Fundamentals Report #138

Deleveraging in bitcoin bull markets.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (members) Fake Outs, Mining, and Turkey - Bitcoin Pulse #107

- Working on a new podcast episode for this weekend!

Get our book the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $49,250 (-$12,233 -19.9%) |

| Market cap | $928 billion |

| Satoshis/$1 USD | 2,011 |

| 1 finney (1/10,000 btc) | $4.97 |

| Median fee confirmed (finneys) | $24.30 (4.88) |

| Market cycle timing | Halfway through bull market |

| Weekly trend | Mid-cycle dip |

| Media sentiment | Semi-positive |

| Network traffic | High traffic |

| Mining | Large dip, stablizing |

Market Commentary

What a dip! These are the times that represent a great risk to reward ratio for investors. Bitcoin dips wildly on its inevitable march forward, that's what it does. But why does bitcoin dip like this?

We can't have great gains without great risk. Risk, in this case, as perceived by investors with less conviction has increased dramatically this week. They will end up panic selling, or waiting to buy until it drops another 50% or something.

One must know and understand the underlying economics and technology to have the proper analysis of the risk in this market. To bitcoiners with the highest conviction, the risk is owning too little bitcoin.

Outsiders think we are panic selling this dip but hardcore bitcoiners are panic buying.

— Ansel Lindner (@AnselLindner) April 23, 2021

Nothing has fundamentally changed in the past week to justify a lower price other than a period deleveraging event. Some people will point to the power outage in China which affected hash rate, some will point to a fake news story about US regulators cracking down on bitcoin money laundering, while others might point to the Biden capital gains tax proposal. However, none of these things affect the fundamental value of bitcoin or its core function, they only affect investors' assessment of risk.

If anything, the developments over the last few weeks have been generally bullish for bitcoin, and introduced more people to the ideas involved. Ultimately, no news is bad news for bitcoin. The struggle it has is market awareness. More headlines equals more people introduced, and a fraction of those will become diehard holders.

In the mean time, these periods of deleveraging are very healthy. They keep excess speculation from building up and train the mind toward long term thinking.

Like our content? SHARE with friends and family!

Quick Price Analysis

Weekly BMI | 1 : Slightly bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

The bottom appears to be in at this point. Price wicked into the support area we've labeled on prior charts and is now looking for a bounce off the 100 exponential moving average.

We won't sugarcoat it, the chart is more bearish than it has been in months. But bearish charts turn into bullish charts and vice versa. We can't have all bullish charts all the time, and it is true that when the chart looks the most bearish is precisely when it flips.

The total drop so far has been 26% which puts it on the smaller side of historical mid-cycle pull backs. The average pull back in the 2017 cycle was 30-40%. A 40% pull back today would put price down to $40,000. It is possible that price continues lower to the next support zone right in that range.

There are several factors making us bearish: the RSI, cloud, average pull back size, etc (for details on these subscribe to the Pulse), but where we are in the market cycle is of primary weight in our prediction. Therefore, our weekly expectation leans slightly bullish. We are in the middle, not the end, of this bull market.

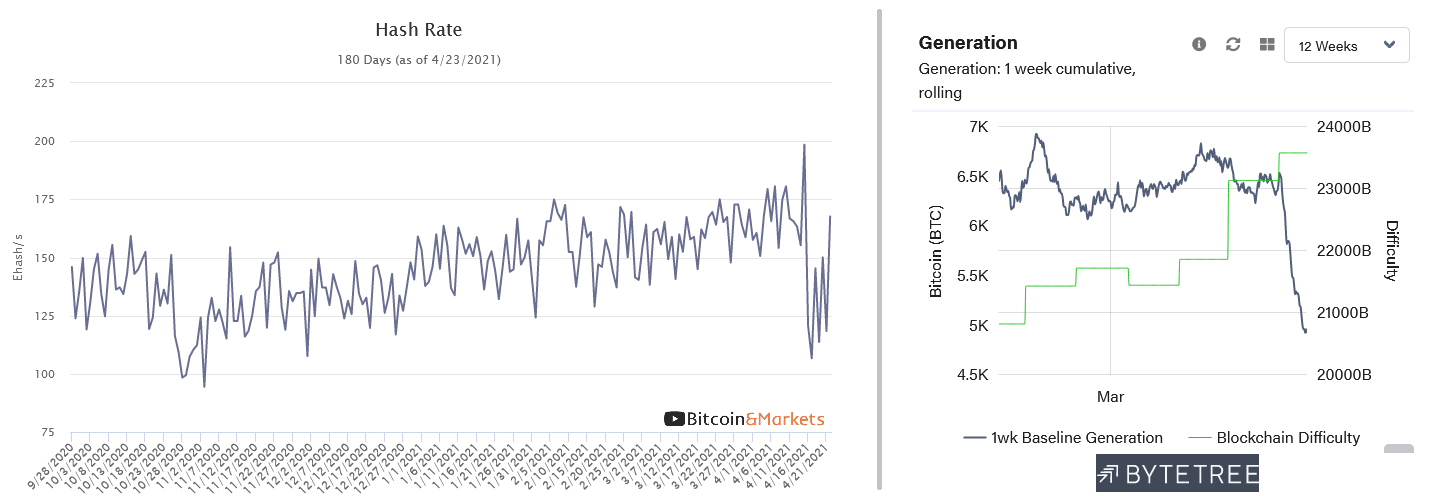

Mining

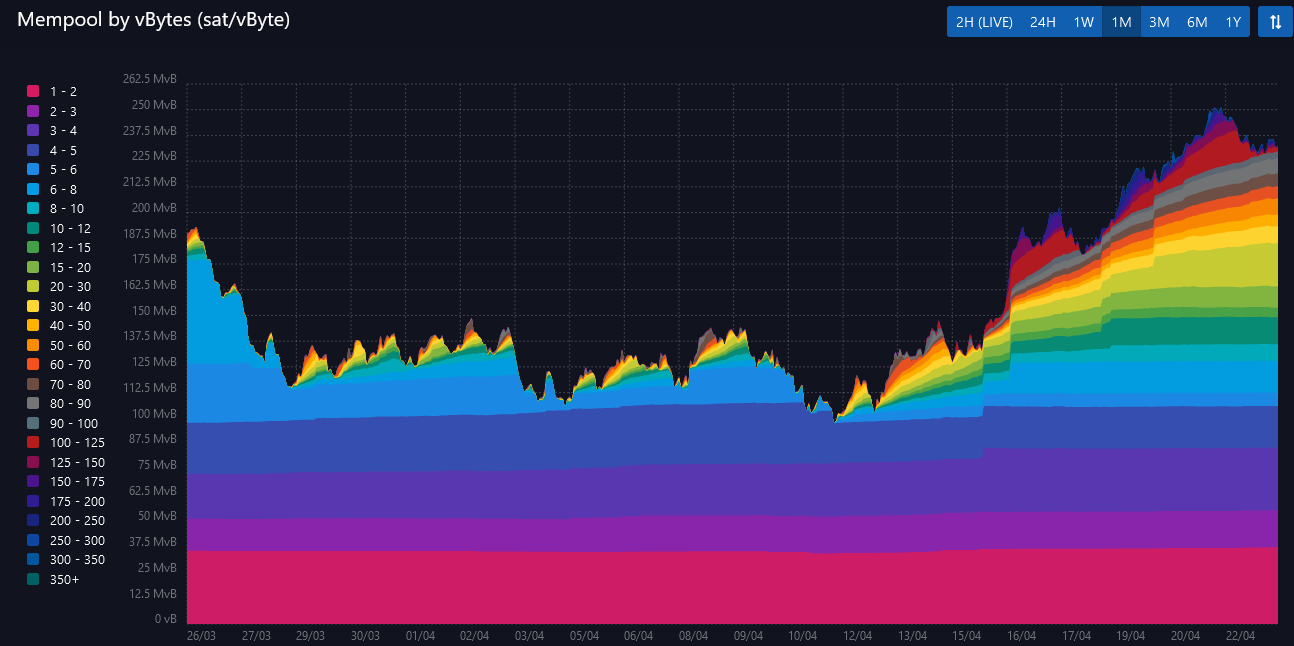

Everything was quiet in the mining world last week and all of sudden blocks slowed and reports spread of a power issue in China knocking miners offline in the Xinjiang region. Ansel talks about the hash rate estimates in China in yesterday's Pulse and how events like this allow us to gain insight into the network. Long story short, we learned Chinese hash rate is a smaller proportion of the market. The hashrate going offline came after difficulty adjusted up which compounded the congestion in the mempool.

Hash rate is back to normal levels already, but the 7-day moving average for bitcoin issuance has dropped now by 20%. There will likely be a reaction to this period of lower issuance in the future as the affect gets amplified with time. Similar to how the affect of the halving every 4 years compounds over a few months until the price exponentially rises. This event won't have nearly that strong of an effect, but it will have some effect in the coming weeks.

Fees are back in the 80-100 sats/byte ($7) range after peaking around 250 sats/b during the week. The mempool also topped out with around 250mb worth of transactions, matching the peak at the end of 2017.

Bitcoin can support much higher fees in this cycle as small transactions are increasingly moving the apps like Lightning Network, and transactions on the main network are larger (currently the median transaction value is $1250 on the network).

Stablecoins / CBDC / Altcoins

Dogecoin went crazy this week. For those new to bitcoin, Dogecoin (pronounced dōj like a Venetian Duke) is an early altcoin that was predicated on marketing and memes. It was never a technologically advanced coin or home to sophisticated developers. In fact, over the years it has been viewed as somewhat "safe" in the altcoin world exactly because it doesn't have any developers and active insiders.

The doge pump likely has something to do with the recent drama out of Turkey. The Turkish Lira has had a bad year, and bitcoin was rising quickly in popularity there. The largest exchange in that country, Thodex, was running several promotions to attract new users, including a Dogecoin giveaway since February.

This week, Turkey announced a ban on bitcoin in the country, and days later Thodex ceased operations leading the CEO to flee the country. It has been estimated that he may have stolen up to $10 billion in customers' bitcoin and altcoins.

This is likely the source of initial underlying Dogecoin demand over the last couple of months and fits perfectly with typical altcoin hijinks. This isn't to say that Elon Musk's Dogecoin trolling and retail investor FOMO didn't account for the later blow off top. Doge traded as high as $0.44 before crashing to $0.15 and is currently in a bounce from that low. We expect it to return shortly to $0.01.

Miscellaneous

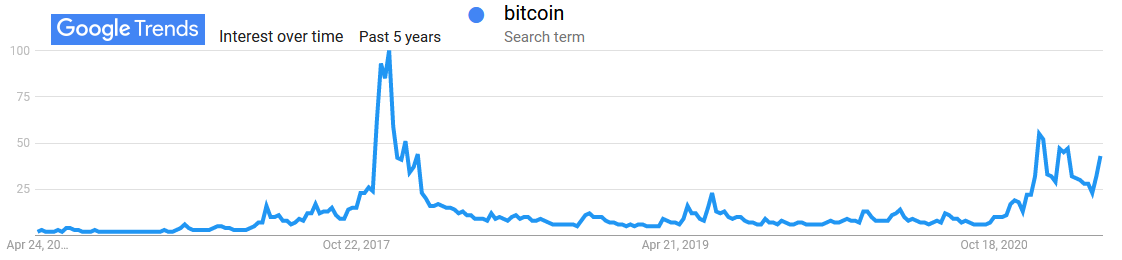

The price action over the last 6 months has shown up nicely on the google search trends for the term bitcoin. As you can see there is a sustained elevated interest during that time and compared to 2017 a lower peak but higher baseline for this rally. We expect interest to continue to grow as retail comes into the second half the this cycle.

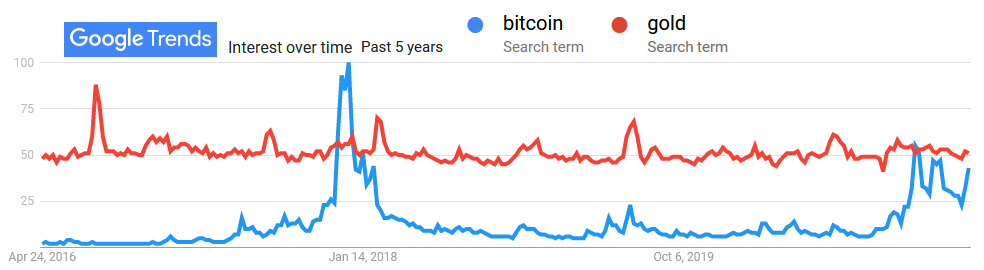

If we compare this search volume with that of "gold" we get a very interesting picture. Gold is still more popular in the world, as shown by its higher market cap of roughly $10 trillion compared to bitcoin's $1 trillion. But bitcoin is catching up quickly. Soon enough bitcoin will be consistently more searched than gold.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

April 23, 2021 | Issue #138 | Block 680,300 | Disclaimer

Meme by @BitcoinMemeHub