Fundamentals Report #136

Q/A about Bitcoin mining and energy consumption, price analysis, network traffic update, CBDC, and SOPR.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Central Banks Update April 2021 - FED 48

- (blog) Chart Rundown for 4/5/2021 - Bitcoin, Dollar, Commodities, Gold, Silver, Oil, and Interest Rates

- (blog) Oil Price Wars 2021

- (community) Epic NFT discussion on Discord and piece written by @Smash: NFTs: A Bitcoiner's Perspective

- (members-only) Coinbase and Consolidation - Bitcoin Pulse #105

Get our book the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $58,184 (-$1,162 -1.96%) |

| Market cap | $1.088 trillion |

| Satoshis/$1 USD | 1,718 |

| 1 finney (1/10,000 btc) | $5.81 |

| Median fee confirmed (finneys) | $6.18 (1.2) |

| Market cycle timing | Beginning 2nd half of bull market |

| Weekly trend | Ready to breakout |

| Media sentiment | VERY positive |

| Network traffic | Elevated |

| Mining | Stable |

Market Commentary

We received a question from a reader this week about bitcoin mining. New readers might have a similar question, so we will take a minute here to discuss it.

Question

"I really don't understand the mining aspect of bitcoin. Doesn't it require a lot of power and isn't that why so much of it is done in China?"

Bitcoin mining is one of the least understood parts of bitcoin. We write a Mining section below each week about some of the news about the industry, but it would helpful to discuss the basics.

Bitcoin mining fulfills two functions, 1) it provides the way to move the network forward in a consistent, decentralized, and secure manner through Proof of Work; and 2) it is a way to distribute coins in a completely open and fair way. Mining is absolutely necessary for a scalable, decentralized network.

Being decentralized means no one is in charge to keep everyone in sync, make the rules or confirm transactions. Bitcoin solved this problem with mining. Participants can trust the ledger because it was updated through a random, expensive process. You can't fake burning energy, everything else can be gamed and corrupted. [...]

Like our content? SHARE with friends and family!

Quick Price Analysis

Weekly BMI | 3 : Extremely bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

This is the most bullish we have ever been on this report at a BMI of 3. BMI stands for Bitcoin Market Indicator and you can see the explanation here.

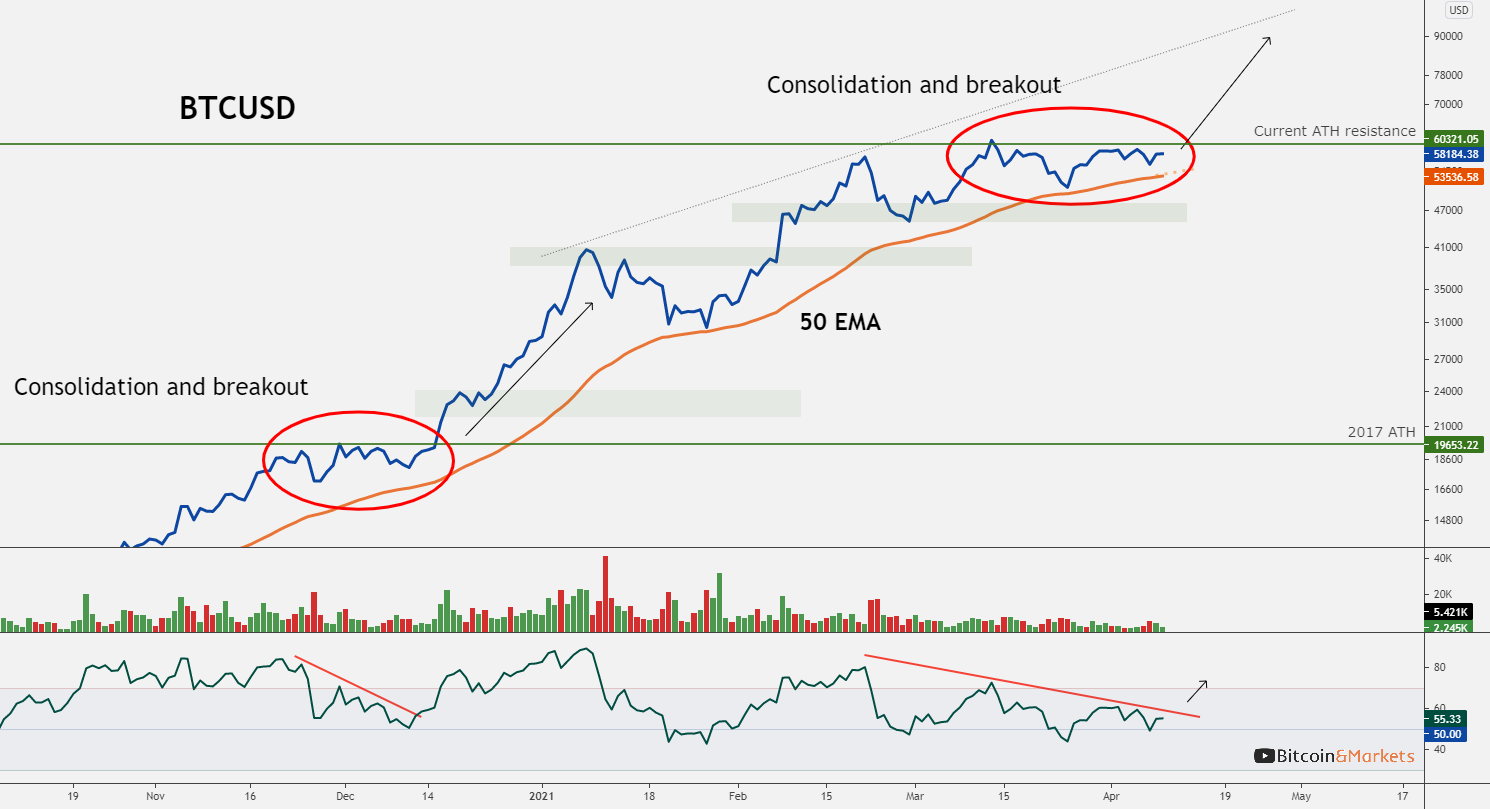

As you can see in the chart, price is pressing up against the All Time High, just like it did back in December at $20,000. In the Bitcoin Pulse yesterday, we looked at several indicators on the chart and all our tracked fundamentals of the network. Long story short, it is bullish guys, very bullish.

There is precedence for a quick dip before more powerful upside, like it did in January to touch some support, but that looks unlikely to us. We are officially starting the second half of this bull market.

Mining

Bitcoin is designed for blocks to be found in the mining process every 10 minutes. Sometimes they get found much faster, causing the difficulty in mining to increase, rarely they are found slower causing the difficulty to decrease. Right now, blocks have been found on average right at the 10 minutes average, so the next adjustment in 6 days is trending to be even.

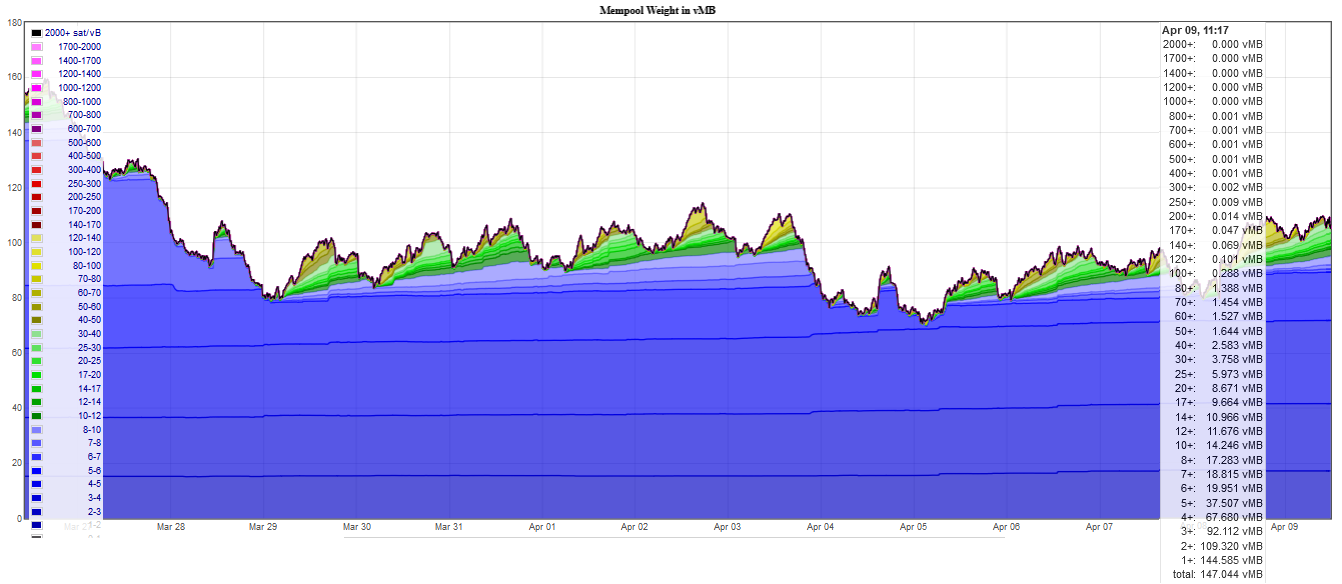

This past week fees dropped as low as 6 sats/bytes (~$2) before the mempool became busy again today. Be sure to check fees before you transact as the estimators in some wallets may be off. Bitcoiner.live is an interesting fee estimator.

Stablecoins / CBDC / Altcoins

We've been saying for years that the Central Bank Digital Currency (CBDC) phenomenon is an extension of the misunderstanding during the "Blockchain not Bitcoin" craze. People in certain roles cannot bring themselves to admit bitcoin's superiority as a money, so they invent other reasons for its success, like "the technology behind bitcoin." Bitcoin is the technology behind Bitcoin.

CBDCs don't offer any benefits over traditional digital fiat. The old central bank/fiat system suffers from regulatory and systemic issues, and the cryptocurrency technology in bitcoin cannot address that without breaking their monopoly control.

Well, it seems Sweden's central bank, the Riksbank, is beginning to learn these same lessons. They've released their latest study of a e-Krona CBDC in which they built and ran as a test. They don't seem much closer to any solutions after two years of study.

There are also challenges with regard to performance of a large scale retail payments system with a technology based on DLT and tokens.

The solution tested in phase one of the e-krona pilot has met the performance requirements made in the public procurement. But this has taken place in a limited test environment and the new technology’s capacity to manage retail payments on a large scale needs to be investigated and tested further.

In other words, the test went fine but probably because it was so unrealistic and every question we had before remains unanswered.

Miscellaneous

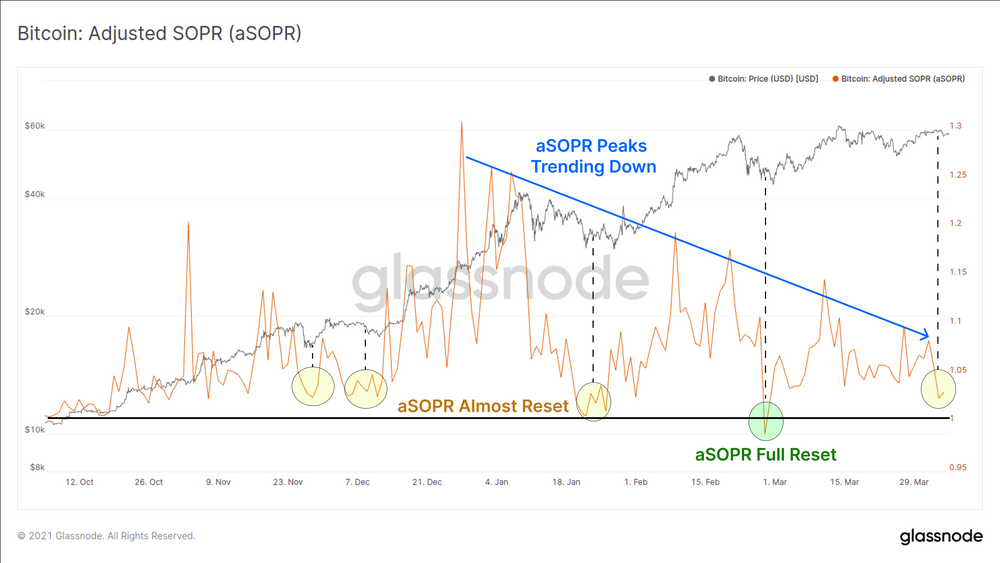

Below is a chart from Glassnode's "The Week On Chain", which has excellent data and analysis about bitcoin's on-chain fundamentals this week. This means data that can be collected and tracked on the network itself. It is important to remember that once these metrics become widely publicized and used as indicators of price movement, manipulators can come in and "game" the on-chain data to send false signals.

Bitcoin's adjusted (7 day average) Spent Output Profit Ratio (SOPR) indicates how much profit was realized when a coin is spent. A SOPR below 1 means coins were transferred at a loss and the higher the SOPR, the more "profit" is realized. SOPR resetting to 1 typically signals a local bottom for price as less profit is being taken and people are holding.

The current pattern is at the same level as the December, as circled in our price chart above.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

April 9, 2021 | Issue #136 | Block 678,493 | Disclaimer

Meme by @LuchoPoletti