

- SkyBridge Capital

- Fidelity

- Wildcard: Grayscale's Bitcoin Trust may try to migrate to an ETF

Of course, the US isn't the only place bitcoin investment is taking off. Canada has approved three bitcoin ETFs and Brazil now has the first Latin American bitcoin ETF approved this last week.

Powell on Bitcoin

Crypto assets are highly volatile, see bitcoin, and therefore not useful as a store of value. And they're not backed by anything. They're more of an asset for speculation. They're also not particularly in use as a means of payment. It's more a speculative asset that is more a substitute for gold, rather than for the dollar.

The above comment, taken in context with others from Powell recently, couldn't be more clear that there is no impending "crackdown" coming against bitcoin - i.e. the Fed is not rushing to create a Central Bank Digital Currency (CBDC), if they do it won't be a replacement for cash but a compliment, and a CBDC would need to have basic privacy built in. Don't let that criticism slide.

Comparing bitcoin to risk-free physical gold is pretty huge actually. Just a few years ago, Warren Buffett was calling it "rat poison squared." Now, the Chairman of the Federal Reserve is saying it is "a substitute for gold."

Like our content? SHARE with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Price roughly followed our bearish scenario from last week. It broke down from the diagonal support line and has tested the 50 EMA. However, price did stay within the $50-60k consolidation range we pointed out.

The major factor affecting price has been the end of quarter activity, namely the expiration of billions of dollars of futures and options contracts, an abnormally high amount for bitcoin, and the end of quarter buying by institutions to get it on their balance sheets by the end of the quarter. There has been a tug-o-war of sorts keeping the price within the 50-60k range.

Even with this slowdown, this cycle (referencing the 4 year halving cycle of bitcoin) is right on track. It is slightly ahead of the 2016-2017 cycle's pace, but that is to be expected since that cycle was dominated by an internal crisis affecting insider confidence. Price could hang out in a range for another 2 months and still be within the ballpark of a normal bull market for bitcoin.

We don't think a long delay happens. Bitcoin can surprise everyone by doubling in week. Any price projection up to $100k in April is possible. There is a growing likelihood that a bitcoin ETF will be approved in the US in Q2, which would absolutely spike the price.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Mining

The next difficulty adjustment is 6 days away, and it is estimated to be the largest adjustment in months at +4%. This indicates a significant increase in hashrate and perhaps an easing of the chip shortage. Profitability remains very high due to price rising and the inability to source many new chips in recent months.

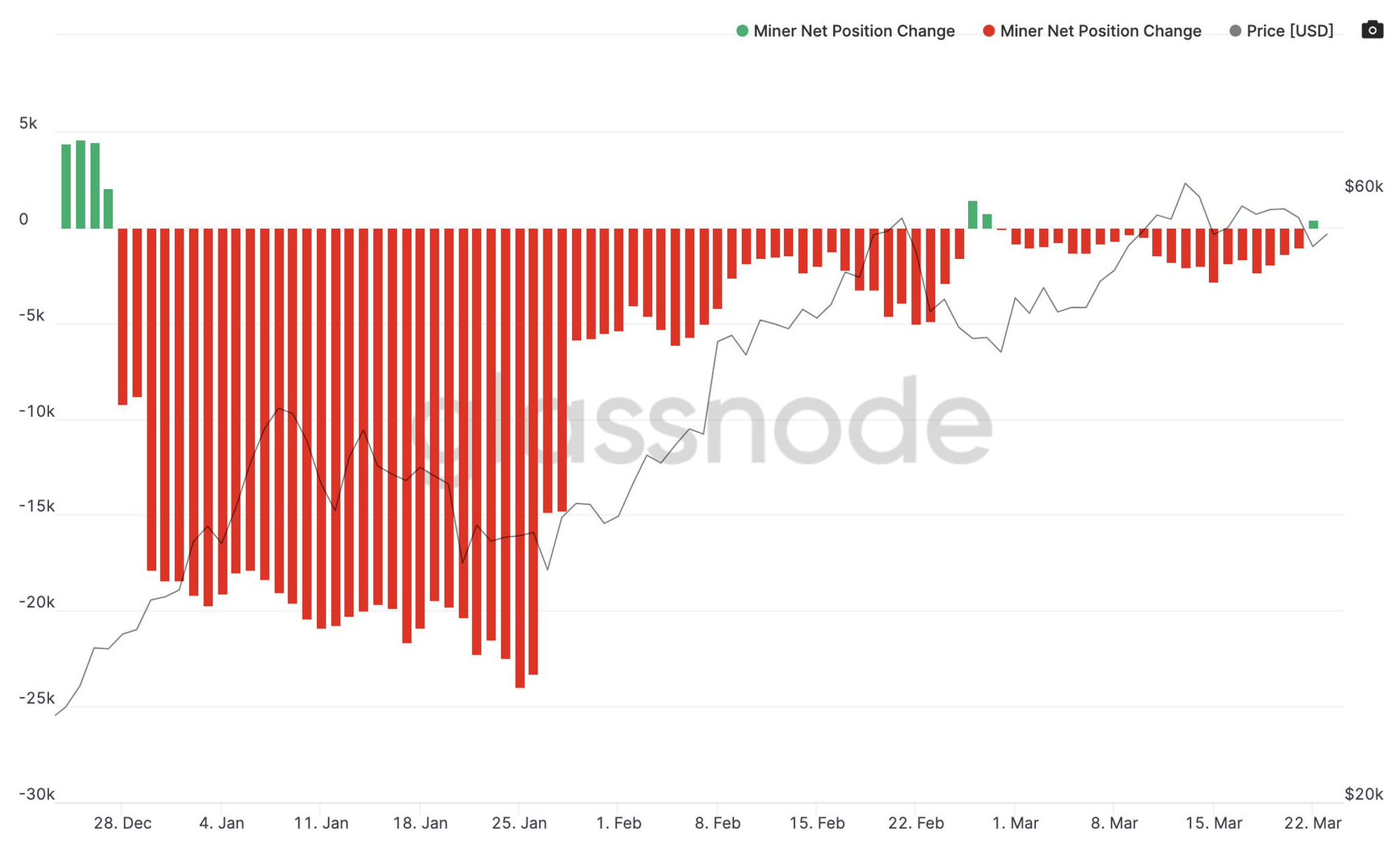

After a significant sell off of bitcoin held by miners in January, the inability to spend their bitcoin on new mining equipment, it seems they are hodling onto the bitcoin they mine. This is evident in the chart below from glassnode. As you can see, when miners tend to hold more of their new coins, price tends to increase due to a shortage.

Stablecoins / CBDC / Altcoins

Coinmetrics put out some good charts in their latest State of the Network post. Let's take a quick look at a couple eth charts.

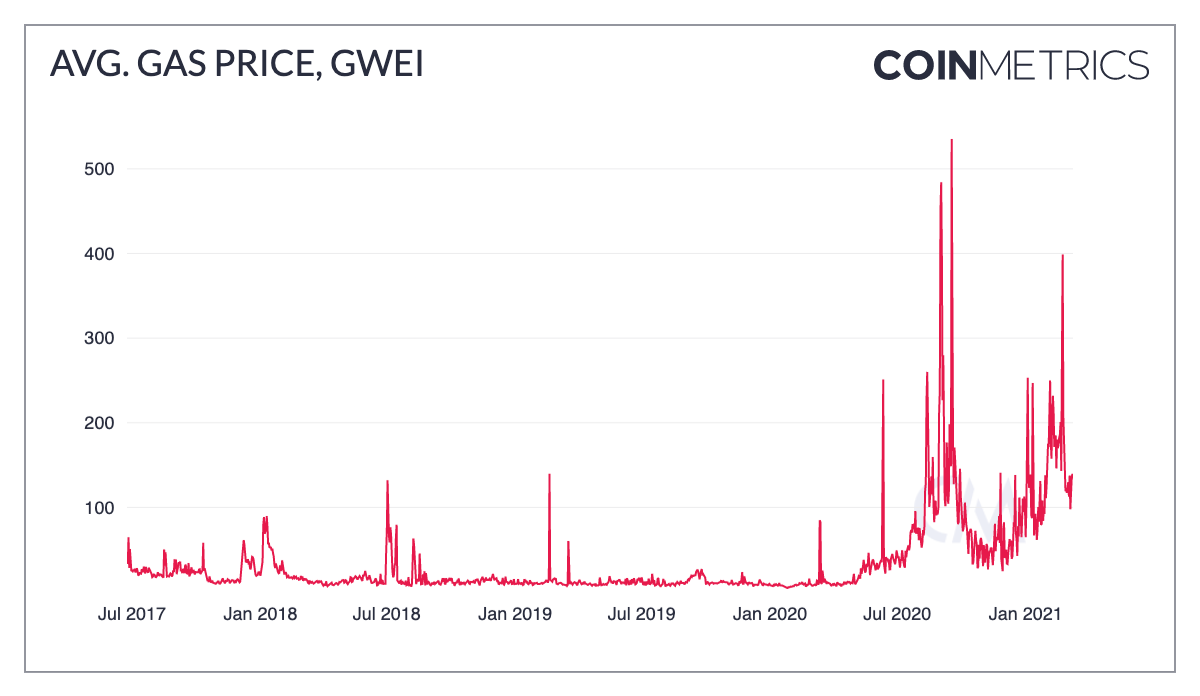

First up is the average gas price. For those who don't know, where bitcoin is decentralized validation (transactions simply checked for validity), ethereum is about decentralized computation (mini programs get run on every node). To keep an infinite loop from happening in the code of this decentralized computation, ethereum requires a gas payment (fee). Transactions are charged according to how many computations nodes have to make. The more crowded the network, the more expensive gas will be to complete your transaction's aims.

As you can see the gas price is highly volatile, which isn't good. Estimating gas needed to execute a smart contract becomes hard. If you add too little gas (fee) and there is a sudden spike in traffic, your smart contract will go through but the programmability won't complete. There's no getting your money back either, the program never runs and you have to try again with a higher fee.

The affect is a rapid upward spiral in gas price as people pad their fees. Very quickly small, less valuable transactions get priced out, making ethereum unusable for most use cases.

The proposed solution to this is part of Eth2.0, called sharding. This is a process where they linearly multiply the amount of processing power available by assigning only a portion of the computation to any individual node. In other words, they break up the work load into shards and divvy that out.

It's a very complex solution and it won't work. One of the laws of nature in the bitcoin space is related to Parkinson's Law, "work expands so as to fill the time available for its completion," or the corollary Parkinson's Law of Data, "data expands to fill the space available for storage." In bitcoin it can be said, "transactions or computation will expand to fill all available space in the network."

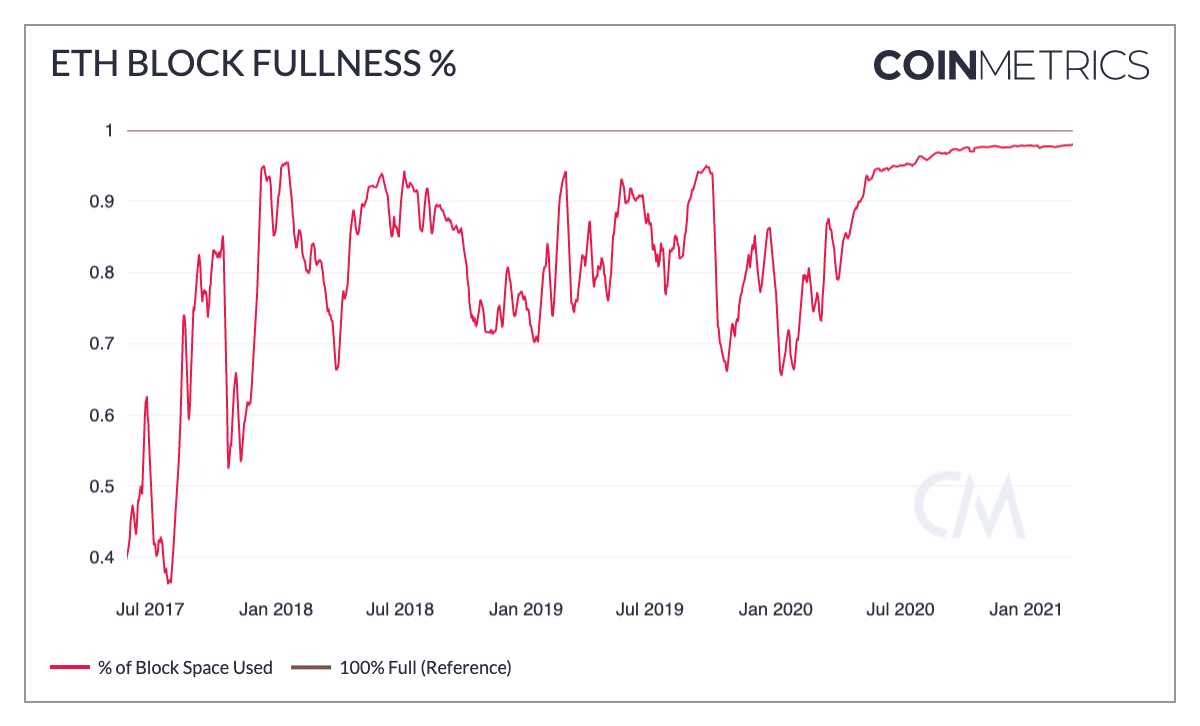

In the below chart, we see that ethereum is full. If they multiply the space by 1000x in Eth2.0, yes, gas prices will fall, but it will quickly get filled up with spam garbage again.

Ethereum folks are finally coming around the solution bitcoin landed on 6-8 years ago, Layer 2, or modular scaling. You cannot do everything on the network. Once again, they all learn from bitcoin.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

March 26, 2021 | Issue #134 | Block 676,416 | Disclaimer